Answered step by step

Verified Expert Solution

Question

1 Approved Answer

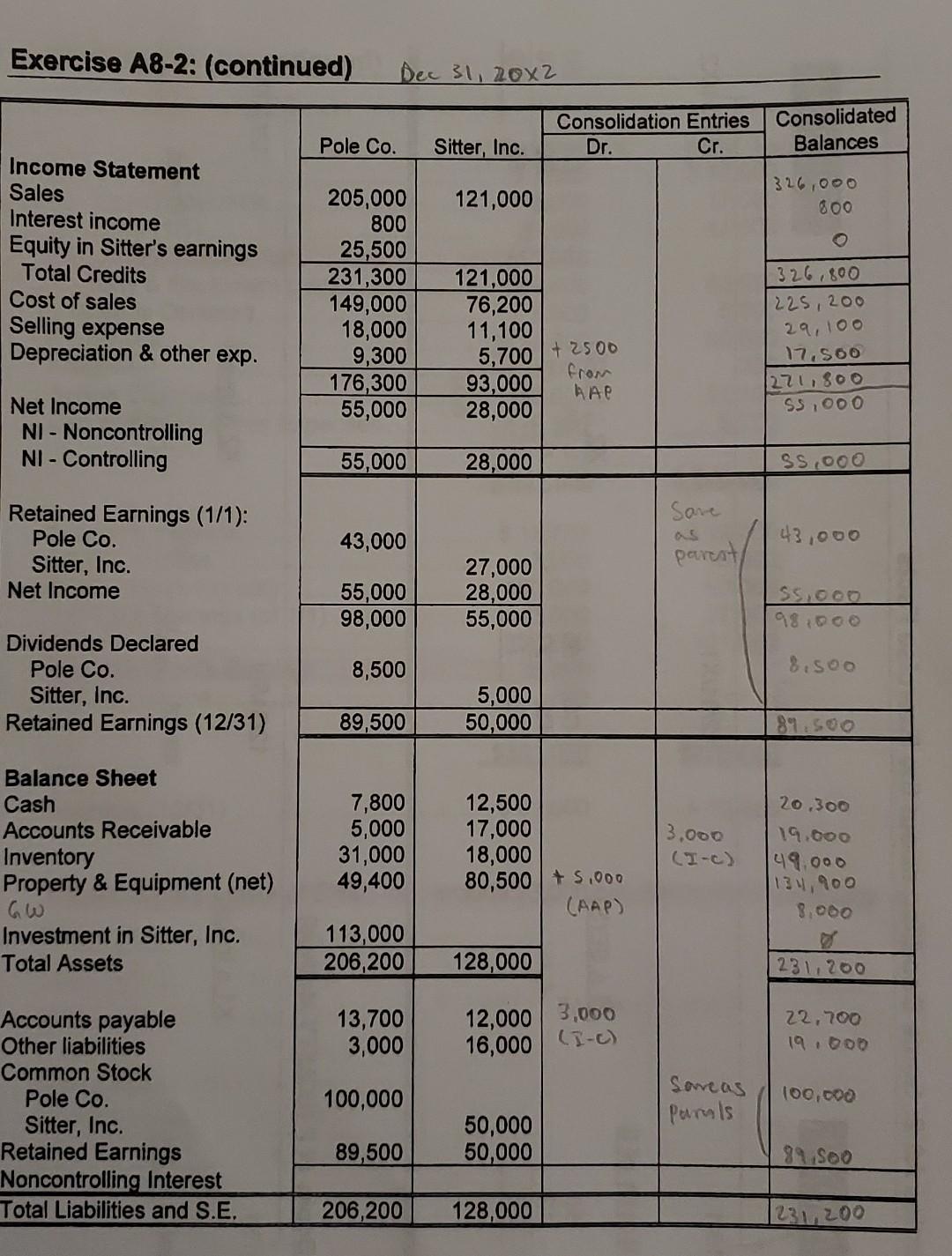

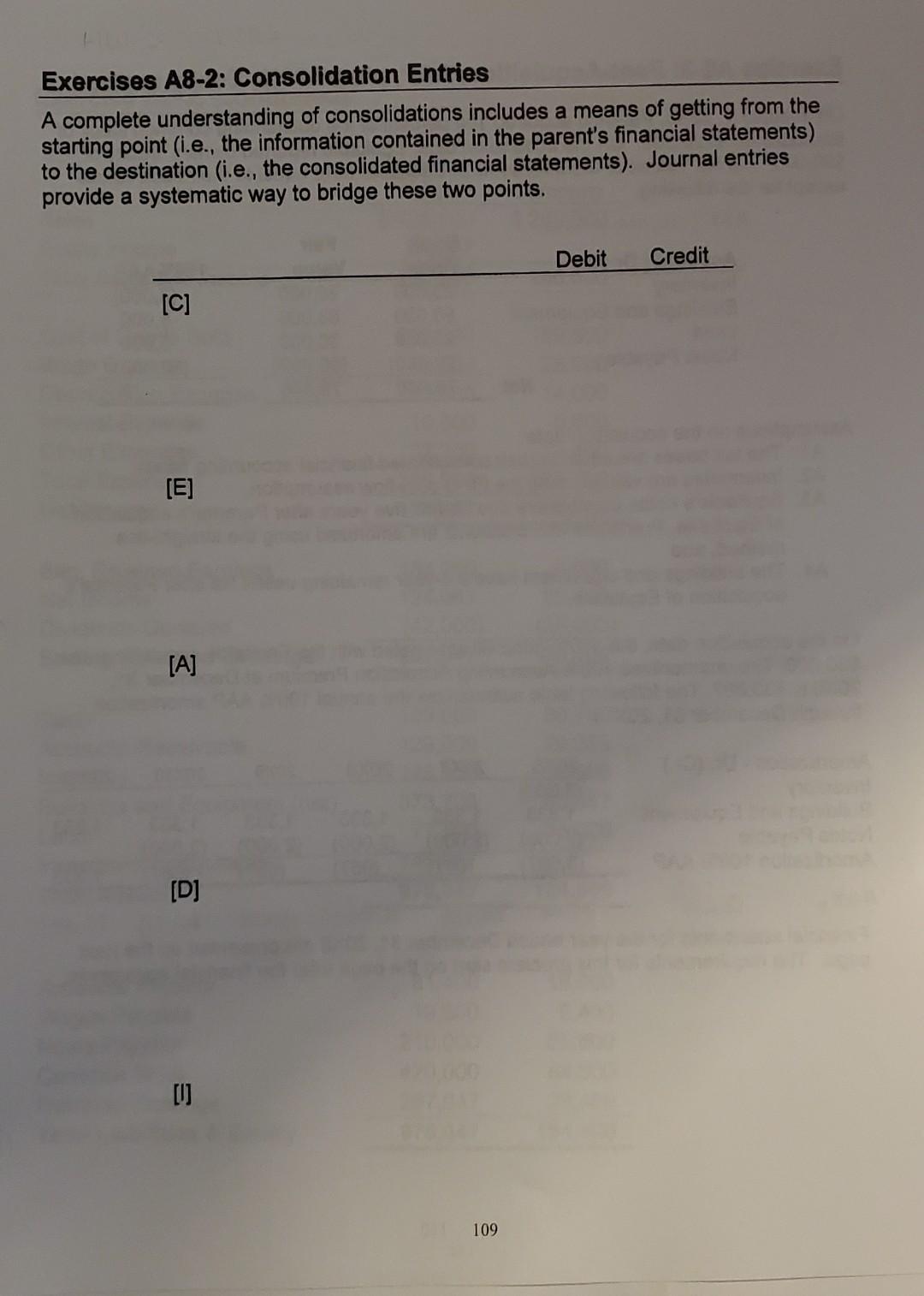

Exercise A8-2: (continued) Dec 31, 20x2 Consolidation Entries Dr. Cr. Consolidated Balances Pole Co. Sitter, Inc. 121,000 320,000 goo Income Statement Sales Interest income Equity

Exercise A8-2: (continued) Dec 31, 20x2 Consolidation Entries Dr. Cr. Consolidated Balances Pole Co. Sitter, Inc. 121,000 320,000 goo Income Statement Sales Interest income Equity in Sitter's earnings Total Credits Cost of sales Selling expense Depreciation & other exp. 205,000 800 25,500 231,300 149,000 18,000 9,300 176,300 55,000 121,000 76,200 11,100 + 2500 5,700 from 93,000 AAR 28,000 326,800 225, 200 29,100 17,soo 271,800 S5,000 Net Income NI -Noncontrolling NI - Controlling 55,000 28,000 SS 000 Sare Retained Earnings (1/1): Pole Co. Sitter, Inc. Net Income 43,000 43,000 parent 55,000 98,000 27,000 28,000 55,000 SS.000 98 DOO 8,500 8.500 Dividends Declared Pole Co. Sitter, Inc. Retained Earnings (12/31) 5,000 50,000 89,500 89.500 Balance Sheet Cash Accounts Receivable Inventory Property & Equipment (net) 13.000 7,800 5,000 31,000 49,400 12,500 17,000 18,000 80,500 + 5.000 (AAP) (I-C) 20,300 19.000 49.000 134,900 8.000 Investment in Sitter, Inc. Total Assets 113,000 206,200 128,000 231.200 13,700 3,000 12,000 3,000 16,000 (1-0) 22,700 19.000 100,000 Accounts payable Other liabilities Common Stock Pole Co. Sitter, Inc. Retained Earnings Noncontrolling Interest Total Liabilities and S.E. Sancas Parals 100,000 50,000 50,000 89,500 99 Soo 206,200 128,000 231,200 Exercises A8-2: Consolidation Entries A complete understanding of consolidations includes a means of getting from the starting point i.e., the information contained in the parent's financial statements) to the destination (i.e., the consolidated financial statements). Journal entries provide a systematic way to bridge these two points. Debit Credit [C] [E] [A] [D] UJ 109 Exercise A8-2: (continued) Dec 31, 20x2 Consolidation Entries Dr. Cr. Consolidated Balances Pole Co. Sitter, Inc. 121,000 320,000 goo Income Statement Sales Interest income Equity in Sitter's earnings Total Credits Cost of sales Selling expense Depreciation & other exp. 205,000 800 25,500 231,300 149,000 18,000 9,300 176,300 55,000 121,000 76,200 11,100 + 2500 5,700 from 93,000 AAR 28,000 326,800 225, 200 29,100 17,soo 271,800 S5,000 Net Income NI -Noncontrolling NI - Controlling 55,000 28,000 SS 000 Sare Retained Earnings (1/1): Pole Co. Sitter, Inc. Net Income 43,000 43,000 parent 55,000 98,000 27,000 28,000 55,000 SS.000 98 DOO 8,500 8.500 Dividends Declared Pole Co. Sitter, Inc. Retained Earnings (12/31) 5,000 50,000 89,500 89.500 Balance Sheet Cash Accounts Receivable Inventory Property & Equipment (net) 13.000 7,800 5,000 31,000 49,400 12,500 17,000 18,000 80,500 + 5.000 (AAP) (I-C) 20,300 19.000 49.000 134,900 8.000 Investment in Sitter, Inc. Total Assets 113,000 206,200 128,000 231.200 13,700 3,000 12,000 3,000 16,000 (1-0) 22,700 19.000 100,000 Accounts payable Other liabilities Common Stock Pole Co. Sitter, Inc. Retained Earnings Noncontrolling Interest Total Liabilities and S.E. Sancas Parals 100,000 50,000 50,000 89,500 99 Soo 206,200 128,000 231,200 Exercises A8-2: Consolidation Entries A complete understanding of consolidations includes a means of getting from the starting point i.e., the information contained in the parent's financial statements) to the destination (i.e., the consolidated financial statements). Journal entries provide a systematic way to bridge these two points. Debit Credit [C] [E] [A] [D] UJ 109

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started