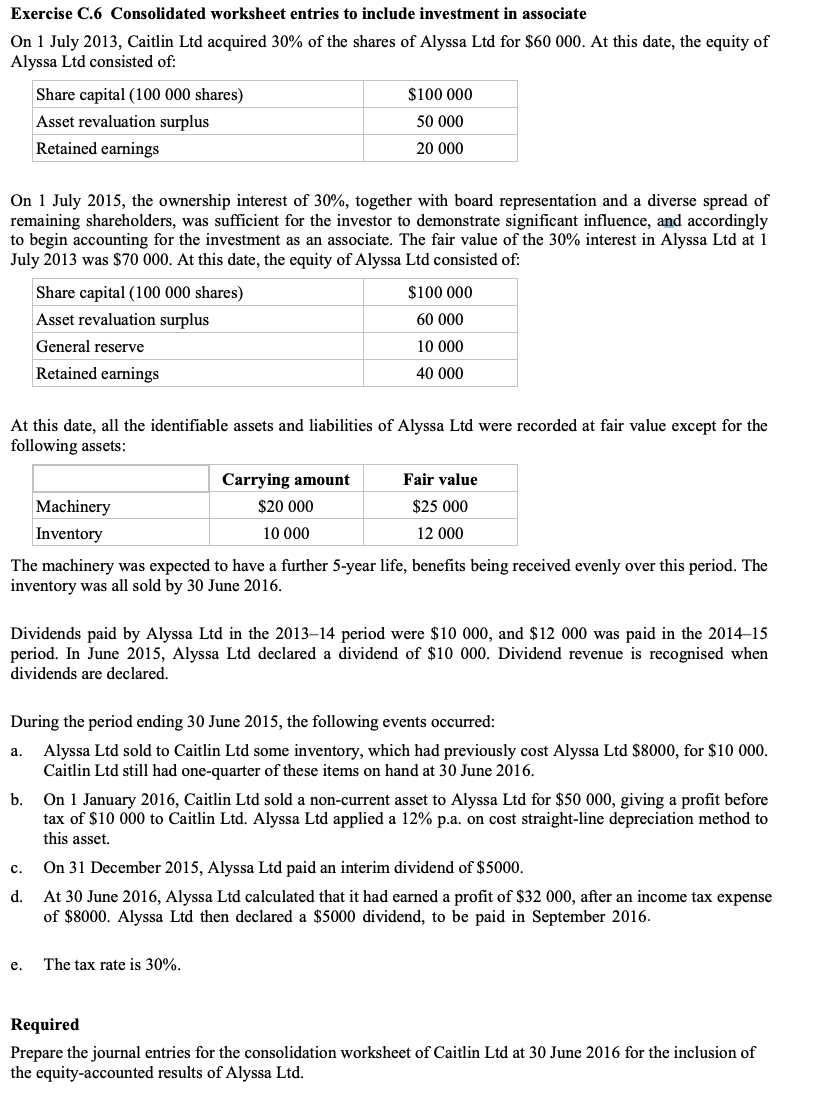

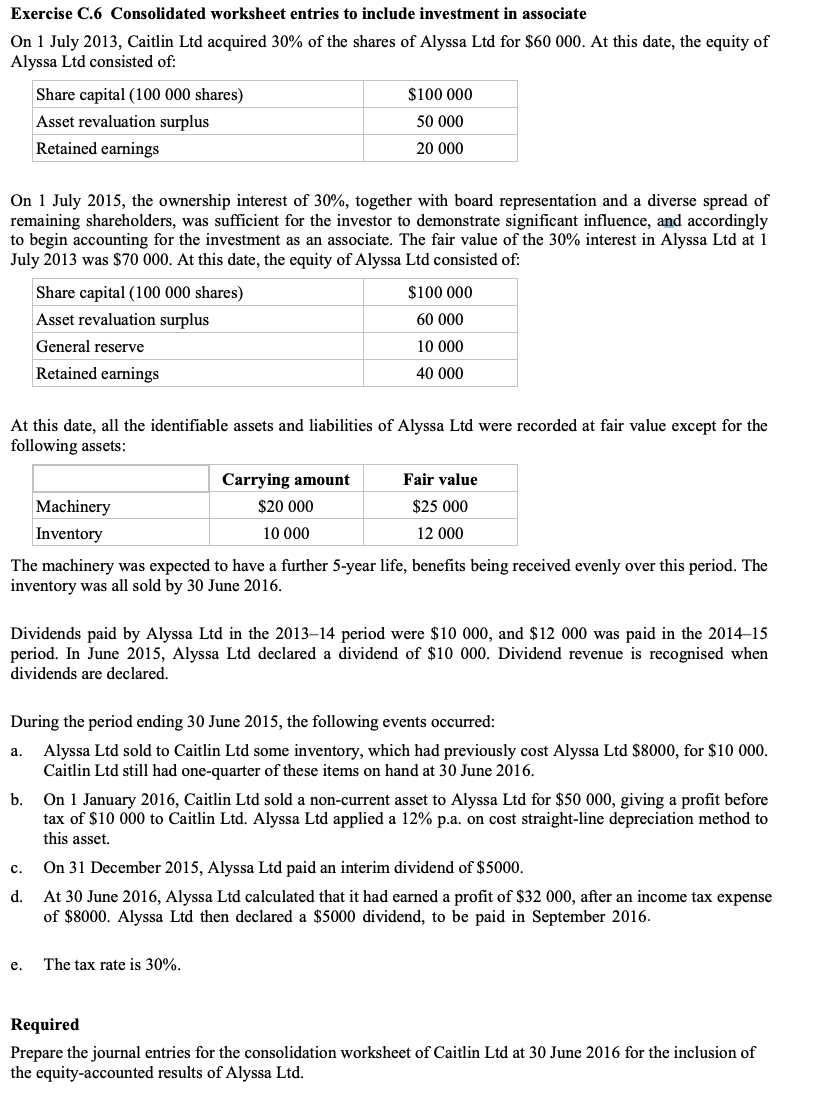

Exercise C.6 Consolidated worksheet entries to include investment in associate On 1 July 2013, Caitlin Ltd acquired 30% of the shares of Alyssa Ltd for $60 000. At this date, the equity of Alyssa Ltd consisted of: Share capital (100 000 shares) Asset revaluation surplus Retained earnings $100 000 50 000 20 000 On 1 July 2015, the ownership interest of 30%, together with board representation and a diverse spread of remaining shareholders, was sufficient for the investor to demonstrate significant influence, and accordingly to begin accounting for the investment as an associate. The fair value of the 30% interest in Alyssa Ltd at 1 July 2013 was $70 000. At this date, the equity of Alyssa Ltd consisted of: Share capital (100 000 shares) $100 000 Asset revaluation surplus 60 000 General reserve 10 000 Retained earnings 40 000 At this date, all the identifiable assets and liabilities of Alyssa Ltd were recorded at fair value except for the following assets: Carrying amount Fair value Machinery $20 000 $25 000 Inventory 10 000 12 000 The machinery was expected to have a further 5-year life, benefits being received evenly over this period. The inventory was all sold by 30 June 2016. Dividends paid by Alyssa Ltd in the 201314 period were $10 000, and $12 000 was paid in the 2014-15 period. In June 2015, Alyssa Ltd declared a dividend of $10 000. Dividend revenue is recognised when dividends are declared. During the period ending 30 June 2015, the following events occurred: a. Alyssa Ltd sold to Caitlin Ltd some inventory, which had previously cost Alyssa Ltd $8000, for $10 000. Caitlin Ltd still had one-quarter of these items on hand at 30 June 2016. b. On 1 January 2016, Caitlin Ltd sold a non-current asset to Alyssa Ltd for $50 000, giving a profit before tax of $10 000 to Caitlin Ltd. Alyssa Ltd applied a 12% p.a. on cost straight-line depreciation method to this asset. c. On 31 December 2015, Alyssa Ltd paid an interim dividend of $5000. d. At 30 June 2016, Alyssa Ltd calculated that it had earned a profit of $32 000, after an income tax expense of $8000. Alyssa Ltd then declared a $5000 dividend, to be paid in September 2016. e. The tax rate is 30%. Required Prepare the journal entries for the consolidation worksheet of Caitlin Ltd at 30 June 2016 for the inclusion of the equity-accounted results of Alyssa Ltd. Exercise C.6 Consolidated worksheet entries to include investment in associate On 1 July 2013, Caitlin Ltd acquired 30% of the shares of Alyssa Ltd for $60 000. At this date, the equity of Alyssa Ltd consisted of: Share capital (100 000 shares) Asset revaluation surplus Retained earnings $100 000 50 000 20 000 On 1 July 2015, the ownership interest of 30%, together with board representation and a diverse spread of remaining shareholders, was sufficient for the investor to demonstrate significant influence, and accordingly to begin accounting for the investment as an associate. The fair value of the 30% interest in Alyssa Ltd at 1 July 2013 was $70 000. At this date, the equity of Alyssa Ltd consisted of: Share capital (100 000 shares) $100 000 Asset revaluation surplus 60 000 General reserve 10 000 Retained earnings 40 000 At this date, all the identifiable assets and liabilities of Alyssa Ltd were recorded at fair value except for the following assets: Carrying amount Fair value Machinery $20 000 $25 000 Inventory 10 000 12 000 The machinery was expected to have a further 5-year life, benefits being received evenly over this period. The inventory was all sold by 30 June 2016. Dividends paid by Alyssa Ltd in the 201314 period were $10 000, and $12 000 was paid in the 2014-15 period. In June 2015, Alyssa Ltd declared a dividend of $10 000. Dividend revenue is recognised when dividends are declared. During the period ending 30 June 2015, the following events occurred: a. Alyssa Ltd sold to Caitlin Ltd some inventory, which had previously cost Alyssa Ltd $8000, for $10 000. Caitlin Ltd still had one-quarter of these items on hand at 30 June 2016. b. On 1 January 2016, Caitlin Ltd sold a non-current asset to Alyssa Ltd for $50 000, giving a profit before tax of $10 000 to Caitlin Ltd. Alyssa Ltd applied a 12% p.a. on cost straight-line depreciation method to this asset. c. On 31 December 2015, Alyssa Ltd paid an interim dividend of $5000. d. At 30 June 2016, Alyssa Ltd calculated that it had earned a profit of $32 000, after an income tax expense of $8000. Alyssa Ltd then declared a $5000 dividend, to be paid in September 2016. e. The tax rate is 30%. Required Prepare the journal entries for the consolidation worksheet of Caitlin Ltd at 30 June 2016 for the inclusion of the equity-accounted results of Alyssa Ltd