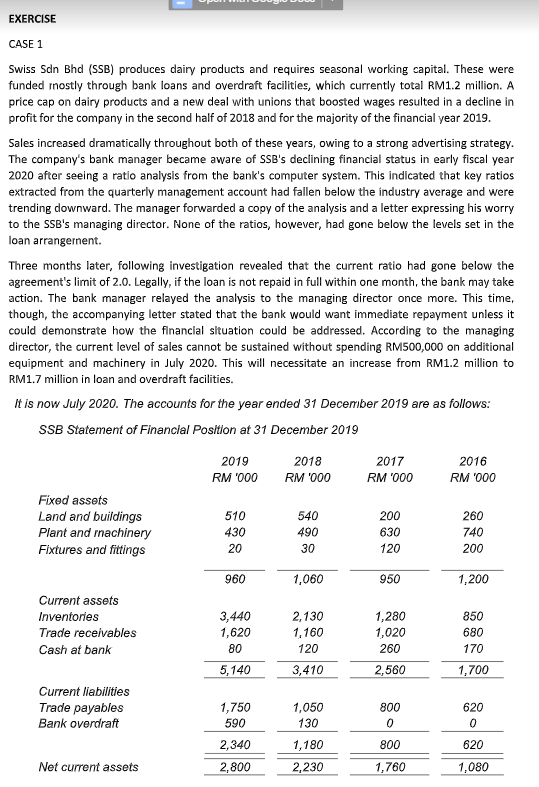

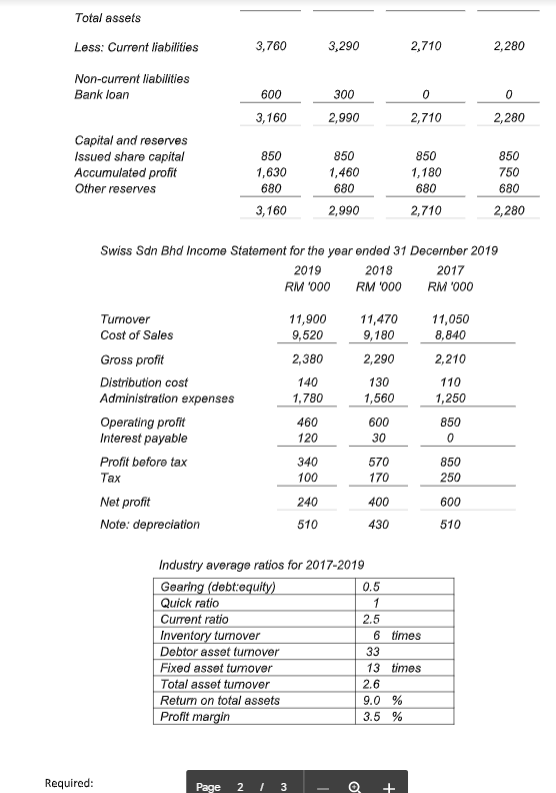

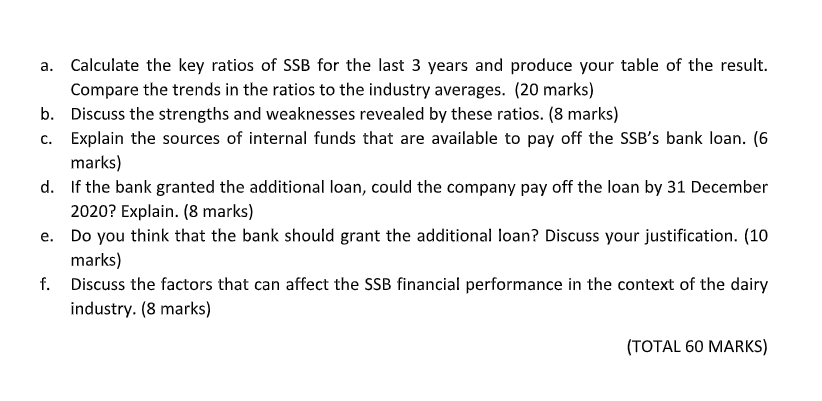

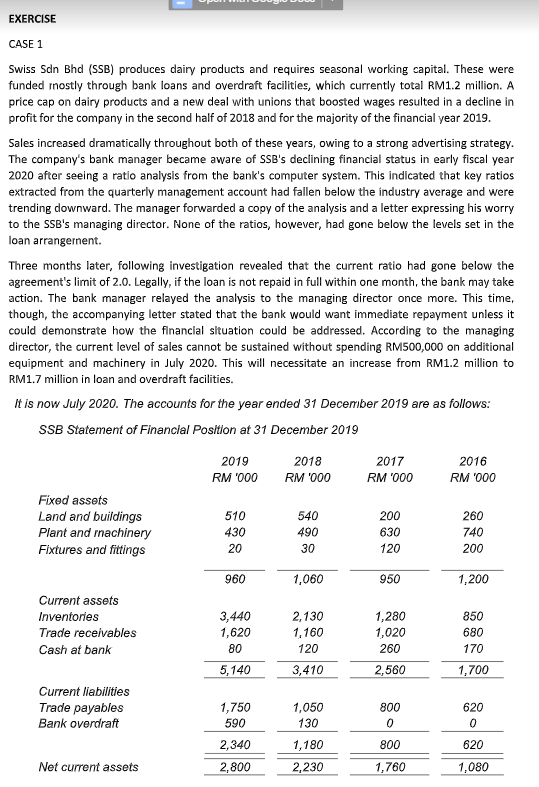

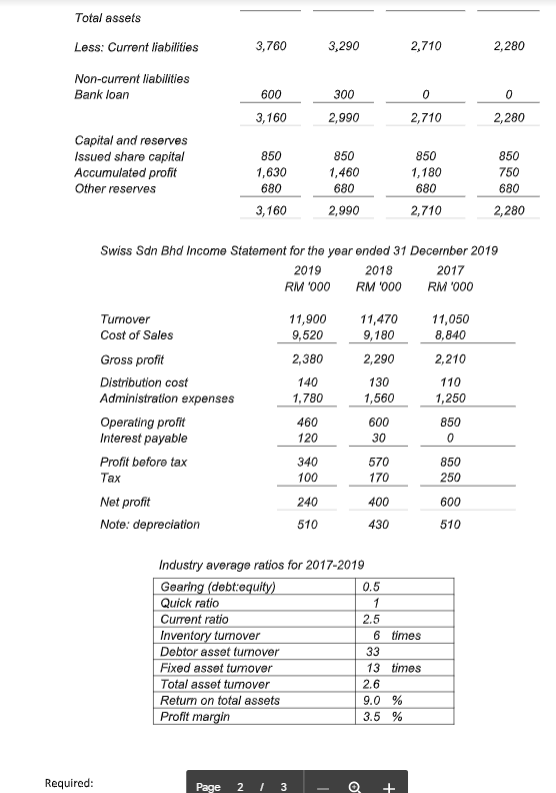

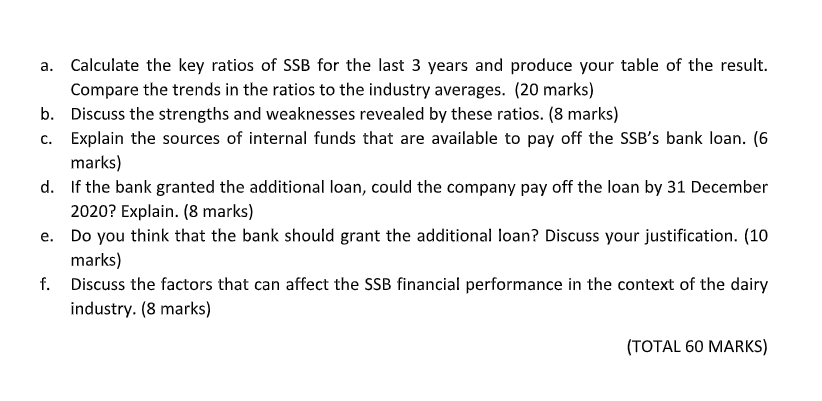

EXERCISE CASE 1 Swiss Sdn Bhd (SSB) produces dairy products and requires seasonal working capital. These were funded mostly through bank loans and overdraft facilities, which currently total RM1.2 million. A price cap on dairy products and a new deal with unions that boosted wages resulted in a decline in profit for the company in the second half of 2018 and for the majority of the financial year 2019. Sales increased dramatically throughout both of these years, owing to a strong advertising strategy. The company's bank manager became aware of SSB's declining financial status in early fiscal year 2020 after seeing a ratio analysis from the bank's computer system. This indicated that key ratios extracted from the quarterly management account had fallen below the industry average and were trending downward. The manager forwarded a copy of the analysis and a letter expressing his worry to the SSB's managing director. None of the ratios, however, had gone below the levels set in the loan arrangernent. Three months later, following investigation revealed that the current ratio had gone below the agreement's limit of 2.0. Legally, if the loan is not repaid in full within one month, the bank may take action. The bank manager relayed the analysis to the managing director once more. This time, though, the accompanying letter stated that the bank would want immediate repayment unless it could demonstrate how the financial situation could be addressed. According to the managing director, the current level of sales cannot be sustained without spending RM500,000 on additional equipment and machinery in July 2020. This will necessitate an increase from RM1.2 million to RM1.7 million in loan and overdraft facilities. it is now July 2020. The accounts for the year ended 31 December 2019 are as follows: SSB Statement of Financial Position at 31 December 2019 2019 2018 2017 2016 RM '000 RM '000 RM 000 RM '000 Fixed assets Land and buildings 510 540 200 Plant and machinery 490 630 740 Fixtures and fittings 20 120 200 260 430 30 960 1,060 950 1,200 3,440 Current assets Inventories Trade receivables Cash at bank 1,620 80 2,130 1,160 120 3,410 1,280 1,020 260 850 680 170 5,140 2,560 1,700 Current liabilities Trade payables Bank overdraft 1,750 590 1,050 130 800 0 620 0 2,340 800 620 1,180 2,230 Net current assets 2,800 1,760 1,080 Total assets Less: Current liabilities 3,760 3,290 2,710 2,280 Non-current liabilities Bank loan 600 0 0 300 2,990 3,160 2,710 2,280 850 Capital and reserves Issued share capital Accumulated profit Other reserves 850 1,630 680 3,160 850 1,460 680 2,990 850 1,180 680 750 680 2,710 2,280 Swiss Sdn Bhd Income Statement for the year ended 31 Decernber 2019 2019 2018 2017 RM '000 RM 1000 RM '000 11,470 9,180 2,290 130 1,560 11,050 8,840 2,210 110 11,900 9,520 2,380 140 1.780 460 120 340 100 Turnover Cost of Sales Gross profit Distribution cost Administration expenses Operating profit Interest payable Profit before tax Tax Net profit Note: depreciation 1,250 600 30 850 0 570 170 850 250 400 600 240 510 430 510 2 Industry average ratios for 2017-2019 Gearing debt:equity) 0.5 Quick ratio 1 Current ratio 2.5 Inventory turnover 6 times Debtor asset turnover 33 Fixed asset tumover 13 times Total asset turnover 2.6 Return on total assets 9.0 % Profit margin 3.5 % Required: Page 2 / 3 a. Calculate the key ratios of SSB for the last 3 years and produce your table of the result. Compare the trends in the ratios to the industry averages. (20 marks) b. Discuss the strengths and weaknesses revealed by these ratios. (8 marks) C. Explain the sources of internal funds that are available to pay off the SSB's bank loan. (6 marks) d. If the bank granted the additional loan, could the company pay off the loan by 31 December 2020? Explain. (8 marks) Do you think that the bank should grant the additional loan? Discuss your justification. (10 marks) f. Discuss the factors that can affect the SSB financial performance in the context of the dairy industry. (8 marks) e. (TOTAL 60 MARKS) EXERCISE CASE 1 Swiss Sdn Bhd (SSB) produces dairy products and requires seasonal working capital. These were funded mostly through bank loans and overdraft facilities, which currently total RM1.2 million. A price cap on dairy products and a new deal with unions that boosted wages resulted in a decline in profit for the company in the second half of 2018 and for the majority of the financial year 2019. Sales increased dramatically throughout both of these years, owing to a strong advertising strategy. The company's bank manager became aware of SSB's declining financial status in early fiscal year 2020 after seeing a ratio analysis from the bank's computer system. This indicated that key ratios extracted from the quarterly management account had fallen below the industry average and were trending downward. The manager forwarded a copy of the analysis and a letter expressing his worry to the SSB's managing director. None of the ratios, however, had gone below the levels set in the loan arrangernent. Three months later, following investigation revealed that the current ratio had gone below the agreement's limit of 2.0. Legally, if the loan is not repaid in full within one month, the bank may take action. The bank manager relayed the analysis to the managing director once more. This time, though, the accompanying letter stated that the bank would want immediate repayment unless it could demonstrate how the financial situation could be addressed. According to the managing director, the current level of sales cannot be sustained without spending RM500,000 on additional equipment and machinery in July 2020. This will necessitate an increase from RM1.2 million to RM1.7 million in loan and overdraft facilities. it is now July 2020. The accounts for the year ended 31 December 2019 are as follows: SSB Statement of Financial Position at 31 December 2019 2019 2018 2017 2016 RM '000 RM '000 RM 000 RM '000 Fixed assets Land and buildings 510 540 200 Plant and machinery 490 630 740 Fixtures and fittings 20 120 200 260 430 30 960 1,060 950 1,200 3,440 Current assets Inventories Trade receivables Cash at bank 1,620 80 2,130 1,160 120 3,410 1,280 1,020 260 850 680 170 5,140 2,560 1,700 Current liabilities Trade payables Bank overdraft 1,750 590 1,050 130 800 0 620 0 2,340 800 620 1,180 2,230 Net current assets 2,800 1,760 1,080 Total assets Less: Current liabilities 3,760 3,290 2,710 2,280 Non-current liabilities Bank loan 600 0 0 300 2,990 3,160 2,710 2,280 850 Capital and reserves Issued share capital Accumulated profit Other reserves 850 1,630 680 3,160 850 1,460 680 2,990 850 1,180 680 750 680 2,710 2,280 Swiss Sdn Bhd Income Statement for the year ended 31 Decernber 2019 2019 2018 2017 RM '000 RM 1000 RM '000 11,470 9,180 2,290 130 1,560 11,050 8,840 2,210 110 11,900 9,520 2,380 140 1.780 460 120 340 100 Turnover Cost of Sales Gross profit Distribution cost Administration expenses Operating profit Interest payable Profit before tax Tax Net profit Note: depreciation 1,250 600 30 850 0 570 170 850 250 400 600 240 510 430 510 2 Industry average ratios for 2017-2019 Gearing debt:equity) 0.5 Quick ratio 1 Current ratio 2.5 Inventory turnover 6 times Debtor asset turnover 33 Fixed asset tumover 13 times Total asset turnover 2.6 Return on total assets 9.0 % Profit margin 3.5 % Required: Page 2 / 3 a. Calculate the key ratios of SSB for the last 3 years and produce your table of the result. Compare the trends in the ratios to the industry averages. (20 marks) b. Discuss the strengths and weaknesses revealed by these ratios. (8 marks) C. Explain the sources of internal funds that are available to pay off the SSB's bank loan. (6 marks) d. If the bank granted the additional loan, could the company pay off the loan by 31 December 2020? Explain. (8 marks) Do you think that the bank should grant the additional loan? Discuss your justification. (10 marks) f. Discuss the factors that can affect the SSB financial performance in the context of the dairy industry. (8 marks) e. (TOTAL 60 MARKS)