Answered step by step

Verified Expert Solution

Question

1 Approved Answer

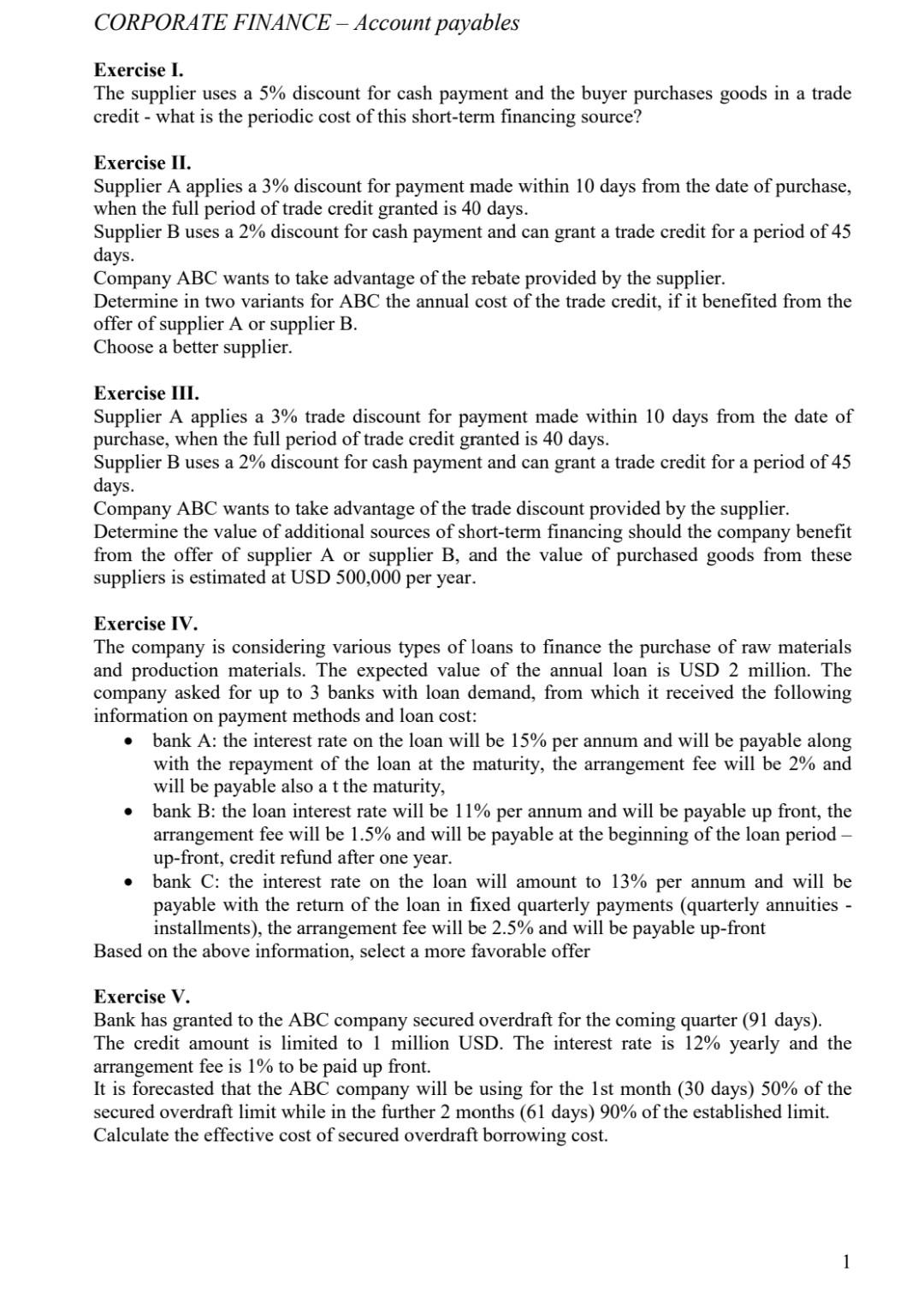

Exercise I. The supplier uses a 5% discount for cash payment and the buyer purchases goods in a trade credit - what is the periodic

Exercise I. The supplier uses a 5% discount for cash payment and the buyer purchases goods in a trade credit - what is the periodic cost of this short-term financing source? Exercise II. Supplier A applies a 3\% discount for payment made within 10 days from the date of purchase, when the full period of trade credit granted is 40 days. Supplier B uses a 2\% discount for cash payment and can grant a trade credit for a period of 45 days. Company ABC wants to take advantage of the rebate provided by the supplier. Determine in two variants for ABC the annual cost of the trade credit, if it benefited from the offer of supplier A or supplier B. Choose a better supplier. Exercise III. Supplier A applies a 3\% trade discount for payment made within 10 days from the date of purchase, when the full period of trade credit granted is 40 days. Supplier B uses a 2\% discount for cash payment and can grant a trade credit for a period of 45 days. Company ABC wants to take advantage of the trade discount provided by the supplier. Determine the value of additional sources of short-term financing should the company benefit from the offer of supplier A or supplier B, and the value of purchased goods from these suppliers is estimated at USD 500,000 per year. Exercise IV. The company is considering various types of loans to finance the purchase of raw materials and production materials. The expected value of the annual loan is USD 2 million. The company asked for up to 3 banks with loan demand, from which it received the following information on payment methods and loan cost: - bank A: the interest rate on the loan will be 15% per annum and will be payable along with the repayment of the loan at the maturity, the arrangement fee will be 2% and will be payable also a the maturity, - bank B: the loan interest rate will be 11% per annum and will be payable up front, the arrangement fee will be 1.5% and will be payable at the beginning of the loan period up-front, credit refund after one year. - bank C : the interest rate on the loan will amount to 13% per annum and will be payable with the return of the loan in fixed quarterly payments (quarterly annuities installments), the arrangement fee will be 2.5% and will be payable up-front Based on the above information, select a more favorable offer Exercise V. Bank has granted to the ABC company secured overdraft for the coming quarter (91 days). The credit amount is limited to 1 million USD. The interest rate is 12% yearly and the arrangement fee is 1% to be paid up front. It is forecasted that the ABC company will be using for the 1st month ( 30 days) 50% of the secured overdraft limit while in the further 2 months (61 days) 90% of the established limit. Calculate the effective cost of secured overdraft borrowing cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started