Answered step by step

Verified Expert Solution

Question

1 Approved Answer

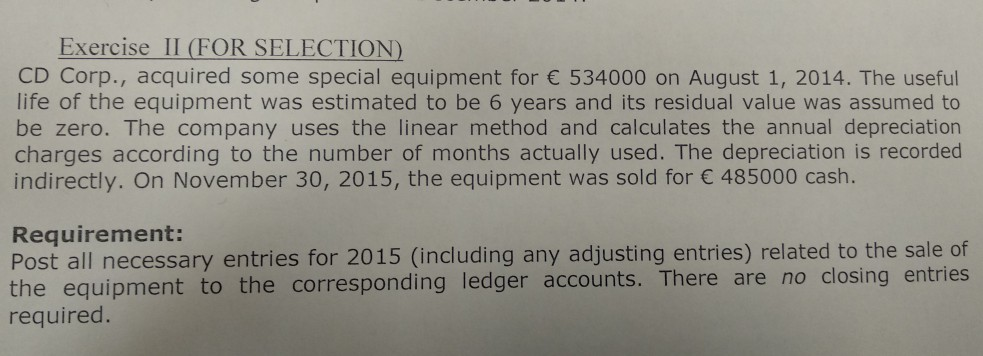

Exercise II (FOR SELECTION) CD Corp., acquired some special equipment for 534000 on August 1, 2014. The useful life of the equipment was estimated to

Exercise II (FOR SELECTION) CD Corp., acquired some special equipment for 534000 on August 1, 2014. The useful life of the equipment was estimated to be 6 years and its residual value was assumed to be zero. The company uses the linear method and calculates the annual depreciation charges according to the number of months actually used. The depreciation is recorded indirectly. On November 30, 2015, the equipment was sold for 485000 cash. Requirement: Post all necessary entries for 2015 (including any adjusting entries) related to the sale of the equipment to the co required. sponding ledger accounts. There are no closing entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started