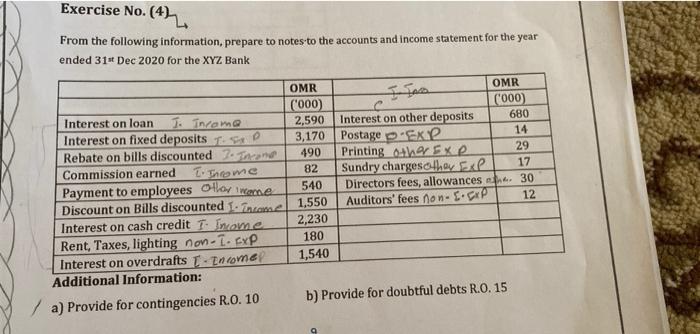

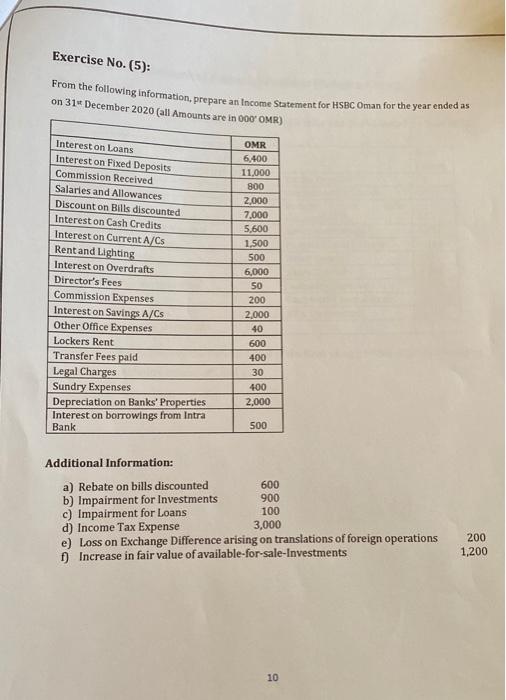

Exercise No.(4) From the following information, prepare to notes to the accounts and income statement for the year ended 31st Dec 2020 for the XYZ Bank OMR 14 29 490 82 OMR ('000) ('000) Interest on loan 1. Income 2,590 Interest on other deposits 680 Interest on fixed deposits T. EXD 3,170 Postage p Exp Rebate on bills discounted 7. Then Printing other Exe Commission earned I. Income Sundry chargesolhere 17 Payment to employees Ollor come 540 Directors fees, allowances. 30 Discount on Bills discounted into 1,550 Auditors' fees non-I.CP 12 Interest on cash credit 1 Erome 2,230 Rent, Taxes, lighting non-I. cxp Interest on overdrafts T-Income 1,540 Additional Information: a) Provide for contingencies R.O. 10 b) Provide for doubtful debts R.O. 15 180 Exercise No.(5): From the following information, prepare an Income Statement for HSBC Oman for the year ended as on 31 December 2020 (all Amounts are in 000 OMR) OMR 6,400 11,000 800 2,000 7.000 5,600 1,500 500 Interest on Loans Interest on Fixed Deposits Commission Received Salaries and Allowances Discount on Bills discounted Interest on Cash Credits Interest on Current A/Cs Rent and Lighting Interest on Overdrafts Director's Fees Commission Expenses Interest on Savings A/C Other Office Expenses Lockers Rent Transfer Fees paid Legal Charges Sundry Expenses Depreciation on Banks' Properties 6,000 50 200 2,000 40 600 400 30 400 2,000 Interest on borrowings from Intra Bank 500 Additional Information: a) Rebate on bills discounted b) Impairment for Investments c) Impairment for Loans d) Income Tax Expense e) Loss on Exchange Difference arising on translations of foreign operations Increase in fair value of available-for-sale-Investments 600 900 100 3,000 200 1,200 10 Exercise No.(4) From the following information, prepare to notes to the accounts and income statement for the year ended 31st Dec 2020 for the XYZ Bank OMR 14 29 490 82 OMR ('000) ('000) Interest on loan 1. Income 2,590 Interest on other deposits 680 Interest on fixed deposits T. EXD 3,170 Postage p Exp Rebate on bills discounted 7. Then Printing other Exe Commission earned I. Income Sundry chargesolhere 17 Payment to employees Ollor come 540 Directors fees, allowances. 30 Discount on Bills discounted into 1,550 Auditors' fees non-I.CP 12 Interest on cash credit 1 Erome 2,230 Rent, Taxes, lighting non-I. cxp Interest on overdrafts T-Income 1,540 Additional Information: a) Provide for contingencies R.O. 10 b) Provide for doubtful debts R.O. 15 180 Exercise No.(5): From the following information, prepare an Income Statement for HSBC Oman for the year ended as on 31 December 2020 (all Amounts are in 000 OMR) OMR 6,400 11,000 800 2,000 7.000 5,600 1,500 500 Interest on Loans Interest on Fixed Deposits Commission Received Salaries and Allowances Discount on Bills discounted Interest on Cash Credits Interest on Current A/Cs Rent and Lighting Interest on Overdrafts Director's Fees Commission Expenses Interest on Savings A/C Other Office Expenses Lockers Rent Transfer Fees paid Legal Charges Sundry Expenses Depreciation on Banks' Properties 6,000 50 200 2,000 40 600 400 30 400 2,000 Interest on borrowings from Intra Bank 500 Additional Information: a) Rebate on bills discounted b) Impairment for Investments c) Impairment for Loans d) Income Tax Expense e) Loss on Exchange Difference arising on translations of foreign operations Increase in fair value of available-for-sale-Investments 600 900 100 3,000 200 1,200 10