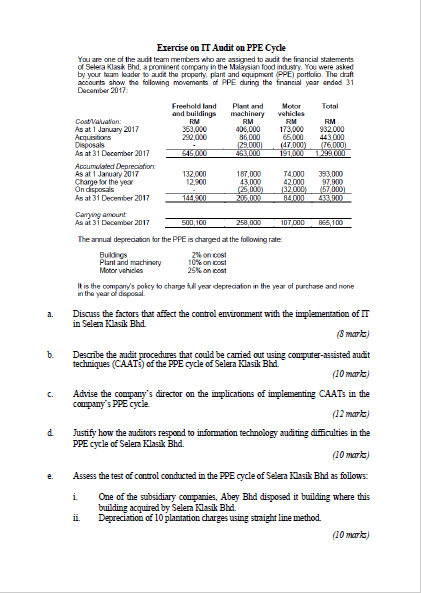

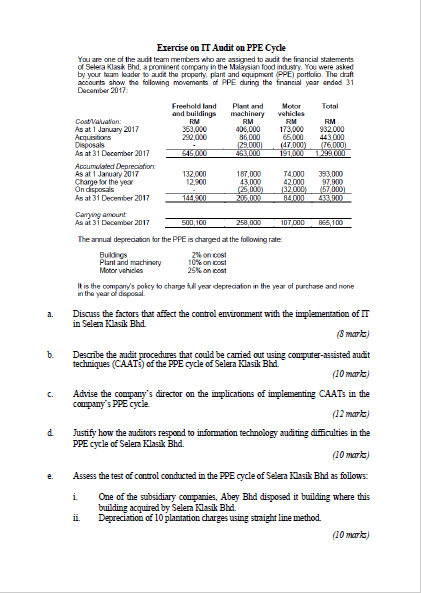

Exercise on IT Audit on PPE Cycle You are one of the audit team members who are assigned to audit the financial statements of Selera Klasik End, a prominent company in the Malaysian food industry. You were asked by your team leader to audit the proparty, plant and equipment (PPE) portfolio. The draft accounts show the following movements of PPE during the francial year ended 31 December 2017 Total Cost Valuation As at 1 January 2017 Acquisitions Disposals As at 31 December 2017 Freehold land and building ROM 353,000 290.000 Plant and machinery RM 406,000 86,000 129,000 49000 Motor vehicles RM 173.000 65,000 (47.000) 191,000 RM 932.000 443.000 (76,000 12941000 64500 Accumulated Depreciation As at 1 January 2017 Charge for the year On disposals As at 31 December 2017 132.000 12.900 187,000 43,000 (25000) 205.000 74.000 42.000 132 000) R400 393,000 97,900 57 000 433.20 144,600 Carrying amount As at 31 December 2017 500,100 258,000 107.000 855,100 The annual depreciation for the PPE is charged at the following rate: Buildings Plant and machinery Motor vehicles on Cost 10% on Cos! 25% on coat It is the company's policy to charge will your depreciation in the year of purchase and none in the year of disposal a. Discuss the factors that affect the control environment with the implementation of IT in Selena Klasik Bhd (8 marks) . Describe the audit procedures that could be carried out using computer-assisted audit techniques (CAATS) of the PPE cycle of Selera Klasik Bhd. (10 marks) Advise the company's director on the implications of implementing CAATS in the company's PPE cycle (12 mars) C. d Justify how the auditors respond to information technology auditing difficulties in the PPE cycle of Selera Klasik Bhd. (10 marks) Assess the test of control conducted in the PPE cycle of Selera Klasik Bhd as follows: i One of the subsidiary companies, Abey Bhd disposed it building where this building acquired by Selera Klasik Bhd Depreciation of 10 plantation charges using straight line method ii. (10 mark) Exercise on IT Audit on PPE Cycle You are one of the audit team members who are assigned to audit the financial statements of Selera Klasik End, a prominent company in the Malaysian food industry. You were asked by your team leader to audit the proparty, plant and equipment (PPE) portfolio. The draft accounts show the following movements of PPE during the francial year ended 31 December 2017 Total Cost Valuation As at 1 January 2017 Acquisitions Disposals As at 31 December 2017 Freehold land and building ROM 353,000 290.000 Plant and machinery RM 406,000 86,000 129,000 49000 Motor vehicles RM 173.000 65,000 (47.000) 191,000 RM 932.000 443.000 (76,000 12941000 64500 Accumulated Depreciation As at 1 January 2017 Charge for the year On disposals As at 31 December 2017 132.000 12.900 187,000 43,000 (25000) 205.000 74.000 42.000 132 000) R400 393,000 97,900 57 000 433.20 144,600 Carrying amount As at 31 December 2017 500,100 258,000 107.000 855,100 The annual depreciation for the PPE is charged at the following rate: Buildings Plant and machinery Motor vehicles on Cost 10% on Cos! 25% on coat It is the company's policy to charge will your depreciation in the year of purchase and none in the year of disposal a. Discuss the factors that affect the control environment with the implementation of IT in Selena Klasik Bhd (8 marks) . Describe the audit procedures that could be carried out using computer-assisted audit techniques (CAATS) of the PPE cycle of Selera Klasik Bhd. (10 marks) Advise the company's director on the implications of implementing CAATS in the company's PPE cycle (12 mars) C. d Justify how the auditors respond to information technology auditing difficulties in the PPE cycle of Selera Klasik Bhd. (10 marks) Assess the test of control conducted in the PPE cycle of Selera Klasik Bhd as follows: i One of the subsidiary companies, Abey Bhd disposed it building where this building acquired by Selera Klasik Bhd Depreciation of 10 plantation charges using straight line method ii. (10 mark)