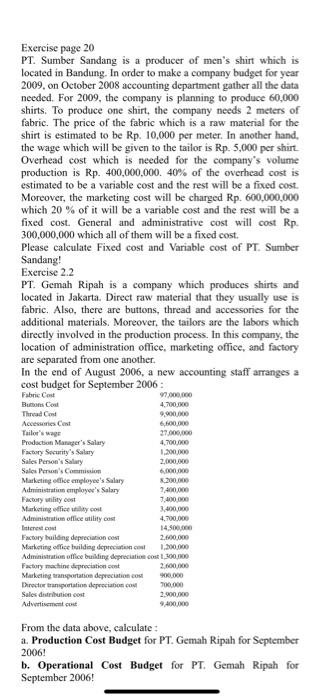

Exercise page 20 PT. Sumber Sandang is a producer of men's shirt which is located in Bandung. In order to make a company budget for year 2009, on October 2008 accounting department gather all the data needed. For 2009, the company is planning to produce 60,000 shirts. To produce one shirt, the company needs 2 meters of fabric. The price of the fabric which is a raw material for the shirt is estimated to be Rp. 10,000 per meter. In another hand, the wage which will be given to the tailor is Rp. 5,000 per shirt Overhead cost which is needed for the company's volume production is Rp. 400,000,000. 40% of the overhead cost is estimated to be a variable cost and the rest will be a fixed cost. Moreover, the marketing cost will be charged Rp. 600,000,000 which 20 % of it will be a variable cost and the rest will be a fixed cost. General and administrative cost will cost Rp. 300,000,000 which all of them will be a fixed cost. Please calculate Fixed cost and Variable cost of PT. Sumber Sandang! Exercise 2.2 PT. Gemah Ripah is a company which produces shirts and located in Jakarta. Direct raw material that they usually use is fabric. Also, there are buttons, thread and accessories for the additional materials. Moreover, the tailors are the labors which directly involved in the production process. In this company, the location of administration office, marketing office, and factory are separated from one another In the end of August 2006, a new accounting staff arranges a cost budget for September 2006: Fabric Cost Buttons Cou 4.700.000 Thread Cost Accessories Cest 6,600.000 Tailor's was 27.000.000 Production Manager's Salary 4,700.000 Factory Security's Salary 1.200,000 Sales Person's Salary 2.000.000 Sales Person's Commission Marketing office employee's Salary 3.200.000 Administration employer's Salary 7.400.000 Factory stility cost 7,400.000 Marketing office ility cost 3.400.000 Administration office utility cost 4.700.000 Interest.com Factory building depreciation Cost 2.600.000 Marketing office building deprem ,200.000 Administration office building depreciation cost 1.300.000 Factory machine depreciation cont 2.600.000 Marketing transportation depreciation.com 00.000 Director transportation depreciation 700.000 Sales distribution cost 2.900.000 Advertisement cost 9,400,000 From the data above, calculate: 1. Production Cost Budget for PT. Gemah Ripah for September 2006! b. Operational Cost Budget for PT. Gemah Ripah for September 2006! 9.900.000