Question

EXERCISE PROBLEM FOR FINANCE 350-EXAM H3 GIVEN: Jones Company has $1,000 par, 10 year, 10% annual =2.15 coupon interest bonds currently outstanding that are n=0.038

EXERCISE PROBLEM FOR FINANCE 350-EXAM H3 GIVEN:

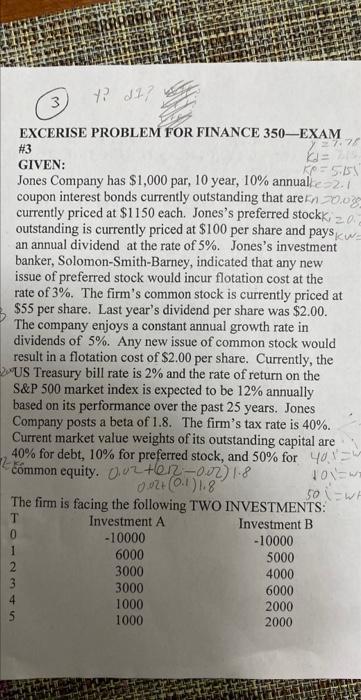

Jones Company has $1,000 par, 10 year, 10% annual =2.15 coupon interest bonds currently outstanding that are n=0.038 currently priced at $1150 each. Jones's preferred stock, outstanding is currently priced at $100 per share and pays an annual dividend at the rate of 5\%. Jones's investment banker, Solomon-Smith-Barney, indicated that any new issue of preferred stock would incur flotation cost at the rate of 3%. The firm's common stock is currently priced at $55 per share. Last year's dividend per share was $2.00. The company enjoys a constant annual growth rate in dividends of 5%. Any new issue of common stock would result in a flotation cost of $2.00 per share. Currently, the US Treasury bill rate is 2% and the rate of return on the S\&P 500 market index is expected to be 12% annually based on its performance over the past 25 years. Jones Company posts a beta of 1.8 . The firm's tax rate is 40%. Current market value weights of its outstanding capital are 40% for debt, 10% for preferred stock, and 50% for common equity.

Calculate Y, Kd, Kp, Ke, Kn, Ki, and Kw. The last person who answered this did not understand the question.

Y = Yield to maturity of the company's bonds

Kd = Cost of debt

Kp = Cost of preferred stock

Ke = Cost of common equity using the dividend growth model

Kn = Weighted average cost of capital

Ki = Cost of equity

Kw = Weighted average cost of capital

3) EXCERISE PROBLEM FOR FINANCE 350-EXAM H3 GIVEN: Jones Company has $1,000 par, 10 year, 10% annuale =2.15 coupon interest bonds currently outstanding that are n=0.038 currently priced at $1150 each. Jones's preferred stockk, outstanding is currently priced at $100 per share and pays an annual dividend at the rate of 5\%. Jones's investment banker, Solomon-Smith-Barney, indicated that any new issue of preferred stock would incur flotation cost at the rate of 3%. The firm's common stock is currently priced at $55 per share. Last year's dividend per share was $2.00. The company enjoys a constant annual growth rate in dividends of 5%. Any new issue of common stock would result in a flotation cost of $2.00 per share. Currently, the US Treasury bill rate is 2% and the rate of return on the S\&P 500 market index is expected to be 12% annually based on its performance over the past 25 years. Jones Company posts a beta of 1.8 . The firm's tax rate is 40%. Current market value weights of its outstanding capital are 40% for debt, 10% for preferred stock, and 50% for cmmon equity. The firm is facing the following TWO INVESTMENTSStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started