Answered step by step

Verified Expert Solution

Question

1 Approved Answer

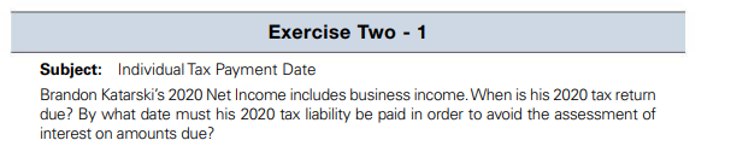

Exercise Two - 1 Subject: Individual Tax Payment Date Brandon Katarski's 2020 Net Income includes business income. When is his 2020 tax return due?

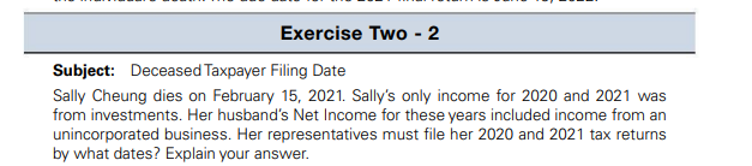

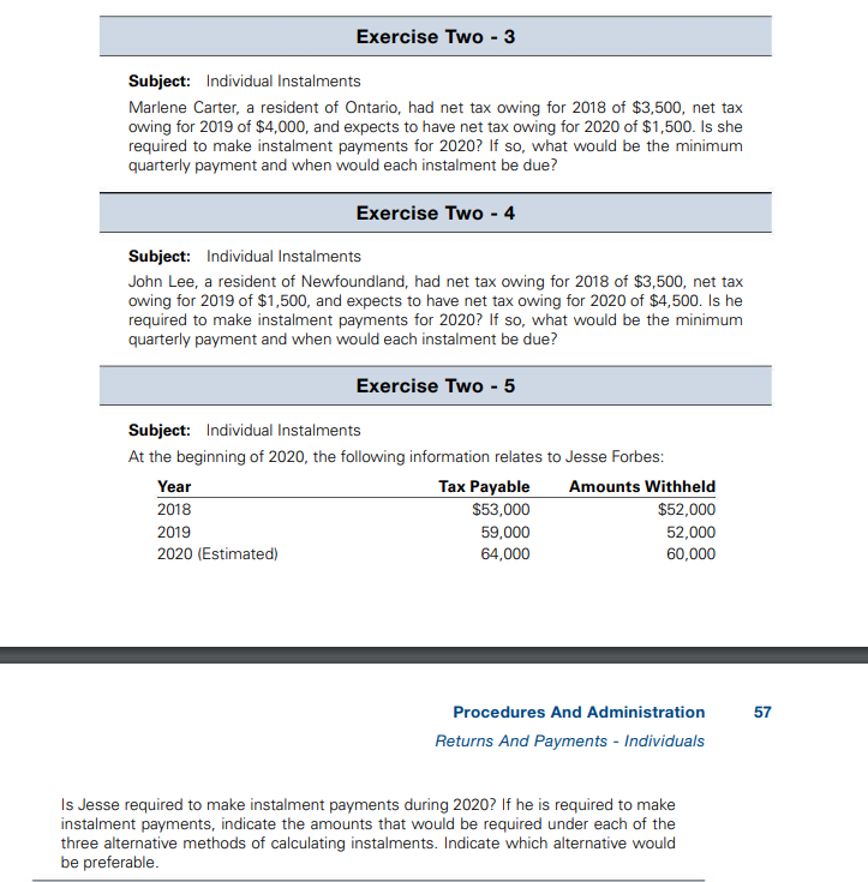

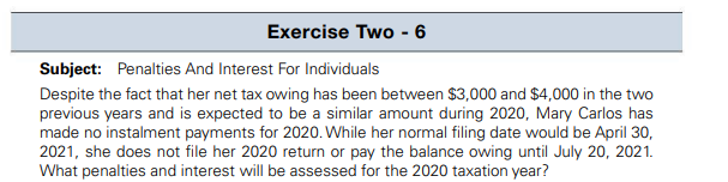

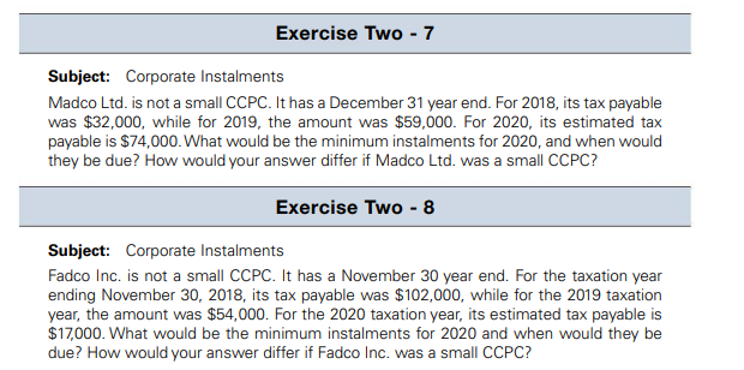

Exercise Two - 1 Subject: Individual Tax Payment Date Brandon Katarski's 2020 Net Income includes business income. When is his 2020 tax return due? By what date must his 2020 tax liability be paid in order to avoid the assessment of interest on amounts due? Exercise Two - 2 Subject: Deceased Taxpayer Filing Date Sally Cheung dies on February 15, 2021. Sally's only income for 2020 and 2021 was from investments. Her husband's Net Income for these years included income from an unincorporated business. Her representatives must file her 2020 and 2021 tax returns by what dates? Explain your answer. Subject: Individual Instalments Exercise Two - 3 Marlene Carter, a resident of Ontario, had net tax owing for 2018 of $3,500, net tax owing for 2019 of $4,000, and expects to have net tax owing for 2020 of $1,500. Is she required to make instalment payments for 2020? If so, what would be the minimum quarterly payment and when would each instalment be due? Subject: Individual Instalments Exercise Two - 4 John Lee, a resident of Newfoundland, had net tax owing for 2018 of $3,500, net tax owing for 2019 of $1,500, and expects to have net tax owing for 2020 of $4,500. Is he required to make instalment payments for 2020? If so, what would be the minimum quarterly payment and when would each instalment be due? Exercise Two - 5 Subject: Individual Instalments At the beginning of 2020, the following information relates to Jesse Forbes: Year 2018 2019 2020 (Estimated) Tax Payable $53,000 59,000 64,000 Amounts Withheld $52,000 52,000 60,000 Procedures And Administration Returns And Payments - Individuals Is Jesse required to make instalment payments during 2020? If he is required to make instalment payments, indicate the amounts that would be required under each of the three alternative methods of calculating instalments. Indicate which alternative would be preferable. 57 40 Exercise Two - 6 Subject: Penalties And Interest For Individuals Despite the fact that her net tax owing has been between $3,000 and $4,000 in the two previous years and is expected to be a similar amount during 2020, Mary Carlos has made no instalment payments for 2020. While her normal filing date would be April 30, 2021, she does not file her 2020 return or pay the balance owing until July 20, 2021. What penalties and interest will be assessed for the 2020 taxation year? Exercise Two - 7 Subject: Corporate Instalments Madco Ltd. is not a small CCPC. It has a December 31 year end. For 2018, its tax payable was $32,000, while for 2019, the amount was $59,000. For 2020, its estimated tax payable is $74,000. What would be the minimum instalments for 2020, and when would they be due? How would your answer differ if Madco Ltd. was a small CCPC? Exercise Two - 8 Subject: Corporate Instalments Fadco Inc. is not a small CCPC. It has a November 30 year end. For the taxation year ending November 30, 2018, its tax payable was $102,000, while for the 2019 taxation year, the amount was $54,000. For the 2020 taxation year, its estimated tax payable is $17,000. What would be the minimum instalments for 2020 and when would they be due? How would your answer differ if Fadco Inc. was a small CCPC?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started