Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercises 1.1,1.2,1.3,1.4,1.8,1.9 Exercises Identify distinguishing features of morial accounting E1.1 (LO 1),c Justin Bleeber has prepared the following list of statements about managerial account ing,

Exercises 1.1,1.2,1.3,1.4,1.8,1.9

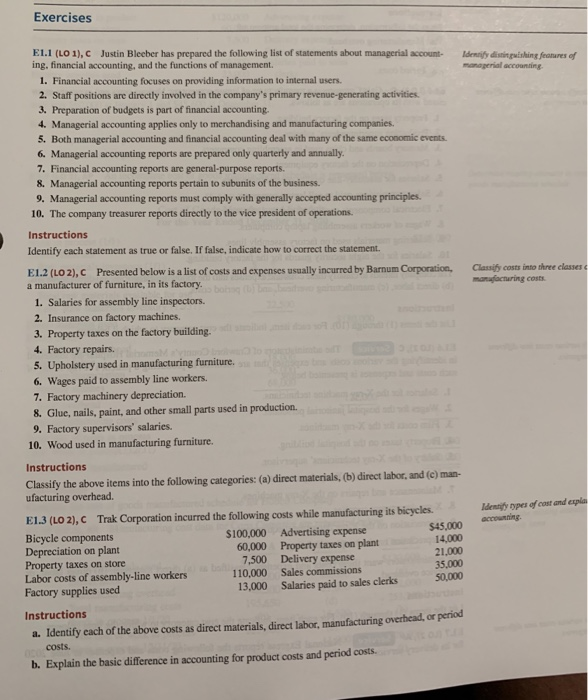

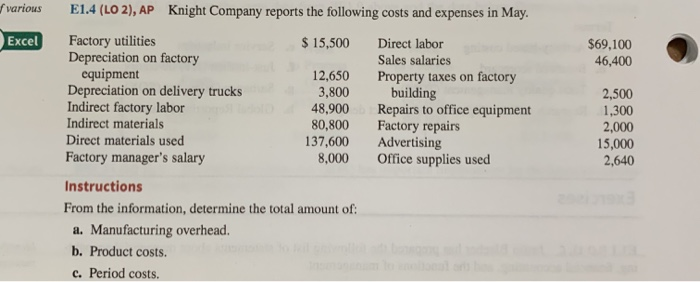

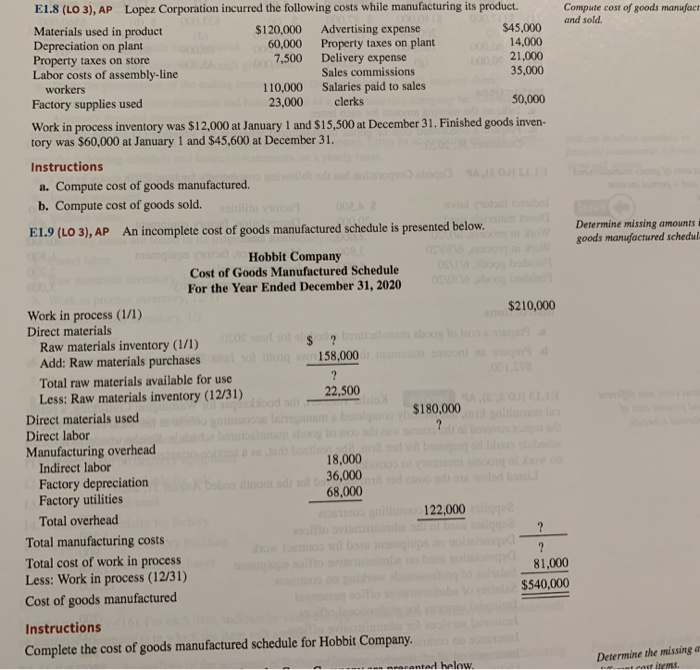

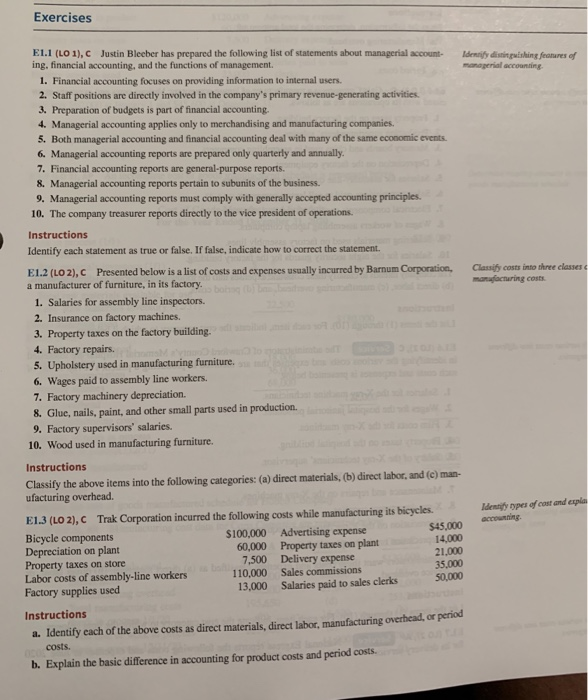

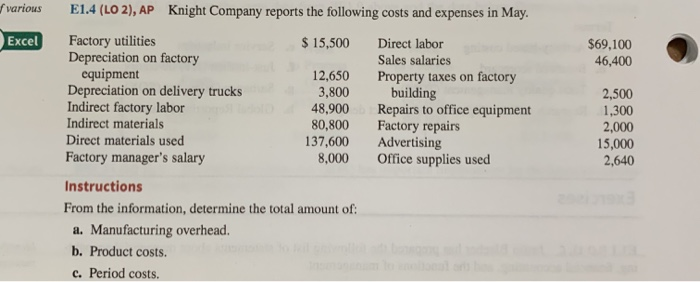

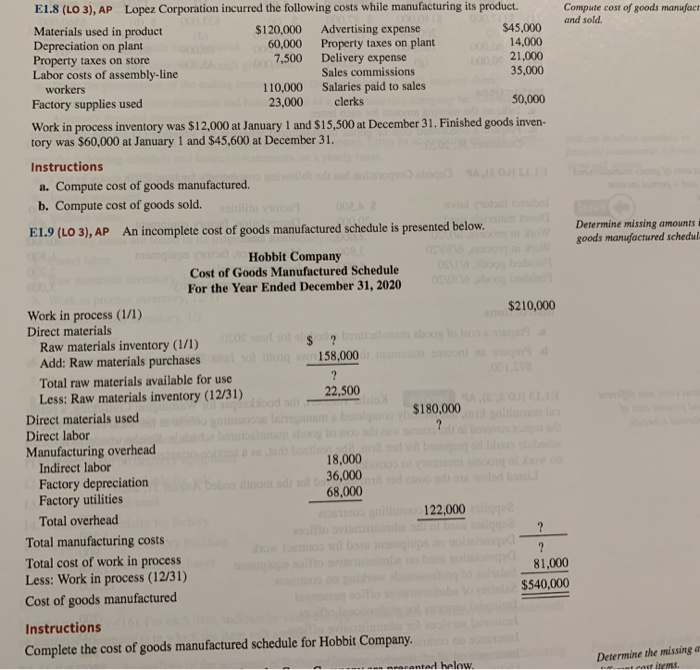

Exercises Identify distinguishing features of morial accounting E1.1 (LO 1),c Justin Bleeber has prepared the following list of statements about managerial account ing, financial accounting, and the functions of management. 1. Financial accounting focuses on providing information to internal users. 2. Staff positions are directly involved in the company's primary revenue generating activities 3. Preparation of budgets is part of financial accounting. 4. Managerial accounting applies only to merchandising and manufacturing companies. 5. Both managerial accounting and financial accounting deal with many of the same economic events. 6. Managerial accounting reports are prepared only quarterly and annually. 7. Financial accounting reports are general-purpose reports. 8. Managerial accounting reports pertain to subunits of the business. 9. Managerial accounting reports must comply with generally accepted accounting principles. 10. The company treasurer reports directly to the vice president of operations Classify costs into three classes manufacturing costs Instructions Identify each statement as true or false. If false, indicate how to correct the statement E1.2 (LO2),C Presented below is a list of costs and expenses usually incurred by Barnum Corporation, a manufacturer of furniture, in its factory. 1. Salaries for assembly line inspectors. 2. Insurance on factory machines. 3. Property taxes on the factory building, 4. Factory repairs. 5. Upholstery used in manufacturing furniture 6. Wages paid to assembly line workers. 7. Factory machinery depreciation. 8. Glue, nails, paint, and other small parts used in production. 9. Factory supervisors' salaries. 10. Wood used in manufacturing furniture. Identify types of cost and expla accounting Instructions Classify the above items into the following categories: (a) direct materials. (b) direct labor, and (c) man ufacturing overhead. E1.3 (LO 2),C Trak Corporation incurred the following costs while manufacturing its bicycles. Bicycle components $100,000 Advertising expense $45.000 Depreciation on plant 60,000 Property taxes on plant 14,000 Property taxes on store 7,500 Delivery expense 21.000 Labor costs of assembly-line workers 110,000 Sales commissions 35.000 Factory supplies used 13,000 Salaries paid to sales clerks 50,000 Instructions a. Identify each of the above costs as direct materials, direct labor, manufacturing overhead, or period costs. b. Explain the basic difference in accounting for product costs and period costs. Excel $69,100 46,400 E1.4 (LO 2), AP Knight Company reports the following costs and expenses in May, Factory utilities $ 15,500 Direct labor Depreciation on factory Sales salaries equipment 12,650 Property taxes on factory Depreciation on delivery trucks 3,800 building Indirect factory labor 48,900 Repairs to office equipment Indirect materials 80,800 Factory repairs Direct materials used 137,600 Advertising Factory manager's salary 8,000 Office supplies used Instructions From the information, determine the total amount of a. Manufacturing overhead. b. Product costs. c. Period costs. 2,500 1,300 2,000 15,000 2,640 E1.8 (LO 3), AP Lopez Corporation incurred the following costs while manufacturing its product. Compute cost of goods manufact and sold Materials used in product $120,000 Advertising expense $45,000 Depreciation on plant 60,000 Property taxes on plant 14,000 Property taxes on store 7,500 Delivery expense 21,000 Labor costs of assembly-line Sales commissions 35,000 workers 110,000 Salaries paid to sales Factory supplies used 23,000 clerks 50,000 Work in process inventory was $12,000 at January 1 and $15,500 at December 31. Finished goods inven. tory was $60,000 at January 1 and $45,600 at December 31. Instructions a. Compute cost of goods manufactured. b. Compute cost of goods sold. E1.9 (LO 3), AP An incomplete cost of goods manufactured schedule is presented below. Determine missing amounts goods manufactured schedul- e Hobbit Company Cost of Goods Manufactured Schedule For the Year Ended December 31, 2020 Work in process (1/1) $210,000 Direct materials $ ? bom o Raw materials inventory (1/1) Add: Raw materials purchases ole 1 58,000 Total raw materials available for use Less: Raw materials inventory (12/31) 22,500 "blood od Direct materials used Direct labor Manufacturing overhead Indirect labor 18,000 o Factory depreciation bi o med to Factory utilities 68,000 Total overhead 122,000 Total manufacturing costs Total cost of work in process 81,000 Less: Work in process (12/31) $540,000 Cost of goods manufactured Instructions Complete the cost of goods manufactured schedule for Hobbit Company. anantad helow. Determine the missing a tems

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started