Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercises 2 Rev2B - E Home Insert Page Layout Formulas Data Review View Help Tell me what you want X Cut General Calibri ll V

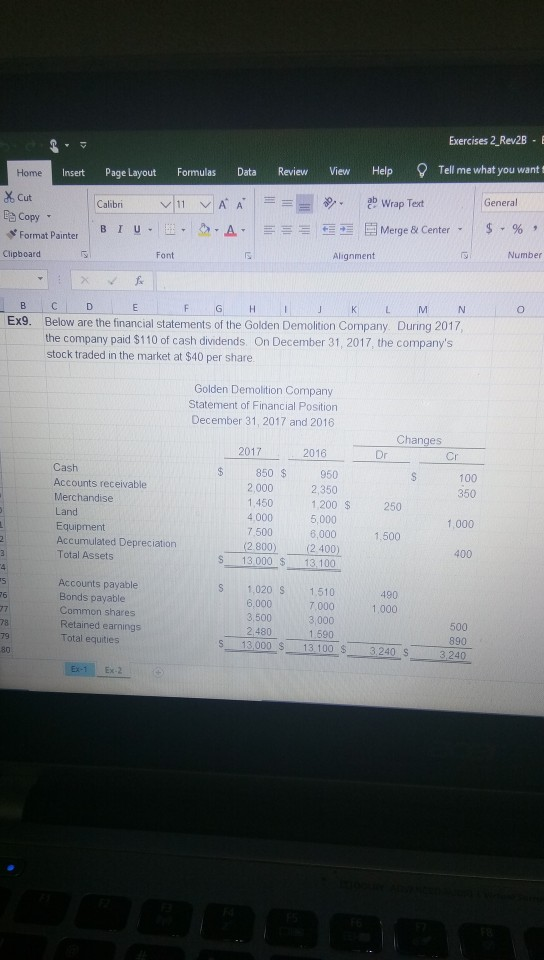

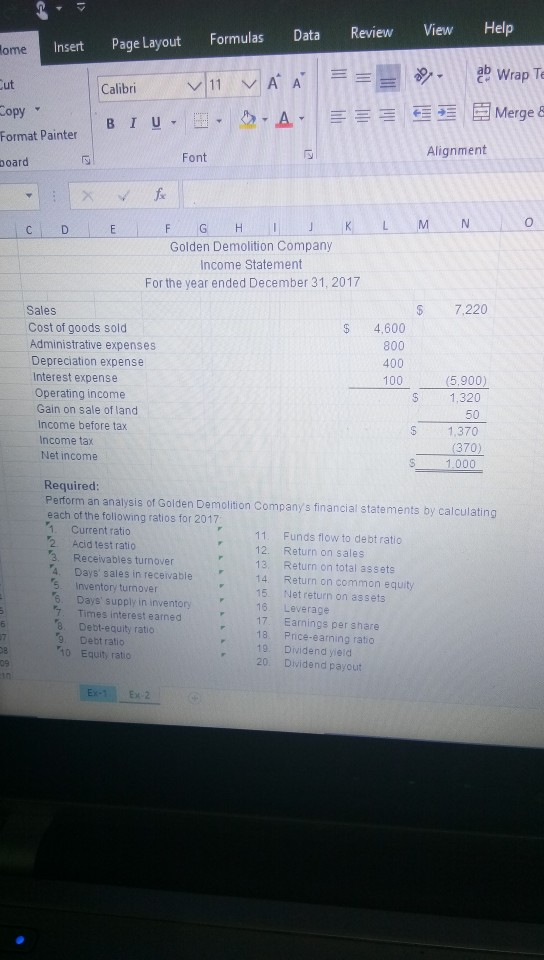

Exercises 2 Rev2B - E Home Insert Page Layout Formulas Data Review View Help Tell me what you want X Cut General Calibri ll V B IU , 2 ab Wrap Text Merge & Center - e Copy : Format Painter Clipboard E $ % , Font Alignment Number F G H I J K L M N Ex9. Below are the financial statements of the Golden Demolition Company. During 2017, the company paid $110 of cash dividends. On December 31, 2017, the company's stock traded in the market at $40 per share Golden Demolition Company Statement of Financial Position December 31, 2017 and 2016 2017 2016 Changes Dr cr 950 100 350 Cash Accounts receivable Merchandise Land Equipment Accumulated Depreciation Total Assets 250 850 $ 2.000 1.450 4.000 7.500 (2.800) 13 000 $ 2,350 1 200 $ 5.000 6.000 (2.400) 13.100 1 000 1.500 S 400 mo Accounts payable Bonds payable Common shares Retained earnings Total equities 490 1.000 1.020 S 6,000 3.500 2,480 13.000 $ 1.510 7.000 3,000 1.690 13.100 S S 500 890 3 240 3240 S Ex-1 Ex-2 Data Review View Help Formulas Home Insert Page Layout On Calibri BIU... a Wrap Te Merge & - A. Copy Format Painter board Font Alignment D E L M N O F G H I J K Golden Demolition Company Income Statement For the year ended December 31, 2017 $ 7.220 $ Sales Cost of goods sold Administrative expenses Depreciation expense Interest expense Operating income Gain on sale of land Income before tax Income tax Net income 4,600 800 400 100 (5.900) 1,320 1.370 (370) 1.000 Required: Perform an analysis of Golden Demolition Company's financial statements by calculating each of the following ratios for 2017: 1. Current ratio 11. Funds flow to debt ratio 2 Acid test ratio 12. Return on sales Receivables turnover Return on total assets Days' sales in receivable 14 Return on common equity 5 Inventory turnover 15 Net return on assets 6. Days' supply in inventory Leverage Times interest earned Earnings per share 8 Debt-equity ratio 18. Price-earning ratio 9 Debt ratio 19. Dividend yield 10 Equity ratio 20. Dividend payout 088 Ex- 1 EX-2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started