Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercises 2.2, 2.3, 2.5, 2.6, 2.7, 2.8(instructions for 2.6 above question 2.7 ) journal entries for manufac E2.2 (LO 1, 2, 3, 4), AP Stine

Exercises 2.2, 2.3, 2.5, 2.6, 2.7, 2.8(instructions for 2.6 above question 2.7 )

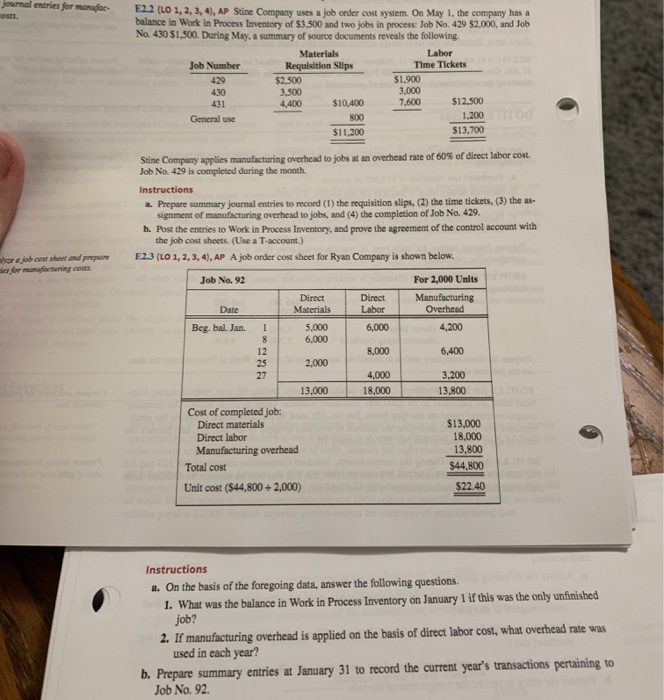

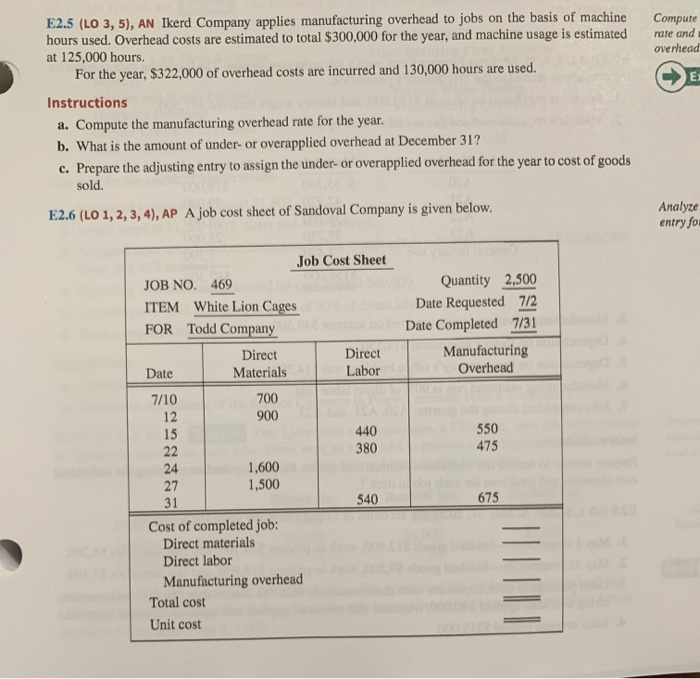

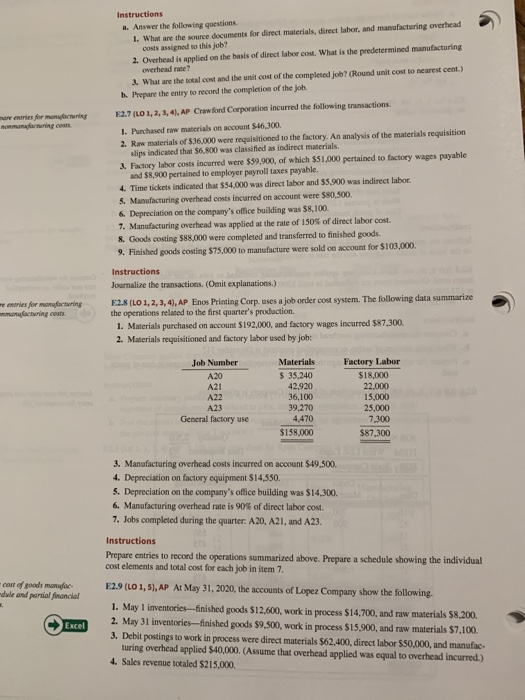

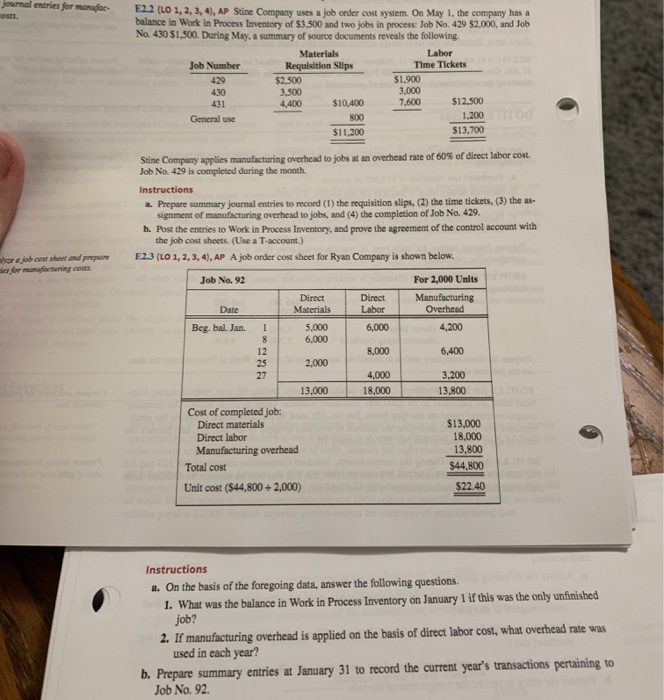

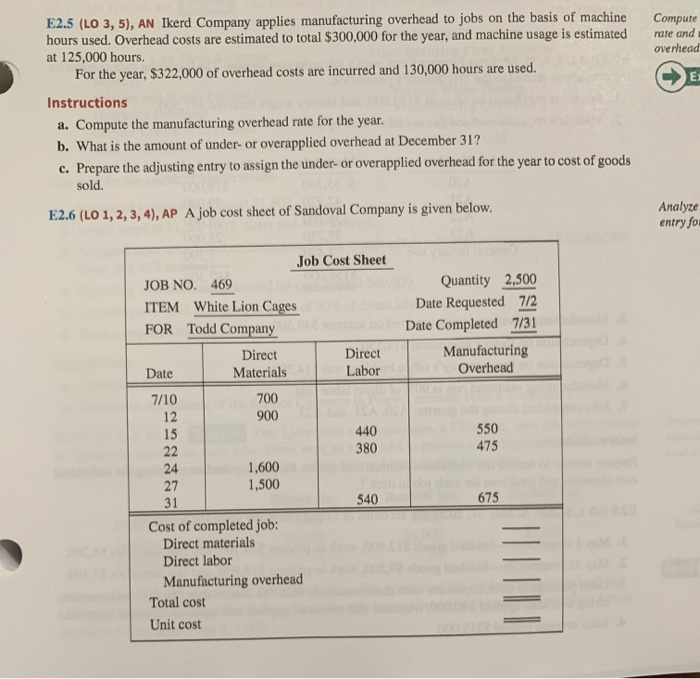

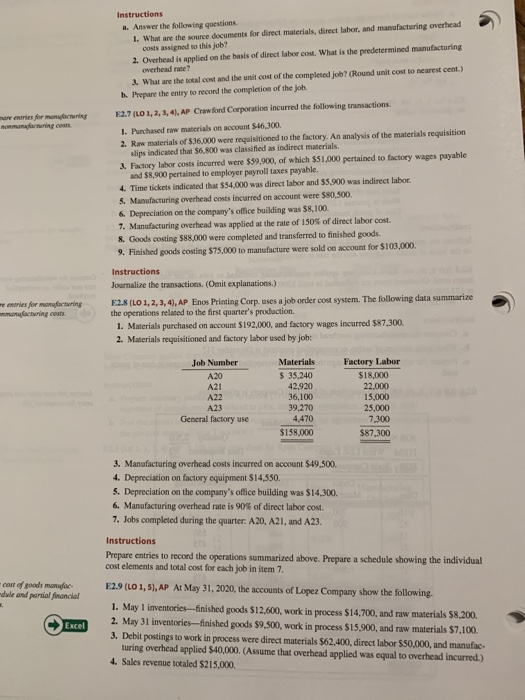

journal entries for manufac E2.2 (LO 1, 2, 3, 4), AP Stine Company uses a job order cost system. On May 1, the company has a balance in Work in Process Inventory of $3,500 and two jobs in process: Job No. 429 $2,000, and Job No. 430 $1,500. During May, a summary of source documents reveals the following. costs Labor Materials Time Tickets Job Number Requisition Slips $1,900 3,000 7,600 429 430 431 $2,500 3,500 4,400 $12,500 $10,400 1,200 d 800 General use $13,700 $11,200 Stine Company applies manufacturing overhead to jobs at an overhead rate of 60 % of direct labor cost Job No. 429 is completed during the month. Instructions a. Prepare summary journal entries to record (1) the requisition slips, (2) the time tickets, (3) the as- signment of manufacturing overhead to jobs, and (4) the completion of Job No. 429. b. Post the entries to Work in Process Inventory, and prove the agreement of the control account with the job cost sheets. (Use a T-account.) E2.3 (LO 1, 2,3, 4), AP A job order cost sheet for Ryan Company is shown below. shor a job cost sheer and prepare ies for manafacturing costs For 2,000 Units Job No. 92 Direct Materials Manufacturing Overhead Direct Labor Date 5,000 6,000 6,000 4,200 Beg. bal. Jan. 1 8,000 6,400 12 2,000 25 4,000 3,200 27 18,000 13,000 13,800 Cost of completed job: Direct materials $13,000 18,000 13,800 Direct labor Manufacturing overhead $44,800 Total cost $22.40 Unit cost ($44,800 + 2,000) Instructions a. On the basis of the foregoing data, answer the following questions. 1. What was the balance in Work in Process Inventory on January 1 if this was the only unfinished job? 2. If manufacturing overhead is applied on the basis of direct labor cost, what overhead rate was used in each year? b. Prepare summary entries at January 31 to record the current year's transactions pertaining to Job No. 92 E2.5 (LO 3, 5), AN Ikerd Company applies manufacturing overhead to jobs on the basis of machine hours used. Overhead costs are estimated to total $300,000 for the year, and machine usage is estimated at 125,000 hours. Compute rate and overhead For the year, $322,000 of overhead costs are incurred and 130,000 hours are used. Ex Instructions a. Compute the manufacturing overhead rate for the year. b. What is the amount of under- or overapplied overhead at December 31? c.Prepare the adjusting entry to assign the under- or overapplied overhead for the year to cost of goods sold. Analyze entry fo E2.6 (LO 1, 2,3, 4), AP A job cost sheet of Sandoval Company is given below. Job Cost Sheet Quantity 2,500 Date Requested 7/2 Date Completed 7/31 JOB NO. 469 White Lion Cages ITEM 4 FOR Todd Company Manufacturing Overhead Direct Direct Labor Materials Date 700 7/10 900 12 550 440 15 475 380 1,600 1,500 24 27 675 540 31 Cost of completed job: Direct materials Direct labor Manufacturing overhead Total cost Unit cost Instructions a. Answer the following questions 1. What are the source documents for direct materials, direct labor, and manufacturing overhead costs assigned to this job? 2. Overhead is applied on the basis of direct labor cost. What is the predetermined manufacturing overhead rate? A What are the total cost and the unit cost cof the completed job? (Round unit cost to nearest cent.) b. Prepare the entry to record the completicn of the job. E2.7 (LO 1,2, 3, 4), AP Crawford Corporation incurred the following transactions are entries for manghcuring nonmanafacturing costs 1. Purchased raw materials on account $46,300 2. Raw materials of $36,000 were requisitioned to the factory. An analysis of the materials requisition slips indicated that $6,800 was classified as indirect materials. 3 Factory labor costs incurred were $59,900, of which $51,000 pertained to factory wages payable and $8,900 pertained to employer payroll taxes payable. 4. Time tickets indicated that $54,000 was direct labor and $5,900 was indirect labor 5. Manufacturing overhead costs incurred on account were $80,500 6. Depreciation on the company's office building was $8,100 7. Manufacturing overhead was applied at the rate of 150 % of direct labor cost. 8. Goods costing $88,000 were completed and transferred to finished goods. 9. Finished goods costing $75,000 to manufacture were sold on account for $103,000 Instructions Journalize the transactions. (Omit explanations.) E2.8 (LO 1, 2,3, 4), AP Enos Printing Corp. uses a job order cost system. The following data summarize the operations related to the first quarter's production enaries for manufacturing monyfacturing costs 1. Materials purchased on account $192,000, and factory wages incurred $87,300 2. Materials requisitioned and factory labor used by job: Factory Labor Job Number Materials $35,240 42,920 36,100 39,270 4,470 $18,000 A20 A21 A22 22,000 15,000 25,000 7,300 A23 General factory use $158,000 $87,300 3. Manufacturing overhead costs incurred on account $49,500. 4. Depreciation on factory equipment $14,550. 5. Depreciation on the company's office building was $14,300. 6. Manufacturing overhead rate is 90 % of direct labor cost. 7. Jobs completed during the quarter: A20, A21, and A23. Instructions Prepare entries to record the operations summarized above. Prepare a schedule showing the individual cost elements and total cost for each job in item 7. cost of goods manufac dule and partial financial E2.9 (LO 1, 5), AP At May 31, 2020, the accounts of Lopez Company show the following. 1. May 1 inventories-finished goods $12,600, work in process $14,700, and raw materials $8,200. 2. May 31 inventories-finished goods $9,500, work in process $15,900, and raw materials $7,100. 3. Debit postings to work in process were direct materials $62,400, direct labor $50,000, and manufac- turing overhead applied $40,000. (Assume that overhead applied was equal to overhead incurred.) 4. Sales revenue totaled $215,000 Excel

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started