Answered step by step

Verified Expert Solution

Question

1 Approved Answer

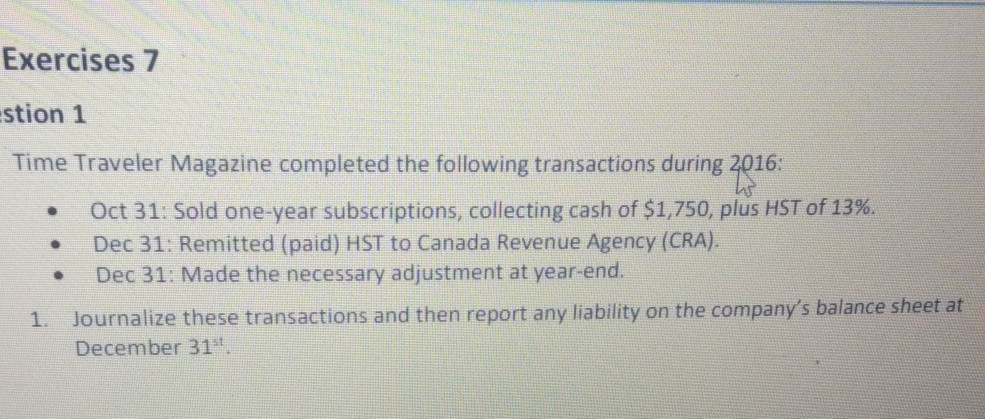

Exercises 7 stion 1 Time Traveler Magazine completed the following transactions during 2016: Oct 31: Sold one-year subscriptions, collecting cash of $1,750, plus HST of

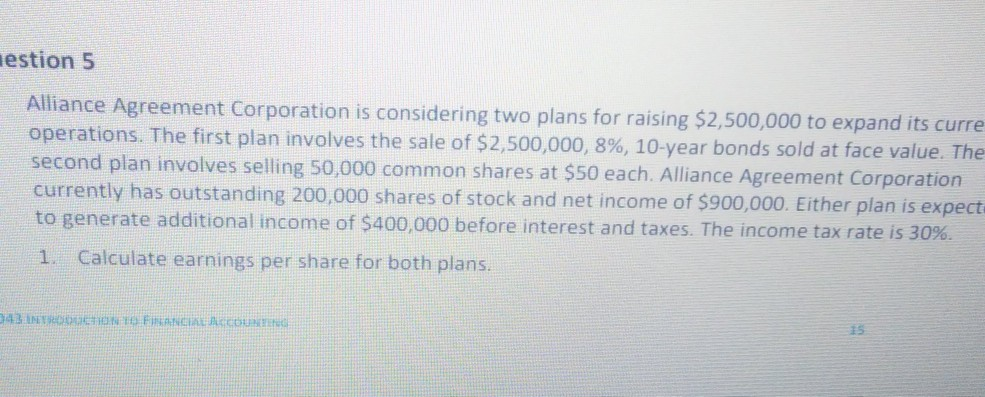

Exercises 7 stion 1 Time Traveler Magazine completed the following transactions during 2016: Oct 31: Sold one-year subscriptions, collecting cash of $1,750, plus HST of 13%. Dec 31: Remitted (paid) HST to Canada Revenue Agency (CRA). Dec 31: Made the necessary adjustment at year-end. 1. Journalize these transactions and then report any liability on the company's balance sheet at December 31 aestion 5 Alliance Agreement Corporation is considering two plans for raising $2,500,000 to expand its curre operations. The first plan involves the sale of $2,500,000, 8%, 10-year bonds sold at face value. The second plan involves selling 50,000 common shares at $50 each. Alliance Agreement Corporation currently has outstanding 200,000 shares of stock and net income of $900,000. Either plan is expect to generate additional income of $400,000 before interest and taxes. The income tax rate is 30%. 1. Calculate earnings per share for both plans. 43 CHON FRANCIREALE COUNTER

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started