Answered step by step

Verified Expert Solution

Question

1 Approved Answer

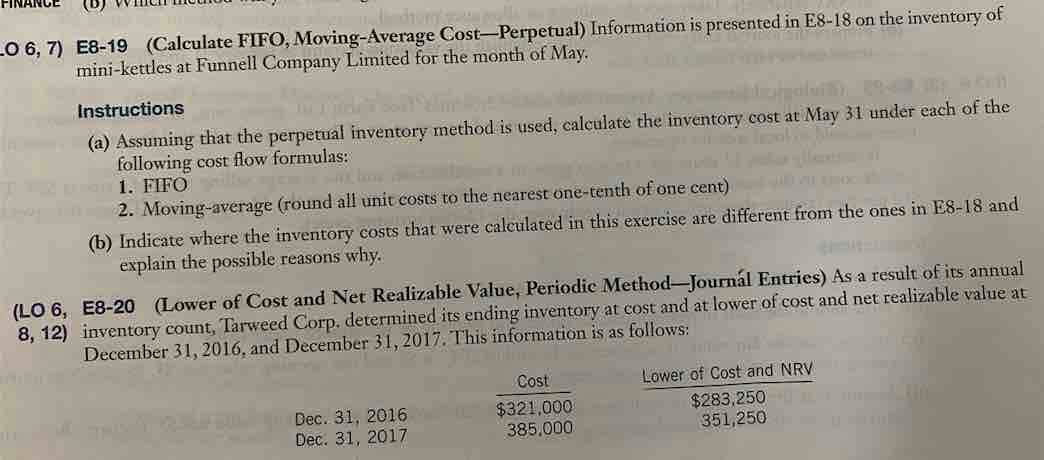

LO 6, 7) E8-19 (Calculate FIFO, Moving-Average Cost-Perpetual) Information is presented in E8-18 on the inventory of mini-kettles at Funnell Company Limited for the

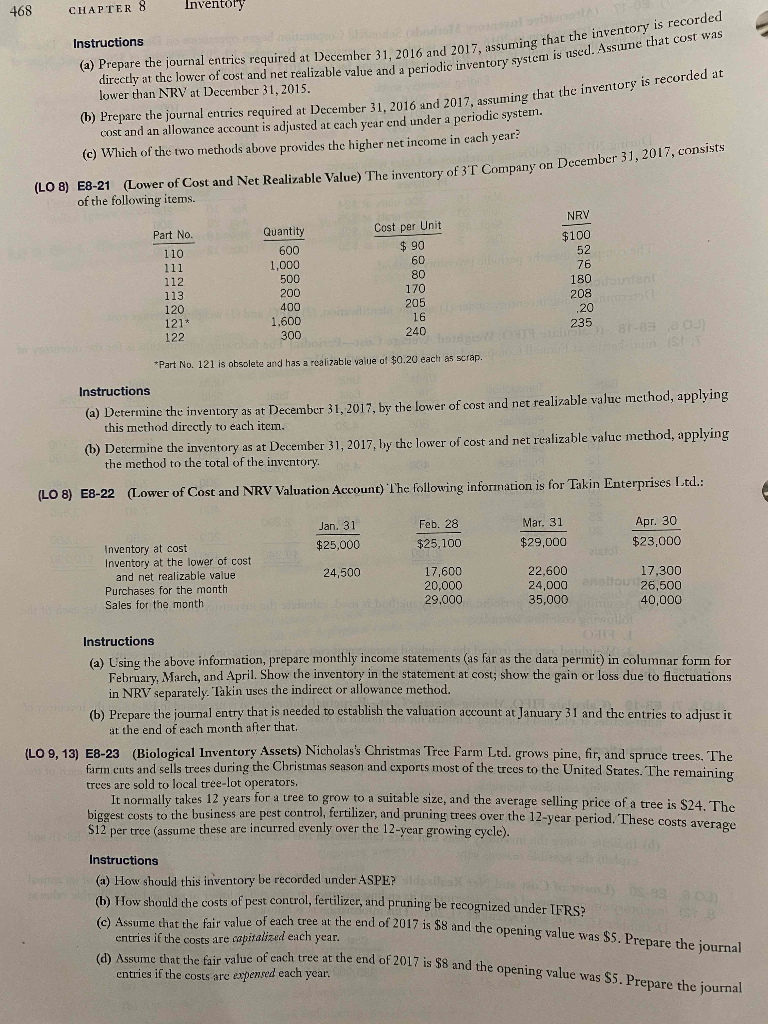

LO 6, 7) E8-19 (Calculate FIFO, Moving-Average Cost-Perpetual) Information is presented in E8-18 on the inventory of mini-kettles at Funnell Company Limited for the month of May. Instructions (a) Assuming that the perpetual inventory method is used, calculate the inventory cost at May 31 under each of the following cost flow formulas: 1. FIFO 2. Moving-average (round all unit costs to the nearest one-tenth of one cent) (b) Indicate where the inventory costs that were calculated in this exercise are different from the ones in E8-18 and explain the possible reasons why. (LO 6, E8-20 (Lower of Cost and Net Realizable Value, Periodic Method-Journal Entries) As a result of its annual 8, 12) inventory count, Tarweed Corp. determined its ending inventory at cost and at lower of cost and net realizable value at December 31, 2016, and December 31, 2017. This information is as follows: Dec. 31, 2016 Dec. 31, 2017 Cost $321,000 385,000 Lower of Cost and NRV $283,250 351,250 468 CHAPTER 8 Instructions Inventory (a) Prepare the journal entries required at December 31, 2016 and 2017, assuming that the inventory is recorded directly at the lower of cost and net realizable value and a periodic inventory system is used. Assume that cost was lower than NRV at December 31, 2015. (b) Prepare the journal entries required at December 31, 2016 and 2017, assuming that the inventory is recorded at cost and an allowance account is adjusted at each year end under a periodic system. (c) Which of the two methods above provides the higher net income in each year? (LO 8) E8-21 (Lower of Cost and Net Realizable Value) The inventory of 3T Company on December 31, 2017, consists of the following items. NRV Part No. 110 Quantity 600 Cost per Unit $ 90 $100 52 111 1,000 60 76 112 500 80 180 113 200 170 nfent 208 120 400 205 .20 121* 1,600 16 122 300 240 235 1-8380J) (ST Instructions *Part No. 121 is obsolete and has a realizable value of $0.20 each as scrap. (a) Determine the inventory as at December 31, 2017, by the lower of cost and net realizable value method, applying this method directly to each item. (b) Determine the inventory as at December 31, 2017, by the lower of cost and net realizable value method, applying the method to the total of the inventory. (LO 8) E8-22 (Lower of Cost and NRV Valuation Account) The following information is for Takin Enterprises Ltd.: Jan. 31 Feb. 28 Inventory at cost Inventory at the lower of cost $25,000 $25,100 Mar. 31 $29,000 Apr. 30 $23,000 and net realizable value 24,500 17,600 22,600 Purchases for the month 20,000 24,000 17,300 analtou 26,500 Sales for the month 29.000 35,000 40,000 Instructions (a) Using the above information, prepare monthly income statements (as far as the data permit) in columnar form for February, March, and April. Show the inventory in the statement at cost; show the gain or loss due to fluctuations in NRV separately. Takin uses the indirect or allowance method. (b) Prepare the journal entry that is needed to establish the valuation account at January 31 and the entries to adjust it at the end of each month after that. (LO 9, 13) E8-23 (Biological Inventory Assets) Nicholas's Christmas Tree Farm Ltd. grows pine, fir, and spruce trees. The farm cuts and sells trees during the Christmas season and exports most of the trees to the United States. The remaining trees are sold to local tree-lot operators. It normally takes 12 years for a tree to grow to a suitable size, and the average selling price of a tree is $24. The biggest costs to the business are pest control, fertilizer, and pruning trees over the 12-year period. These costs average $12 per tree (assume these are incurred evenly over the 12-year growing cycle). Instructions (a) How should this inventory be recorded under ASPE? (b) How should the costs of pest control, fertilizer, and pruning be recognized under IFRS? 83 30.3) (c) Assume that the fair value of each tree at the end of 2017 is $8 and the opening value was $5. Prepare the journal entries if the costs are capitalized each year. (d) Assume that the fair value of each tree at the end of 2017 is $8 and the opening value was $5. Prepare the journal entries if the costs are expensed each year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To tackle Exercise E819 lets go through the steps required to solve part a and provide guidance for the rest Were looking at calculating inventory cos...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started