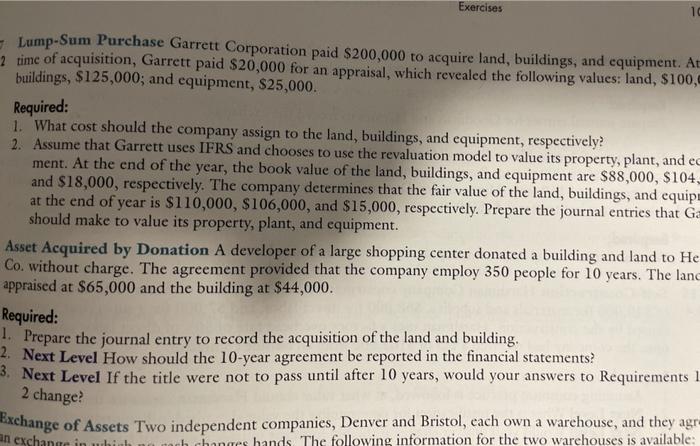

Exercises Lump-Sum Purchase Garrett Corporation paid $200,000 to acquire land, buildings, and equipment 2 time of acquisition, Garrett paid $20,000 for an appraisal, which revealed the following values: land, $100, buildings, $125,000; and equipment, $25,000. Required: 1. What cost should the company assign to the land, buildings, and equipment, respectively? 2. Assume that Garrett uses IFRS and chooses to use the revaluation model to value its property, plant, and ec ment. At the end of the year, the book value of the land, buildings, and equipment are $88,000, $104_ and $18,000, respectively. The company determines that the fair value of the land, buildings, and equip at the end of year is $110,000, $106,000, and $15,000, respectively. Prepare the journal entries that G should make to value its property, plant, and equipment. Asset Acquired by Donation A developer of a large shopping center donated a building and land to He Co. without charge. The agreement provided that the company employ 350 people for 10 years. The land appraised at $65,000 and the building at $44,000. Required: 1. Prepare the journal entry to record the acquisition of the land and building. 2. Next Level How should the 10-year agreement be reported in the financial statements? 3. Next Level If the title were not to pass until after 10 years, would your answers to Requirements 1 2 change? Exchange of Assets Two independent companies, Denver and Bristol, each own a warehouse, and they agr an exchange in whim changes hands. The following information for the two warehouses is available: Exercises Lump-Sum Purchase Garrett Corporation paid $200,000 to acquire land, buildings, and equipment 2 time of acquisition, Garrett paid $20,000 for an appraisal, which revealed the following values: land, $100, buildings, $125,000; and equipment, $25,000. Required: 1. What cost should the company assign to the land, buildings, and equipment, respectively? 2. Assume that Garrett uses IFRS and chooses to use the revaluation model to value its property, plant, and ec ment. At the end of the year, the book value of the land, buildings, and equipment are $88,000, $104_ and $18,000, respectively. The company determines that the fair value of the land, buildings, and equip at the end of year is $110,000, $106,000, and $15,000, respectively. Prepare the journal entries that G should make to value its property, plant, and equipment. Asset Acquired by Donation A developer of a large shopping center donated a building and land to He Co. without charge. The agreement provided that the company employ 350 people for 10 years. The land appraised at $65,000 and the building at $44,000. Required: 1. Prepare the journal entry to record the acquisition of the land and building. 2. Next Level How should the 10-year agreement be reported in the financial statements? 3. Next Level If the title were not to pass until after 10 years, would your answers to Requirements 1 2 change? Exchange of Assets Two independent companies, Denver and Bristol, each own a warehouse, and they agr an exchange in whim changes hands. The following information for the two warehouses is available