Question

Exercises: Set A Sales and Production Budgets. Templeton Corporation produces windows used in residential construction. Unit sales last year, ending December 31, are as follow:

Exercises: Set A

Sales and Production Budgets. Templeton Corporation produces windows used in residential construction. Unit sales last year, ending December 31, are as follow:

| First quarter | 40,000 |

| Second quarter | 50,000 |

| Third quarter | 52,000 |

| Fourth quarter | 48,000 |

Unit sales are expected to increase 10 percent this coming year over the same quarter last year. Average sales price per window will remain at $200.

Assume finished goods inventory is maintained at a level equal to 5 percent of the next quarters sales. Finished goods inventory at the end of the fourth quarter budget period is estimated to be 2,300 units.

Required:

Prepare a sales budget for Templeton Corporation using a format similar to Figure 9.3 "Sales Budget for Jerrys Ice Cream". (Hint: be sure to increase last years unit sales by 10 percent.)

Prepare a production budget for Templeton Corporation using a format similar to Figure 9.4 "Production Budget for Jerrys Ice Cream".

Direct Materials Purchases and Direct Labor Budgets. Templeton Corporation produces windows used in residential construction. The company expects to produce 44,550 units in the first quarter, 55,110 units in the second quarter, 56,980 units in the third quarter, and 52,460 units in the fourth quarter. (This information is derived from the previous exercise for Templeton Corporation.)

With regards to direct materials, each unit of product requires 12 square feet of glass at a cost of $1.50 per square foot. Management prefers to maintain ending raw materials inventory equal to 10 percent of next quarters materials needed in production. Raw materials inventory at the end of the fourth quarter budget period is estimated to be 65,000 square feet.

With regards to direct labor, each unit of product requires 2 labor hours at a cost of $15 per hour.

Required:

Prepare a direct materials purchases budget for Templeton Corporation using a format similar to Figure 9.5 "Direct Materials Purchases Budget for Jerrys Ice Cream".

Prepare a direct labor budget for Templeton Corporation using a format similar to Figure 9.6 "Direct Labor Budget for Jerrys Ice Cream".

Manufacturing Overhead Budget. Templeton Corporation produces windows used in residential construction. The company expects to produce 44,550 units in the first quarter, 55,110 units in the second quarter, 56,980 units in the third quarter, and 52,460 units in the fourth quarter. (This information is the same as in the previous exercise for Templeton Corporation.) The following information relates to the manufacturing overhead budget.

| Variable Overhead Costs | |

| Indirect materials | $2.50 per unit |

| Indirect labor | $3.20 per unit |

| Other | $1.70 per unit |

| Fixed Overhead Costs per Quarter | |

| Salaries | $50,000 |

| Rent | $60,000 |

| Depreciation | $36,370 |

Required:

Prepare a manufacturing overhead budget for Templeton Corporation using a format similar to Figure 9.7 "Manufacturing Overhead Budget for Jerrys Ice Cream".

Budgets for Cash Collections from Sales and Cash Payments for Purchases. Templeton Corporation produces windows used in residential construction. The dollar amount of the companys quarterly sales and direct materials purchases are projected to be as follows (this information is derived from the previous exercises for Templeton Corporation):

| 1st | 2nd | 3rd | 4th | |

| Sales | $8,800,000 | $11,000,000 | $11,440,000 | $10,560,000 |

| Direct materials purchases | $ 820,908 | $ 995,346 | $ 1,017,504 | $ 947,352 |

Assume all sales are made on credit. The company expects to collect 60 percent of sales in the quarter of sale and 40 percent the quarter following the sale. Accounts receivable at the end of last year totaled $3,000,000, all of which will be collected in the first quarter of the coming year.

Assume all direct materials purchases are on credit. The company expects to pay 70 percent of purchases in the quarter of purchase and 30 percent the following quarter. Accounts payable at the end of last year totaled $325,000, all of which will be paid in the first quarter of this coming year.

Required:

Prepare a budget for cash collections from sales. Use a format similar to the top section of Figure 9.11 "Cash Budget for Jerrys Ice Cream".

Prepare a budget for cash payments for purchases of materials. Use a format similar to the middle section of Figure 9.11 "Cash Budget for Jerrys Ice Cream". Round to the nearest dollar.

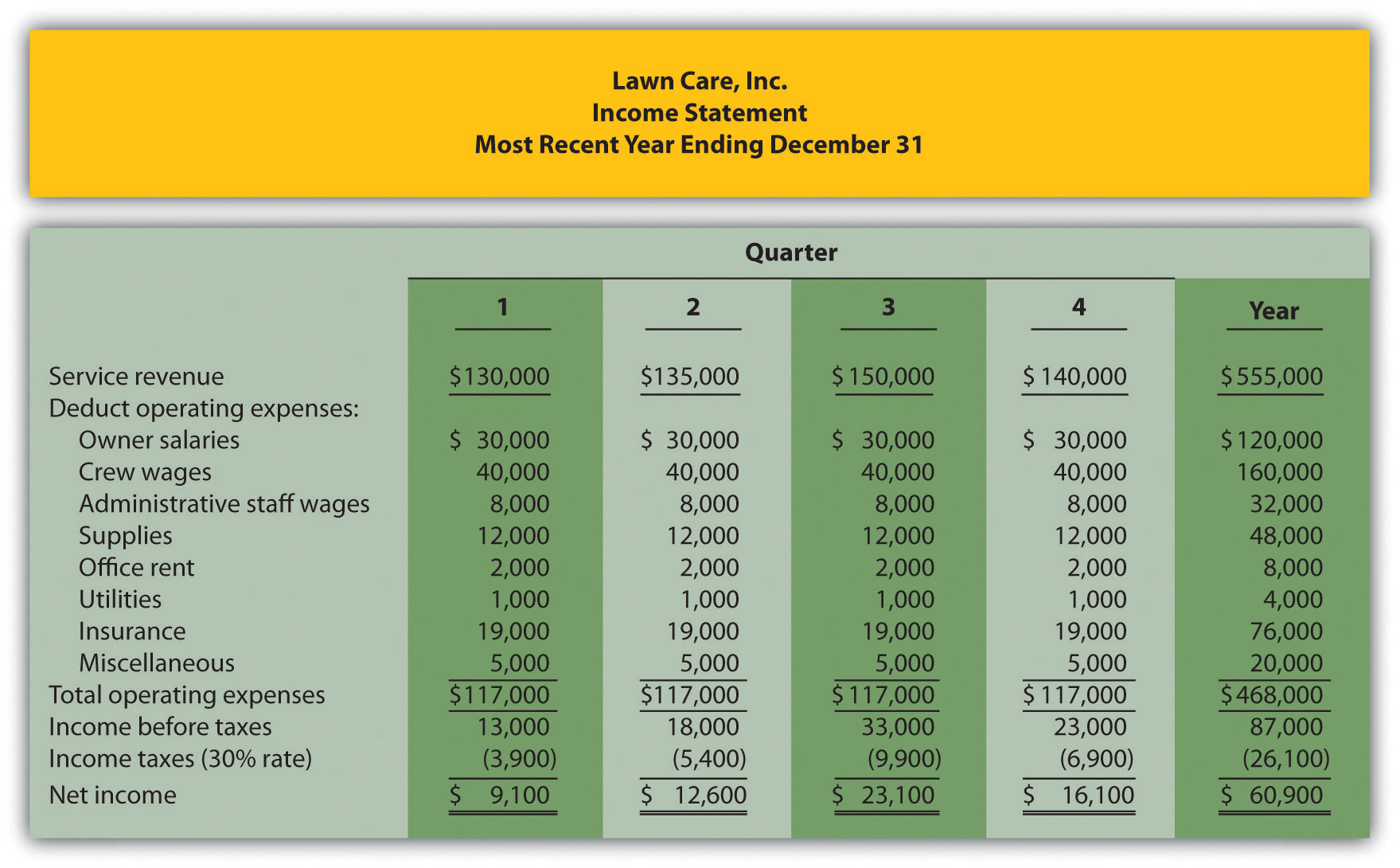

Service Company Budgeted Income Statement and Ethical Issues. Lawn Care, Inc., has two owners who maintain lawns for residential customers. The company had the following net income for the most current year.

The following information was gathered from the owners to help prepare this coming years budgeted income statement:

Service revenue will increase 15 percent (e.g., first quarter service revenue for this coming year will be 15 percent higher than the first quarter shown previously).

Owner salaries will increase 8 percent.

Crew wages will increase 12 percent.

Administrative staff wages will increase 5 percent, and a new staff member will be hired at the beginning of the third quarter at a quarterly rate of $7,000.

Supplies will increase 9 percent.

Office rent, utilities, and miscellaneous expenses will remain the same.

Insurance will increase 18 percent.

The tax rate will remain at 30 percent.

Required:

Prepare a quarterly budgeted income statement for Lawn Care, Inc., and include a column summarizing the year.

The owners of Lawn Care, Inc., have decided to expand and are in need of additional cash to expand operations. Unknown to the owners, the companys accountant intentionally inflated the revenue projections for this coming year to make the company look better when applying for a loan. Is this behavior ethical? Explain. (It may be helpful to review the presentation of ethics in Chapter 1 "What Is Managerial Accounting?".)

Lawn Care, Inc. Income Statement Most Recent Year Ending December 31 Quarter 2 3 4 Year Service revenue $130,000 $135,000 $150,000 $ 140,000 $555,000 Deduct operating expenses: Owner salaries Crew wages Administrative staff wages Supplies Office rent Utilities nsurance Miscellaneous $ 30,000 40,000 8,000 12,000 2,000 1,000 19,000 5,000 $117,000 13,000 (3,900) $ 9,100 $ 30,000 40,000 8,000 12,000 2,000 1,000 19,000 5,000 $117,000 18,000 (5,400) $ 12,600 $ 30,000 40,000 8,000 12,000 2,000 1,000 19,000 5,000 $117,000 33,000 (9,900) $ 23,100 $ 30,000 40,000 8,000 12,000 2,000 1,000 19,000 5,000 $ 117,000 23,000 (6,900) $ 16,100 $ 120,000 160,000 32,000 48,000 8,000 4,000 76,000 20,000 $468,000 87,000 (26,100) $ 60,900 Total operating expenses Income before taxes Income taxes (30% rate) Net incomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started