Answered step by step

Verified Expert Solution

Question

1 Approved Answer

EXERCISES The following are selected accounts coming from the adjusted trial balance at the end of 2019: Sales Revenues P1,600,000, Rent Income P150,000, Cost of

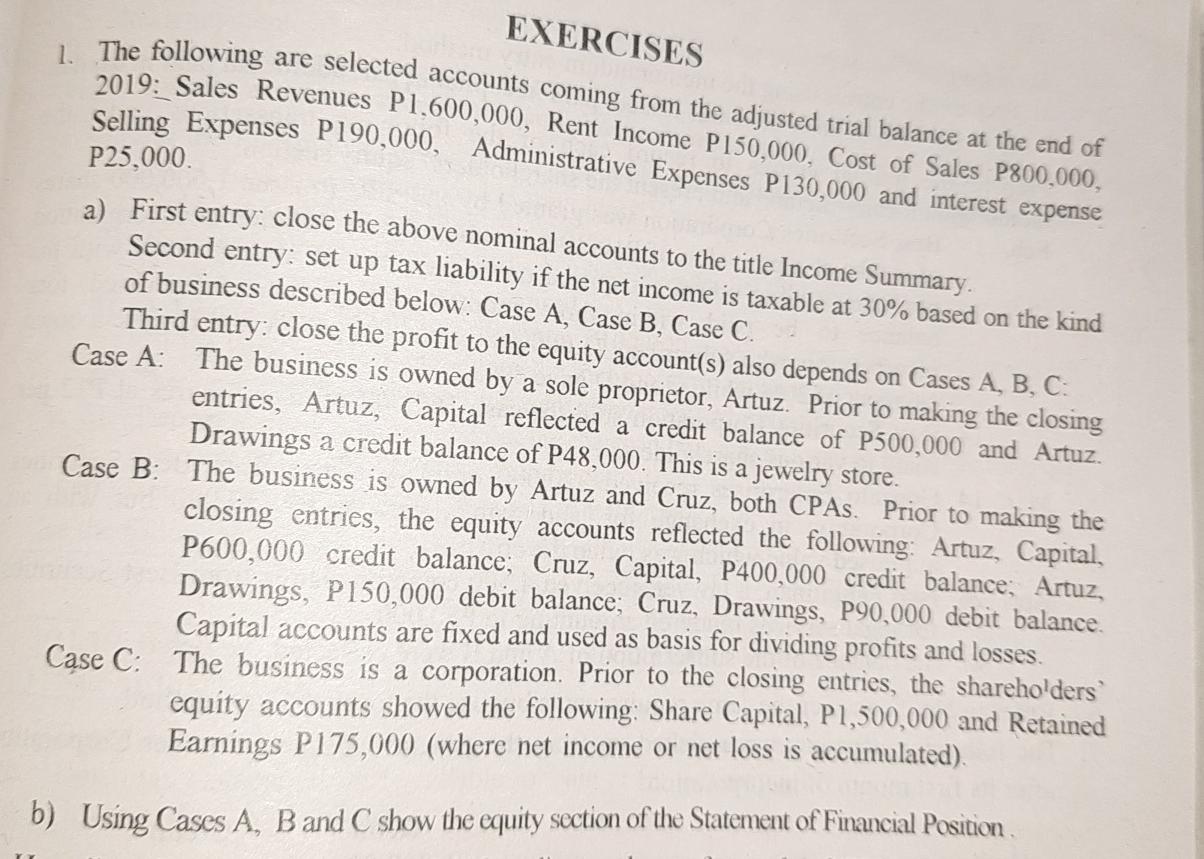

EXERCISES The following are selected accounts coming from the adjusted trial balance at the end of 2019: Sales Revenues P1,600,000, Rent Income P150,000, Cost of Sales P800,000, Selling Expenses P190,000, Administrative Expenses P130,000 and interest expense P25,000 a) First entry: close the above nominal accounts to the title Income Summary. Second entry: set up tax liability if the net income is taxable at 30% based on the kind of business described below: Case A, Case B, Case C. Third entry: close the profit to the equity account(s) also depends on Cases A, B, C: Case A: The business is owned by a sole proprietor, Artuz. Prior to making the closing entries, Artuz, Capital reflected a credit balance of P500,000 and Artuz. Drawings a credit balance of P48,000. This is a jewelry store. Case B: The business is owned by Artuz and Cruz, both CPAs. Prior to making the closing entries, the equity accounts reflected the following: Artuz, Capital, P600,000 credit balance; Cruz, Capital, P400,000 credit balance; Artuz, Drawings, P150,000 debit balance; Cruz, Drawings, P90,000 debit balance. Capital accounts are fixed and used as basis for dividing profits and losses. Case C: The business is a corporation. Prior to the closing entries, the shareholders equity accounts showed the following: Share Capital, P1,500,000 and Retained Earnings P175,000 (where net income or net loss is accumulated). b) Using Cases A, B and C show the equity section of the Statement of Financial Position

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started