Answered step by step

Verified Expert Solution

Question

1 Approved Answer

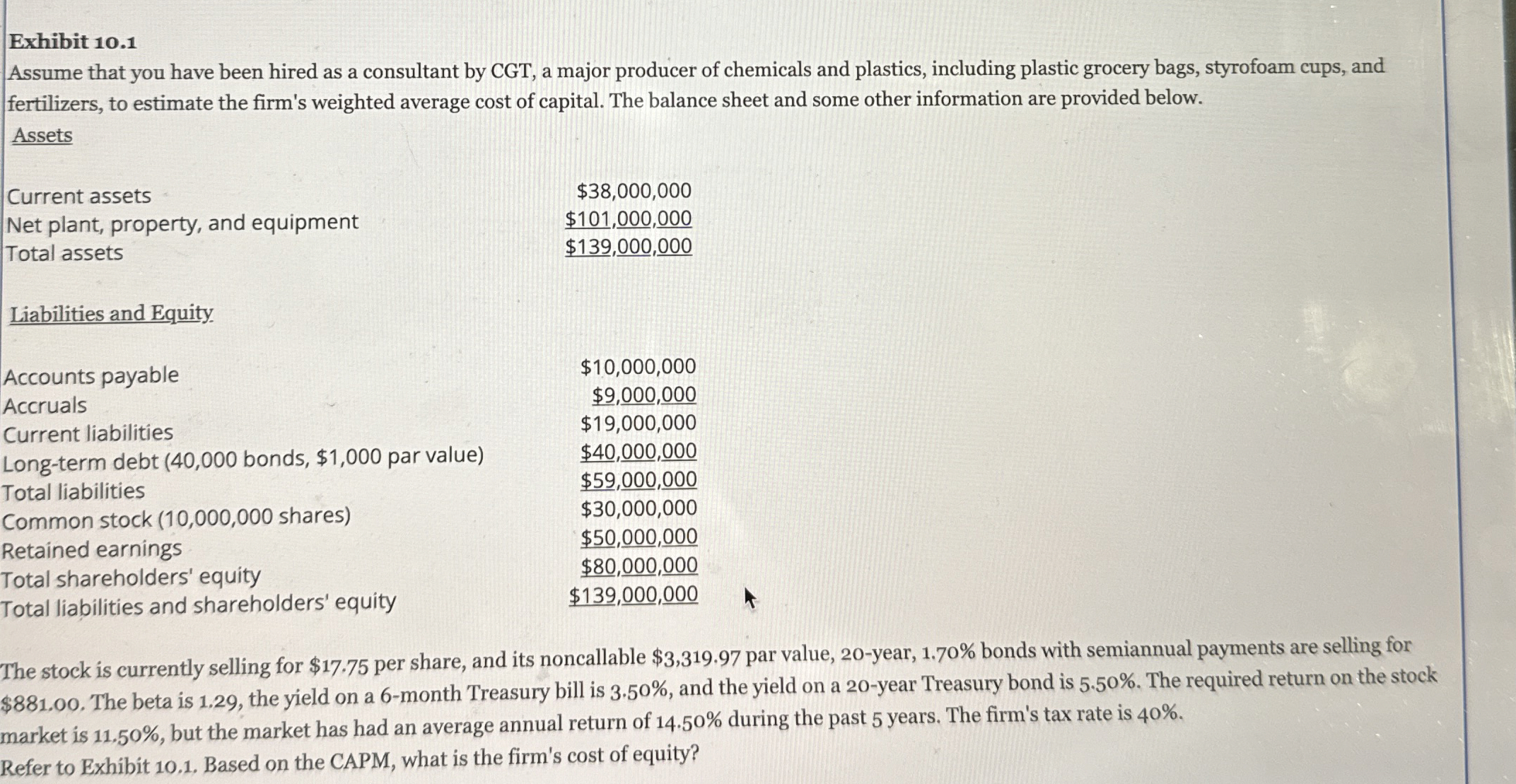

Exhibit 1 0 . 1 Assume that you have been hired as a consultant by CGT , a major producer of chemicals and plastics, including

Exhibit

Assume that you have been hired as a consultant by CGT a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and

fertilizers, to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below.

Assets

Liabilities and Equity

The stock is currently selling for $ per share, and its noncallable $ par value, year, bonds with semiannual payments are selling for

$ The beta is the yield on a month Treasury bill is and the yield on a year Treasury bond is The required return on the stock

market is but the market has had an average annual return of during the past years. The firm's tax rate is

Refer to Exhibit Based on the CAPM, what is the firm's cost of equity?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started