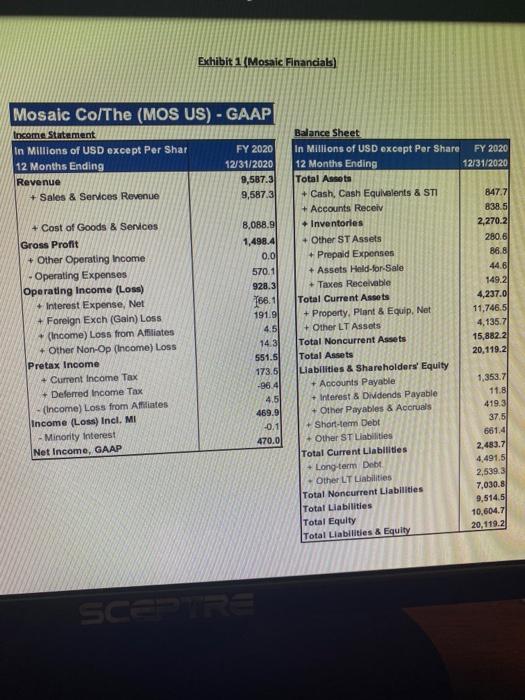

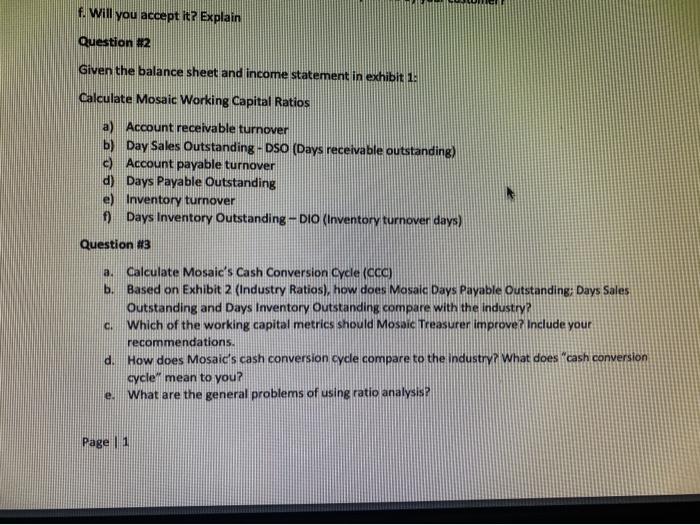

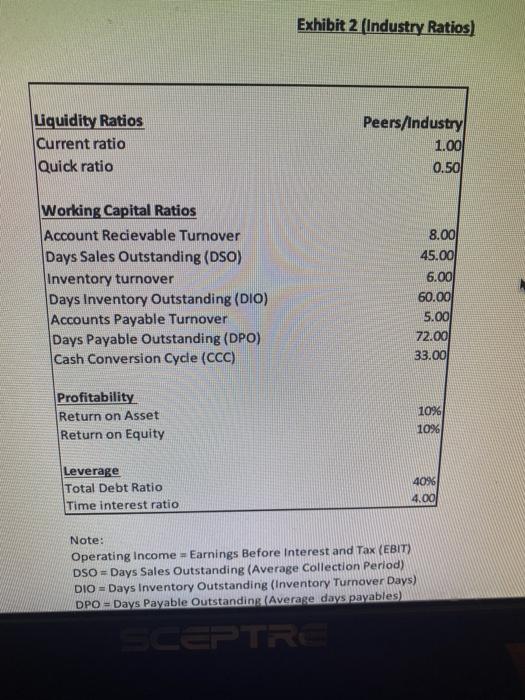

Exhibit 1 (Mosaic Financials) Mosaic Co/The (MOS US) - GAAP Income Statement in Millions of USD except Per Shar 12 Months Ending Revenue + Sales & Services Revenue FY 2020 12/31/2020 9,587.3 9,587.31 8,088.91 1,498.4 0.0 + Cost of Goods & Services Gross Profit + Other Operating Income - Operating Expenses Operating Income (Loss) + Interest Expense, Net + Foreign Exch (Gain) Loss - (Income) Loss from Affiliates + Other Non-Op (Income) Loss Pretax Income + Current Income Tax Deferred Income Tax - (Income) Loss from Affiliates Income (Loss) Incl. MI Minority Interest Net Income, GAAP 570 1 928.3 766.1 1919 4.5 14.3 551.5 173.51 -96.4 4.5 469.9 -0.1 470.0 Balance Sheet In Millions of USD except Per Share FY 2020 12 Months Ending 12/31/2020 Total Assets + Cash, Cash Equivalents & STI 847.71 + Accounts Receiv 838.5 Inventories 2,270.21 + Other ST Assets 280.6 + Prepaid Expenses 86.8 + Assets Hold-for Sale 44.6 + Taxes Receivable 149.2 Total Current Assets 4,237.0 + Property, Plant & Equip, Net 11,746.5 + Other LT Assets 4,135.7 Total Noncurrent Assets 15,882.2 Total Assets 20.119.2 Liabilities & Shareholders' Equity + Accounts Payable 1,353.7 + Interest & Dividends Payable 11.8 419.3 + Other Payables & Accruals Short-term Debt 37.5 + Other ST Liabilities 661,4 Total Current Liabilities 2.483.7 Long-term Debt 4,491.5 2,5393 Other LT Liabilities 7,030.5 Total Noncurrent Liabilities 9,514,5 Total Liabilities 10.604.7 Total Equity 20.119.2 Total Liabilities & Equity SCEPTRE f. Will you accept it? Explain Question #2 Given the balance sheet and income statement in exhibit 1: Calculate Mosaic Working Capital Ratios a) Account receivable turnover b) Day Sales Outstanding - DSO (Days receivable outstanding) c) Account payable turnover d) Days Payable Outstanding e) Inventory turnover f) Days Inventory Outstanding-DIO (Inventory turnover days) Question #3 a. Calculate Mosaic's Cash Conversion Cycle (cca) b. Based on Exhibit 2 (Industry Ratios), how does Mosaic Days Payable Outstanding; Days Sales Outstanding and Days Inventory Outstanding compare with the industry? C! Which of the working capital metrics should Mosaic Treasurer improve? Include your recommendations. d. How does Mosaid's cash conversion cycle compare to the industry? What does "cash conversion cycle" mean to you? What are the general problems of using ratio analysis? e. Page 1 Exhibit 2 (Industry Ratios) Liquidity Ratios Current ratio Quick ratio Peers/Industry 1.00 0.50 Working Capital Ratios Account Recievable Turnover Days Sales Outstanding (DSO) Inventory turnover Days Inventory Outstanding (DIO) Accounts Payable Turnover Days Payable Outstanding (DPO) Cash Conversion Cycle (CCC) 8.00 45.00 6.00 60.00 5.00 72.000 33.000 Profitability Return on Asset Return on Equity 10% 10% Leverage Total Debt Ratio Time interest ratio 4096 4.00 Note: Operating Income = Earnings Before Interest and Tax (EBIT) DSO = Days Sales Outstanding (Average Collection Period) DIO = Days Inventory Outstanding (Inventory Turnover Days) DPO = Days Payable Outstanding Average days payables) SCEPTRE