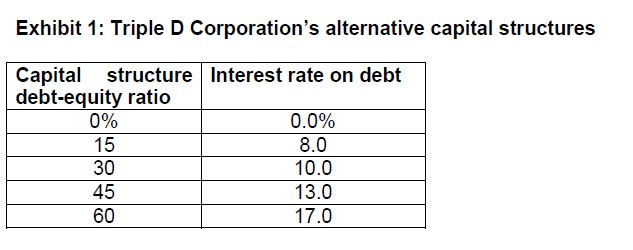

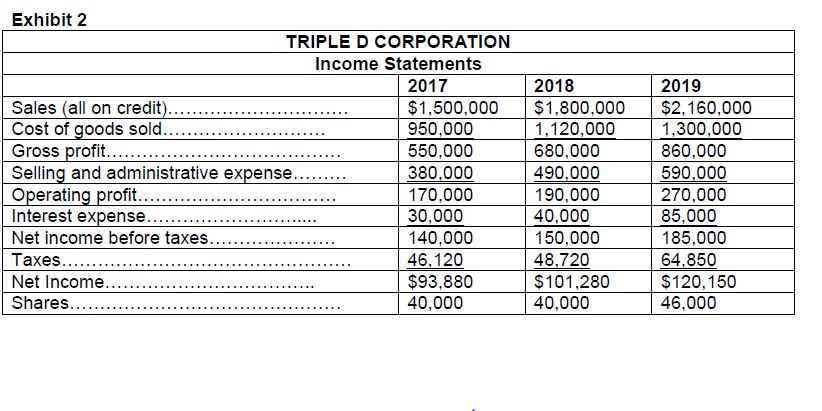

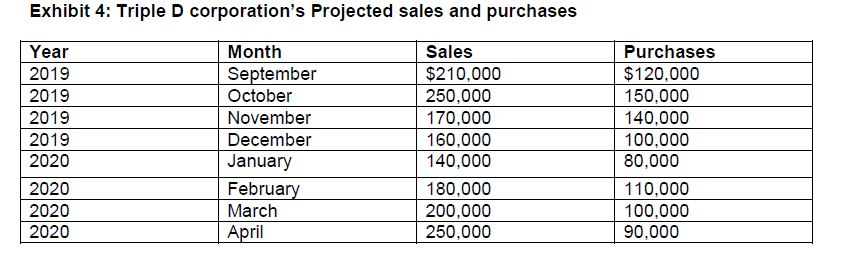

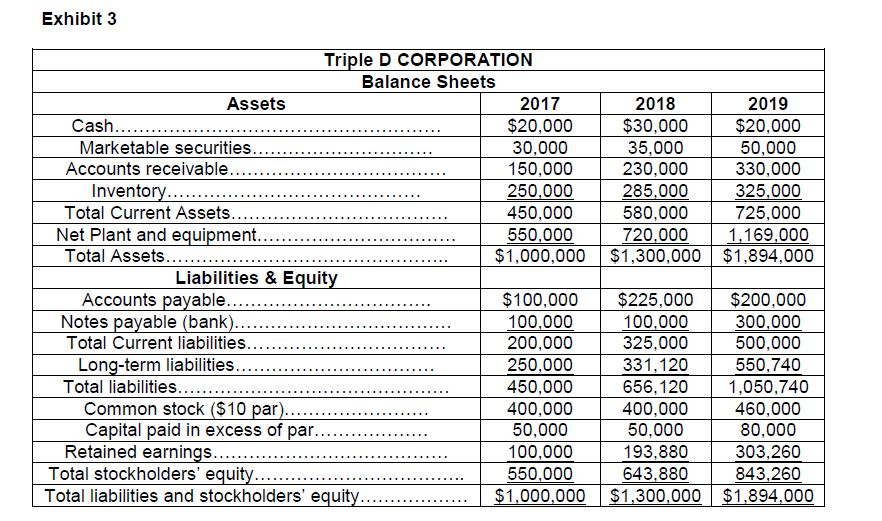

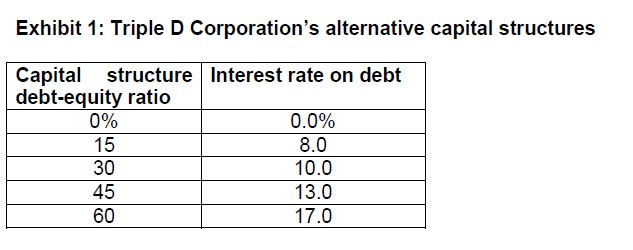

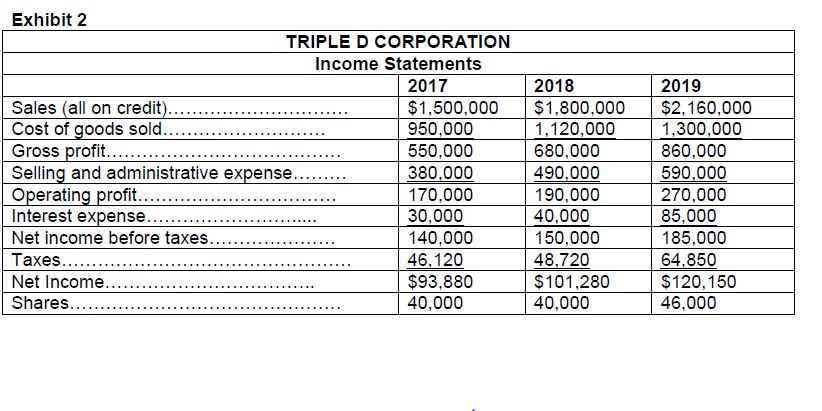

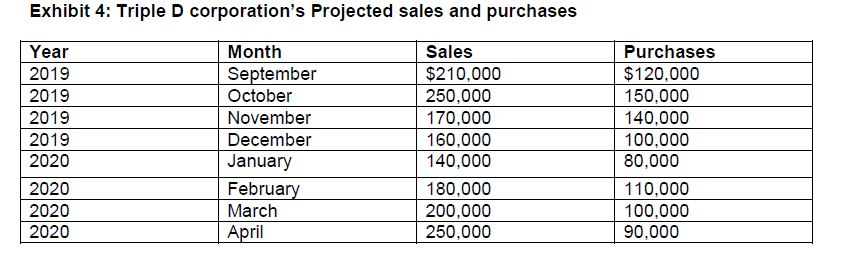

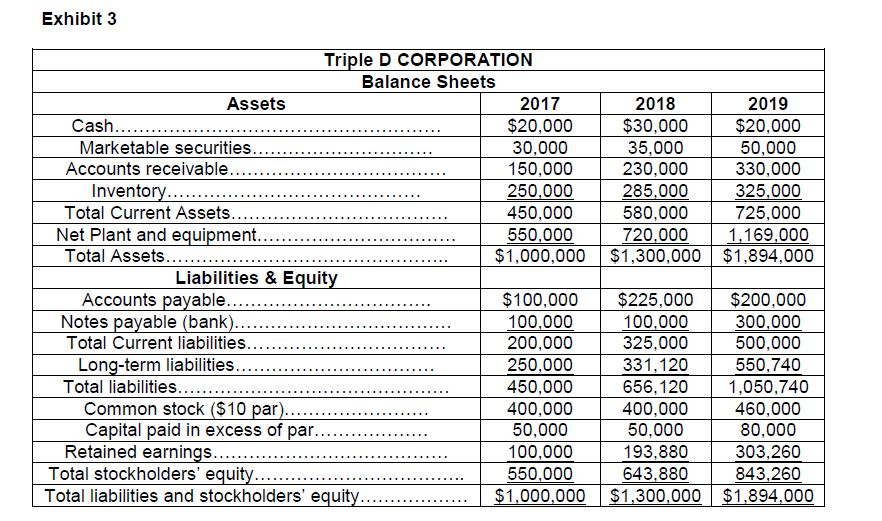

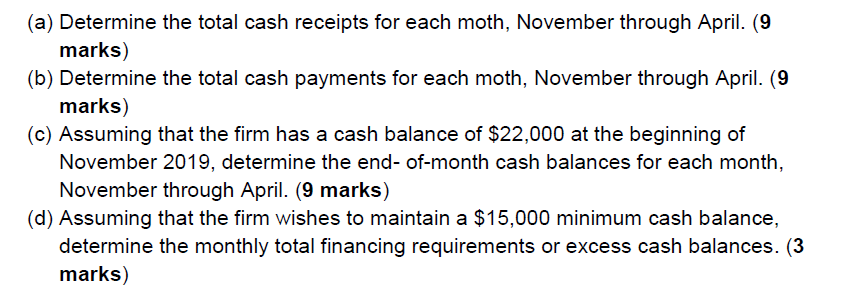

Exhibit 1: Triple D Corporation's alternative capital structures Capital structure Interest rate on debt debt-equity ratio 0% 0.0% 15 8.0 30 10.0 45 13.0 60 17.0 Exhibit 2 TRIPLE D CORPORATION Income Statements 2017 Sales (all on credit). $1,500,000 Cost of goods sold.. 950,000 Gross profit......... 550,000 Selling and administrative expense.. 380.000 Operating profit. 170,000 Interest expense.... 30,000 Net income before taxes. 140,000 Taxes... 46,120 Net Income.. $93,880 Shares... 40,000 2018 $1,800,000 1,120,000 680,000 490,000 190,000 40,000 150,000 48,720 $101,280 40,000 2019 $2,160,000 1,300,000 860,000 590,000 270,000 85,000 185,000 64,850 $120, 150 46,000 Exhibit 4: Triple D corporation's Projected sales and purchases Year 2019 2019 2019 2019 2020 2020 2020 2020 Month September October November December January February March April Sales $210,000 250.000 170,000 160,000 140,000 180,000 200,000 250,000 Purchases $120,000 150,000 140,000 100,000 80,000 110,000 100,000 90,000 Exhibit 3 Triple D CORPORATION Balance Sheets Assets 2017 2018 2019 Cash.... $20,000 $30,000 $20,000 Marketable securities. 30,000 35,000 50,000 Accounts receivable... 150,000 230,000 330,000 Inventory....... 250,000 285.000 325,000 Total Current Assets..... 450,000 580,000 725,000 Net Plant and equipment... 550,000 720.000 1,169,000 Total Assets...... $1,000,000 $1,300,000 $1,894,000 Liabilities & Equity Accounts payable... $100,000 $225,000 $200,000 Notes payable (bank).. 100,000 100,000 300,000 Total Current liabilities. 200,000 325,000 500,000 Long-term liabilities.. 250,000 331,120 550,740 Total liabilities....... 450,000 656,120 1,050,740 Common stock ($10 par.. 400,000 400,000 460,000 Capital paid in excess of par.. 50,000 50,000 80,000 Retained earnings..... 100,000 193,880 303,260 Total stockholders' equity.. 550,000 643,880 843,260 Total liabilities and stockholders' equity.. $1,000,000 $1,300,000 $1,894,000 (a) Determine the total cash receipts for each moth, November through April. (9 marks) (b) Determine the total cash payments for each moth, November through April. (9 marks) (c) Assuming that the firm has a cash balance of $22,000 at the beginning of November 2019, determine the end-of-month cash balances for each month, November through April. (9 marks) (d) Assuming that the firm wishes to maintain a $15,000 minimum cash balance, determine the monthly total financing requirements or excess cash balances. (3 marks) Exhibit 1: Triple D Corporation's alternative capital structures Capital structure Interest rate on debt debt-equity ratio 0% 0.0% 15 8.0 30 10.0 45 13.0 60 17.0 Exhibit 2 TRIPLE D CORPORATION Income Statements 2017 Sales (all on credit). $1,500,000 Cost of goods sold.. 950,000 Gross profit......... 550,000 Selling and administrative expense.. 380.000 Operating profit. 170,000 Interest expense.... 30,000 Net income before taxes. 140,000 Taxes... 46,120 Net Income.. $93,880 Shares... 40,000 2018 $1,800,000 1,120,000 680,000 490,000 190,000 40,000 150,000 48,720 $101,280 40,000 2019 $2,160,000 1,300,000 860,000 590,000 270,000 85,000 185,000 64,850 $120, 150 46,000 Exhibit 4: Triple D corporation's Projected sales and purchases Year 2019 2019 2019 2019 2020 2020 2020 2020 Month September October November December January February March April Sales $210,000 250.000 170,000 160,000 140,000 180,000 200,000 250,000 Purchases $120,000 150,000 140,000 100,000 80,000 110,000 100,000 90,000 Exhibit 3 Triple D CORPORATION Balance Sheets Assets 2017 2018 2019 Cash.... $20,000 $30,000 $20,000 Marketable securities. 30,000 35,000 50,000 Accounts receivable... 150,000 230,000 330,000 Inventory....... 250,000 285.000 325,000 Total Current Assets..... 450,000 580,000 725,000 Net Plant and equipment... 550,000 720.000 1,169,000 Total Assets...... $1,000,000 $1,300,000 $1,894,000 Liabilities & Equity Accounts payable... $100,000 $225,000 $200,000 Notes payable (bank).. 100,000 100,000 300,000 Total Current liabilities. 200,000 325,000 500,000 Long-term liabilities.. 250,000 331,120 550,740 Total liabilities....... 450,000 656,120 1,050,740 Common stock ($10 par.. 400,000 400,000 460,000 Capital paid in excess of par.. 50,000 50,000 80,000 Retained earnings..... 100,000 193,880 303,260 Total stockholders' equity.. 550,000 643,880 843,260 Total liabilities and stockholders' equity.. $1,000,000 $1,300,000 $1,894,000 (a) Determine the total cash receipts for each moth, November through April. (9 marks) (b) Determine the total cash payments for each moth, November through April. (9 marks) (c) Assuming that the firm has a cash balance of $22,000 at the beginning of November 2019, determine the end-of-month cash balances for each month, November through April. (9 marks) (d) Assuming that the firm wishes to maintain a $15,000 minimum cash balance, determine the monthly total financing requirements or excess cash balances