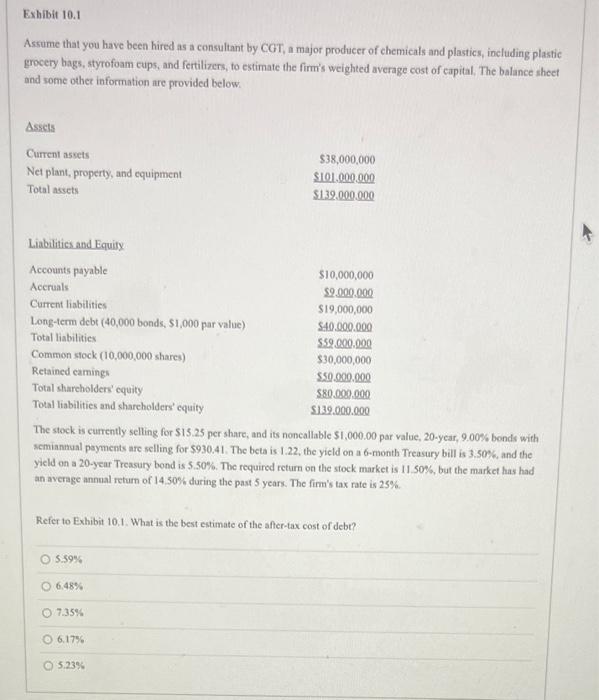

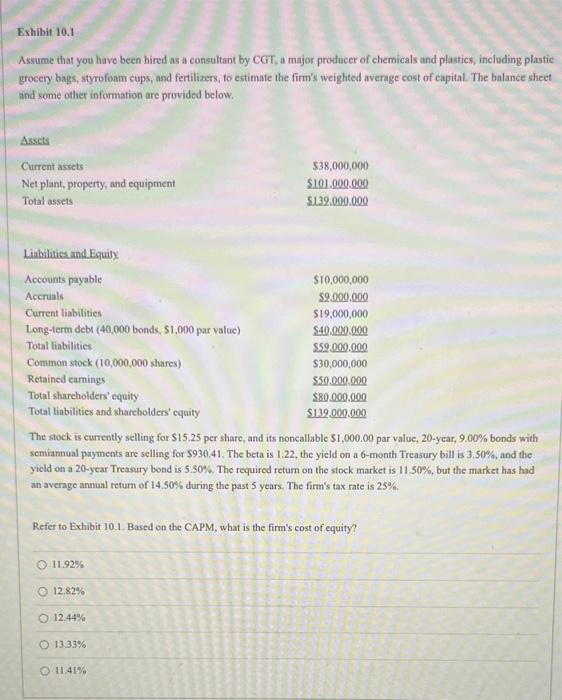

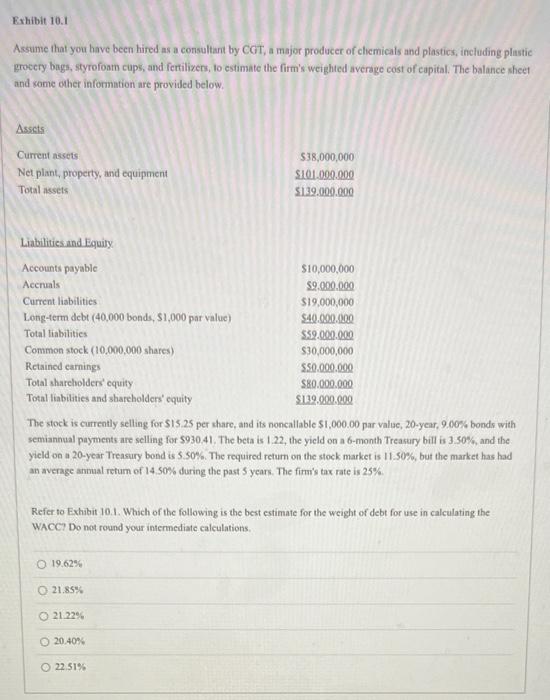

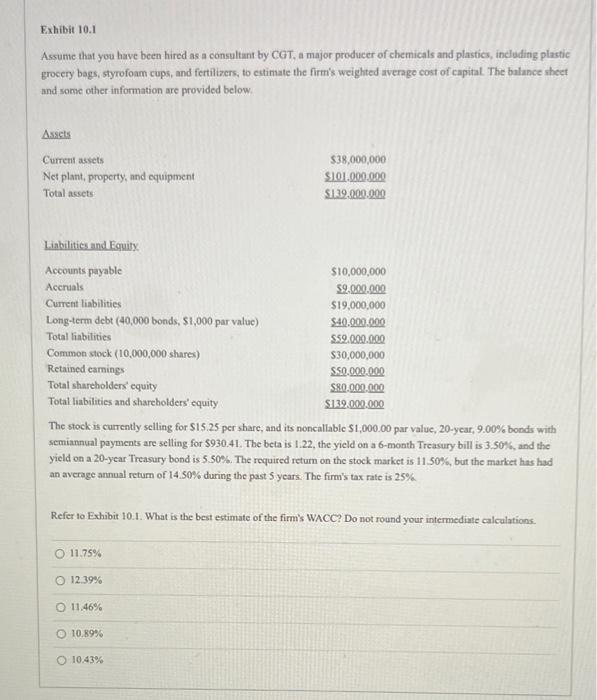

Exhibit 10.1 Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and fertilizers, to estimate the firm's weighted average cost of eapital. The balance sheet and some othet information are provided below. The stock is currently selling for $15.25 per share, and its noncallable $1,000.00 par value, 20 year, 9.00% bonds with semianmual peyments are selling for 5930.41. The beta is 1.22, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 25%. Refer to Exhibit 10.1. What is the best estimate of the affer-tax cost of debt? 5.59% 6.48% 7.35% 6.17% 5.23% Exhibit 10.1 Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and fertilizers, to estimate the firm's weighted average cost of eapital. The balance sheet and some other information are provided below. The stock is currently selling for $15.25 per share, and its noncallable $1,000.00 par value, 20y ear, 9.00% bonds with semiannual payments are selling for $930.41. The beta is 1.22, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual retum of 14.50% during the past 5 years. The firm's tax rate is 25%. Refer to Exhibit 10.1. Based on the CAPM, what is the fim's cost of equity? 11.92% 12.82% 12.44% 13.33% 11.41% Exhibit 10.1 Assume that you have been hired as a consultant by CGT, a major producer of clicmicals and plastics, including plastic grocery bags, styrofons cups, and fertilizers, to estimate the firm's weighted average cost of eapital. The balance sheet and some other information are provided below. The stock is currently selling for $15.25 per share, and its noncallable $1,000.00 par value, 20 -year, 900% bonds with semiannual payments are selling for 5930.41. The beta is 1.22, the yicld on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required retum on the stock market is 11.50%, but the market has had an average annual retum of 14.50% during the past 5 years. The fimis's tax rate is 25%. Refer to Exhibit 10.1. Which of the following is the best estimate for the weight of debt for use in calculating the WACC? Do not round your internediate calculations. 19.62% 21.85% 21.22% 20.405 22.51% Exhibit 10.1 Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and fertilizers, to cutimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below. The stock is currently selling for $15.25 per share, and its noncallable $1,000.00 par value, 20 -ycar, 9.00% bonds with semiannual payments are selling for 5930.41. The beta is 1.22, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required retum on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 25% Refer to Exhibit 10.1. What is the best estimate of the firm's WACC? Do not round your intermediate calcalations. 11.75% 12.395 11.46% 10.8958 10.43%