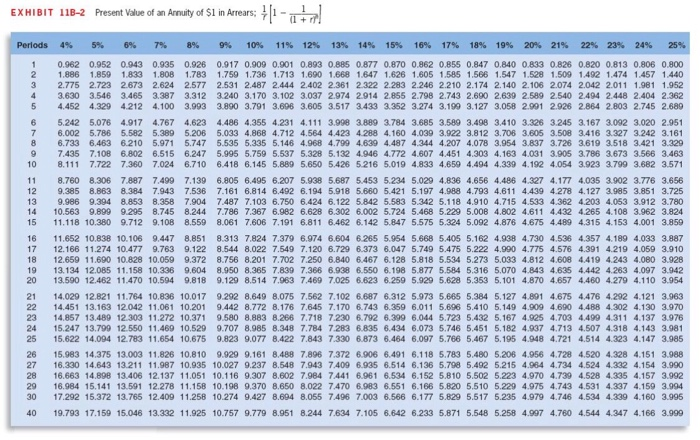

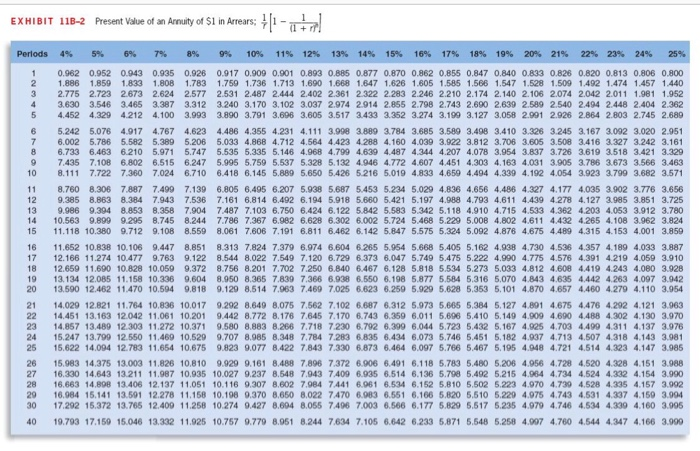

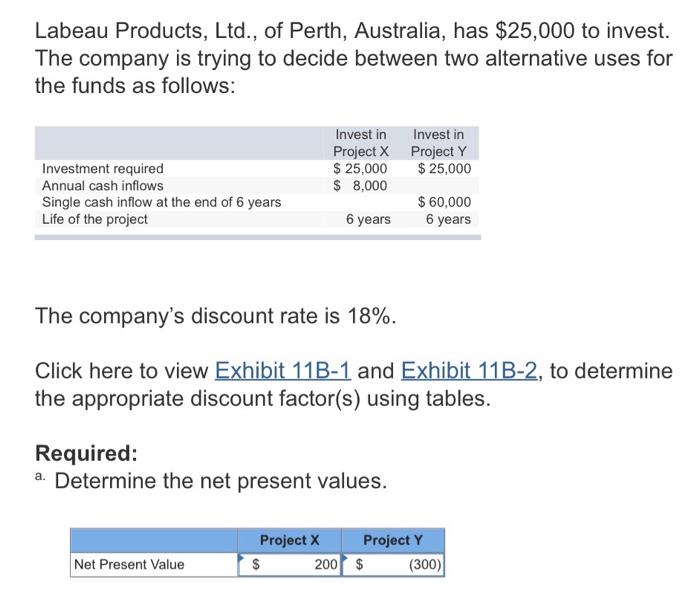

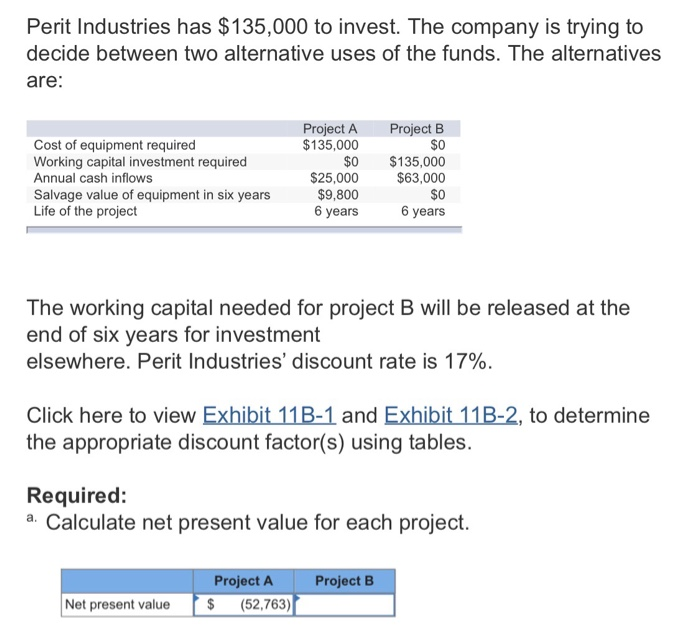

EXHIBIT 11B-2 Present Value of an Annuity of $1 in Arrears;1 Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 1 3 5 4.452 4.329 4.212 4.100 3.993 3890 3.791 3.698 3.605 3.517 3.433 3.352 3.274 3.199 3.127 3,058 2991 2.928 2.864 2.803 2.745 2.68 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0855 0.847 0.840 0.833 0.826 0.820 0.813 0.806 0.800 1.886 1.859 18331.808 1.783 1.759 1.736 1.713 1.690 1.668 1.647 1.626 1.605 1.585 1.566 1.547 1.528 1.509 1.492 1.474 1.457 1.440 2.775 2.723 2.673 2.624 2.5772.531 2.487 2.444 2.402 2.361 2.322 2.283 2.246 2.210 2.174 2.140 2.106 2.074 2.042 2.011 1.981 1.952 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.102 3.037 2.974 2914 2.855 2.798 2.743 2.690 2.639 2.589 2.540 2494 2.448 2.404 2.362 6 5.242 5.076 4917 4.767 4.623 4.486 4.355 4.231 4.111 3.998 3889 3.784 3.685 3.589 3.498 3.410 3.326 3.245 3.167 3.092 3.020 2.951 7 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.712 4.564 4.423 4288 4.160 4.039 3.922 3.812 3.706 3.605 3.508 3.416 3.327 3.242 3.161 8 6.733 6.463 6210 5.971 5.747 5.535 5.335 5.146 4.968 4.799 4639 4487 4.344 4.207 4.078 3.954 3.837 3.726 3.619 3518 3.421 3.329 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.537 5.328 5.132 4.946 4.772 4.607 4451 4.303 4.163 4031 3.905 3.786 3673 3.566 3.463 10 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.889 5.650 5.426 5216 5.019 4833 4.659 4.494 4.339 4.192 4.054 3923 3.799 3.682 3571 11 8.760 8.306 7.887 7.499 7.139 6.805 6.495 6.207 5.938 5.687 5.453 5.234 5.029 4.836 4.656 4.486 4.327 4.177 4035 3902 3.776 3.656 12 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.492 6.194 5.918 5.660 5.421 5.197 4.988 4.793 4.611 4.439 4.278 4.127 3985 3.851 3.725 13 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.750 6.424 6.122 5842 5.583 5.342 5.118 4.910 4.715 4.533 4.362 4.203 4.053 3.912 3.780 14 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.982 6.628 6.302 6.002 5.724 5.468 5.229 5.008 4.802 4.611 4432 4.265 4.108 3.962 3.824 .793 4.611 4.439 4.278 4.127 8.061 7.606 7.191 6.811 6462 6.142 5847 5.575 5.324 5.092 4.876 4.675 4.489 4.315 4.153 4.001 16 11.652 10.838 10.106 9.447 8.851 8.313 7.824 7.379 6.974 6.604 6265 5.954 5.668 5.405 5.162 4.938 4.730 4.536 4.357 4.189 4.033 3.887 17 12.166 11.274 10.477 9.763 9.122 8.544 8.022 7.549 7.120 6.729 6.373 6.047 5.749 5.475 5.222 4.990 4.775 4.576 4.391 4.219 4.059 3.910 18 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.702 7.250 6.840 6.467 6.128 5.818 5.534 5.273 5.033 4.812 4.608 4.419 4.243 4.080 3.928 19 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.839 7.366 6.938 6.550 6.198 5.877 5.584 5.316 5.070 4.843 4.635 4442 4.263 4.097 3.942 20 13590 12.462 11.470 10.594 9.818 9.129 8.514 7.963 7.469 7025 6.623 6.259 5.929 5.628 5.353 5.101 4.870 4.657 4.460 4.279 4.110 3.954 18 5.534 5.273 5.033 4.812 4.608 4.419 4243 4.080 3 21 14.029 12.821 11.764 10.836 10.017 9.292 8.649 8.075 7.562 7.102 6.687 6.312 5.973 5.665 5.384 5.127 4.891 4.675 4.476 4.292 4.121 3.963 22 14.451 13.163 12.042 11.061 10.201 9.442 8.772 8.176 7.645 7.170 6.743 6.359 6.011 5.696 5.410 5.149 4.909 4.690 4.488 4.302 4.130 3.970 23 14.857 13.489 12.303 11.272 10.371 9.580 8.883 8.266 7.718 7.230 6.792 6.399 6.044 5.723 5.432 5.167 4.925 4.703 4499 4.311 4.137 3.976 24 15.247 13.799 12.550 11,469 10.529 9.707 8.985 8.348 7.784 7283 6.835 6.434 6.073 5.746 5,451 5.182 4.937 4.713 4.507 4.318 4.143 3.981 25 15.622 14.094 12.783 11.654 10.675 9.823 9.077 8.422 7.843 7.330 6.873 6.464 6.097 5.766 5.467 5.195 4.948 4.721 4.514 4.323 4.147 3.985 26 15.983 14.375 13.003 11.826 10.810 9.929 9.161 8.488 7.896 7.372 6.906 6.491 6.118 5.783 5,480 5.206 4.956 4.728 4.520 4.328 4.151 3.988 27 16.330 14.643 13.211 11.987 10.935 10.027 9.237 8.548 7.943 7409 6.935 6.514 6.136 5.798 5.492 5.215 4.964 4.734 4.524 4.332 4.154 3.990 28 16.663 14.898 13.406 12.137 11.051 10.116 9.307 8.602 7.984 7441 6961 6.534 6.152 5.810 5.502 5.223 4.970 4.739 4.528 4.335 4.157 3.992 29 16.984 15.141 13.591 12.278 11.158 10.198 9.370 8.650 8.022 7470 6.983 6.551 6.166 5820 5,510 5.229 4.975 4.743 4.531 4.337 4.159 3.994 30 17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.694 8.055 7496 7.003 6.566 6.177 5.829 5.517 5.235 4.979 4.746 4.534 4.339 4.160 3.995 40 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.951 8.244 7.634 7.105 6.642 6.233 5.871 5.548 5.258 4.997 4.760 4.544 4.347 4.166 3.999 EXHIBIT 11B-2 Present Value of an Arnuity of $1 in Arrears; 1- Periods 4% 5% 5% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 1 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0,855 0.847 0.840 0.833 0.826 0.820 0.813 0.806 0,800 2 1.886 1859 1.833 1,808 1.783 1.759 1.736 1.713 1.690 1.668 1.847 1.626 1.605 1.585 1.568 1.547 1.528 1.509 1492 1.474 1.457 1.440 3 2.775 2.723 2673 2.624 2.577 2.531 2.487 2.444 2.402 2.361 2.322 2.283 2 .981 1.952 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.102 3.037 2.974 2.914 2.855 2.798 2.743 2.690 2.639 2.589 2.540 2.494 2.448 2404 2.362 5 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 3.517 3433 3.352 3.274 3.199 3.127 3.058 2.991 2.926 2.864 2.803 2.745 2.689 2.246 2.210 2.174 2.140 2.106 2.074 2.042 2.011 242 5.076 4917 4.767 4.623 4.486 4.355 4.231 4.111 6 5. 3.998 3.889 3.784 3.685 3.589 3,498 3.410 3.326 3.245 3.167 3.092 3.020 2.951 3.812 3.706 3.605 3.508 3.416 3.327 3.242 3.161 6.733 6.463 6.210 5.971 5.747 5.535 5.335 5.146 4.968 4.799 4.639 4487 4.344 4.207 4.078 3.954 3.837 3.726 3.619 3518 3421 3.329 9 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.537 5.328 5.132 4946 4.772 4.607 4451 4.303 4.163 4.031 3.905 3.786 3.673 3.566 3.463 10 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.889 5.650 5.426 5216 5.019 4.833 4.859 4.494 4.339 4.192 4.054 3.923 3.799 3.682 3.571 7 6.002 5.786 5.582 5.389 5.206 5 5.033 4.868 4.712 4.564 4.4 23 4.288 4.160 4.039 3.922 11 8.760 8.306 7.887 7.499 7.139 6.805 6.495 6.207 5.938 5.687 5.453 5.234 5.029 4.836 4.656 4.486 4.327 4.177 4035 3902 3.776 3.656 12 9.385 8.863 8.384 7.943 7.5367.161 6.814 6.492 6.194 5.918 5.660 5.421 5.197 4.988 4.793 4.611 4.439 4.278 4.127 3.985 3.851 3.725 13 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.750 6.424 6.122 5842 5.583 5.342 5.118 4.910 4.715 4.533 4.362 4.203 4.053 3.912 3.780 14 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.982 6.628 6.302 6.002 5.724 5.468 5.229 5.008 4.802 4.611 4.432 4.265 4.108 3.962 3.824 15 11.118 10.380 9.712 9.108 8.559 8.061 7.606 7.191 6.811 6.462 6.142 5.847 5.575 5.324 5.092 4.876 4.675 4.489 4.315 4.153 4.001 3.859 5.405 5.162 4.938 4.730 4.536 4.357 4.189 4.033 3.887 17 12.166 11.274 10.477 9.763 9.122 8.544 8.022 7.549 7.120 6.729 6.373 6.047 5.749 5.475 5.222 4.990 4.775 4.576 4.391 4.219 4.059 3.910 18 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.702 7.250 6.840 6.467 6.128 5.818 5.534 5.273 5,033 4.812 4.608 4.419 4.243 4.080 3.928 19 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.839 7.366 6.938 6.550 6.198 5.877 5.584 5.316 5,070 4.843 4.635 4.442 4.263 4.097 3.942 20 13.590 12.462 11.470 10.594 9.818 9.129 8514 7.963 7469 7.025 6.623 6.259 5.929 5.628 5.353 5.101 4.870 4.657 4.460 4.279 4.110 3.954 16 11.652 10.838 1 0.106 9.447 8.851 8.313 7.824 7.379 6.974 6.604 6.265 5.954 5.668 5.384 5.127 4.891 4.675 4.476 4.292 4.121 3.963 22 14.451 13.163 12.042 11.061 10.201 9.442 8.772 8.176 7.645 7.170 6.743 6.359 6.011 5.696 5.410 5.149 4.009 4.690 4.488 4 302 4.130 3.970 23 14.857 13.489 12.303 11.272 10.371 9.580 8.883 8.266 7.718 7.230 6.792 6.399 6.044 5.723 5,432 5.167 4.925 4.703 4.499 4.311 4.137 3.976 24 15.247 13.799 12.550 11.469 10.529 9.707 8.985 8.348 7.784 7.283 6.835 6.434 6.073 5.746 5.451 5.182 4.937 4.713 4.507 4.318 4.143 3.981 25 15.622 14.094 12.783 11.654 10.675 9.823 9.077 8.422 7.843 7.330 6.873 6.464 6.097 5.766 5.467 5.195 4.948 4.721 4.514 4.323 4.147 3.985 21 14.029 12.821 11.764 10.836 10.017 9.292 8.649 8.075 7.562 7.102 6.687 6.312 5.973 5.665 5 26 15.983 14.375 13.003 11.826 10.810 9.929 9.161 8.488 7.896 7.372 6.906 6.491 6.118 5.783 5,480 5.206 4.956 4.728 4.520 4.328 4.151 3.988 27 16.330 14.643 13.211 11.987 10.935 10.027 9.237 8.548 7.943 7409 6.935 6.514 6.136 5.798 5.492 5.215 4.964 4.734 4.524 4.332 4.154 3.990 28 16.663 14.898 13.406 12.137 11.051 10.116 9.307 8.602 7.984 7441 6.061 6.534 6.152 5.810 5.502 5.223 4.970 4.730 4.528 4.335 4.157 3.992 29 16.984 15.141 13.591 12.278 11.158 10.198 9.370 8.650 8.022 7.470 6.983 6.551 6.166 5.820 5.510 5.229 4.975 4.743 4.631 4.337 4.159 3.904 30 17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.694 8.055 7496 7.003 6.566 6.177 5.829 5.517 5.235 4.979 4.746 4.534 4.339 4.160 3.995 40 19793 17.150 15046 13.102 11925 10.757 9779 8951 B244 7604 7.105 6 642 6233 5871 5548 5258 4007 4760 4544 4047 4.16 Labeau Products, Ltd., of Perth, Australia, has $25,000 to invest. The company is trying to decide between two alternative uses for the funds as follows Invest in Project X $ 25,000 $ 8,000 Invest in Project Y $25,000 Investment required Annual cash inflows Single cash inflow at the end of 6 years Life of the project $60,000 6 years 6 years The company's discount rate is 18%. o view Exhibit 118-1and ibit n 1 and Exhibit 11B-2, to determine the appropriate discount factor(s) using tables Required a. Determine the net present values. Project X Project Y Net Present Value 200 $ (300) Perit Industries has $135,000 to invest. The company is trying to decide between two alternative uses of the funds. The alternatives are Cost of equipment required Working capital investment required Annual cash inflows Salvage value of equipment in six years Life of the project Project A $135,000 $0 $25,000 $9,800 6 years Project B $0 $135,000 $63,000 $0 6 years The working capital needed for project B will be released at the end of six vears for investment elsewhere. Perit Industries, discount rate is 17% Click here to view Exhibit 11B-1 and Exhibit 11B-2, to determine the appropriate discount factor(s) using tables. Required: a. Calculate net present value for each project Project B Project A $ Net present value (52,763)