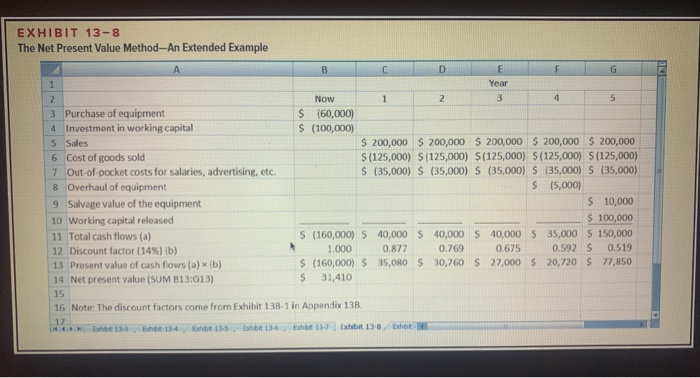

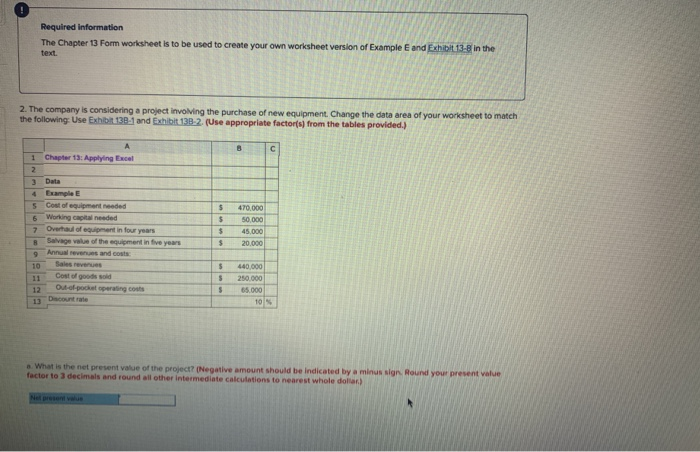

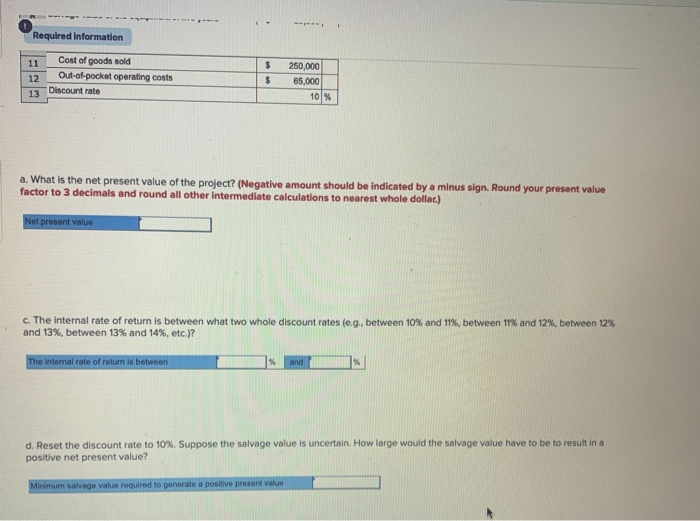

EXHIBIT 13-8 The Net Present Value Method-An Extended Example C D E F G 3 Purchase of equipment 4 Investment in working capital 5 Sales 6 Cost of goods sold 7 Out-of-pocket costs for salaries, advertising, etc. 8 Overhaul of equipment 9 Salvage value of the equipment 10 Working capital released 11 Total cash flows (a) 12 Discount factor (14%) ib) 13 Present value of cash flows (a) (b) 14 Net present value (SUM B13:613) Now $ 60,000) $ (100,000) $ 200,000 $ 200,000 $ 200,000 $ 200,000 $ 200,000 $(125,000) S(125,000) $(125,000) $(125,000) $(125,000) $ (35,000) S (35,000) S (35,000) S (35,000) S (35,000) S (5,000) $ 10,000 $ 100,000 $ (160,000) $ 40,000 $ 40,000 $ 40,000 $ 35,000 S 150,000 1.000 0.877 0.769 0 .675 0.592 S 0.519 $ (160,000) $ 35,080 $ 30,760 $ 27,000 $20,720 $ 77,850 $ 31,410 16 Note: The discount factors come from Exhibit 138-1 in Appendix 13B. 13 Echt 134 135 136 137 Exhibit 130 h Required information The Chapter 13 Form worksheet is to be used to create your own worksheet version of Example E and Exhibit13-8 in the 2. The company is considering a project involving the purchase of new equipment Change the data area of your worksheet to match the following: Use Ext 138-1 and Exhib138-2 (Use appropriate factors from the tables provided.) 1 Chapter 13: Applying Excel Example Costo de Working capital needed Overtulof t in four years Savage value of the mentin five years 2 What is the nel present value of the project? (Negative amount should be indicated by a minus sign Round your present value factor to 3 decimals and round all other intermediate calculations to nearest whole dollar) Required information 250,000 11 Cost of goods sold 12 Out-of-pocket operating costs 13 Discount rate 65.000 10 % a. What is the net present value of the project? (Negative amount should be indicated by a minus sign. Round your present value factor to 3 decimals and round all other intermediate calculations to nearest whole dollar) Not present value c. The internal rate of return is between what two whole discount rates (e.g., between 10% and 11%, between 11% and 12%, between 12% and 13%, between 13% and 14%, etc.)? The Internal rate of return is between d. Reset the discount rate to 10%. Suppose the salvage value is uncertain. How large would the salvage value have to be to result in a positive net present value? Minimum salvage value required to generate a positive present value