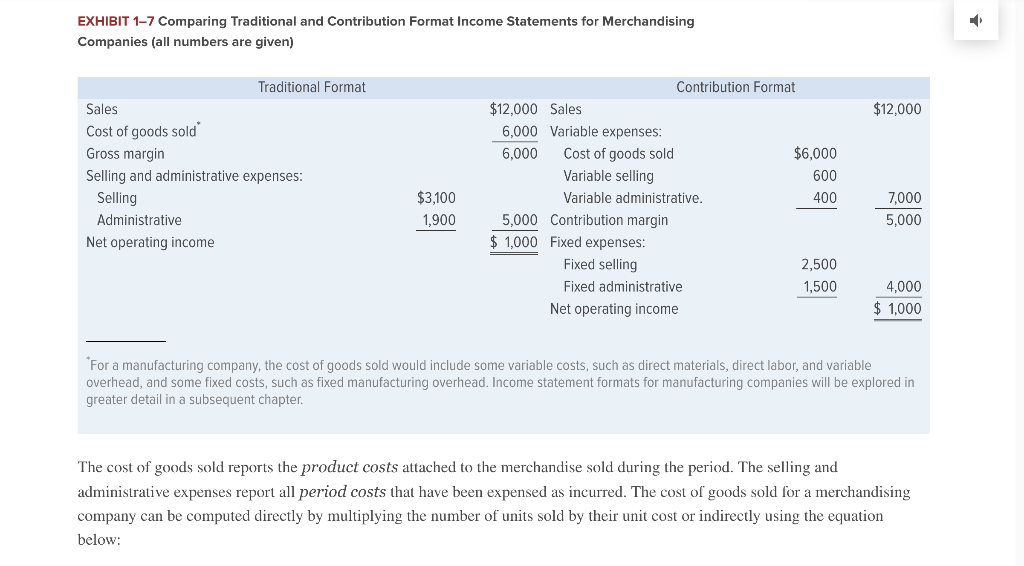

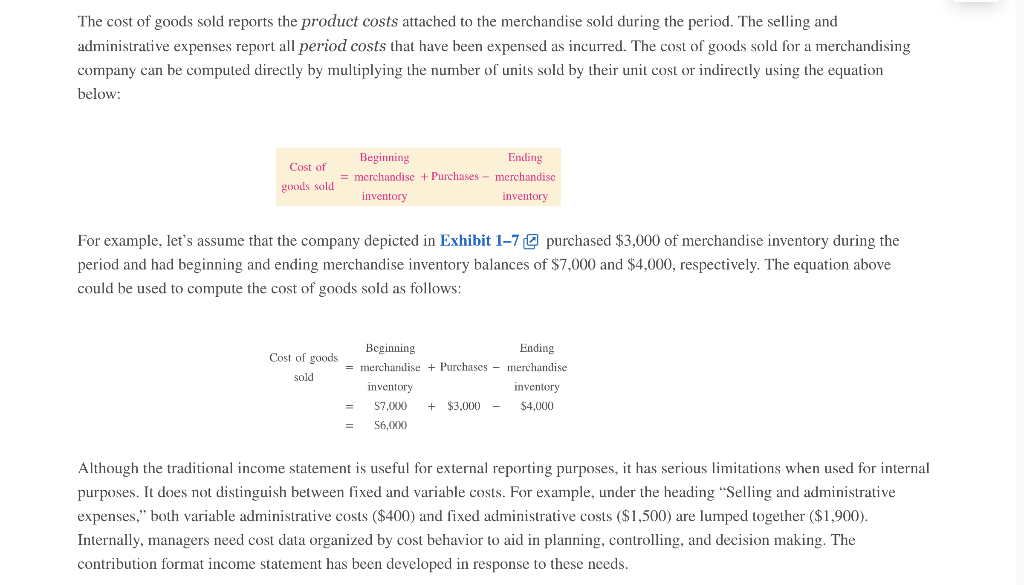

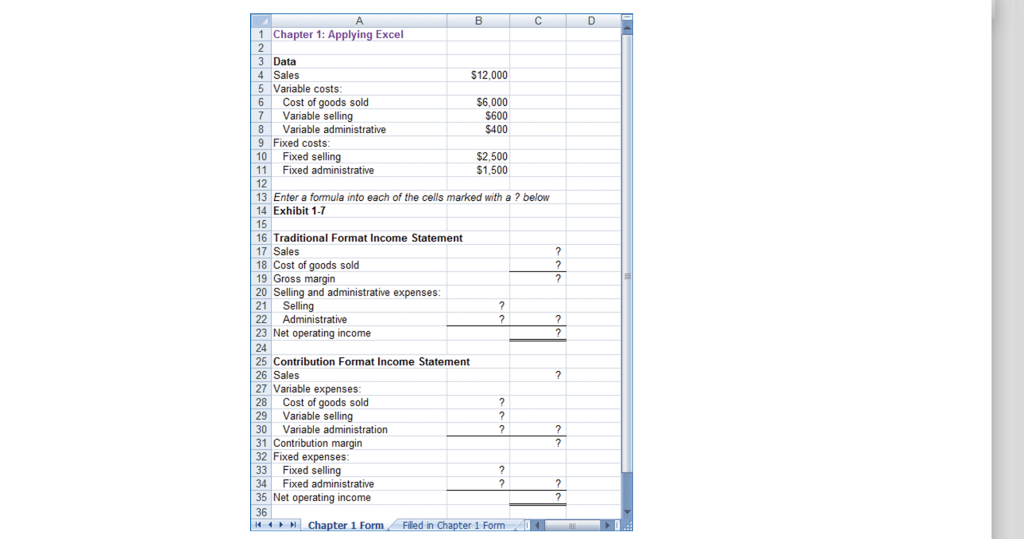

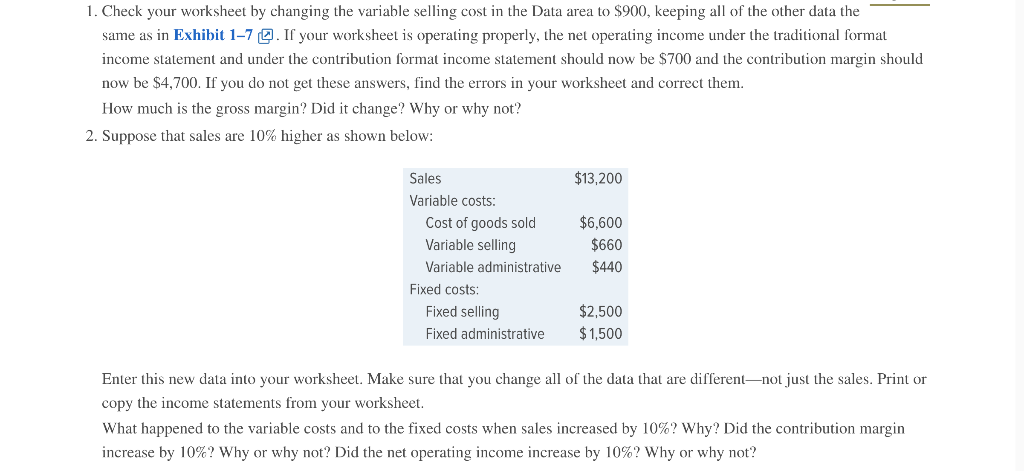

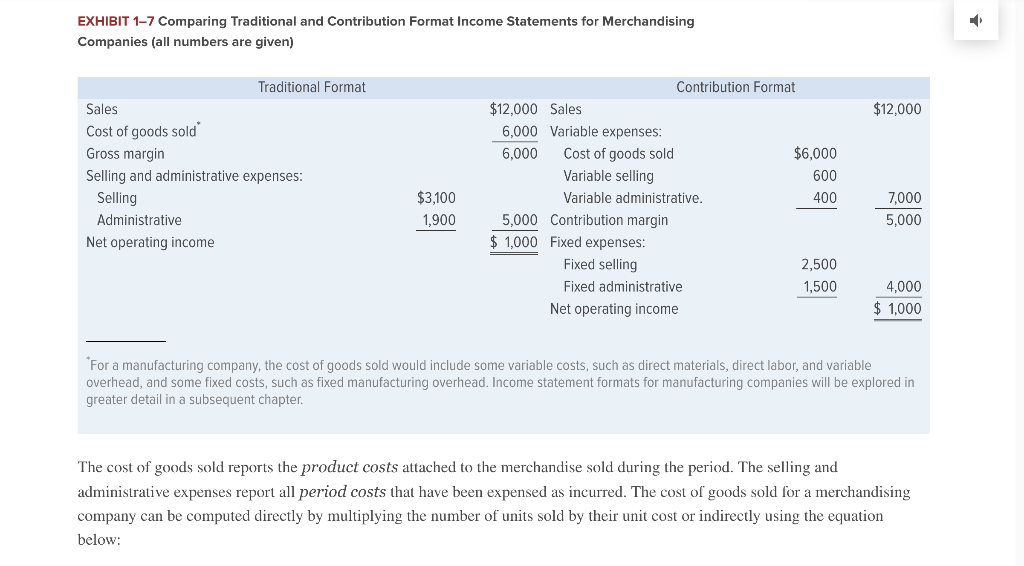

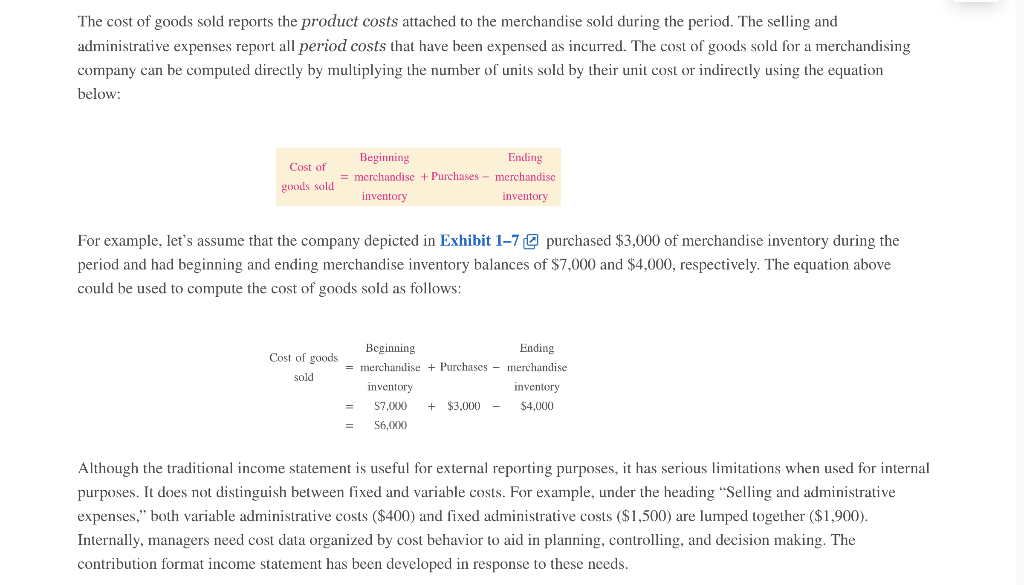

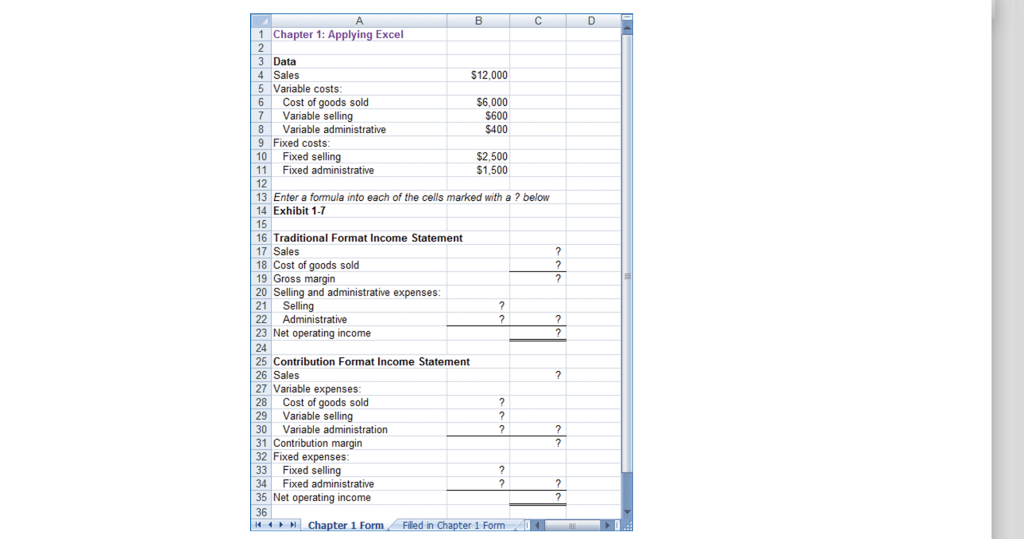

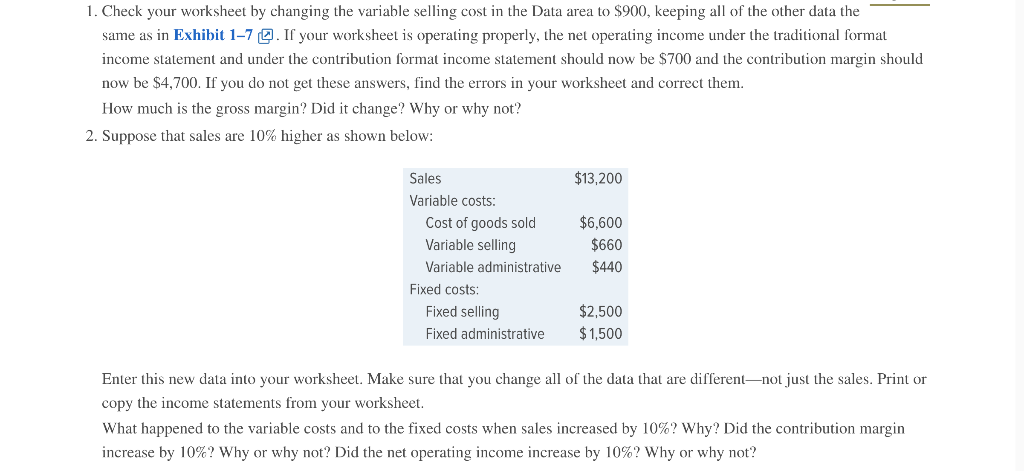

EXHIBIT 1-7 Comparing Traditional and Contribution Format Income Statements for Merchandising Companies (all numbers are given) $12,000 Traditional Format Sales Cost of goods sold Gross margin Selling and administrative expenses: Selling Administrative Net operating income $3,100 1,900 Contribution Format $12,000 Sales 6,000 Variable expenses: 6,000 Cost of goods sold $6,000 Variable selling 600 Variable administrative. 400 5,000 Contribution margin $ 1,000 Fixed expenses: Fixed selling 2,500 Fixed administrative 1,500 Net operating income 7,000 5,000 4,000 $ 1,000 *For a manufacturing company, the cost of goods sold would include some variable costs, such as direct materials, direct labor, and variable overhead, and some fixed costs, such as fixed manufacturing overhead. Income statement formats for manufacturing companies will be explored in greater detail in a subsequent chapter. The cost of goods sold reports the product costs attached to the merchandise sold during the period. The selling and administrative expenses report all period costs that have been expensed as incurred. The cost of goods sold for a merchandising company can be computed directly by multiplying the number of units sold by their unit cost or indirectly using the equation below: The cost of goods sold reports the product costs attached to the merchandise sold during the period. The selling and administrative expenses report all period costs that have been expensed as incurred. The cost of goods sold for a merchandising company can be computed directly by multiplying the number of units sold by their unit cost or indirectly using the equation below: Cost of goods sold Beginning Ending = merchandise + Purchases - merchandise inventory inventory For example, let's assume that the company depicted in Exhibit 1-7 purchased $3,000 of merchandise inventory during the period and had beginning and ending merchandise inventory balances of $7,000 and $4,000, respectively. The equation above could be used to compute the cost of goods sold as follows: Cost of goods sold Beginning Ending = merchandise + Purchases merchandise inventory inventory 57.000 $3,000 $4,000 S6.000 + Although the traditional income statement is useful for external reporting purposes, it has serious limitations when used for internal purposes. It does not distinguish between fixed and variable costs. For example, under the heading "Selling and administrative expenses," both variable administrative costs ($400) and fixed administrative costs ($1,500) are lumped together ($1,900). Internally, managers need cost data organized by cost behavior to aid in planning, controlling, and decision making. The contribution format income statement has been developed in response to these needs. D A B 1 Chapter 1: Applying Excel 2 3 Data 4 Sales $12,000 5 Variable costs: 6 Cost of goods sold $6,000 7 Variable selling $600 8 Variable administrative $400 9 Fixed costs: 10 Fixed selling $2,500 11 Fixed administrative $1,500 12 13 Enter a formula into each of the cells marked with a ? below 14 Exhibit 1-7 15 16 Traditional Format Income Statement 17 Sales 18 Cost of goods sold 19 Gross margin 20 Selling and administrative expenses: 21 Selling ? 22 Administrative ? 23 Net operating income 24 25 Contribution Format Income Statement 26 Sales 27 Variable expenses 28 Cost of goods sold ? 29 Variable selling ? 30 Variable administration 2 31 Contribution margin 32 Fixed expenses 33 Fixed selling ? 34 Fixed administrative ? 35 Net operating income 36 H + Chapter 1 Form Filled in Chapter 1 Form 2 ? ? ? ? 2 ? ? ? ? 1. Check your worksheet by changing the variable selling cost in the Data area to $900, keeping all of the other data the same as in Exhibit 1-7 Q. If your worksheet is operating properly, the net operating income under the traditional format income statement and under the contribution format income statement should now be $700 and the contribution margin should now be $4,700. If you do not get these answers, find the errors in your worksheet and correct them. How much is the gross margin? Did it change? Why or why not? 2. Suppose that sales are 10% higher as shown below: $13,200 Sales Variable costs: Cost of goods sold Variable selling Variable administrative Fixed costs: Fixed selling Fixed administrative $6.600 $660 $440 $2,500 $1,500 Enter this new data into your worksheet. Make sure that you change all of the data that are differentnot just the sales. Print or copy the income statements from your worksheet. What happened to the variable costs and to the fixed costs when sales increased by 10%? Why? Did the contribution margin increase by 10%? Why or why not? Did the net operating income increase by 10%? Why or why not