Answered step by step

Verified Expert Solution

Question

1 Approved Answer

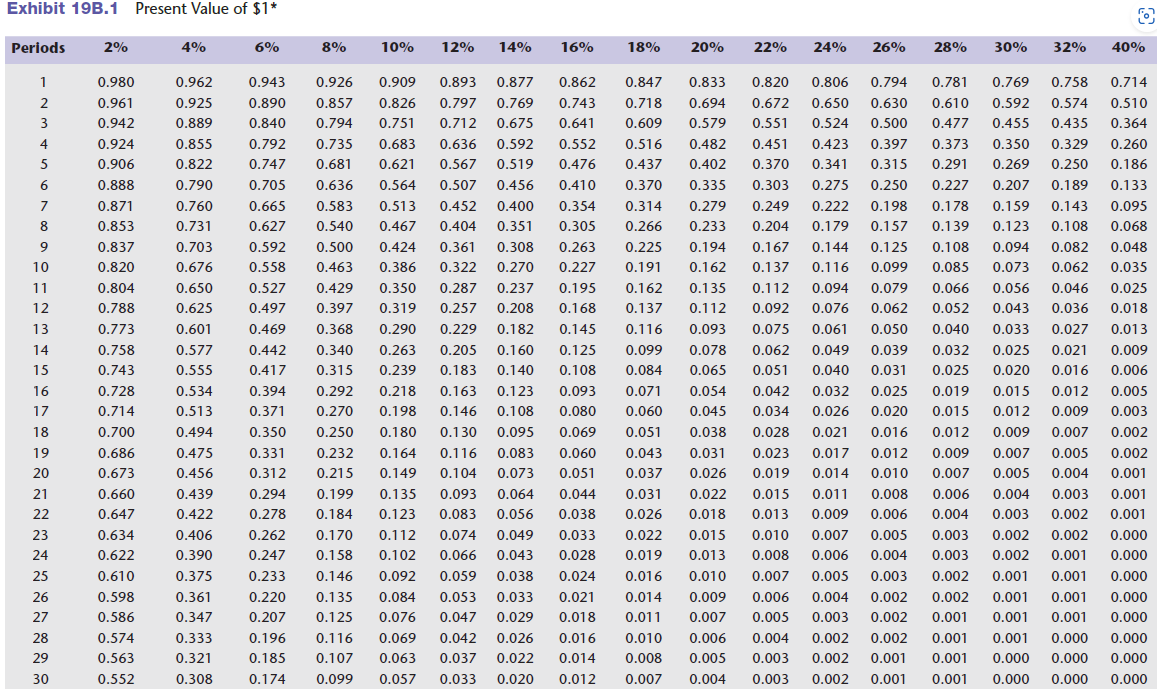

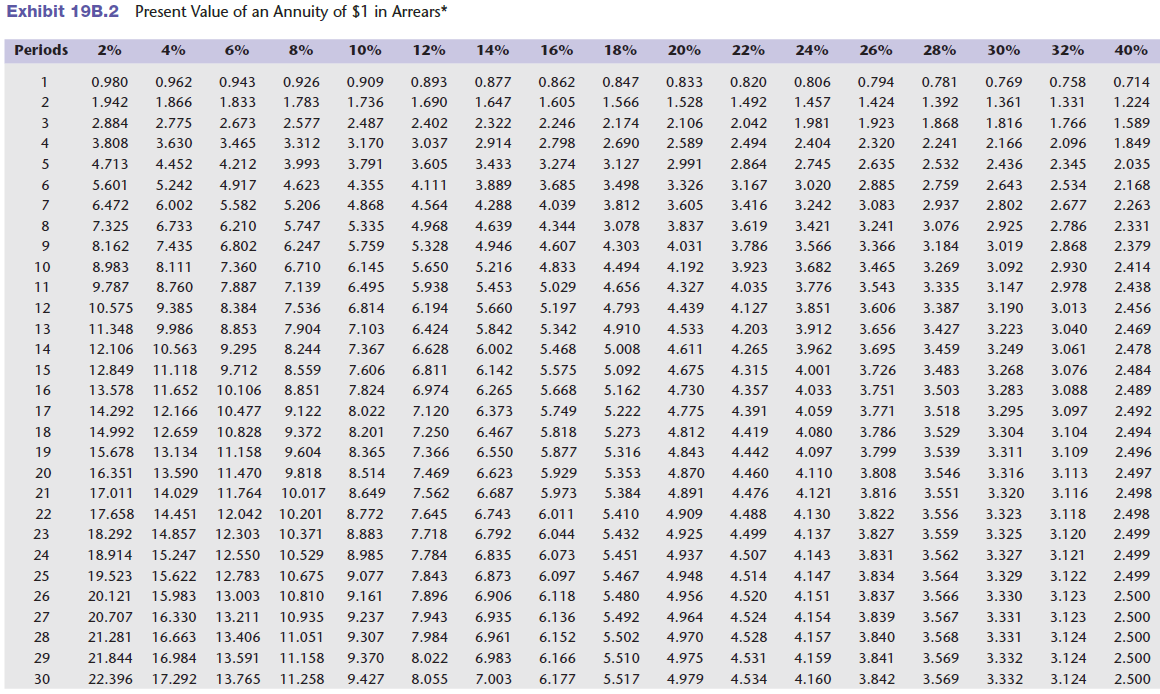

Exhibit 19B.1 Present Value of $1* Periods 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% 22% 24% 26% 28% 30% 32% 40%

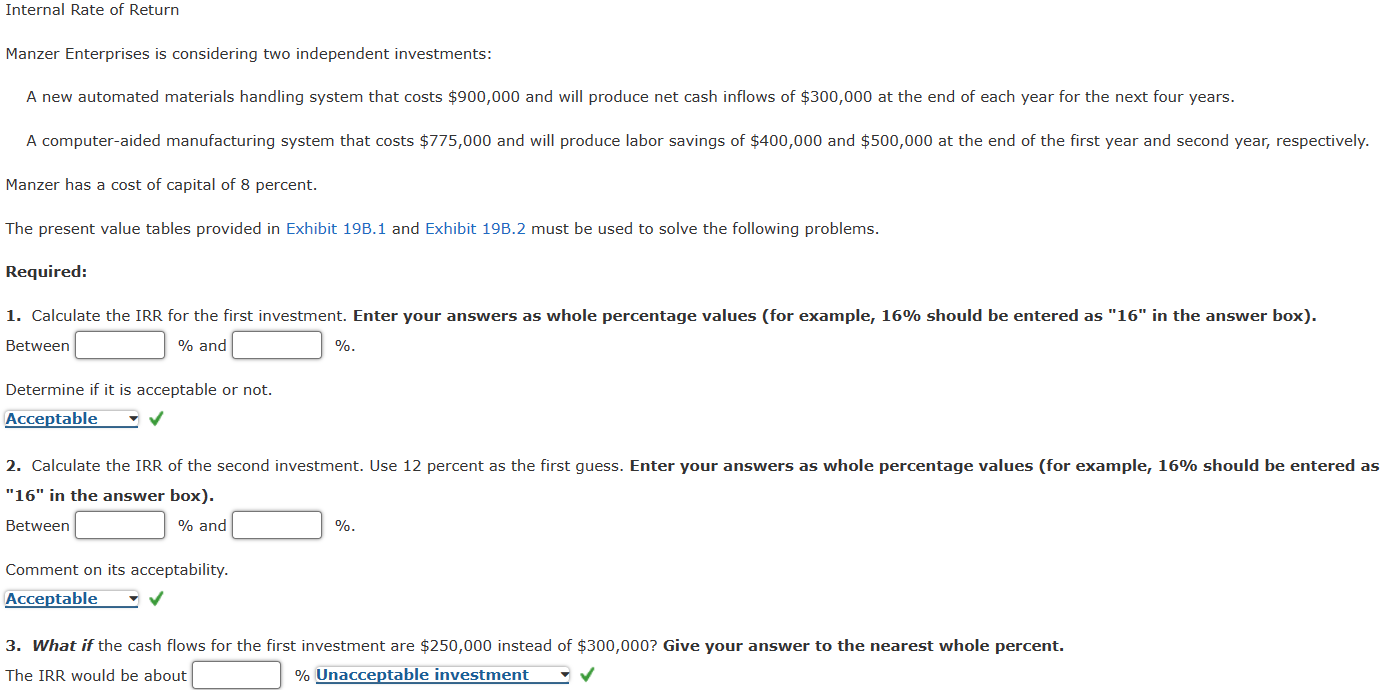

Exhibit 19B.1 Present Value of $1* Periods 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% 22% 24% 26% 28% 30% 32% 40% 1 0.980 0.962 0.943 2 0.961 0.925 0.890 3 0.942 0.889 0.840 0.926 0.857 0.794 4 0.924 0.855 0.792 0.906 0.822 0.747 0.681 0.621 6 0.888 0.790 0.705 0.636 0.564 7 0.871 0.760 0.665 0.583 0.513 8 0.853 0.731 0.627 9 0.837 0.703 0.592 10 0.820 0.676 0.558 11 0.804 0.650 0.527 0.429 0.500 0.424 0.463 0.386 0.350 12 0.788 0.625 0.497 0.397 0.319 13 0.773 0.601 0.469 0.368 14 0.758 0.577 0.442 15 0.743 0.555 0.417 16 0.728 0.534 0.394 17 0.714 0.513 0.371 18 0.700 0.494 0.350 0.290 0.340 0.263 0.315 0.239 0.292 0.218 0.270 0.198 0.250 0.180 222222222223 19 0.686 0.475 0.331 0.232 0.164 0.116 20 0.673 0.456 0.312 0.215 21 0.660 0.439 0.294 0.647 0.422 0.278 0.634 0.406 0.262 0.170 0.149 0.104 0.073 0.199 0.135 0.093 0.064 0.184 0.123 0.083 0.056 0.112 0.074 0.049 0.051 0.044 0.038 24 0.622 0.390 0.247 0.158 0.102 0.066 0.043 0.033 0.028 25 0.610 0.375 0.233 0.146 0.092 0.059 0.038 26 0.598 0.361 0.220 0.135 0.084 0.053 0.033 27 0.586 0.347 0.207 0.125 0.076 0.047 0.029 28 0.574 0.333 0.196 0.116 29 0.563 0.321 0.185 0.107 0.063 0.037 30 0.552 0.308 0.174 0.099 0.057 0.033 0.069 0.042 0.026 0.022 0.020 0.909 0.893 0.877 0.862 0.847 0.833 0.820 0.806 0.794 0.781 0.769 0.758 0.714 0.826 0.797 0.769 0.743 0.718 0.694 0.672 0.650 0.630 0.610 0.592 0.574 0.510 0.751 0.712 0.675 0.641 0.609 0.579 0.551 0.524 0.500 0.477 0.455 0.435 0.364 0.735 0.683 0.636 0.592 0.552 0.516 0.482 0.451 0.423 0.397 0.373 0.350 0.329 0.260 0.567 0.519 0.476 0.437 0.402 0.370 0.341 0.315 0.291 0.269 0.250 0.186 0.507 0.456 0.410 0.370 0.335 0.303 0.275 0.250 0.227 0.207 0.189 0.133 0.452 0.400 0.354 0.314 0.279 0.249 0.222 0.198 0.178 0.159 0.143 0.095 0.540 0.467 0.404 0.351 0.305 0.266 0.233 0.204 0.179 0.157 0.139 0.123 0.108 0.068 0.361 0.308 0.263 0.225 0.194 0.167 0.144 0.125 0.108 0.094 0.082 0.048 0.322 0.270 0.227 0.191 0.162 0.137 0.116 0.099 0.085 0.073 0.062 0.035 0.287 0.237 0.195 0.162 0.135 0.112 0.094 0.079 0.066 0.056 0.046 0.025 0.257 0.208 0.168 0.137 0.112 0.092 0.076 0.062 0.052 0.043 0.036 0.018 0.229 0.182 0.145 0.116 0.093 0.075 0.061 0.050 0.040 0.033 0.027 0.013 0.205 0.160 0.125 0.099 0.078 0.062 0.049 0.039 0.032 0.025 0.021 0.009 0.183 0.140 0.108 0.084 0.065 0.051 0.040 0.031 0.025 0.020 0.016 0.006 0.163 0.123 0.093 0.071 0.054 0.042 0.032 0.025 0.019 0.015 0.012 0.005 0.146 0.108 0.080 0.060 0.045 0.034 0.026 0.020 0.015 0.012 0.009 0.003 0.130 0.095 0.069 0.051 0.038 0.028 0.021 0.016 0.012 0.009 0.007 0.002 0.083 0.060 0.043 0.031 0.023 0.017 0.012 0.009 0.007 0.005 0.002 0.037 0.026 0.019 0.014 0.010 0.007 0.005 0.004 0.001 0.031 0.022 0.015 0.011 0.008 0.006 0.004 0.003 0.001 0.026 0.018 0.013 0.009 0.006 0.004 0.003 0.002 0.001 0.022 0.015 0.010 0.007 0.005 0.003 0.002 0.002 0.000 0.019 0.013 0.008 0.006 0.004 0.003 0.002 0.001 0.024 0.016 0.010 0.007 0.005 0.003 0.002 0.001 0.001 0.021 0.014 0.009 0.006 0.004 0.002 0.002 0.001 0.001 0.018 0.011 0.007 0.005 0.003 0.002 0.001 0.001 0.001 0.000 0.016 0.010 0.006 0.004 0.002 0.002 0.001 0.001 0.000 0.000 0.014 0.008 0.005 0.003 0.002 0.001 0.001 0.000 0.000 0.000 0.012 0.007 0.004 0.003 0.002 0.001 0.001 0.000 0.000 0.000 0.000 0.000 0.000 Exhibit 19B.2 Present Value of an Annuity of $1 in Arrears* Periods 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% 22% 24% 26% 28% 30% 32% 40% 1 0.980 0.962 0.943 0.926 2 1.942 1.866 1.833 1.783 3 2.884 2.775 2.673 0.909 1.736 2.577 2.487 0.820 4 3.808 3.630 3.465 3.312 3.170 5 4.713 4.452 4.212 3.993 3.791 6 5.601 5.242 4.917 4.623 4.355 4.111 7 6.472 6.002 5.582 5.206 4.868 4.564 8 7.325 6.733 6.210 5.747 5.335 4.968 4.639 4.344 9 8.162 7.435 10 8.983 8.111 6.802 6.247 7.360 6.710 5.759 5.328 4.946 4.607 6.145 5.650 5.216 4.833 11 9.787 8.760 7.887 7.139 6.495 5.938 5.453 5.029 12 10.575 9.385 13 11.348 14 12.106 15 12.849 16 17 8.384 9.986 8.853 7.904 7.103 6.424 10.563 9.295 8.244 7.367 6.628 11.118 9.712 8.559 7.606 6.811 13.578 11.652 10.106 8.851 7.824 6.974 14.292 12.166 10.477 9.122 8.022 7.120 7.536 6.814 6.194 5.660 18 14.992 12.659 10.828 9.372 8.201 7.250 19 15.678 13.134 11.158 9.604 8.365 7.366 6.550 5.877 22232222223 20 16.351 13.590 11.470 9.818 8.514 7.469 6.623 21 17.011 14.029 11.764 10.017 8.649 7.562 6.687 17.658 14.451 12.042 10.201 8.772 18.292 14.857 12.303 10.371 8.883 7.645 6.743 7.718 6.792 24 25 18.914 15.247 12.550 10.529 19.523 15.622 12.783 8.985 7.784 6.835 6.073 5.451 26 27 28 21.281 16.663 13.406 29 21.844 16.984 13.591 10.675 9.077 20.121 15.983 13.003 10.810 9.161 20.707 16.330 13.211 10.935 9.237 11.051 9.307 11.158 9.370 7.843 6.873 6.097 5.467 7.896 6.906 6.118 5.480 7.943 6.935 6.136 7.984 6.961 5.492 6.152 5.502 8.022 6.983 30 22.396 17.292 13.765 11.258 9.427 8.055 7.003 6.166 5.510 6.177 5.517 0.893 0.877 0.862 0.847 0.833 0.806 0.794 0.781 0.769 0.758 0.714 1.690 1.647 1.605 1.566 1.528 1.492 1.457 1.424 1.392 1.361 1.331 1.224 2.402 2.322 2.246 2.174 2.106 2.042 1.981 1.923 1.868 1.816 1.766 1.589 3.037 2.914 2.798 2.690 2.589 2.494 2.404 2.320 2.241 2.166 2.096 1.849 3.605 3.433 3.274 3.127 2.991 2.864 2.745 2.635 2.532 2.436 2.345 2.035 3.889 3.685 3.498 3.326 3.167 3.020 2.885 2.759 2.643 2.534 2.168 4.288 4.039 3.812 3.605 3.416 3.242 3.083 2.937 2.802 2.677 2.263 3.078 3.837 3.619 3.421 3.241 3.076 2.925 2.786 2.331 4.303 4.031 3.786 3.566 3.366 3.184 3.019 2.868 2.379 4.494 4.192 3.923 3.682 3.465 3.269 3.092 2.930 2.414 4.656 4.327 4.035 3.776 3.543 3.335 3.147 2.978 5.197 4.793 4.439 4.127 3.851 3.606 3.387 3.190 3.013 5.842 5.342 4.910 4.533 4.203 3.912 3.656 3.427 3.223 6.002 5.468 5.008 4.611 4.265 3.962 3.695 3.459 3.249 6.142 5.575 5.092 4.675 4.315 4.001 3.726 3.483 6.265 5.668 5.162 4.730 4.357 4.033 3.751 3.503 6.373 5.749 5.222 4.775 4.391 4.059 3.771 3.518 6.467 5.818 5.273 4.812 4.419 4.080 3.786 3.529 5.316 4.843 4.442 4.097 3.799 3.539 5.929 5.353 4.870 4.460 4.110 3.808 3.546 5.973 5.384 4.891 4.476 4.121 3.816 3.551 3.320 6.011 5.410 4.909 4.488 4.130 3.822 3.556 3.323 3.118 2.498 6.044 5.432 4.925 4.499 4.137 3.827 3.559 3.325 3.120 2.499 4.937 4.507 4.143 3.831 3.562 3.327 3.121 2.499 4.948 4.514 4.147 3.834 3.564 3.329 3.122 2.499 4.956 4.520 4.151 3.837 3.566 3.330 3.123 2.500 4.964 4.524 4.154 3.839 3.567 3.331 3.123 2.500 4.970 4.528 4.157 3.840 3.568 3.331 3.124 2.500 4.975 4.531 4.159 3.841 3.569 3.332 3.124 2.500 4.979 4.534 4.160 3.842 3.569 3.332 3.124 2.500 2.438 2.456 3.040 2.469 3.061 2.478 3.268 3.076 2.484 3.283 3.088 2.489 3.295 3.097 2.492 3.304 3.104 2.494 3.311 3.109 2.496 3.316 3.113 2.497 3.116 2.498 Internal Rate of Return Manzer Enterprises is considering two independent investments: A new automated materials handling system that costs $900,000 and will produce net cash inflows of $300,000 at the end of each year for the next four years. A computer-aided manufacturing system that costs $775,000 and will produce labor savings of $400,000 and $500,000 at the end of the first year and second year, respectively. Manzer has a cost of capital of 8 percent. The present value tables provided in Exhibit 19B.1 and Exhibit 19B.2 must be used to solve the following problems. Required: 1. Calculate the IRR for the first investment. Enter your answers as whole percentage values (for example, 16% should be entered as "16" in the answer box). Between % and Determine if it is acceptable or not. Acceptable %. 2. Calculate the IRR of the second investment. Use 12 percent as the first guess. Enter your answers as whole percentage values (for example, 16% should be entered as "16" in the answer box). Between % and %. Comment on its acceptability. Acceptable 3. What if the cash flows for the first investment are $250,000 instead of $300,000? Give your answer to the nearest whole percent. The IRR would be about % Unacceptable investment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To calculate the IRR for the first investment Cash outflow Cost of investment 900000 Net cash infl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started