Question

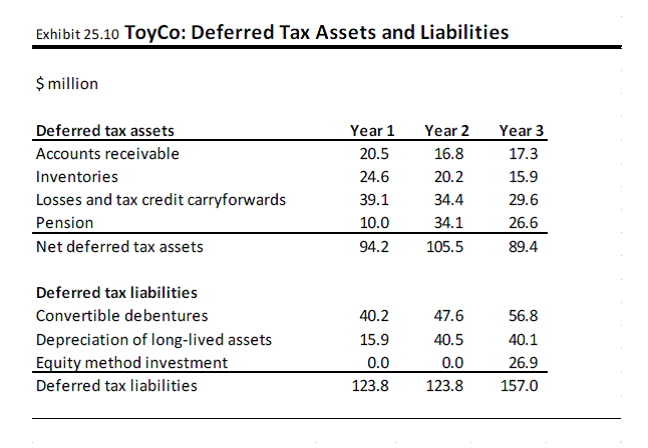

Exhibit 25.10 presents deferred tax assets and liabilities for ToyCo. Reorganize the deferred tax table into three categories net operating deferred tax liabilities (net of

Exhibit 25.10 presents deferred tax assets and liabilities for ToyCo. Reorganize the deferred tax table into three categories net operating deferred tax liabilities (net of operating deferred tax assets), nonoperating deferred tax assets, and nonoperating deferred tax liabilities. In Year 3, ToyCo generated $200.7 million in operating taxes on $673.6 million of EBITA. Using this information, what are the cash taxes in Year 3? What is percent of operating taxes that were deferred and what is the operating cash tax rate?

ToyCo has working capital of $400 million, fixed assets equal to $800 million, and debt equal to $600 million. Use this data and the reorganized deferred taxes in Question 4 to create invested capital and total funds invested for Year 3. Use equity as the plug to get total fund invested to reconcile.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started