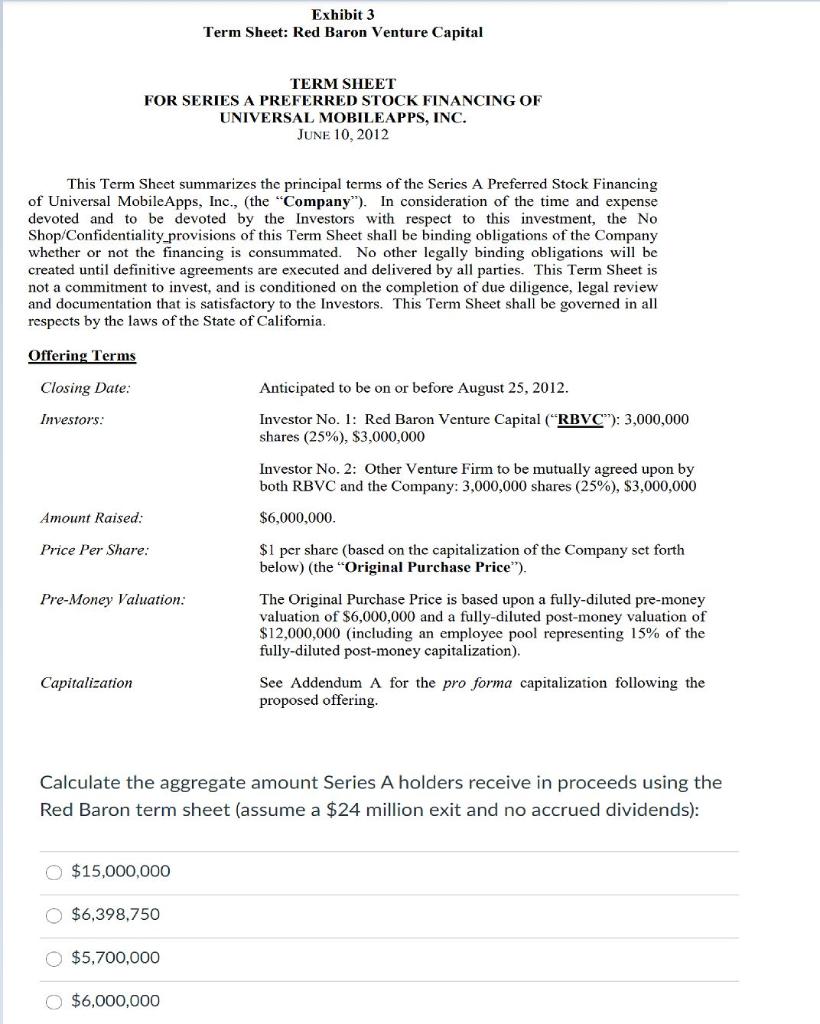

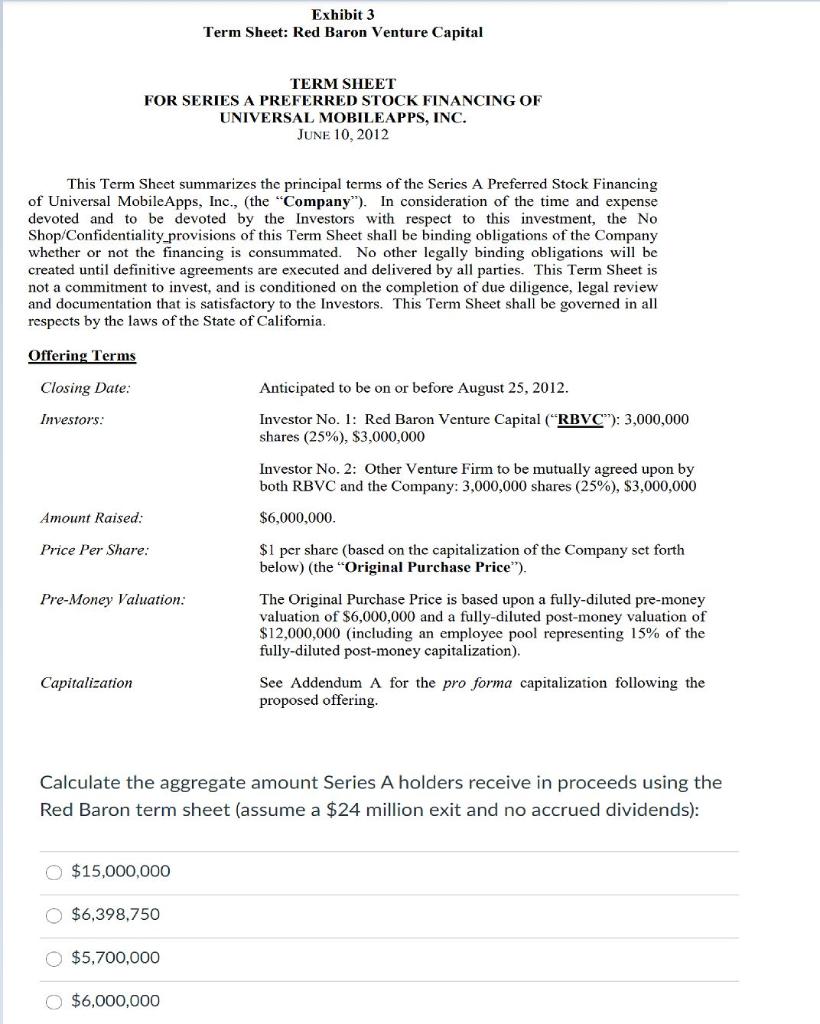

Exhibit 3 Term Sheet: Red Baron Venture Capital TERM SHEET FOR SERIES A PREFERRED STOCK FINANCING OF UNIVERSAL MOBILEAPPS, INC. JUNE 10, 2012 This Term Sheet summarizes the principal terms of the Series A Preferred Stock Financing of Universal Mobile Apps, Inc., (the "Company'). In consideration of the time and expense devoted and to be devoted by the Investors with respect to this investment, the No Shop/Confidentiality provisions of this Term Sheet shall be binding obligations of the Company whether or not the financing is consummated. No other legally binding obligations will be created until definitive agreements are executed and delivered by all parties. This Term Sheet is not a commitment to invest, and is conditioned on the completion of due diligence, legal review and documentation that is satisfactory to the Investors. This Term Sheet shall be governed in all respects by the laws of the State of California Offering Terms Closing Date: Anticipated to be on or before August 25, 2012. Investor's Investor No. 1: Red Baron Venture Capital (RBVC"): 3,000,000 shares (25%), $3,000,000 Investor No. 2: Other Venture Firm to be mutually agreed upon by both RBVC and the Company: 3,000,000 shares (25%), $3,000,000 Amount Raised: $6,000,000 Price Per Share: $1 per share (based on the capitalization of the Company set forth below) (the "Original Purchase Price"). Pre-Money Valuation: The Original Purchase Price is based upon a fully-diluted pre-money valuation of $6,000,000 and a fully-diluted post-money valuation of $12,000,000 (including an employee pool representing 15% of the fully-diluted post-money capitalization), See Addendum A for the pro forma capitalization following the proposed offering. Capitalization Calculate the aggregate amount Series A holders receive in proceeds using the Red Baron term sheet (assume a $24 million exit and no accrued dividends): O $15,000,000 O $6,398.750 $5,700,000 $6,000,000 Exhibit 3 Term Sheet: Red Baron Venture Capital TERM SHEET FOR SERIES A PREFERRED STOCK FINANCING OF UNIVERSAL MOBILEAPPS, INC. JUNE 10, 2012 This Term Sheet summarizes the principal terms of the Series A Preferred Stock Financing of Universal Mobile Apps, Inc., (the "Company'). In consideration of the time and expense devoted and to be devoted by the Investors with respect to this investment, the No Shop/Confidentiality provisions of this Term Sheet shall be binding obligations of the Company whether or not the financing is consummated. No other legally binding obligations will be created until definitive agreements are executed and delivered by all parties. This Term Sheet is not a commitment to invest, and is conditioned on the completion of due diligence, legal review and documentation that is satisfactory to the Investors. This Term Sheet shall be governed in all respects by the laws of the State of California Offering Terms Closing Date: Anticipated to be on or before August 25, 2012. Investor's Investor No. 1: Red Baron Venture Capital (RBVC"): 3,000,000 shares (25%), $3,000,000 Investor No. 2: Other Venture Firm to be mutually agreed upon by both RBVC and the Company: 3,000,000 shares (25%), $3,000,000 Amount Raised: $6,000,000 Price Per Share: $1 per share (based on the capitalization of the Company set forth below) (the "Original Purchase Price"). Pre-Money Valuation: The Original Purchase Price is based upon a fully-diluted pre-money valuation of $6,000,000 and a fully-diluted post-money valuation of $12,000,000 (including an employee pool representing 15% of the fully-diluted post-money capitalization), See Addendum A for the pro forma capitalization following the proposed offering. Capitalization Calculate the aggregate amount Series A holders receive in proceeds using the Red Baron term sheet (assume a $24 million exit and no accrued dividends): O $15,000,000 O $6,398.750 $5,700,000 $6,000,000