Answered step by step

Verified Expert Solution

Question

1 Approved Answer

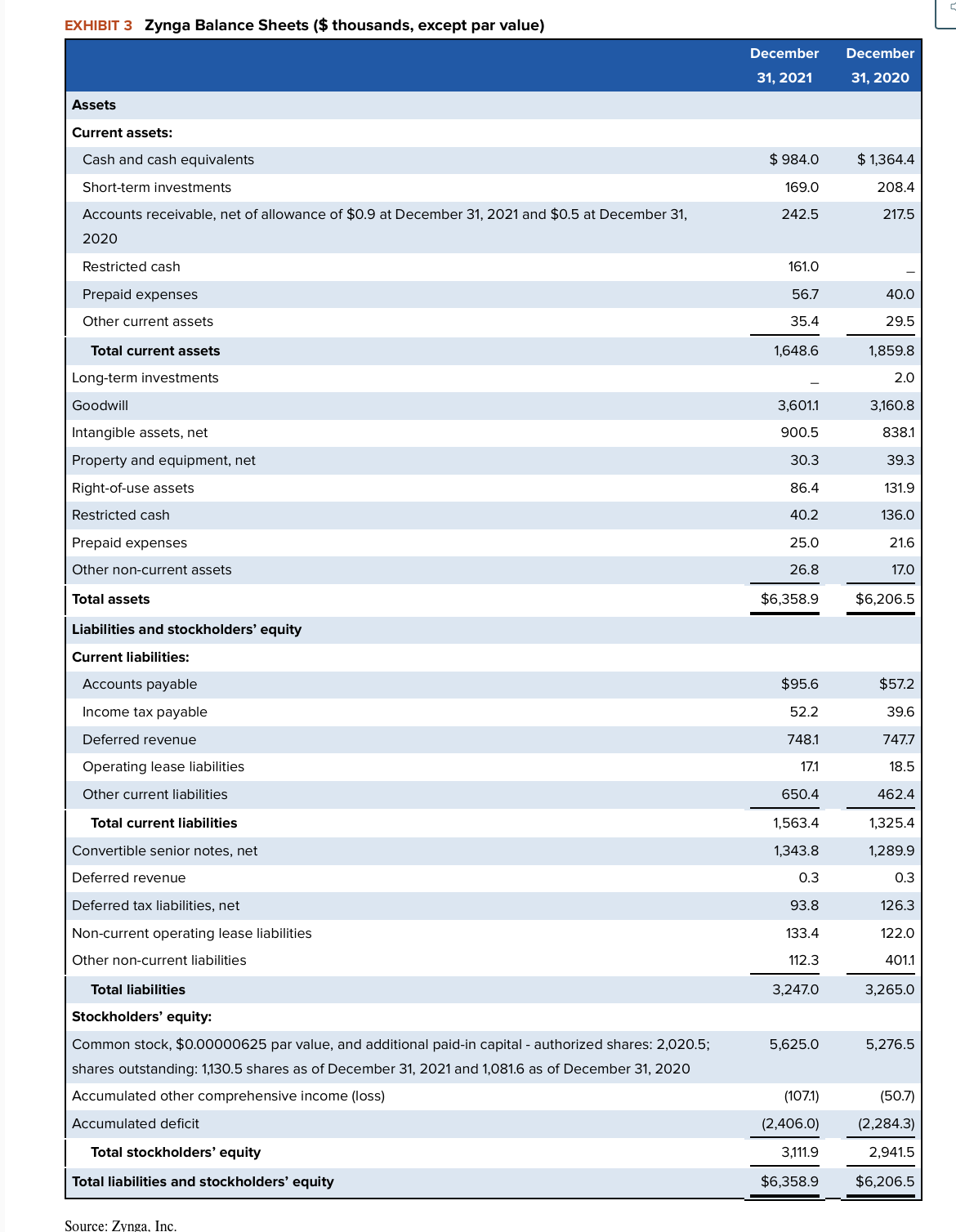

EXHIBIT 3 Zynga Balance Sheets ($ thousands, except par value) begin{tabular}{|c|c|c|} hline & December31,2021 & December31,2020 hline multicolumn{3}{|l|}{ Assets } hline multicolumn{3}{|l|}{ Current

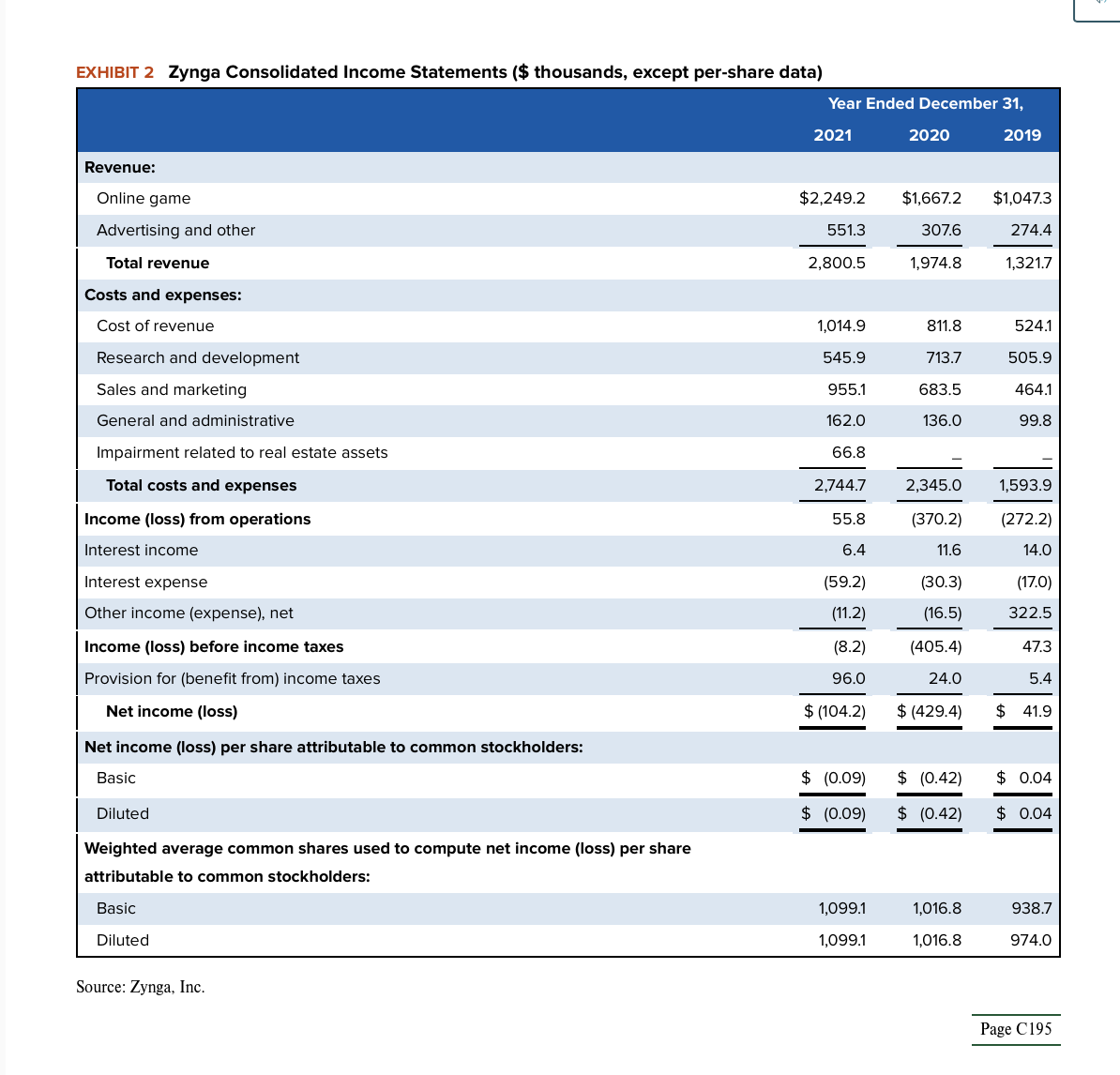

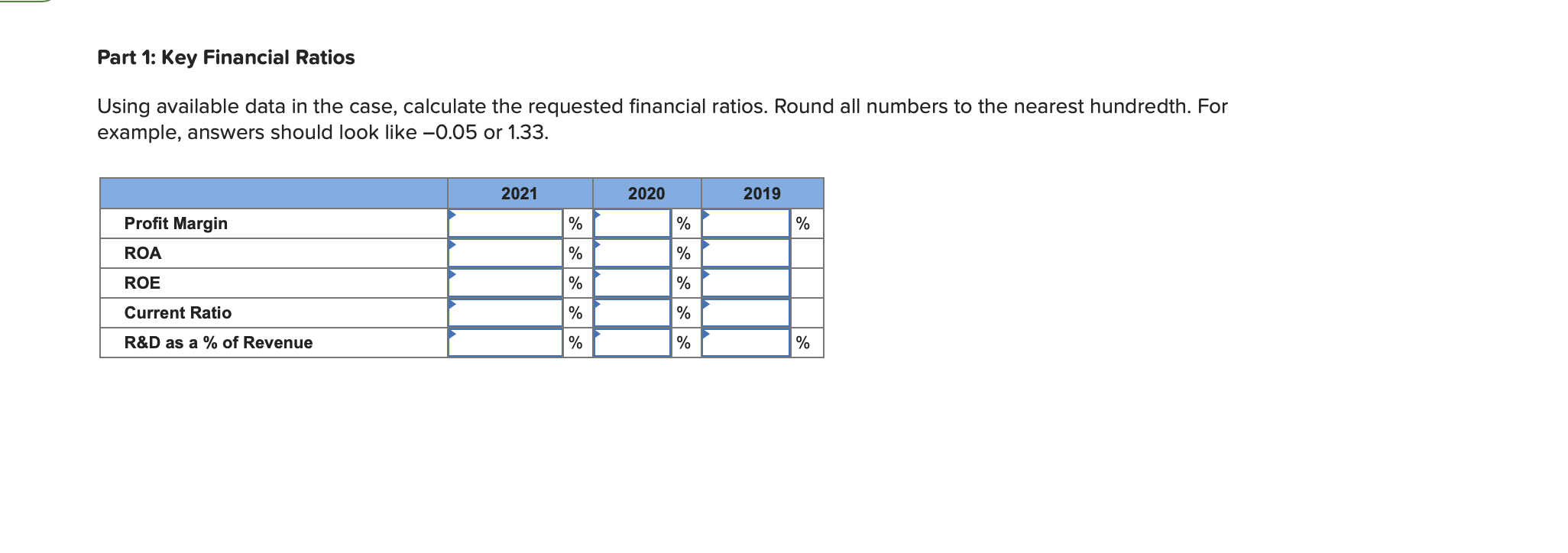

EXHIBIT 3 Zynga Balance Sheets (\$ thousands, except par value) \begin{tabular}{|c|c|c|} \hline & December31,2021 & December31,2020 \\ \hline \multicolumn{3}{|l|}{ Assets } \\ \hline \multicolumn{3}{|l|}{ Current assets: } \\ \hline Cash and cash equivalents & $984.0 & $1,364.4 \\ \hline Short-term investments & 169.0 & 208.4 \\ \hline Accountsreceivable,netofallowanceof$0.9atDecember31,2021and$0.5atDecember31,2020 & 242.5 & 217.5 \\ \hline Restricted cash & 161.0 & - \\ \hline Prepaid expenses & 56.7 & 40.0 \\ \hline Other current assets & 35.4 & 29.5 \\ \hline Total current assets & 1,648.6 & 1,859.8 \\ \hline Long-term investments & - & 2.0 \\ \hline Goodwill & 3,601.1 & 3,160.8 \\ \hline Intangible assets, net & 900.5 & 838.1 \\ \hline Property and equipment, net & 30.3 & 39.3 \\ \hline Right-of-use assets & 86.4 & 131.9 \\ \hline Restricted cash & 40.2 & 136.0 \\ \hline Prepaid expenses & 25.0 & 21.6 \\ \hline Other non-current assets & 26.8 & 17.0 \\ \hline Total assets & $6,358.9 & $6,206.5 \\ \hline \multicolumn{3}{|l|}{ Liabilities and stockholders' equity } \\ \hline \multicolumn{3}{|l|}{ Current liabilities: } \\ \hline Accounts payable & $95.6 & $57.2 \\ \hline Income tax payable & 52.2 & 39.6 \\ \hline Deferred revenue & 748.1 & 747.7 \\ \hline Operating lease liabilities & 17.1 & 18.5 \\ \hline Other current liabilities & 650.4 & 462.4 \\ \hline Total current liabilities & 1,563.4 & 1,325.4 \\ \hline Convertible senior notes, net & 1,343.8 & 1,289.9 \\ \hline Deferred revenue & 0.3 & 0.3 \\ \hline Deferred tax liabilities, net & 93.8 & 126.3 \\ \hline Non-current operating lease liabilities & 133.4 & 122.0 \\ \hline Other non-current liabilities & 112.3 & 401.1 \\ \hline Total liabilities & 3,247.0 & 3,265.0 \\ \hline \multicolumn{3}{|l|}{ Stockholders' equity: } \\ \hline Commonstock,$0.00000625parvalue,andadditionalpaid-incapital-authorizedshares:2,020.5;sharesoutstanding:1,130.5sharesasofDecember31,2021and1,081.6asofDecember31,2020 & 5,625.0 & 5,276.5 \\ \hline Accumulated other comprehensive income (loss) & (107.1) & (50.7) \\ \hline Accumulated deficit & (2,406.0) & (2,284.3) \\ \hline Total stockholders' equity & 3,111.9 & 2,941.5 \\ \hline Total liabilities and stockholders' equity & $6,358.9 & $6,206.5 \\ \hline \end{tabular} Source: Zynga. Inc. Part 1: Key Financial Ratios Using available data in the case, calculate the requested financial ratios. Round all numbers to the nearest hundredth. For example, answers should look like -0.05 or 1.33 . EXHIBIT 2 Zynga Consolidated Income Statements (\$ thousands, except per-share data) \begin{tabular}{|c|c|c|c|} \hline & Year E & ded Decem & er 31, \\ \hline & 2021 & 2020 & 2019 \\ \hline Revenue: & & & \\ \hline Online game & $2,249.2 & $1,667.2 & $1,047.3 \\ \hline Advertising and other & 551.3 & 307.6 & 274.4 \\ \hline Total revenue & 2,800.5 & 1,974.8 & 1,321.7 \\ \hline Costs and expenses: & & & \\ \hline Cost of revenue & 1,014.9 & 811.8 & 524.1 \\ \hline Research and development & 545.9 & 713.7 & 505.9 \\ \hline Sales and marketing & 955.1 & 683.5 & 464.1 \\ \hline General and administrative & 162.0 & 136.0 & 99.8 \\ \hline Impairment related to real estate assets & 66.8 & - & - \\ \hline Total costs and expenses & 2,744.7 & 2,345.0 & 1,593.9 \\ \hline Income (loss) from operations & 55.8 & (370.2) & (272.2) \\ \hline Interest income & 6.4 & 11.6 & 14.0 \\ \hline Interest expense & (59.2) & (30.3) & (17.0) \\ \hline Other income (expense), net & (11.2) & (16.5) & 322.5 \\ \hline Income (loss) before income taxes & (8.2) & (405.4) & 47.3 \\ \hline Provision for (benefit from) income taxes & 96.0 & 24.0 & 5.4 \\ \hline Net income (loss) & $(104.2) & $(429.4) & $41.9 \\ \hline Net income (loss) per share attributable t & & & \\ \hline Basic & $(0.09) & $(0.42) & $0.04 \\ \hline Diluted & $(0.09) & $(0.42) & $0.04 \\ \hline Weightedaveragecommonsharesusedattributabletocommonstockholders: & & & \\ \hline Basic & 1,099.1 & 1,016.8 & 938.7 \\ \hline Diluted & 1,099.1 & 1,016.8 & 974.0 \\ \hline \end{tabular} Source: Zynga, Inc

EXHIBIT 3 Zynga Balance Sheets (\$ thousands, except par value) \begin{tabular}{|c|c|c|} \hline & December31,2021 & December31,2020 \\ \hline \multicolumn{3}{|l|}{ Assets } \\ \hline \multicolumn{3}{|l|}{ Current assets: } \\ \hline Cash and cash equivalents & $984.0 & $1,364.4 \\ \hline Short-term investments & 169.0 & 208.4 \\ \hline Accountsreceivable,netofallowanceof$0.9atDecember31,2021and$0.5atDecember31,2020 & 242.5 & 217.5 \\ \hline Restricted cash & 161.0 & - \\ \hline Prepaid expenses & 56.7 & 40.0 \\ \hline Other current assets & 35.4 & 29.5 \\ \hline Total current assets & 1,648.6 & 1,859.8 \\ \hline Long-term investments & - & 2.0 \\ \hline Goodwill & 3,601.1 & 3,160.8 \\ \hline Intangible assets, net & 900.5 & 838.1 \\ \hline Property and equipment, net & 30.3 & 39.3 \\ \hline Right-of-use assets & 86.4 & 131.9 \\ \hline Restricted cash & 40.2 & 136.0 \\ \hline Prepaid expenses & 25.0 & 21.6 \\ \hline Other non-current assets & 26.8 & 17.0 \\ \hline Total assets & $6,358.9 & $6,206.5 \\ \hline \multicolumn{3}{|l|}{ Liabilities and stockholders' equity } \\ \hline \multicolumn{3}{|l|}{ Current liabilities: } \\ \hline Accounts payable & $95.6 & $57.2 \\ \hline Income tax payable & 52.2 & 39.6 \\ \hline Deferred revenue & 748.1 & 747.7 \\ \hline Operating lease liabilities & 17.1 & 18.5 \\ \hline Other current liabilities & 650.4 & 462.4 \\ \hline Total current liabilities & 1,563.4 & 1,325.4 \\ \hline Convertible senior notes, net & 1,343.8 & 1,289.9 \\ \hline Deferred revenue & 0.3 & 0.3 \\ \hline Deferred tax liabilities, net & 93.8 & 126.3 \\ \hline Non-current operating lease liabilities & 133.4 & 122.0 \\ \hline Other non-current liabilities & 112.3 & 401.1 \\ \hline Total liabilities & 3,247.0 & 3,265.0 \\ \hline \multicolumn{3}{|l|}{ Stockholders' equity: } \\ \hline Commonstock,$0.00000625parvalue,andadditionalpaid-incapital-authorizedshares:2,020.5;sharesoutstanding:1,130.5sharesasofDecember31,2021and1,081.6asofDecember31,2020 & 5,625.0 & 5,276.5 \\ \hline Accumulated other comprehensive income (loss) & (107.1) & (50.7) \\ \hline Accumulated deficit & (2,406.0) & (2,284.3) \\ \hline Total stockholders' equity & 3,111.9 & 2,941.5 \\ \hline Total liabilities and stockholders' equity & $6,358.9 & $6,206.5 \\ \hline \end{tabular} Source: Zynga. Inc. Part 1: Key Financial Ratios Using available data in the case, calculate the requested financial ratios. Round all numbers to the nearest hundredth. For example, answers should look like -0.05 or 1.33 . EXHIBIT 2 Zynga Consolidated Income Statements (\$ thousands, except per-share data) \begin{tabular}{|c|c|c|c|} \hline & Year E & ded Decem & er 31, \\ \hline & 2021 & 2020 & 2019 \\ \hline Revenue: & & & \\ \hline Online game & $2,249.2 & $1,667.2 & $1,047.3 \\ \hline Advertising and other & 551.3 & 307.6 & 274.4 \\ \hline Total revenue & 2,800.5 & 1,974.8 & 1,321.7 \\ \hline Costs and expenses: & & & \\ \hline Cost of revenue & 1,014.9 & 811.8 & 524.1 \\ \hline Research and development & 545.9 & 713.7 & 505.9 \\ \hline Sales and marketing & 955.1 & 683.5 & 464.1 \\ \hline General and administrative & 162.0 & 136.0 & 99.8 \\ \hline Impairment related to real estate assets & 66.8 & - & - \\ \hline Total costs and expenses & 2,744.7 & 2,345.0 & 1,593.9 \\ \hline Income (loss) from operations & 55.8 & (370.2) & (272.2) \\ \hline Interest income & 6.4 & 11.6 & 14.0 \\ \hline Interest expense & (59.2) & (30.3) & (17.0) \\ \hline Other income (expense), net & (11.2) & (16.5) & 322.5 \\ \hline Income (loss) before income taxes & (8.2) & (405.4) & 47.3 \\ \hline Provision for (benefit from) income taxes & 96.0 & 24.0 & 5.4 \\ \hline Net income (loss) & $(104.2) & $(429.4) & $41.9 \\ \hline Net income (loss) per share attributable t & & & \\ \hline Basic & $(0.09) & $(0.42) & $0.04 \\ \hline Diluted & $(0.09) & $(0.42) & $0.04 \\ \hline Weightedaveragecommonsharesusedattributabletocommonstockholders: & & & \\ \hline Basic & 1,099.1 & 1,016.8 & 938.7 \\ \hline Diluted & 1,099.1 & 1,016.8 & 974.0 \\ \hline \end{tabular} Source: Zynga, Inc Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started