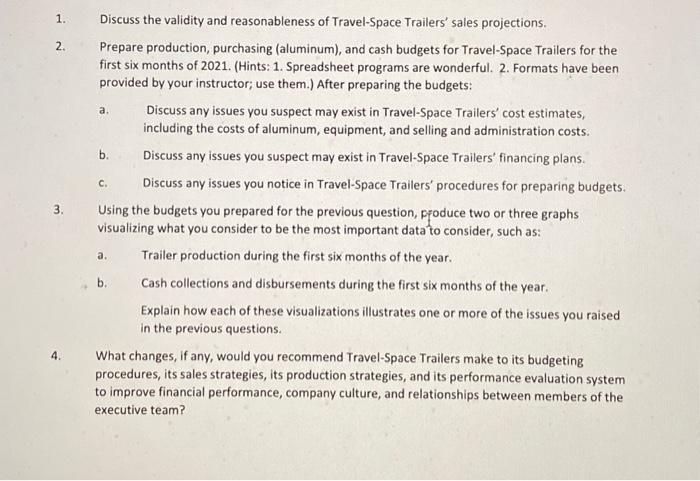

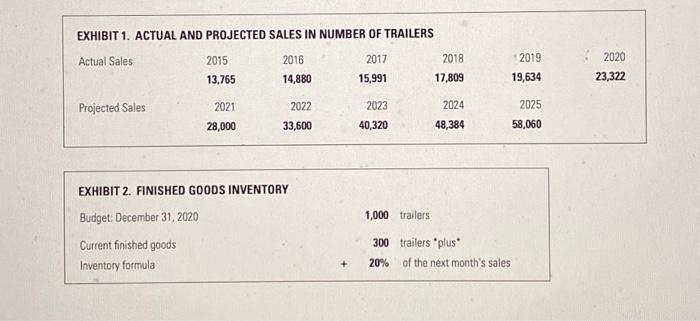

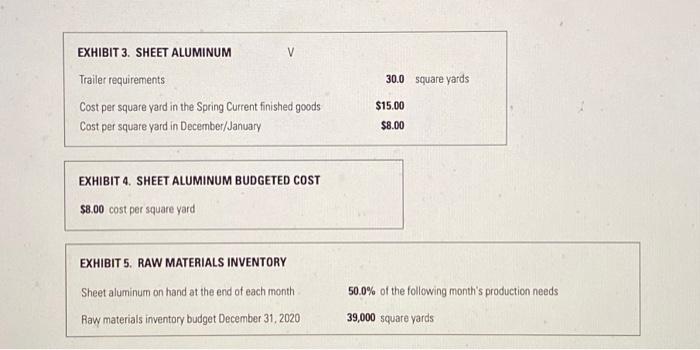

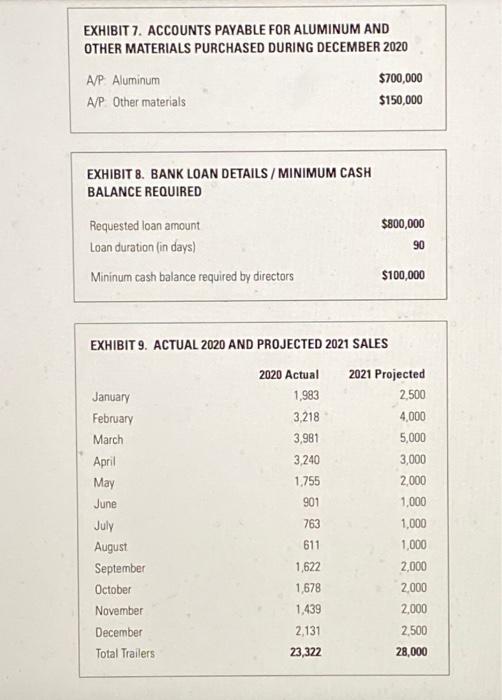

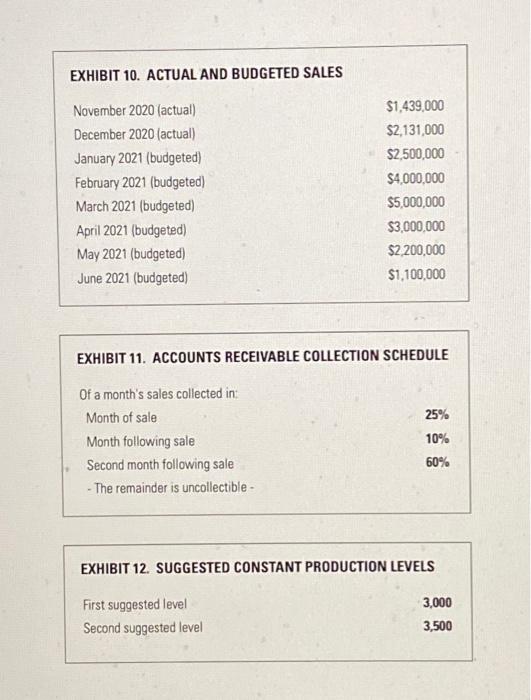

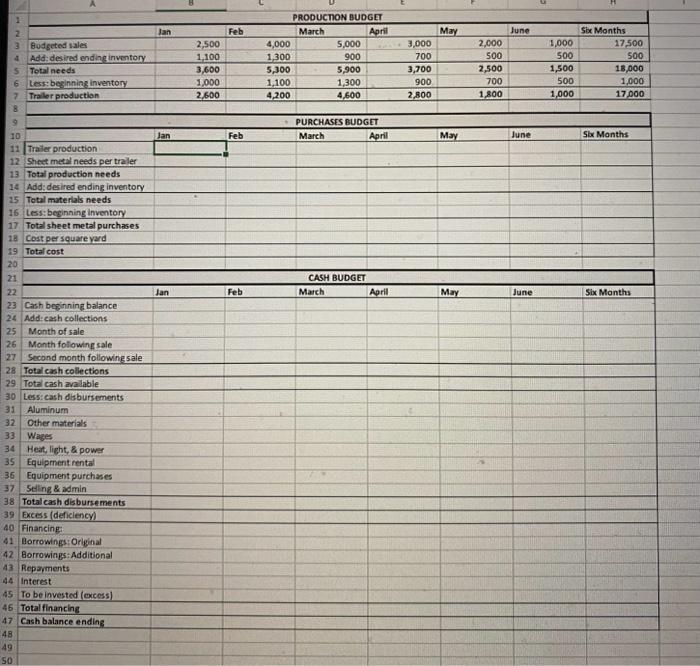

EXHIBIT 4. SHEET ALUMINUM BUDGETED COST $8.00 cost per square yard EXHIBIT 5. RAW MATERIALS INVENTORY Sheet aluminum on hand at the end of each month 50.0% of the following month's production needs Raw materials inventory budget December 31,2020 39,000 square yards EXHIBIT 1. ACTUAL AND PROJECTED SALES IN NUMBER OF TRAILERS Actual Sales Projected Sales 2015 2016 2017 2018 2019 15,991 17,809 19,634 2020 13,765 14,880 2023 2024 2025 28,000 33,600 40,320 48,384 58,060 EXHIBIT 2. FINISHED GOODS INVENTORY Budget: December 31, 2020 1,000 trailers Current finished goods 300 trailers "plus* Inventory formula 20% of the next month's sales EXHIBIT 7. ACCOUNTS PAYABLE FOR ALUMINUM AND OTHER MATERIALS PURCHASED DURING DECEMBER 2020 A/P. Aluminum $700,000 A/P. Other materials $150,000 EXHIBIT 10. ACTUAL AND BUDGETED SALES November 2020 (actual) December 2020 (actual) January 2021 (budgeted) February 2021 (budgeted) March 2021 (budgeted) April 2021 (budgeted) May 2021 (budgeted) June 2021 (budgeted) $1,439,000 $2,131,000 $2,500,000 $4,000,000 $5,000,000 $3,000,000 $2,200,000 $1,100,000 EXHIBIT 11. ACCOUNTS RECEIVABLE COLLECTION SCHEDULE Of a month's sales collected in: Month of sale 25% Month following sale 10% Second month following sale 60% - The remainder is uncollectible - EXHIBIT 12. SUGGESTED CONSTANT PRODUCTION LEVELS First suggested level 3,000 Second suggested level 3,500 2. Prepare production, purchasing (aluminum), and cash budgets for Travel-Space Trailers for the first six months of 2021. (Hints: 1 . Spreadsheet programs are wonderful. 2. Formats have been provided by your instructor; use them.) After preparing the budgets: a. Discuss any issues you suspect may exist in Travel-Space Trailers' cost estimates, including the costs of aluminum, equipment, and selling and administration costs. b. Discuss any issues you suspect may exist in Travel-Space Trailers' financing plans. c. Discuss any issues you notice in Travel-Space Trailers' procedures for preparing budgets. 3. Using the budgets you prepared for the previous question, ffoduce two or three graphs visualizing what you consider to be the most important data to consider, such as: a. Trailer production during the first six months of the year. b. Cash collections and disbursements during the first six months of the year. Explain how each of these visualizations illustrates one or more of the issues you raised in the previous questions. 4. What changes, if any, would you recommend Travel-Space Trailers make to its budgeting procedures, its sales strategies, its production strategies, and its performance evaluation system to improve financial performance, company culture, and relationships between members of the executive team? EXHIBIT 6. BUDGETED EXPENSES FOR THE FIRST SIX MONTHS 2021 \begin{tabular}{|c|c|c|c|} \hline & January & February & March \\ \hline Aluminum & $816,000 & $1,056,000 & $888,000 \\ \hline Other materials & 54,000 & 264,000 & 222,000 \\ \hline Wages & 624,000 & 1,008,000 & 1,104,000 \\ \hline Heat, light, \& power & 130,000 & 195,000 & 220,000 \\ \hline Equipment rental & 390,000 & 390,000 & 390,000 \\ \hline Equipment purchases & 300,000 & 300,000 & 300,000 \\ \hline Depreciation & 250,000 & 250,000 & 250,000 \\ \hline \multirow[t]{2}{*}{ Selling \& admin } & 400,000 & 400,000 & 400,000 \\ \hline & April & May & June \\ \hline Aluminum & $552,000 & $336,000 & $240,000 \\ \hline Other materials & 138,000 & 84,000 & 90,000 \\ \hline Wages & 672,000 & 432,000 & 240,000 \\ \hline Heat, light, \& power & 135,000 & 110,000 & 110,000 \\ \hline Equipment rental & 340,000 & 340,000 & 340,000 \\ \hline Equipment purchases & 300,000 & 300,000 & 300,000 \\ \hline Depreciation & 275,000 & 275,000 & 275,000 \\ \hline Selling \& admin & 400,000 & 400,000 & 400,000 \\ \hline \end{tabular}