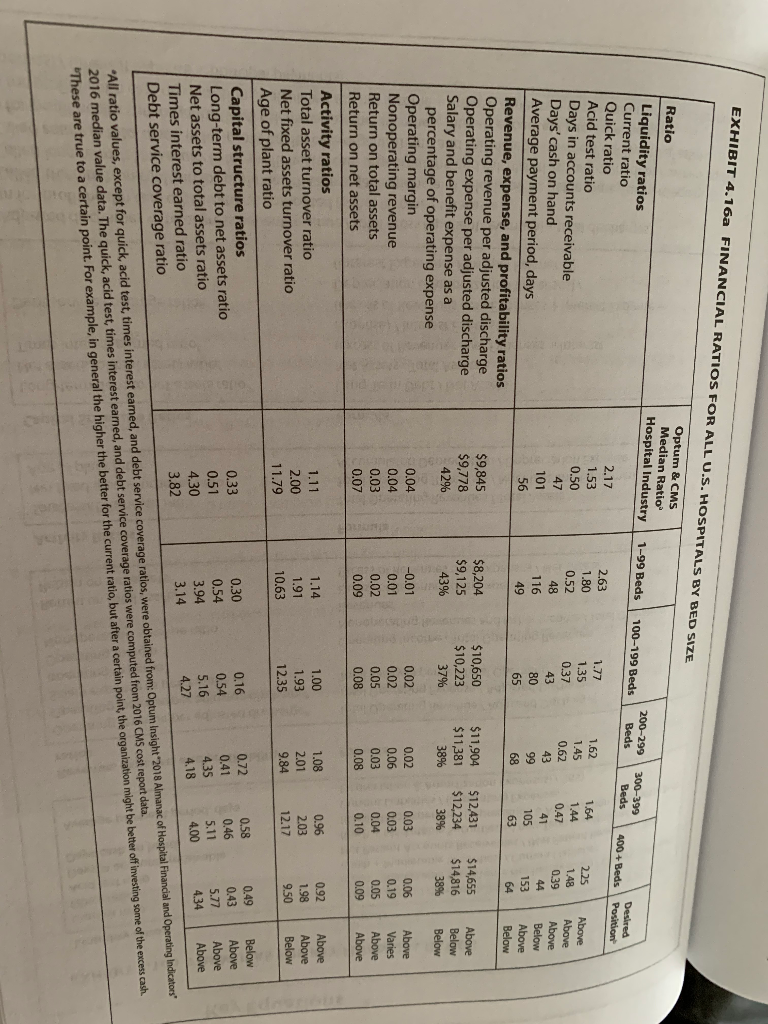

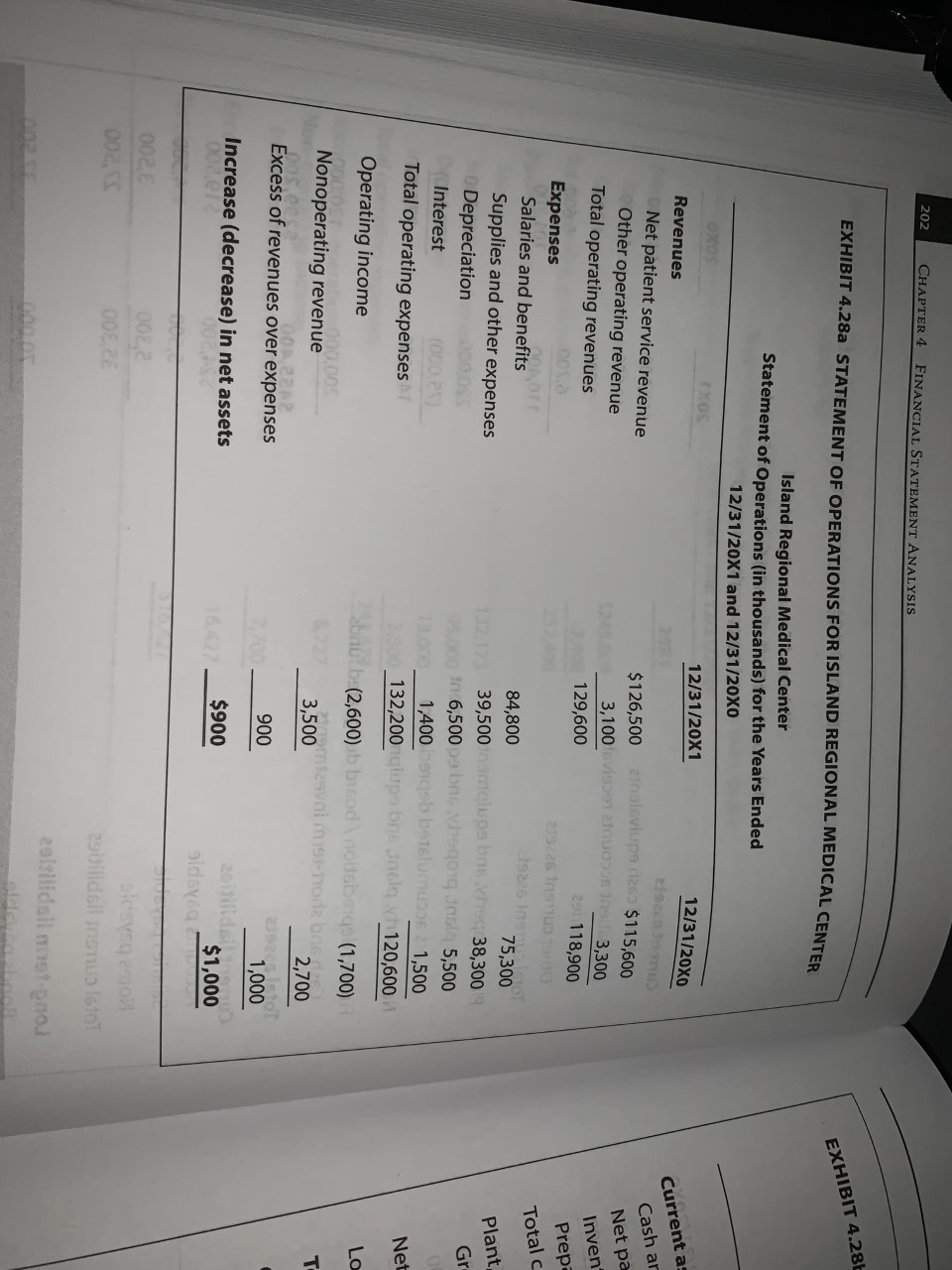

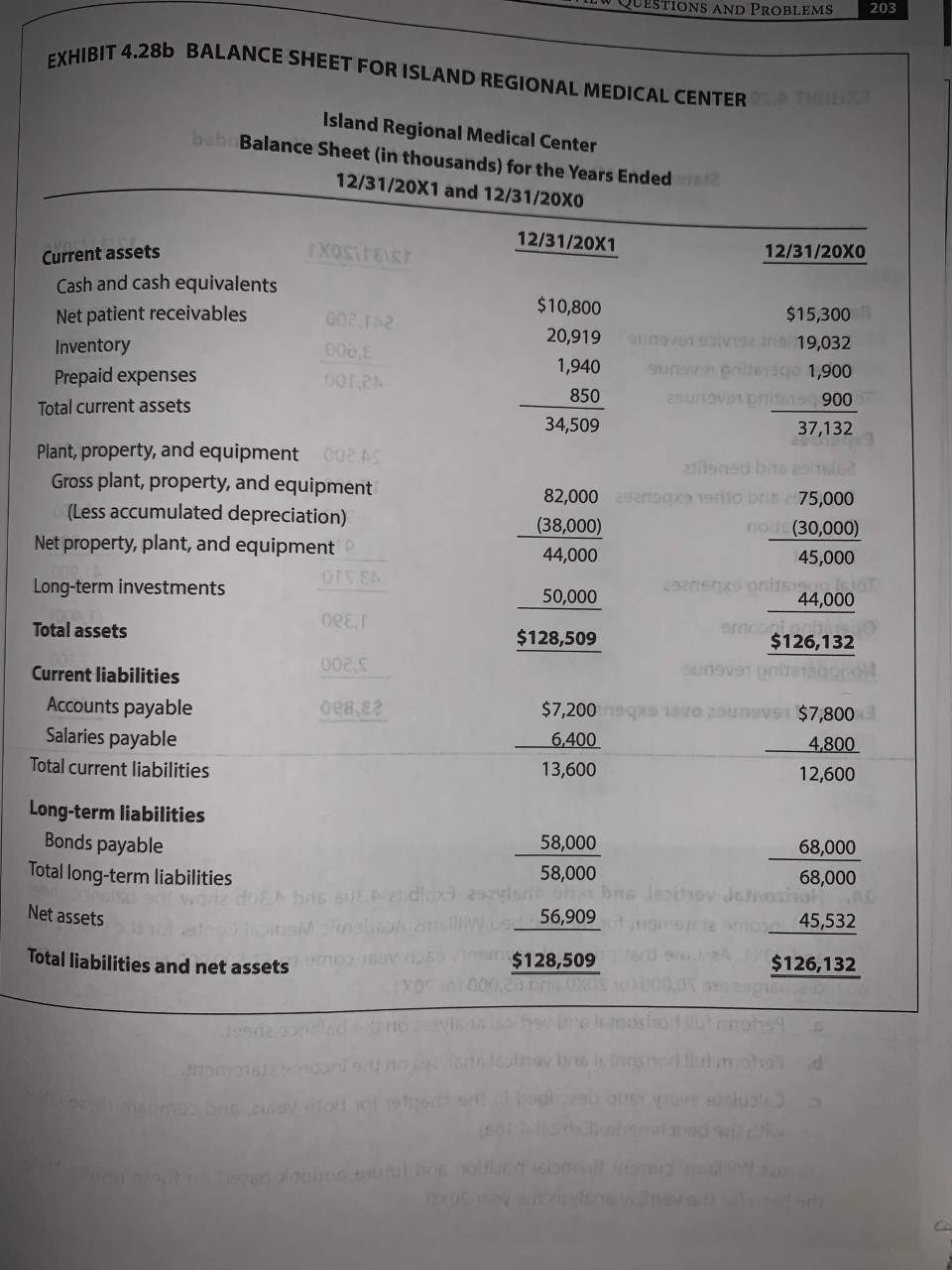

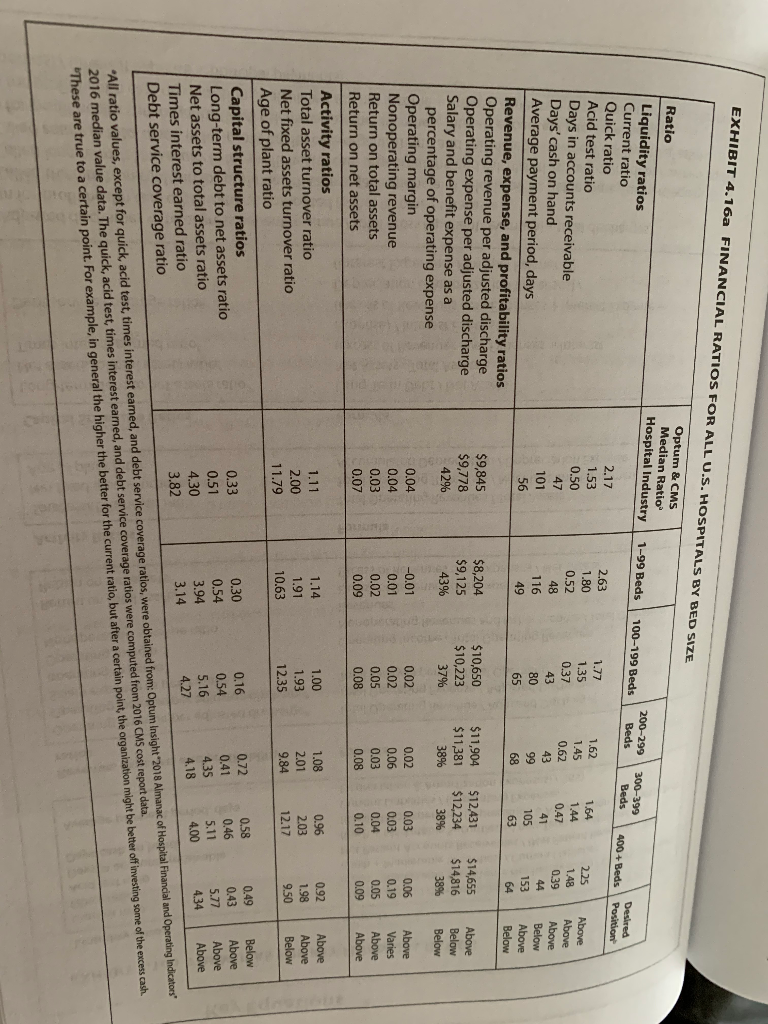

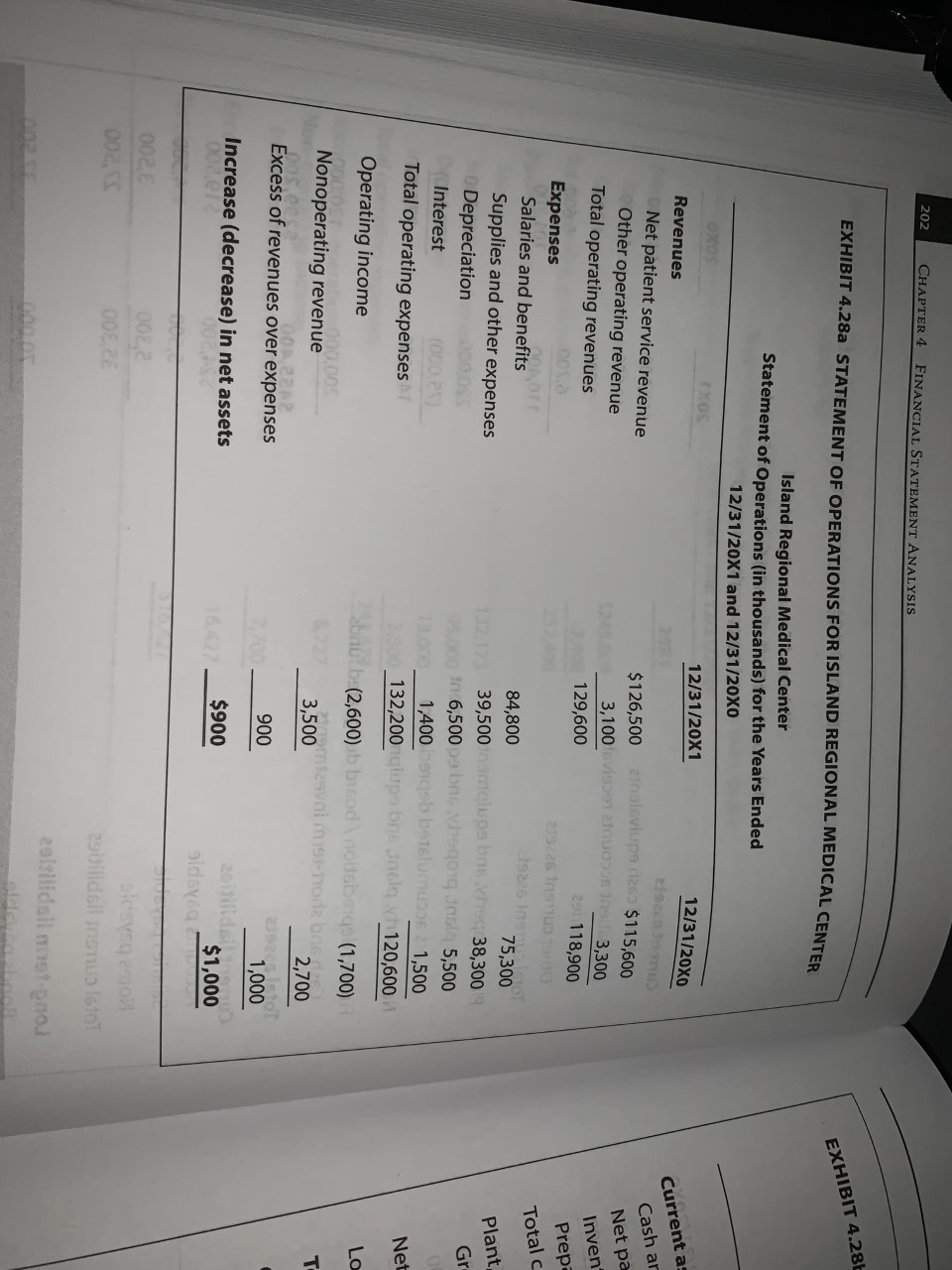

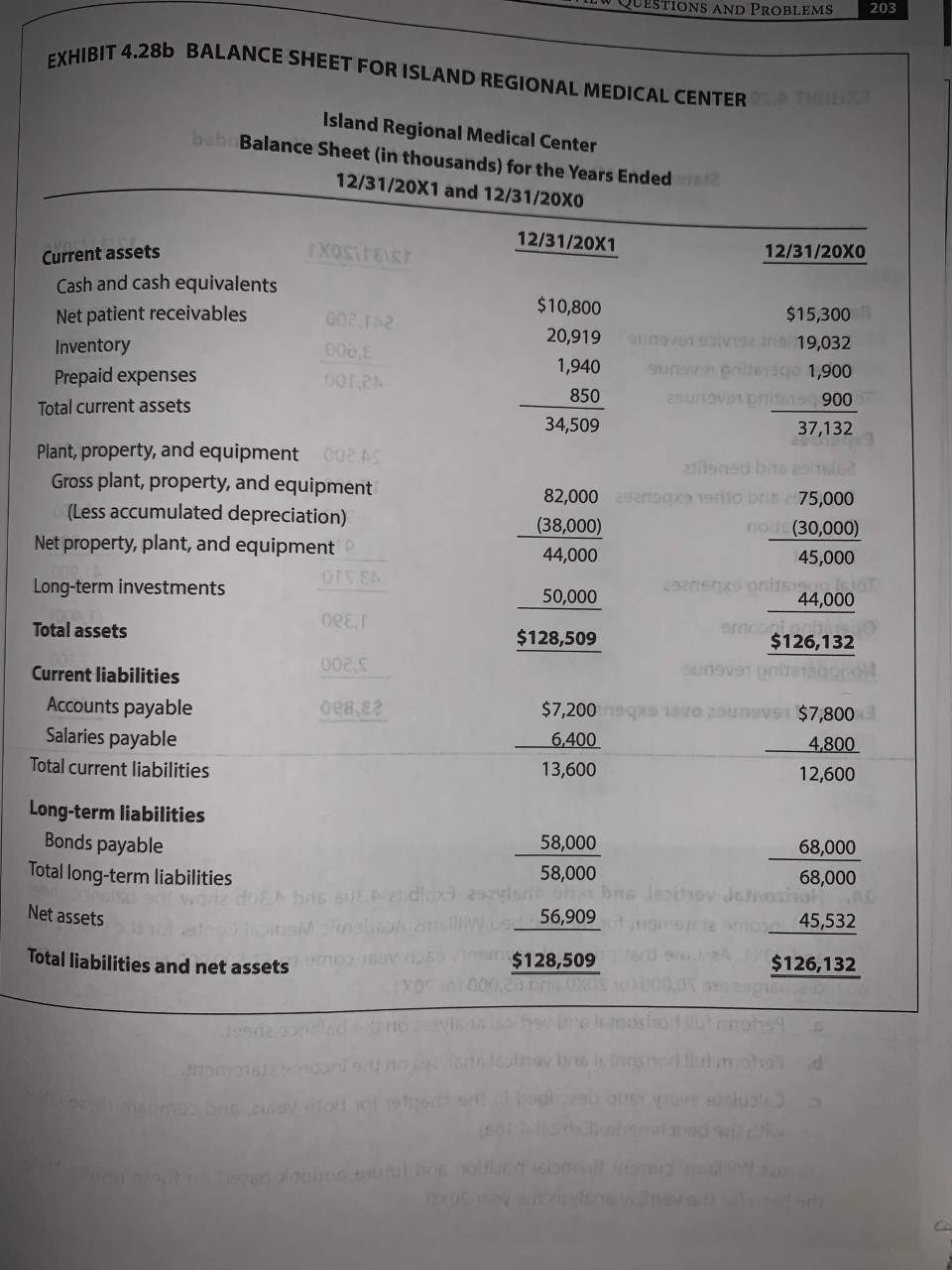

EXHIBIT 4.16a FINANCIAL RATIOS FOR ALL U.S. HOSPITALS BY BED SIZE Optum & CMS Median Ratio Hospital Industry 1-99 Beds 100-199 Beds 200-299 Beds 300-399 Beds 400+ Beds Desired Position 2.17 1.53 0.50 47 101 56 2.63 1.80 0.52 48 116 49 Ratio Liquidity ratios Current ratio Quick ratio Acid test ratio Days in accounts receivable Days' cash on hand Average payment period, days Revenue, expense, and profitability ratios Operating revenue per adjusted discharge Operating expense per adjusted discharge Salary and benefit expense as a percentage of operating expense Operating margin Nonoperating revenue Return on total assets Return on net assets 1.77 1.35 0.37 43 80 65 1.62 1.45 0.62 43 99 68 1.64 1.44 0.47 41 105 63 2.25 1.48 0.39 44 153 64 Above Above Above Below Above Below $9,845 $9,778 42% $8,204 $9,125 43% $10,650 $10,223 37% $11,904 $11,381 38% $12,431 $12,234 38% $14,655 $14,816 38% Above Below Below 0.04 0.04 -0.01 0.01 0.02 0.09 0.02 0.02 0.05 0.08 0.02 0.06 0.03 0.08 0.03 0.03 0.04 0.10 0.06 0.19 0.05 0.09 Above Varies Above Above 0.03 0.07 1.11 2.00 11.79 1.14 1.91 1.00 1.93 12.35 1.08 2.01 9.84 0.96 2.03 12.17 0.92 1.98 9.50 Above Above Below 10.63 Activity ratios Total asset turnover ratio Net fixed assets turnover ratio Age of plant ratio Capital structure ratios Long-term debt to net assets ratio Net assets to total assets ratio Times interest earned ratio Debt service coverage ratio 0.33 0.51 4.30 3.82 0.30 0.54 3.94 3.14 0.16 0.54 5.16 4.27 0.72 0.41 4.35 4.18 0.58 0.46 5.11 4.00 0.49 0.43 5.77 434 Below Above Above Above "All ratio values, except for quick acid test, times interest eamed, and debt service coverage ratios, were obtained from: Optum Insight 2018 Almanac of Hospital Financial and Operating Indicators 2016 median value data. The quick, acid test, times interest earned, and debt service coverage ratios were computed from 2016 CMS cost report data. "These are true to a certain point. For example, in general the higher the better for the current ratio, but after a certain point, the organization might be better off investing some of the excess cash. es, as mentioned, are 23,000 in 20X0 and 24,000 in 20X1. isted 22. Horizontal, vertical, and ratio analyses. Exhibits 4.28a and 4.28b show the statement of operations and balance sheet for the 375-bed Island Regional Medical Center for 20X0 and 20X1. Perform a horizontal analysis on both statements. b. Perform a vertical analysis on both statements relative to 20X0. c. Compute all the selected ratios listed in Exhibit 4.16a, and compare them with the bench- marks for its bed size. a. Using these financial performance measures, evaluate the financial state of Island. The debt principal payments each year are $1,800,000, and adjusted discharges are 11,000 for 20X0 and 11,500 for 20X1. 202 CHAPTER 4 FINANCIAL STATEMENT ANALYSIS EXHIBIT 4.28a STATEMENT OF OPERATIONS FOR ISLAND REGIONAL MEDICAL CENTER EXHIBIT 4.284 Island Regional Medical Center Statement of Operations (in thousands) for the Years Ended 12/31/20X1 and 12/31/20XO XOS 12/31/20X1 12/31/20X0 Revenues Net patient service revenue Other operating revenue Total operating revenues Current as Cash ar Net pa Inven Preps Totalc Expenses Salaries and benefits Supplies and other expenses Depreciation DO Interest (CO2 Total operating expenses Operating income Plant Gr. $126,500 naleviupa 125 $115,600 3,100 v19391 3,300 129,600 20118,900 219225 19326 InOT 84,800 75,300 39,500mclupe bas he 38,300 tr6,500 bao Vysor nisl 5,500 1,400b bolum 1,500 132,200 lupa bronca 120,600 abou (2,600) bbsod modeberg (1,700) tasvni misi-honor 3,500 2,700 2393 900 1,000 $900 2013 $1,000 eldsyo Net Lo Nonoperating revenue . Excess of revenues over expenses Increase (decrease) in net assets 00er 002 0022 00E 002, sidsysscow 290 ildil insultor 201llidsilmet-enol EXHIBIT 4.28b BALANCE SHEET FOR ISLAND REGIONAL MEDICAL CENTER UESTIONS AND PROBLEMS 203 Island Regional Medical Center bab Balance Sheet (in thousands) for the Years Ended 12/31/20X1 and 12/31/20X0 12/31/20X1 XOSITES 12/31/20XO Current assets Cash and cash equivalents Net patient receivables Inventory Prepaid expenses Total current assets 007.12 000 00121 $10,800 20,919 1,940 850 34,509 $15,300 Volvo 19,032 sunn61390 1,900 2 900 37,132 Plant, property, and equipment 002. AS Gross plant, property, and equipment (Less accumulated depreciation) Net property, plant, and equipment OTTEN Long-term investments ORE, Total assets 002, Current liabilities Accounts payable 0e8, Salaries payable Total current liabilities igned bis 2016 82,000 2920x9 erobris 75,000 (38,000) no (30,000) 44,000 45,000 292016 xs pnitet 50,000 44,000 smo $128,509 $126,132 Suneven stor $7,20019939 1940 vs $7,800 6.400 4.800 13,600 12,600 Long-term liabilities Bonds payable 58,000 68,000 Total long-term liabilities 58,000 68,000 DOE bris so aldea zastons do Jorosho me 56,909 45,532 Total liabilities and net assets mois de $128,509 $126,132 O 000.CO DI OXUS Net assets e mennes bric is todo el bodies visus o loco sul sol