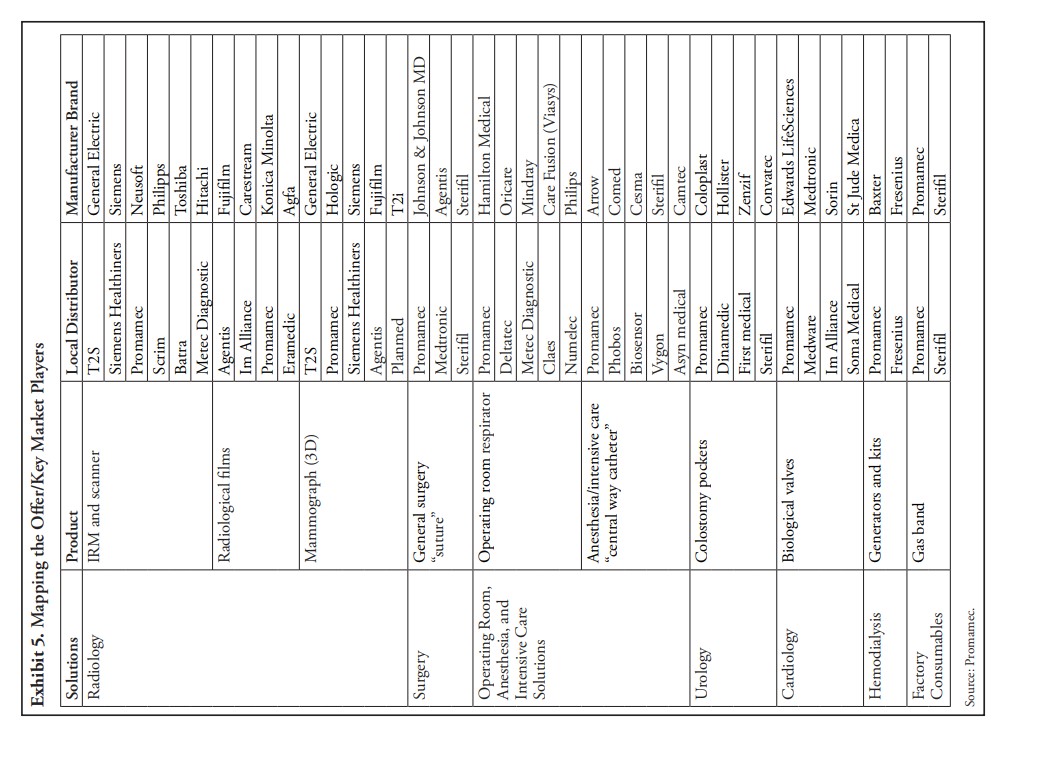

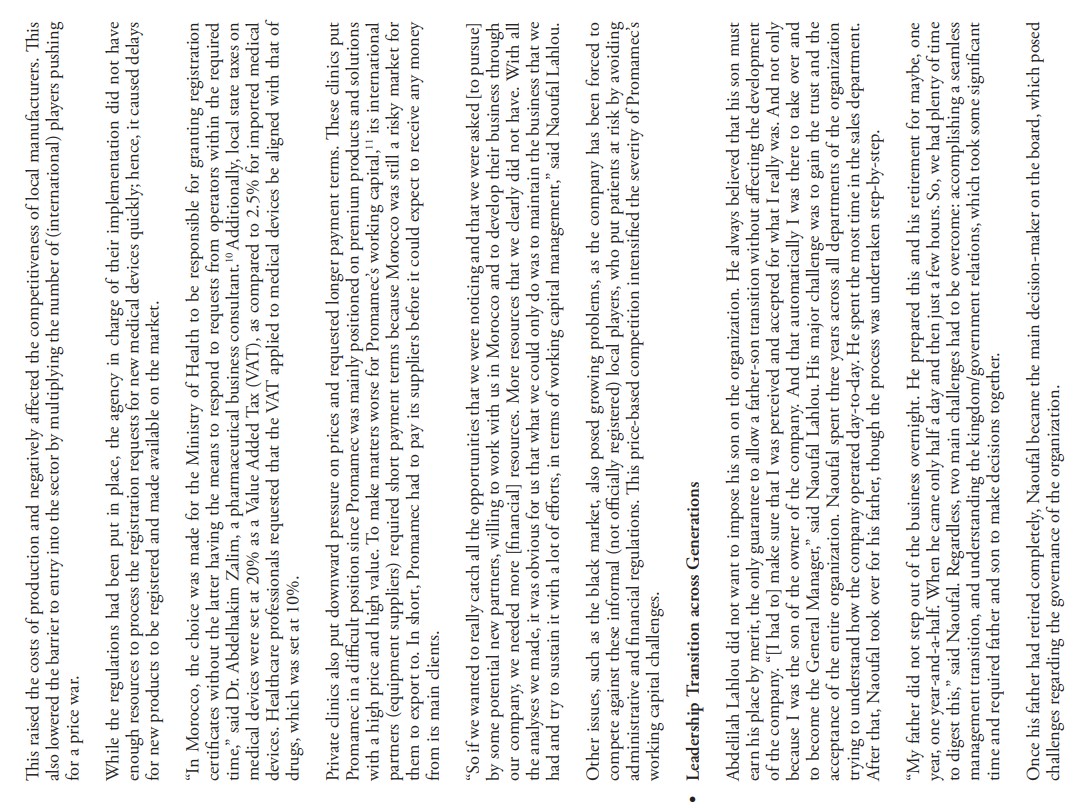

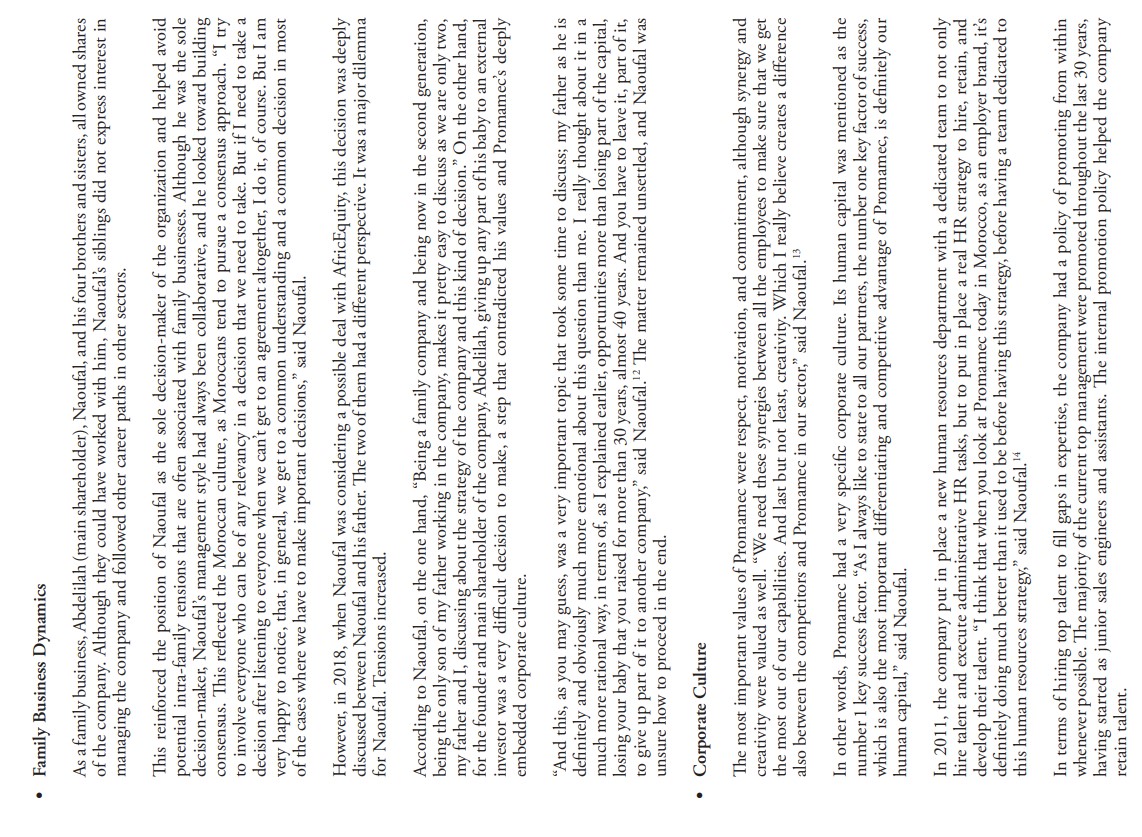

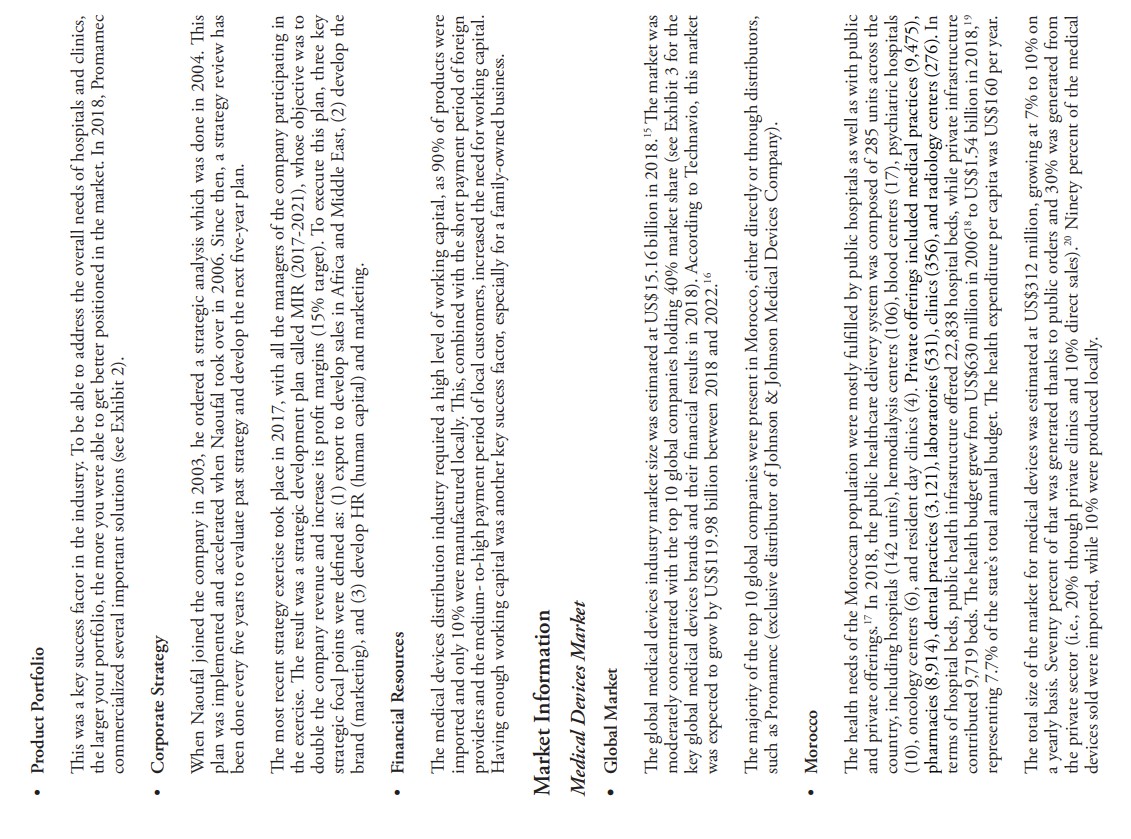

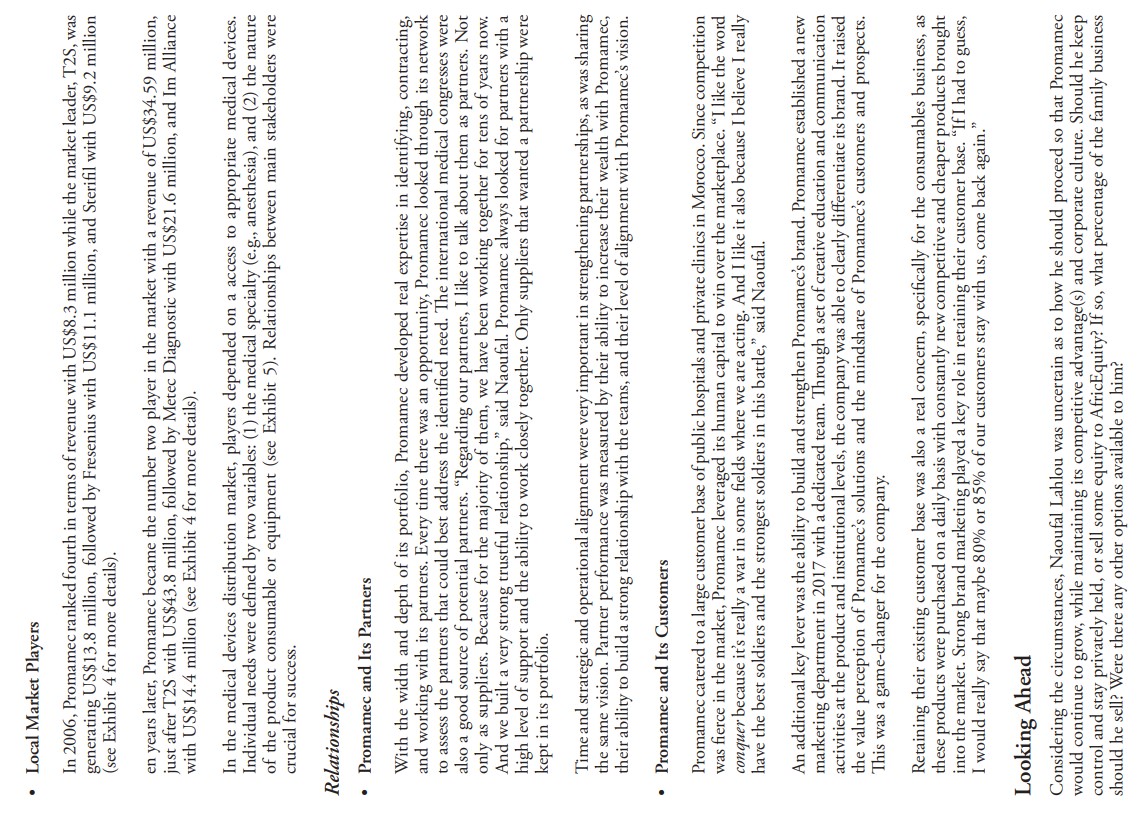

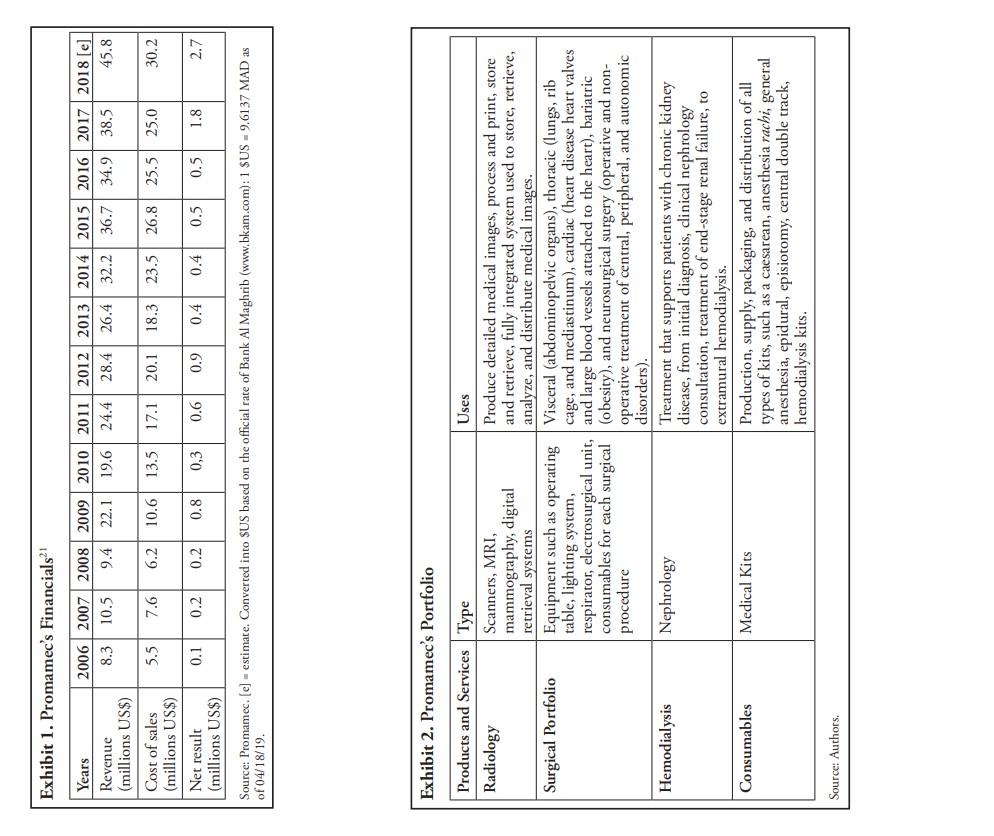

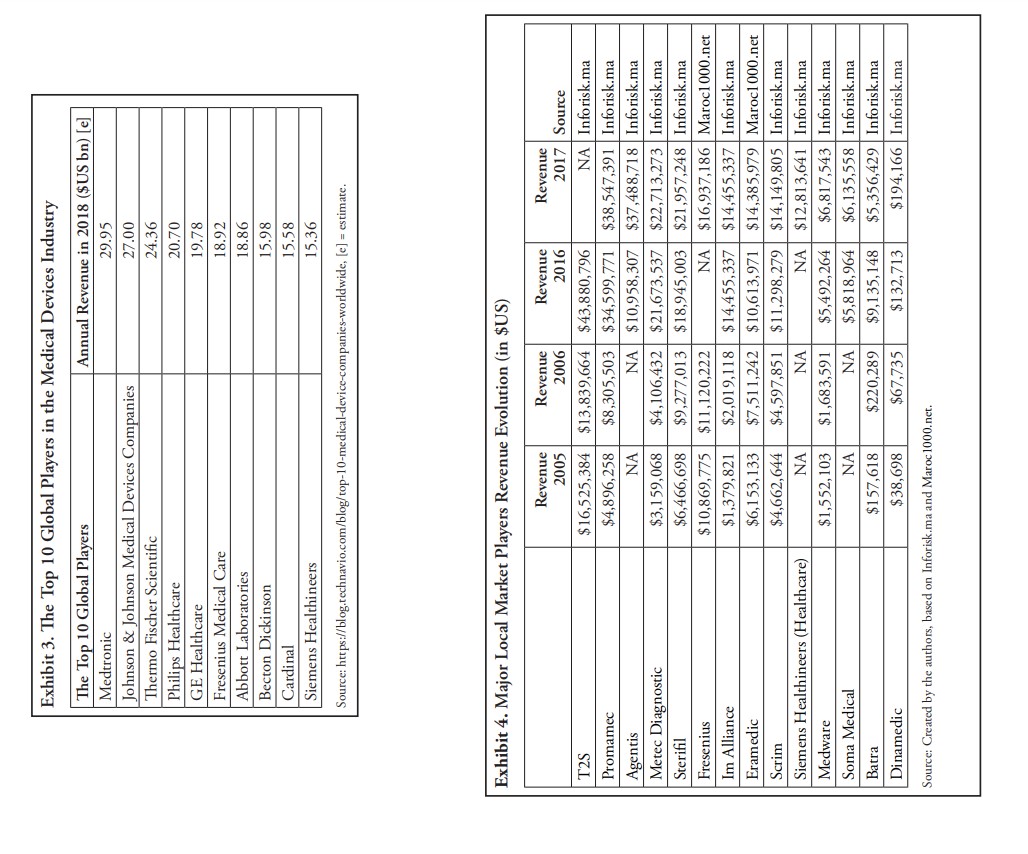

Exhibit 5. Mapping the Offer/Key Market Players Solutions Product Local Distributor Manufacturer Brand Radiology IRM and scanner T2S General Electric Siemens Healthiners Siemens Promamec Neusoft Scrim Philipps Batra Toshiba Metec Diagnostic Hitachi Radiological films Agentis Fujifilm Im Alliance Carestream Promamec Konica Minolta Eramedic Agfa Mammograph (3D) T2S General Electric Promamec Hologic Siemens Healthiners Siemens Agentis Fujifilm Planmed T2 Surgery General surgery Promamec Johnson & Johnson MD "suture' Medtronic Agentis Sterifil Sterifil Operating Room, Operating room respirator Promamec Hamilton Medical Anesthesia, and Deltatec Oricare Intensive Care Metec Diagnostic Mindray Solutions Claes Care Fusion (Viasys) Numelec Philips Anesthesia/intensive care Promamec Arrow "central way catheter" Phobos Comed Biosensor Cesma Vygon Sterifil Asyn medical Camtec Urology Colostomy pockets Promamec Coloplast Dinamedic Hollister First medical Zenzif Sterifil Convatec Cardiology Biological valves Promamec Edwards LifeSciences Medware Medtronic Im Alliance Sorin Soma Medical St Jude Medica Hemodialysis Generators and kits Promamec Baxter Fresenius Fresenius Factory Gas band Promamec Promamec Consumables Sterifil Sterifil Source: Promamec.Keep or Sell the Healthcare Family Business: The Case of Promamec in Morocco Introduction "At the end of the 1970s, the Moroccan corporatization policy led to a massive departure of expatriate specialists in the medical field [with dire consequences for patients]. Driven by a strong entrepreneurial ambition and after four years of experience in the field of medical devices, I seized the market opportunity by founding Promamec [in Casablanca, Morocco's business capital] in the early 1980s," said Mr. Abdelilah Lahlou.' Looking back, he hadn't known how to grow his business over the next 25 years, and had no idea how the 2011 Arab Spring events would transform his industry forever. For the first time in history, the right to access healthcare became part of the Moroccan Constitution. A new law (1 13-13)' allowed non-healthcare professionals to enter the market. Competition intensified and financial resources became more limited, while he had remained the largest Promamec shareholder and his son had become the boss. In October 2018, Abdelilah's son, Naoufal, then Promamec's General Manager/CEO, faced the dilemma of a lifetime: keep the business in the family or sell it to external investors. In closing discussions with AfricEquity, a private equity firm interested in buying the successful, family-owned business, Naoufal had to chart the best way forward for Promamec to continue to grow. Background: Morocco and Promamec Morocco: Economic Overview Morocco had long been an international hub between Europe and Africa with its access to both the Atlantic Ocean and the Mediterranean Sea. Although it had faced economic, political, and social challenges, Morocco had enjoyed political stability of late, allowing it to attract foreign direct investment in sectors such as automotive, aeronautics, healthcare, energy, information, and communication technologies. By most accounts, Morocco was now an emerging market. In 2016, it had a population of 36.1 million citizens, with a median age of 28.1, a fertility rate of 2.56, and 59.9% of the population living in urban areas.' The country's GDP was US$ 118.18 billion, or US$3,355 per capita.* More importantly, the life expectancy of Moroccans had increased from 58 years in 1981 to 76 years in 2017, as compared to the life expectancy of Americans, which had increased from 74 years to 78 years for the same period.' This implied that healthcare had contributed to economic development and was an important sector. . Legal Transformation of the Healthcare Industry From the start, Promamec was born amid wild changes in its legal landscape, which had a profound and lasting impact on the healthcare industry and its business.Moroccan Corporatization Law. The year was 1981. The law was changing, medical talent was leaving Morocco, forced to abandon patients. Mr. A. Lahlou, a 26-year-old nontraditional and improvisational entrepreneur, faced a daunting challenge: how to turn a profit with his start-up while meeting-if not exceeding-patients' healthcare needs. Making matters more difficult, he wished to grow the business without compromising its values and corporate culture. He also hoped to someday transfer it successfully to the next generation. - 2011 Arab Spring. Regulating the medical devices industry had not been a key focus of the public regulatory health office. Changes to regulations only truly began in 2011, during the Arab Spring. At this time, events in the Arab world led to a new Moroccan constitution, which was implemented in 2011. For the first time, the right to access healthcare was part of constitutional law. This watershed moment was followed by a new law (84-12) in 2013. It was dedicated to medical devices, and it required distributors and importers to register each medical device to ensure its traceability and compliance with regulations. Although passed in 2013, the law only came into force in February 2017. Law 113-13." This 2015 law stimulated the creation of many new private clinics and made Morocco increasingly attractive for local and foreign investors. This accelerated the arrival of more international firms and competitors. Local, informal competitors were also on the scene. Combined with the new international firms, they made the local landscape more competitive and complex than expected. On the customer side, the public tender system, which favored the cheapest offers, impacted Promamec negatively. Promamec's positioning was based on the best quality and highest value solutions available through its world-class medical device partners. However, these solutions came at a higher price point. In that context, international firms established themselves in Morocco either directly or via local distributors. Developing fast as an emerging market, the Moroccan kingdom was also known for its rich cultural heritage. Moroccan Culture and Its Impact on Decisions Culture can be defined as a set of values, beliefs, and habits that impact the way people process information and make decisions. It is crucial to understand its subtleties in an international business context. Geert Hofstede, a renowned scholar in the area of cross-cultural communication, used as many as six dimensions to analyze a country's culture. By focusing on some of the most relevant dimensions for this case (Power Distance, Individualism, and Long-Term Orientation), we get an insider's view into Moroccan culture and better understand our protagonist's dilemma. Power Distance Index (PDI). This index measured the inequalities of power in society. A high PDI ranking was synonymous with a clear and strict hierarchy between members of that society, where business was often conducted using titles and last names. For example, Morocco had a high score of 70, as opposed to the United States, with a low score of 40, where business was conducted on a first-name basis and without many formalities. Individualism versus Collectivism. This concept described how connected the members of a society were with one another. With a low score of 46, Morocco was considered a collectivist society, where loyalty to a group or family was more important than societal rules and regulations. In such a society, employer/employee relationships, for example, functioned based on moral terms as they would in a family. Long-Term Orientation versus Short-Term Normative Orientation. This concept addressed how societies saw their past, present, and future. A long-term orientation prioritized the future, whereas a society with a short-term normative orientation prioritized its past and present. In business, this concept was helpful to better understand people's motivations and time horizons when they made decisions. With a very low score of 14, Morocco was considered a normative society, with great respect for traditions. In this complex context, how did this family start-up, born in the early 80s, grow so fast, especially in the most recent decade: from $8 million USD (2006) to $45 million USD (2018)? How could the son of the founder make the right strategic decision on the next phase of growth while maintaining harmony?Promamec: Milestones, Leadership Transition, Family Business Dynamics, Human Capital, and Strategy Founded in 1981 in the heart of the economic capital of Morocco, Casablanca, Promamec was a healthcare company specializing in the production and distribution of medical devices, equipment, and consumables for the public and private sectors. Its mission was to provide competitive and innovative medical solutions for health professionals to improve the quality of care for their patients. . Key Milestones Five years after its creation, in 1986, the company was awarded its first real project. It was a public tender to supply medical films, associated with a US$300,000 order. Then, as the company started to grow, the need to manufacture medical devices locally was felt. This led the company to create a factory in the industrial area of Casablanca in 2000. Naoufal Lahlou, the current general manager and son of the president and founder, joined the company in 2003 when he was 24 years old. After earning his master's degree from a top French business school, ESC- Bordeaux/KEDGE Business School, known to produce high-quality talent, Naoufal worked in France for more than a year before going back to Morocco to join his father's company. Although his father wanted him to develop more skills in France before moving back, Naoufal joined the Promamec public healthcare business unit for a year and then moved into the private healthcare business unit for three years. This helped him acquire a deeper understanding of the medical devices market and how the overall domestic market functioned. In parallel, he ordered a strategic diagnosis of the company from a consulting firm in 2004. "One important date was 2004 with the first strategic diagnosis that we did. And that led us to the diversification of our portfolio and the development of our business in general,"s said Naoufal. In 2006, Naoufal became the general manager of Promamec and continued to implement the strategic diagnosis recommendations of the consulting firm. This strategy led the company to grow quickly beyond the organic traditional growth path from US$8.3 million to US$45.8 million. (See Exhibit 19 for detailed financial results 2006-2018.) In 2008, Promamec was awarded the international quality certificate ISO 9001, version 2008. In 2011, a human resources department was established. In order to consolidate its growth, the company also established a strategic program called "Next Steps" with the objective of improving the overall performance of the company by optimizing its processes. Late 2016 marked the start of the discussions between Promamec and AfricEquity, a large private equity firm with offices in several African countries, that was managed by savvy, local executives who often had been trained in top schools in Europe and/or the U.S. In 2017, the company, now with 300 employees, established a new marketing department with the objective of strengthening its brand equity and sales performance. Simultaneously, Promamec launched a strategic plan-"MIR 21"-aimed at doubling the company's revenue by 2021 with a 15% profit margin. In 2018, Promamec had to consider whether or not to sell any or all of its shares to AfricEquity. Key Challenges From 2003 to 2010, the main challenge of the company was growth related. The company aimed to grow faster than traditional organic growth figures (8% to 12%) per year. It relied on a narrow portfolio of products, mainly limited to consumables, a small number of product providers, limited financial capabilities, and medium-sized market shares in the markets where the company was operating. Between 2011 and 2018, the passage of new laws increased international firms' interest in the Moroccan market, and accelerated the arrival of more firms from Asia (China and India, mainly). In a sector where 90% of local needs were met by imports, local manufacturers were not encouraged by the state to produce locally.This raised the costs of production and negatively affected the competitiveness of local manufacturers. This also lowered the barrier to entry into the sector by multiplying the number of (international) players pushing for a price war. While the regulations had been put in place, the agency in charge of their implementation did not have enough resources to process the registration requests for new medical devices quickly; hence, it caused delays for new products to be registered and made available on the market. "In Morocco, the choice was made for the Ministry of Health to be responsible for granting registration certificates without the latter having the means to respond to requests from operators within the required time," said Dr. Abdelhakim Zalim, a pharmaceutical business consultant. " Additionally, local state taxes on medical devices were set at 20% as a Value Added Tax (VAT), as compared to 2.5% for imported medical devices. Healthcare professionals requested that the VAT applied to medical devices be aligned with that of drugs, which was set at 10%. Private clinics also put downward pressure on prices and requested longer payment terms. These clinics put Promamec in a difficult position since Promamec was mainly positioned on premium products and solutions with a high price and high value. To make matters worse for Promamec's working capital," its international partners (equipment suppliers) required short payment terms because Morocco was still a risky market for them to export to. In short, Promamec had to pay its suppliers before it could expect to receive any money from its main clients. "So if we wanted to really catch all the opportunities that we were noticing and that we were asked [ to pursue] by some potential new partners, willing to work with us in Morocco and to develop their business through our company, we needed more [financial] resources. More resources that we clearly did not have. With all the analyses we made, it was obvious for us that what we could only do was to maintain the business that we had and try to sustain it with a lot of efforts, in terms of working capital management," said Naoufal Lahlou. Other issues, such as the black market, also posed growing problems, as the company has been forced to compete against these informal (not officially registered) local players, who put patients at risk by avoiding administrative and financial regulations. This price-based competition intensified the severity of Promamec's working capital challenges. Leadership Transition across Generations Abdelilah Lahlou did not want to impose his son on the organization. He always believed that his son must earn his place by merit, the only guarantee to allow a father-son transition without affecting the development of the company. "[I had to] make sure that I was perceived and accepted for what I really was. And not only because I was the son of the owner of the company. And that automatically I was there to take over and to become the General Manager," said Naoufal Lahlou. His major challenge was to gain the trust and the acceptance of the entire organization. Naoufal spent three years across all departments of the organization trying to understand how the company operated day-to-day. He spent the most time in the sales department. After that, Naoufal took over for his father, though the process was undertaken step-by-step. "My father did not step out of the business overnight. He prepared this and his retirement for maybe, one year, one year-and-a-half. When he came only half a day and then just a few hours. So, we had plenty of time to digest this," said Naoufal. Regardless, two main challenges had to be overcome: accomplishing a seamless management transition, and understanding the kingdom/government relations, which took some significant time and required father and son to make decisions together. Once his father had retired completely, Naoufal became the main decision-maker on the board, which posed challenges regarding the governance of the organization.. Family Business Dynamics As a family business, Abdelilah (main shareholder), Naoufal, and his four brothers and sisters, all owned shares of the company. Although they could have worked with him, Naoufal's siblings did not express interest in managing the company and followed other career paths in other sectors. This reinforced the position of Naoufal as the sole decision-maker of the organization and helped avoid potential intra-family tensions that are often associated with family businesses. Although he was the sole decision-maker, Naoufal's management style had always been collaborative, and he looked toward building consensus. This reflected the Moroccan culture, as Moroccans tend to pursue a consensus approach. "I try to involve everyone who can be of any relevancy in a decision that we need to take. But if I need to take a decision after listening to everyone when we can't get to an agreement altogether, I do it, of course. But I am very happy to notice, that, in general, we get to a common understanding and a common decision in most of the cases where we have to make important decisions," said Naoufal. However, in 2018, when Naoufal was considering a possible deal with AfricEquity, this decision was deeply discussed between Naoufal and his father. The two of them had a different perspective. It was a major dilemma for Naoufal. Tensions increased. According to Naoufal, on the one hand, "Being a family company and being now in the second generation, being the only son of my father working in the company, makes it pretty easy to discuss as we are only two, my father and I, discussing about the strategy of the company and this kind of decision." On the other hand, for the founder and main shareholder of the company, Abdelilah, giving up any part of his baby to an external investor was a very difficult decision to make, a step that contradicted his values and Promamec's deeply embedded corporate culture. "And this, as you may guess, was a very important topic that took some time to discuss; my father as he is definitely and obviously much more emotional about this question than me. I really thought about it in a much more rational way, in terms of, as I explained earlier, opportunities more than losing part of the capital, losing your baby that you raised for more than 30 years, almost 40 years. And you have to leave it, part of it, to give up part of it to another company," said Naoufal."? The matter remained unsettled, and Naoufal was unsure how to proceed in the end. . Corporate Culture The most important values of Promamec were respect, motivation, and commitment, although synergy and creativity were valued as well. "We need these synergies between all the employees to make sure that we get the most out of our capabilities. And last but not least, creativity. Which I really believe creates a difference also between the competitors and Promamec in our sector," said Naoufal. 13 In other words, Promamec had a very specific corporate culture. Its human capital was mentioned as the number 1 key success factor. "As I always like to state to all our partners, the number one key factor of success, which is also the most important differentiating and competitive advantage of Promamec, is definitely our human capital," said Naoufal. In 2011, the company put in place a new human resources department with a dedicated team to not only hire talent and execute administrative HR tasks, but to put in place a real HR strategy to hire, retain, and develop their talent. "I think that when you look at Promamec today in Morocco, as an employer brand, it's definitely doing much better than it used to be before having this strategy, before having a team dedicated to this human resources strategy," said Naoufal. 14 In terms of hiring top talent to fill gaps in expertise, the company had a policy of promoting from within whenever possible. The majority of the current top management were promoted throughout the last 30 years, having started as junior sales engineers and assistants. The internal promotion policy helped the company retain talent.. Product Portfolio This was a key success factor in the industry. To be able to address the overall needs of hospitals and clinics, the larger your portfolio, the more you were able to get better positioned in the market. In 2018, Promamec commercialized several important solutions (see Exhibit 2). . Corporate Strategy When Naoufal joined the company in 2003, he ordered a strategic analysis which was done in 2004. This plan was implemented and accelerated when Naoufal took over in 2006. Since then, a strategy review has been done every five years to evaluate past strategy and develop the next five-year plan. The most recent strategy exercise took place in 2017, with all the managers of the company participating in the exercise. The result was a strategic development plan called MIR (2017-2021), whose objective was to double the company revenue and increase its profit margins (15% target). To execute this plan, three key strategic focal points were defined as: (1) export to develop sales in Africa and Middle East, (2) develop the brand (marketing), and (3) develop HR (human capital) and marketing. Financial Resources The medical devices distribution industry required a high level of working capital, as 90% of products were imported and only 10% were manufactured locally. This, combined with the short payment period of foreign providers and the medium- to-high payment period of local customers, increased the need for working capital. Having enough working capital was another key success factor, especially for a family-owned business. Market Information Medical Devices Market . Global Market The global medical devices industry market size was estimated at US$ 15. 16 billion in 2018." The market was moderately concentrated with the top 10 global companies holding 40% market share (see Exhibit 3 for the key global medical devices brands and their financial results in 2018). According to Technavio, this market was expected to grow by US$1 19.98 billion between 2018 and 2022.16 The majority of the top 10 global companies were present in Morocco, either directly or through distributors, such as Promamec (exclusive distributor of Johnson & Johnson Medical Devices Company). Morocco The health needs of the Moroccan population were mostly fulfilled by public hospitals as well as with public and private offerings.' In 2018, the public healthcare delivery system was composed of 285 units across the country, including hospitals (142 units), hemodialysis centers (106), blood centers (17), psychiatric hospitals (10), oncology centers (6), and resident day clinics (4). Private offerings included medical practices (9,475), pharmacies (8,914), dental practices (3, 121), laboratories (531), clinics (356), and radiology centers (276). In terms of hospital beds, public health infrastructure offered 22,838 hospital beds, while private infrastructure contributed 9,719 beds. The health budget grew from US$630 million in 200618 to US$1.54 billion in 2018,19 representing 7.7% of the state's total annual budget. The health expenditure per capita was US$160 per year. The total size of the market for medical devices was estimated at US$3 12 million, growing at 7% to 10% on a yearly basis. Seventy percent of that was generated thanks to public orders and 30% was generated from the private sector (i.e., 20% through private clinics and 10% direct sales).20 Ninety percent of the medical devices sold were imported, while 10% were produced locally.. Local Market Players In 2006, Promamec ranked fourth in terms of revenue with US$8.3 million while the market leader, T2S, was generating US$13.8 million, followed by Fresenius with US$1 1.1 million, and Sterifil with US$9.2 million (see Exhibit 4 for more details). en years later, Promamec became the number two player in the market with a revenue of US$34.59 million, just after T2S with US$43.8 million, followed by Metec Diagnostic with US$21.6 million, and Im Alliance with US$14.4 million (see Exhibit 4 for more details). In the medical devices distribution market, players depended on a access to appropriate medical devices. Individual needs were defined by two variables: (1) the medical specialty (e.g., anesthesia), and (2) the nature of the product consumable or equipment (see Exhibit 5). Relationships between main stakeholders were crucial for success. Relationships . Promamec and Its Partners With the width and depth of its portfolio, Promamec developed real expertise in identifying, contracting, and working with its partners. Every time there was an opportunity, Promamec looked through its network to assess the partners that could best address the identified need. The international medical congresses were also a good source of potential partners. "Regarding our partners, I like to talk about them as partners. Not only as suppliers. Because for the majority of them, we have been working together for tens of years now. And we built a very strong trustful relationship," said Naoufal. Promamec always looked for partners with a high level of support and the ability to work closely together. Only suppliers that wanted a partnership were kept in its portfolio. Time and strategic and operational alignment were very important in strengthening partnerships, as was sharing the same vision. Partner performance was measured by their ability to increase their wealth with Promamec, their ability to build a strong relationship with the teams, and their level of alignment with Promamec's vision. . Promamec and Its Customers Promamec catered to a large customer base of public hospitals and private clinics in Morocco. Since competition was fierce in the market, Promamec leveraged its human capital to win over the marketplace. "I like the word conquer because it's really a war in some fields where we are acting. And I like it also because I believe I really have the best soldiers and the strongest soldiers in this battle," said Naoufal. An additional key lever was the ability to build and strengthen Promamec's brand. Promamec established a new marketing department in 2017 with a dedicated team. Through a set of creative education and communication activities at the product and institutional levels, the company was able to clearly differentiate its brand. It raised the value perception of Promamec's solutions and the mindshare of Promamec's customers and prospects. This was a game-changer for the company. Retaining their existing customer base was also a real concern, specifically for the consumables business, as these products were purchased on a daily basis with constantly new competitive and cheaper products brought into the market. Strong brand marketing played a key role in retaining their customer base. "If I had to guess, I would really say that maybe 80% or 85% of our customers stay with us, come back again." Looking Ahead Considering the circumstances, Naoufal Lahlou was uncertain as to how he should proceed so that Promamec would continue to grow, while maintaining its competitive advantage(s) and corporate culture. Should he keep control and stay privately held, or sell some equity to AfricEquity? If so, what percentage of the family business should he sell? Were there any other options available to him?Exhibit 1. Promamec's Financials? Years 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 [e] Revenue 8.3 10.5 9.4 22. 1 19.6 24.4 28.4 26.4 32.2 36.7 34. 38.5 45.8 (millions US$) Cost of sales 5.5 7.6 6.2 10.6 13.5 17.1 20.1 18.3 23.5 26.8 25.5 25.0 30.2 (millions US$) Net result 0.1 0.2 0.2 0. 8 0.3 0.6 0.9 0.4 0.4 0.5 1.8 2.7 (millions US$) Source: Promamec. [e] = estimate. Converted into SUS based on the official rate of Bank Al Maghrib (www.bkam.com) : 1 $US = 9.6137 MAD as of 04/18/19. Exhibit 2. Promamec's Portfolio Products and Services Type Uses Radiology Scanners, MRI, Produce detailed medical images, process and print, store mammography, digital and retrieve, fully integrated system used to store, retrieve, retrieval systems analyze, and distribute medical images. Surgical Portfolio Equipment such as operating Visceral (abdominopelvic organs), thoracic (lungs, rib table, lighting system, cage, and mediastinum), cardiac (heart disease heart valves respirator, electrosurgical unit, and large blood vessels attached to the heart), bariatric consumables for each surgical (obesity), and neurosurgical surgery (operative and non- procedure operative treatment of central, peripheral, and autonomic disorders). Hemodialysis Nephrology Treatment that supports patients with chronic kidney disease, from initial diagnosis, clinical nephrology consultation, treatment of end-stage renal failure, to extramural hemodialysis. Consumables Medical Kits Production, supply, packaging, and distribution of all types of kits, such as a caesarean, anesthesia rachi, general anesthesia, epidural, episiotomy, central double track, hemodialysis kits. Source: Authors.Exhibit 3. The Top 10 Global Players in the Medical Devices Industry The Top 10 Global Players Annual Revenue in 2018 ($US bn) [e] Medtronic 29.95 Johnson & Johnson Medical Devices Companies 27.00 Thermo Fischer Scientific 24.36 Philips Healthcare 20.70 GE Healthcare 19.78 Fresenius Medical Care 18.92 Abbott Laboratories 8.86 Becton Dickinson 15.98 Cardinal 15.58 Siemens Healthineers 15.36 Source: https://blog.technavio.com/blog/top-10-medical-device-companies-worldwide, [e] = estimate. Exhibit 4. Major Local Market Players Revenue Evolution (in $US) Revenue Revenue Revenue Revenue 2005 2006 2016 2017 Source T2S $16,525,384 $13,839,664 $43,880,796 NA Inforisk.ma Promamec $4,896,258 $8,305,503 $34,599,771 $38,547,391 Inforisk.ma Agentis NA NA $10,958,307 $37,488,718 Inforisk.ma Metec Diagnostic $3,159,068 $4,106,432 $21,673,537 $22,713,273 Inforisk.ma Sterifil $6,466, 698 $9,277,013 $18,945,003 $21,957,248 Inforisk.ma Fresenius $10,869,775 $11,120,222 NA $16,937,186 Maroc1 000.net Im Alliance $1,379,821 $2,019,118 $14,455,337 $14,455,337 Inforisk.ma Eramedic $6,153, 133 $7,51 1,242 $10,613,971 $14,385,979 Maroc1 000.net Scrim $4,662,644 $4,597,851 $11,298,279 $14,149,805 Inforisk.ma Siemens Healthineers (Healthcare) NA NA NA $12,813,641 Inforisk.ma Medware $1,552, 103 $1,683,591 $5,492,264 $6,817,543 Inforisk.ma Soma Medical NA NA $5,818,964 $6,135,558 Inforisk.ma Batra $157,618 $220,289 $9,135,148 $5,356,429 Inforisk.ma Dinamedic $38,698 $67,735 $132,713 $194,166 Inforisk.ma Source: Created by the authors, based on Inforisk.ma and Maroc 1000.net