Answered step by step

Verified Expert Solution

Question

1 Approved Answer

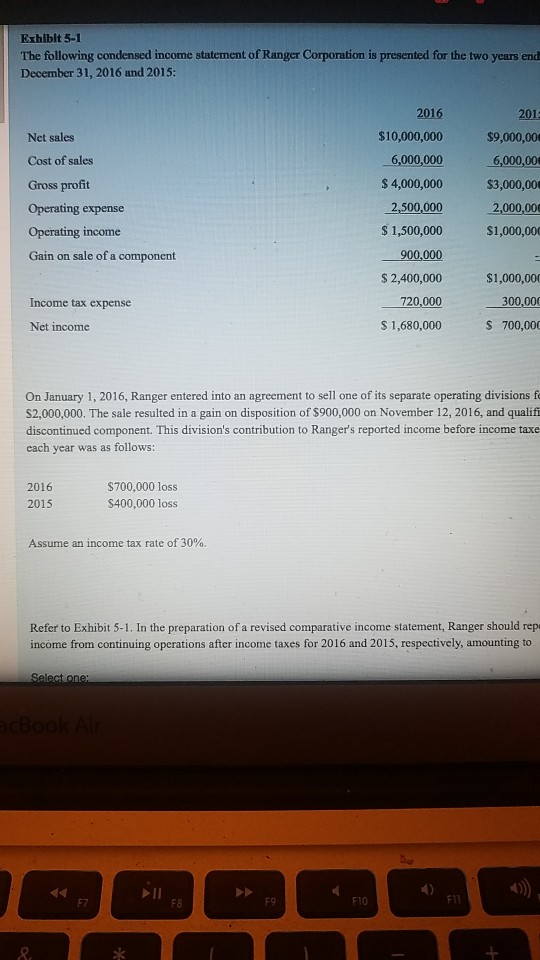

Exhibit 5-1 The following condensed income statement of Ranger Corporation is presented for the two years end December 31, 2016 and 2015: 2016 201 $9,000,00

Exhibit 5-1 The following condensed income statement of Ranger Corporation is presented for the two years end December 31, 2016 and 2015: 2016 201 $9,000,00 6,000,0006,000,000 $4,000,000 3,000,00 $10,000,000 Net sales Cost of sales Gross proft Operating expense Operating income Gain on sale of a component 2.500,000 000.00 2,500,000 $ 1,500,000 $%1,000,000 S 2,400,000 $1,000,000 720,000 300,00 s 700,000 Income tax expense Net income S 1,680,000 On January 1, 2016, Ranger entered into an agreement to sell one of its separate operating divisions f S2,000,000. The sale resulted in a gain on disposition of $900,000 on November 12, 2016, and qualifi discontinued component. This division's contribution to Ranger's reported income before income taxe each year was as follows S700,000 loss 2016 2015 Assume an income tax rate of 30%. Refer to Exhibit 5-1. In the preparation of a revised comparative income statement, Ranger should rep income from continuing operations after income taxes for 2016 and 2015, respectively, amounting to 4) 40) F7 F8 F10 F1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started