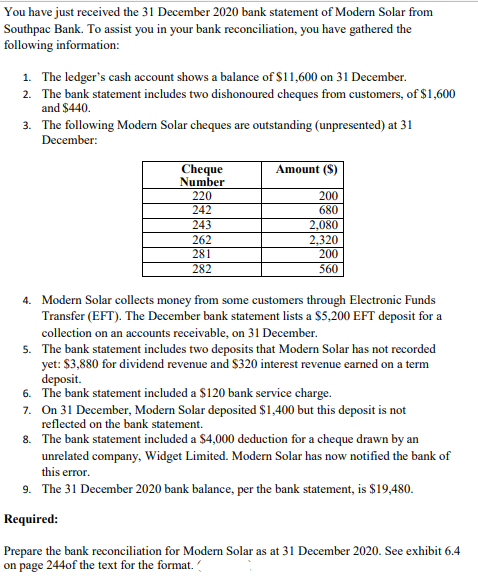

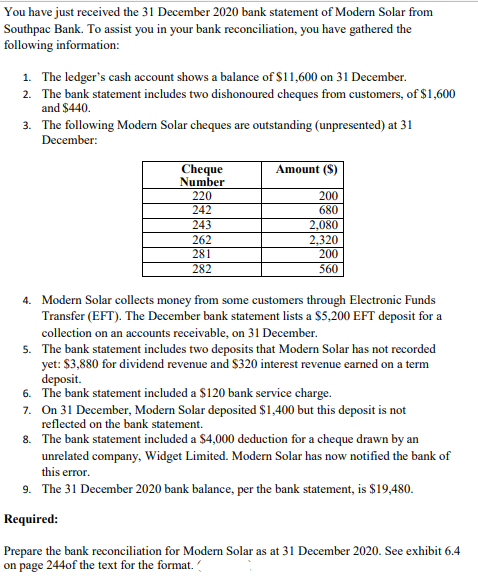

Exhibit 6.4

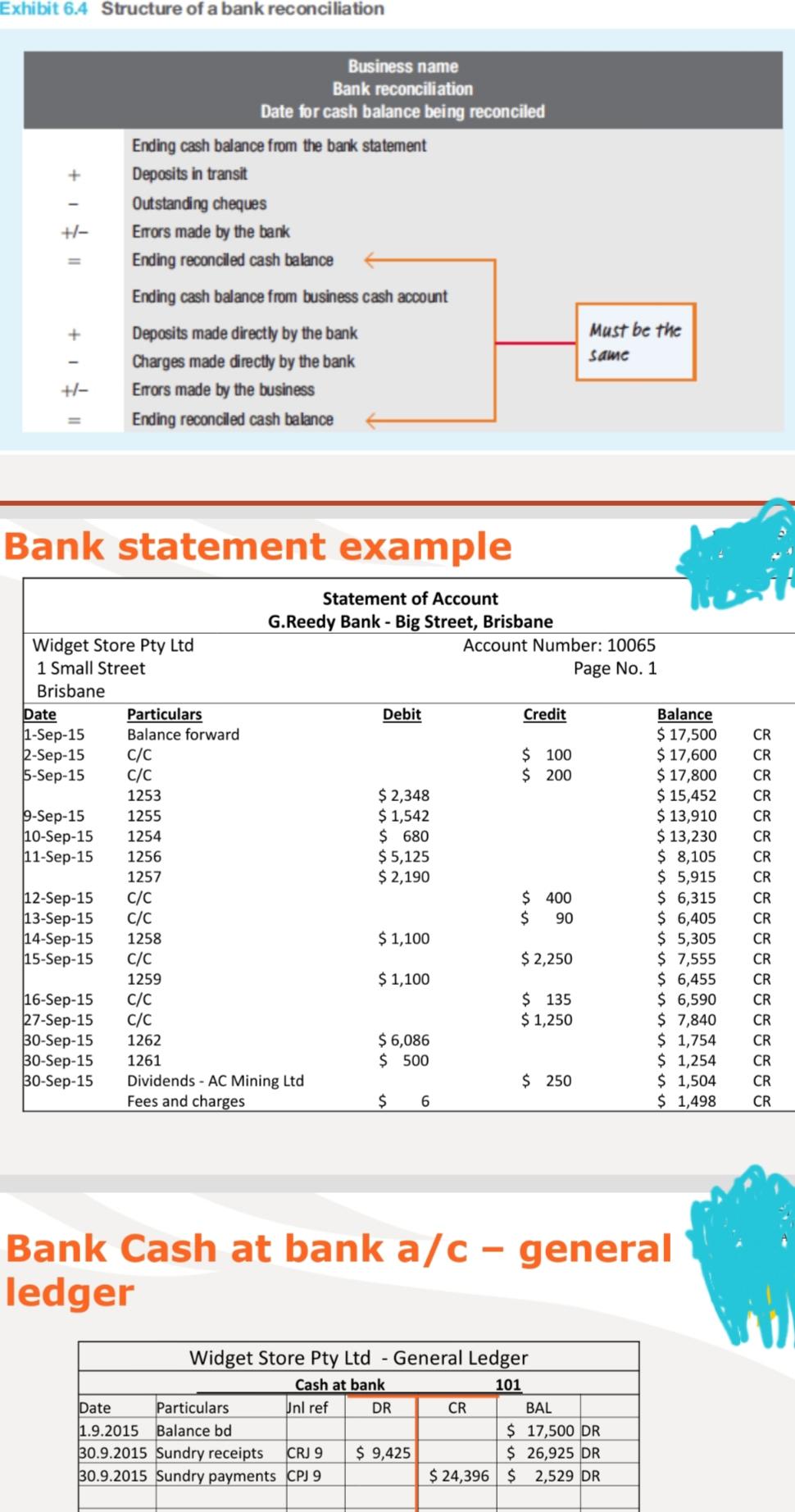

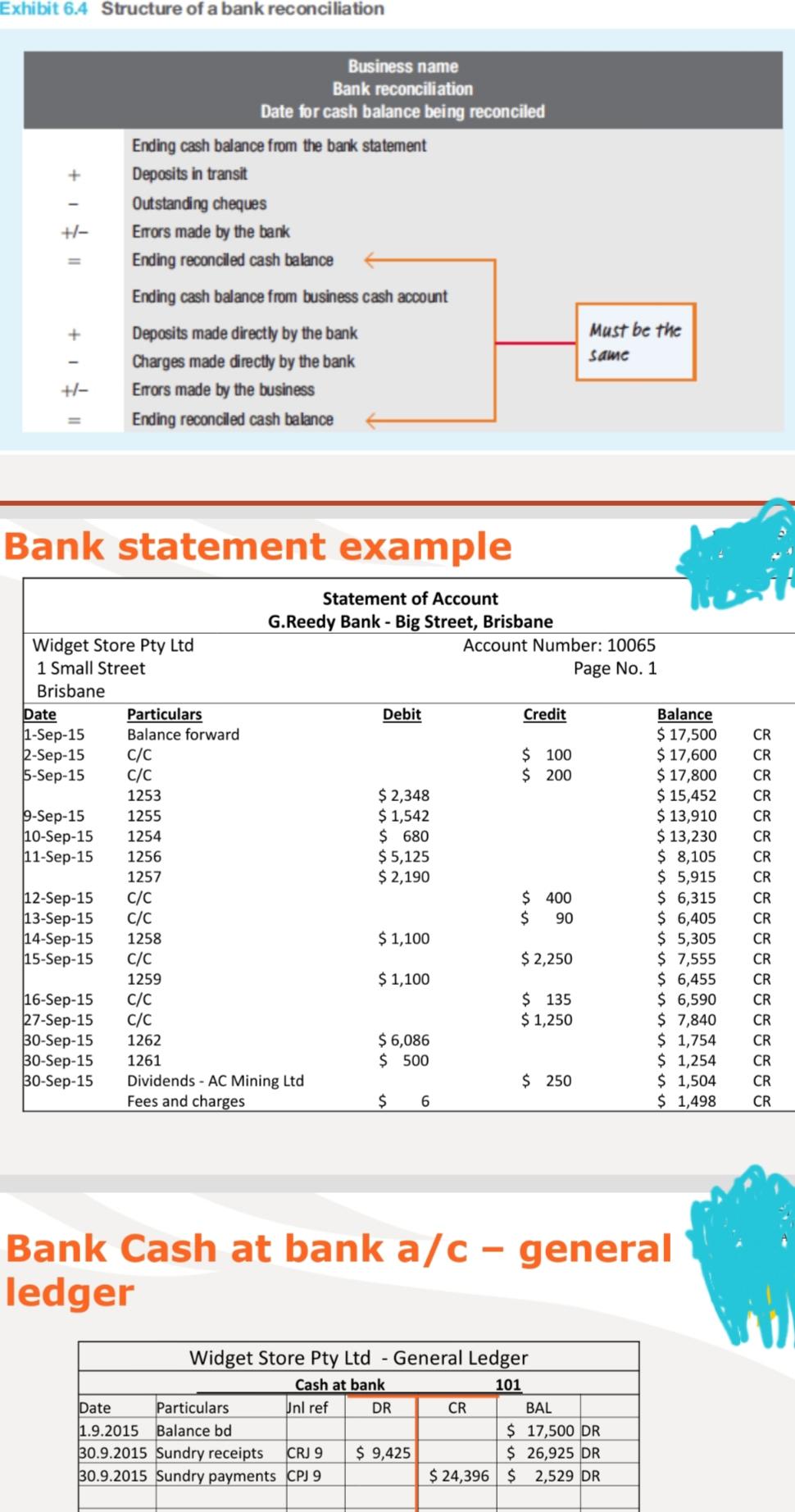

You have just received the 31 December 2020 bank statement of Modern Solar from Southpac Bank. To assist you in your bank reconciliation, you have gathered the following information: 1. The ledger's cash account shows a balance of $11,600 on 31 December. 2. The bank statement includes two dishonoured cheques from customers, of $1,600 and $440. 3. The following Modern Solar cheques are outstanding (unpresented) at 31 December: Amount (S) Cheque Number 220 242 243 262 281 282 200 680 2,080 2.320 200 560 4. Modern Solar collects money from some customers through Electronic Funds Transfer (EFT). The December bank statement lists a $5,200 EFT deposit for a collection on an accounts receivable, on 31 December. 5. The bank statement includes two deposits that Modern Solar has not recorded yet: $3,880 for dividend revenue and $320 interest revenue earned on a term deposit. 6. The bank statement included a $120 bank service charge. 7. On 31 December, Modern Solar deposited $1,400 but this deposit is not reflected on the bank statement. 8. The bank statement included a $4,000 deduction for a cheque drawn by an unrelated company, Widget Limited. Modern Solar has now notified the bank of this error. 9. The 31 December 2020 bank balance, per the bank statement, is $19,480. Required: Prepare the bank reconciliation for Modern Solar as at 31 December 2020. See exhibit 6.4 on page 244of the text for the format. Exhibit 6.4 Structure of a bank reconciliation + +- Business name Bank reconciliation Date for cash balance being reconciled Ending cash balance from the bank statement Deposits in transit Outstanding cheques Errors made by the bank Ending reconciled cash balance Ending cash balance from business cash account Deposits made directly by the bank Charges made directly by the bank Errors made by the business Ending reconciled cash balance + Must be the Same +- Bank statement example Statement of Account G.Reedy Bank - Big Street, Brisbane Widget Store Pty Ltd Account Number: 10065 1 Small Street Page No. 1 Brisbane Date Particulars Debit Credit Balance 1-Sep-15 Balance forward $ 17,500 12-Sep-15 C/C $ 100 $ 17,600 5-Sep-15 C/C $ 200 $ 17,800 1253 $ 2,348 $ 15,452 9-Sep-15 1255 $ 1,542 $ 13,910 10-Sep-15 1254 $ 680 $ 13,230 11-Sep-15 1256 $ 5,125 $ 8,105 1257 $ 2,190 $ 5,915 12-Sep-15 C/C $ 400 $ 6,315 13-Sep-15 C/C $ 90 $ 6,405 14-Sep-15 1258 $ 1,100 $ 5,305 15-Sep-15 C/C $ 2,250 $ 7,555 1259 $ 1,100 $ 6,455 16-Sep-15 C/C $ 135 $ 6,590 27-Sep-15 C/C $ 1,250 $ 7,840 30-Sep-15 1262 $ 6,086 $ 1,754 B0-Sep-15 1261 $ 500 $ 1,254 30-Sep-15 Dividends - AC Mining Ltd $ 250 $ 1,504 Fees and charges $ 6 $ 1,498 CR CR CR CR CR CR CR CR CR CR CR CR CR CR CR CR CR CR CR Bank Cash at bank a/c - general ledger Widget Store Pty Ltd - General Ledger Cash at bank 101 Date Particulars Unl ref DR CR BAL 1.9.2015 Balance bd $ 17,500 DR 30.9.2015 Sundry receipts CRJ 9 $ 9,425 $ 26,925 DR 30.9.2015 Sundry payments CPJ 9 $ 24,396 $ 2,529 DR