Answered step by step

Verified Expert Solution

Question

1 Approved Answer

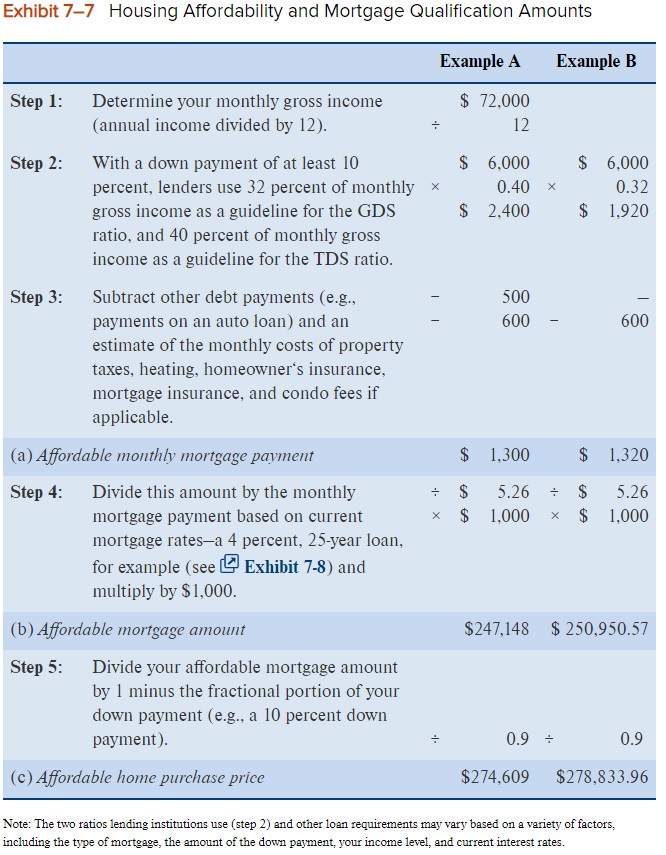

Exhibit 7-7 Housing Affordability and Mortgage Qualification Amounts Example A Example B Step 1: Determine your monthly gross income (annual income divided by 12).

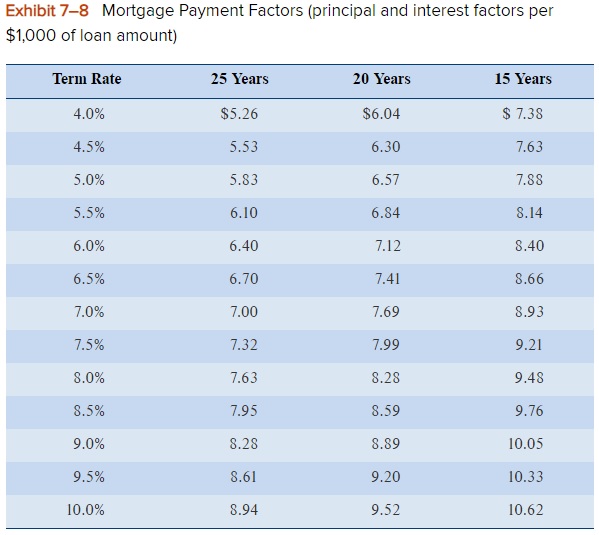

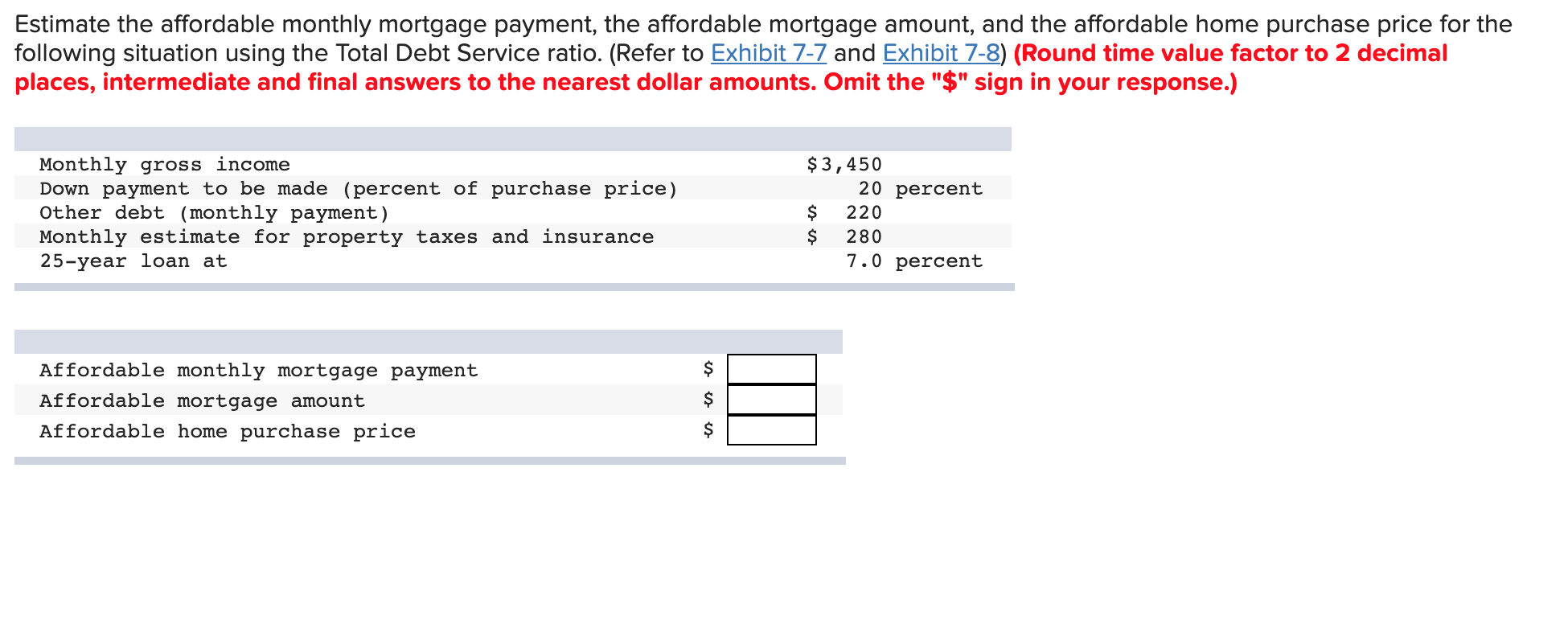

Exhibit 7-7 Housing Affordability and Mortgage Qualification Amounts Example A Example B Step 1: Determine your monthly gross income (annual income divided by 12). $ 72,000 12 Step 2: $ 6,000 $ 6,000 0.40 x 0.32 $ 2,400 $ 1.920 Step 3: With a down payment of at least 10 percent, lenders use 32 percent of monthly gross income as a guideline for the GDS ratio, and 40 percent of monthly gross income as a guideline for the TDS ratio. Subtract other debt payments (e.g., payments on an auto loan) and an estimate of the monthly costs of property taxes, heating, homeowner's insurance, mortgage insurance, and condo fees if applicable. (a) Affordable monthly mortgage payment Step 4: Divide this amount by the monthly mortgage payment based on current mortgage rates-a 4 percent, 25-year loan, for example (see Exhibit 7-8) and multiply by $1,000. (b) Affordable mortgage amount Step 5: Divide your affordable mortgage amount by 1 minus the fractional portion of your down payment (e.g., a 10 percent down payment). (c) Affordable home purchase price 500 600 600 $ 1,300 $ 1,320 $ 5.26 $ 5.26 $ 1,000 $ 1,000 $247,148 $250,950.57 0.9 0.9 $274,609 $278,833.96 Note: The two ratios lending institutions use (step 2) and other loan requirements may vary based on a variety of factors, including the type of mortgage, the amount of the down payment, your income level, and current interest rates. Exhibit 7-8 Mortgage Payment Factors (principal and interest factors per $1,000 of loan amount) Term Rate 25 Years 20 Years 15 Years 4.0% $5.26 $6.04 $ 7.38 4.5% 5.53 6.30 7.63 5.0% 5.83 6.57 7.88 5.5% 6.10 6.84 8.14 6.0% 6.40 7.12 8.40 6.5% 6.70 7.41 8.66 7.0% 7.00 7.69 8.93 7.5% 7.32 7.99 9.21 8.0% 7.63 8.28 9.48 8.5% 7.95 8.59 9.76 9.0% 8.28 8.89 10.05 9.5% 8.61 9.20 10.33 10.0% 8.94 9.52 10.62 Estimate the affordable monthly mortgage payment, the affordable mortgage amount, and the affordable home purchase price for the following situation using the Total Debt Service ratio. (Refer to Exhibit 7-7 and Exhibit 7-8) (Round time value factor to 2 decimal places, intermediate and final answers to the nearest dollar amounts. Omit the "$" sign in your response.) Monthly gross income $3,450 Down payment to be made (percent of purchase price) Other debt (monthly payment) 20 percent $ 220 Monthly estimate for property taxes and insurance 25-year loan at $ 280 7.0 percent Affordable monthly mortgage payment Affordable mortgage amount Affordable home purchase price $ es es es

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started