Answered step by step

Verified Expert Solution

Question

1 Approved Answer

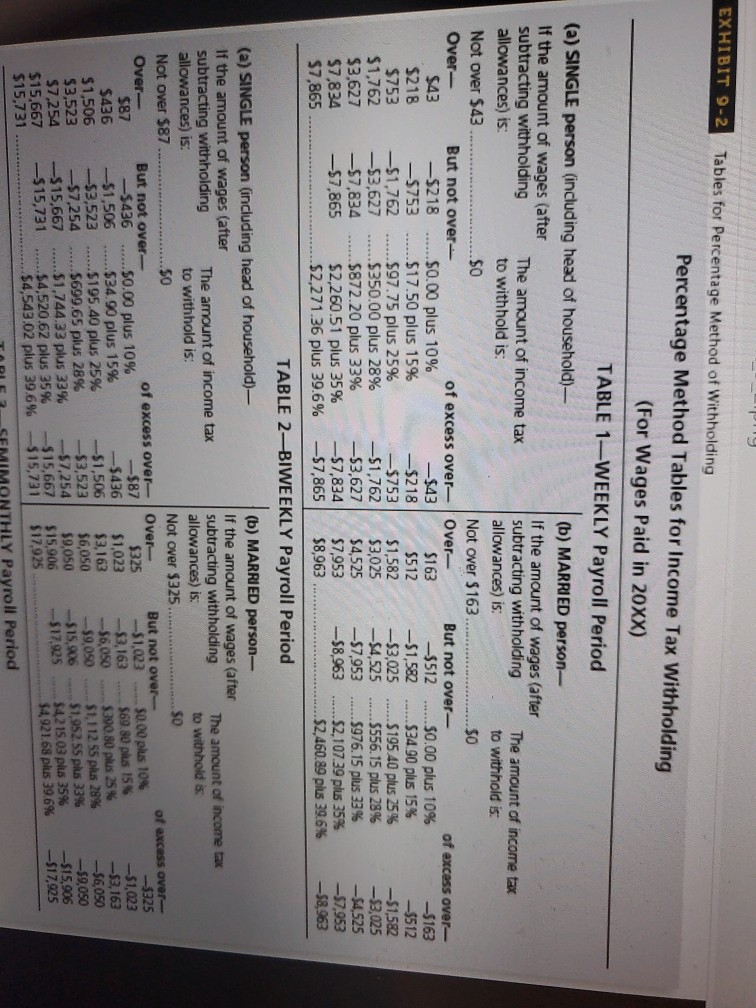

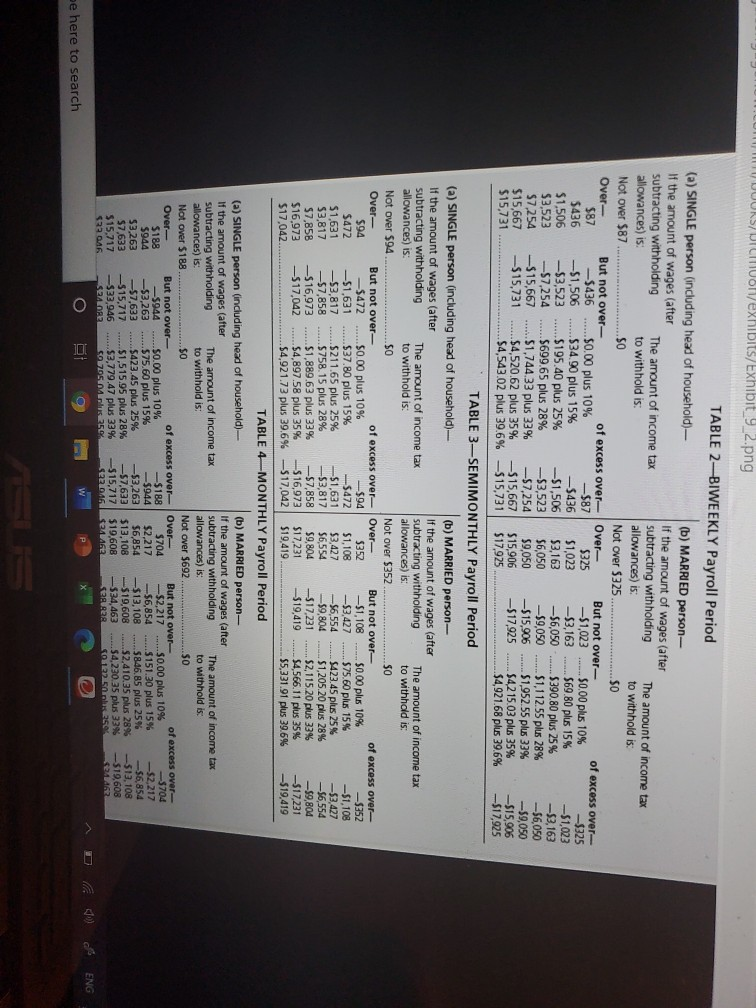

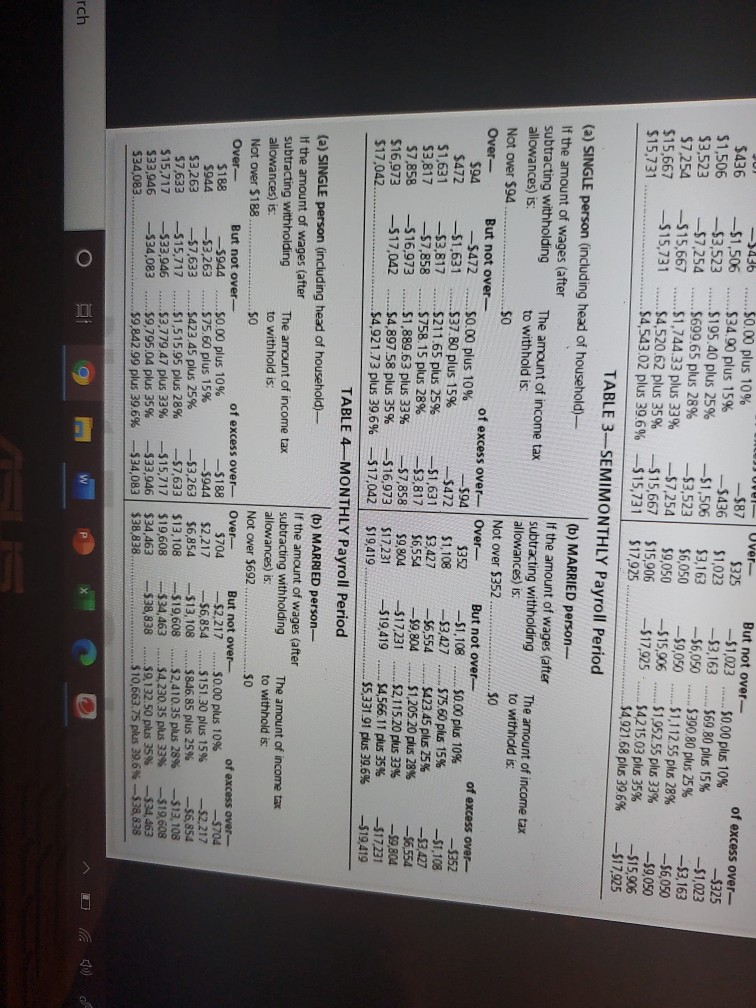

exhibit 9_1 exhibit 9_2 exhibit 9_2 I hope this time all pictures are clear BUSINESS DECISION: TAKE HOME PAY You are the payroll manager for

exhibit 9_1

exhibit 9_2

exhibit 9_2

I hope this time all pictures are clear

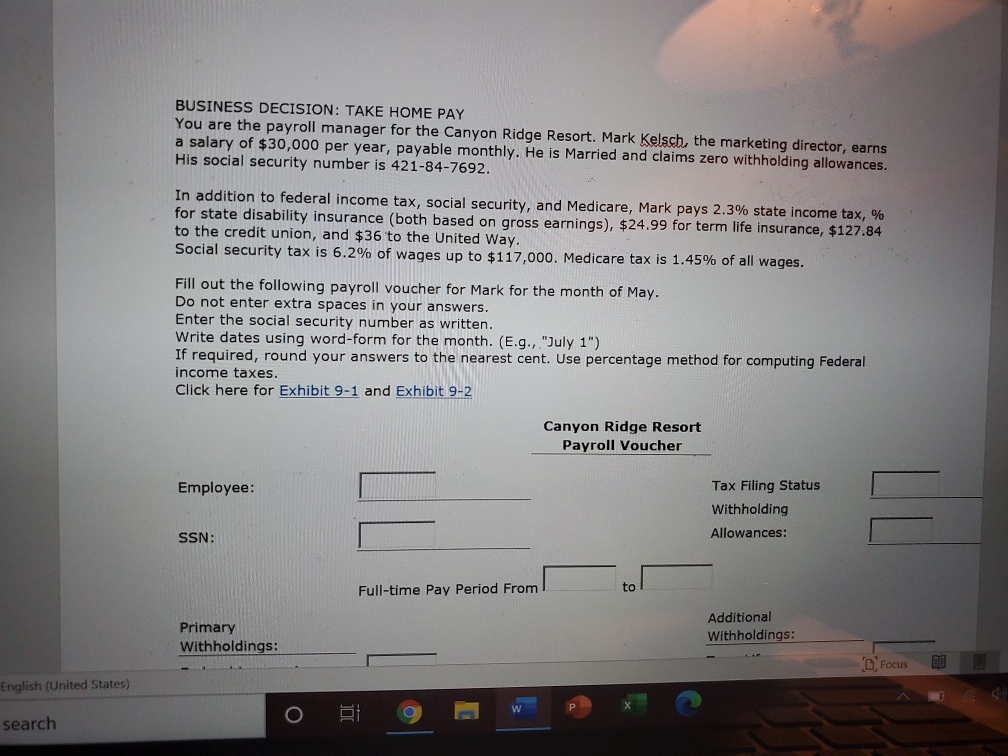

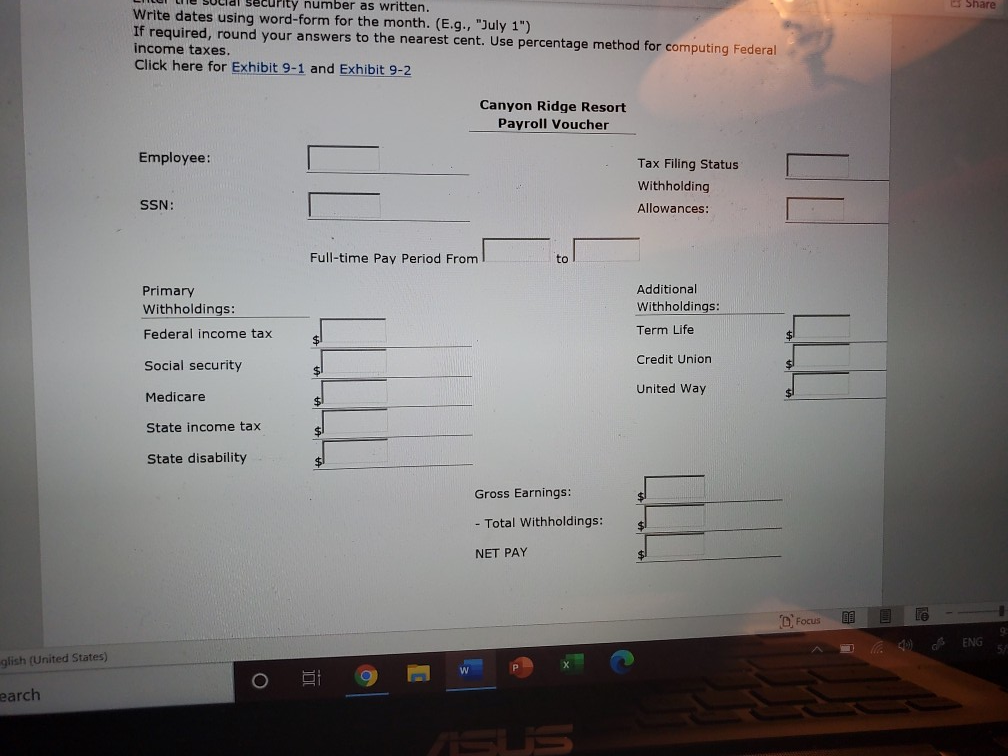

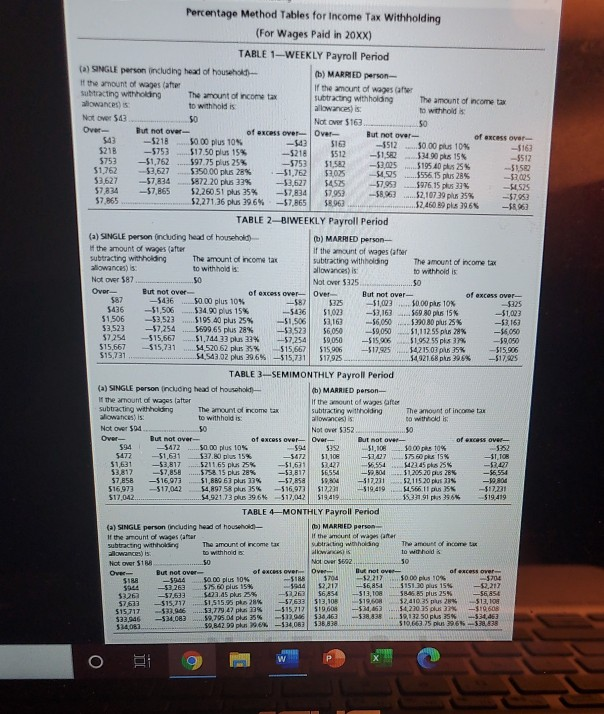

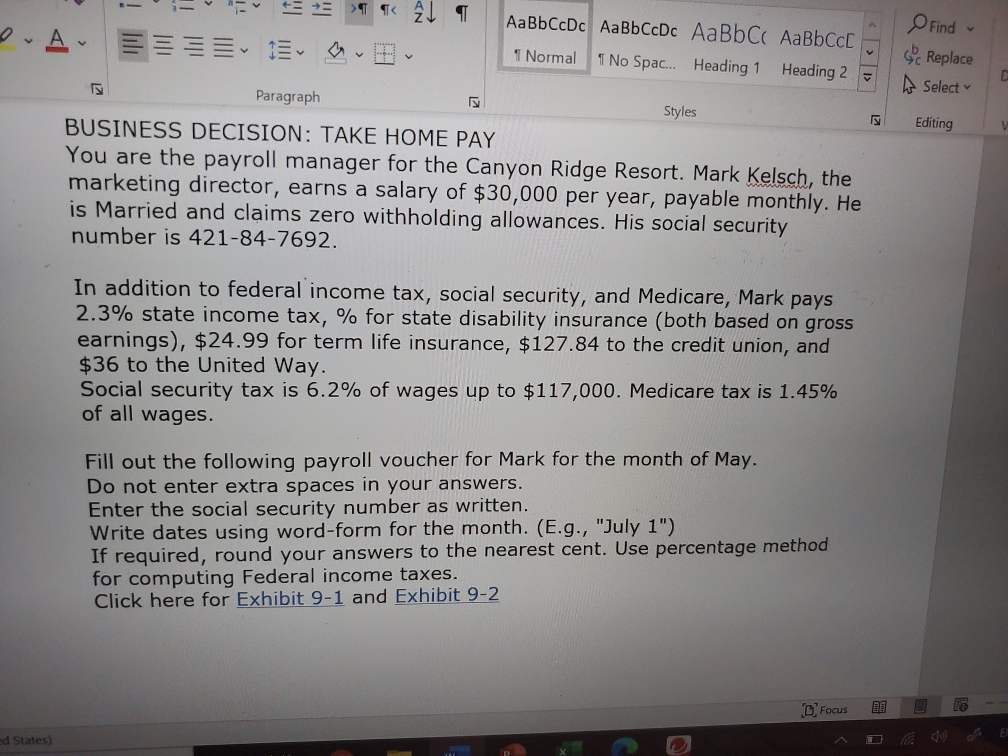

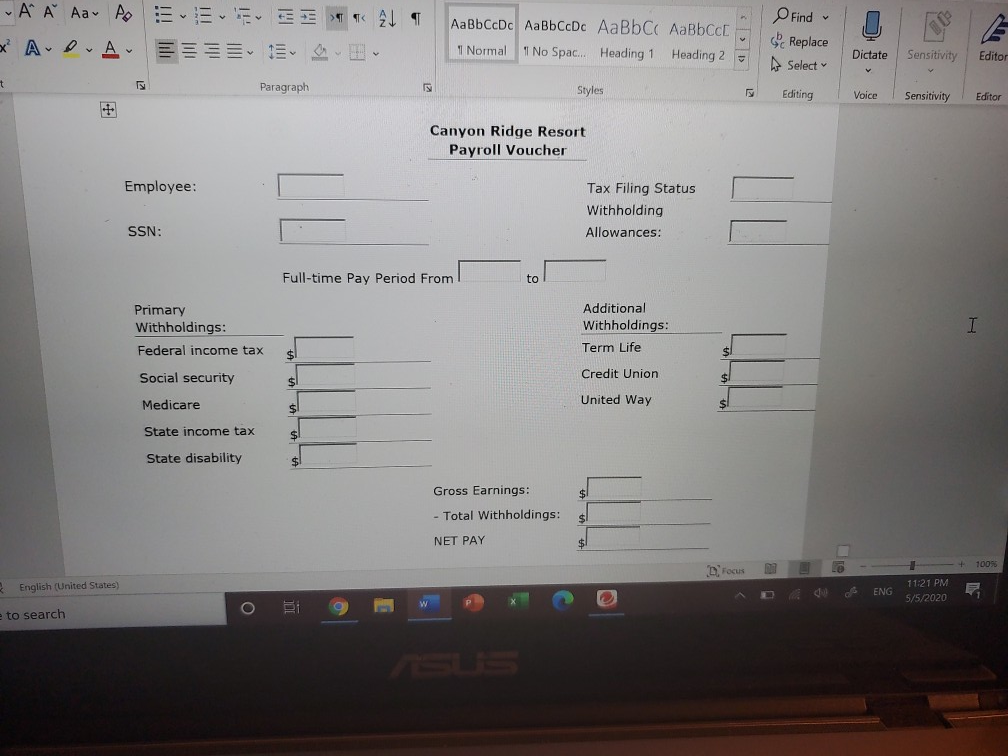

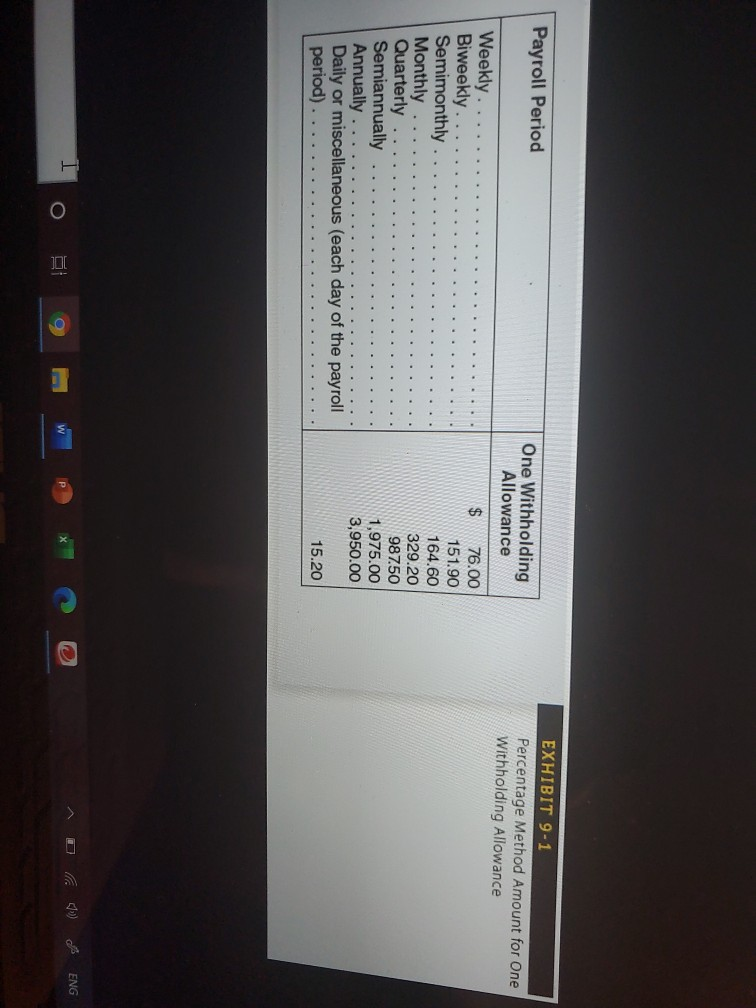

BUSINESS DECISION: TAKE HOME PAY You are the payroll manager for the Canyon Ridge Resort. Mark Kelsch, the marketing director, earns a salary of $30,000 per year, payable monthly. He is Married and claims zero withholding allowances. His social security number is 421-84-7692. In addition to federal income tax, social security, and Medicare, Mark pays 2.3% state income tax, % for state disability insurance (both based on gross earnings), $24.99 for term life insurance, $127.84 to the credit union, and $36 to the United Way. Social security tax is 6.2% of wages up to $117,000, Medicare tax is 1.45% of all wages. Fill out the following payroll voucher for Mark for the month of May. Do not enter extra spaces in your answers. Enter the social security number as written. Write dates using word-form for the month. (E.g., "July 1") If required, round your answers to the nearest cent. Use percentage method for computing Federal income taxes. Click here for Exhibit 9-1 and Exhibit 9-2 Canyon Ridge Resort Payroll Voucher Employee: Tax Filing Status Withholding Allowances: SSN: Full-time Pay Period From Additional Withholdings: Primary Withholdings: Focus English (United States) search Share LULUI Le solidl Security number as written. Write dates using word-form for the month. (E.g., "July 1") If required, round your answers to the nearest cent. Use percentage method for computing Federal income taxes. Click here for Exhibit 9-1 and Exhibit 9-2 Canyon Ridge Resort Payroll Voucher Employee: Tax Filing Status Withholding Allowances: SSN: Full-time Pay Period From Primary Withholdings: Federal income tax Additional Withholdings: Term Life Credit Union Social security United Way Medicare State income tax State disability Gross Earnings: - Total Withholdings: NET PAY Focus EEE- 4) ENG 5 glish (United States) earch Payroll Period EXHIBIT 9-1 Percentage Method Amount for One Withholding Allowance $ Weekly Biweekly Semimonthly Monthly Quarterly .. Semiannually Annually.... Daily or miscellaneous (each day of the payroll period)...... One Withholding Allowance 76.00 151.90 164.60 329.20 987.50 1,975.00 3,950.00 15.20 rch _ o B 9 WPC ASUS -5512 Percentage Method Tables for Income Tax Withholding (For Wages Paid in 20XX) TABLE 1-WEEKLY Payroll Period () SINGLE person including head of houss- 1) MARRIED per- the amount of wages Gate the amount of wages Subtracting w holding the amount of income tax subtracting withholding The amount of income tax shown to withholdis allowance is whold Not Over 50 Not over 5163 50 Over But not over- of Cover Over But not over of an over- 543 ---5218 50.00 plus 10% 52 510 5000 plus 10% -1167 --5753 $17.50 plus 15% -$218 5512 -$1.52 SMO 156 -5512 5753 -51,762 597 75 plus 25% -5753 5152 -1005 $195. -5150 51.762 ---3,627 $350.00 plus 28% ---$1,762 $2,025 - $5561525 - os $7834 5 87220 plus 32% -$2.627 SATS -57,953 976 15 plus ES 574 -57 865 52260 51 plus 25 -57634 57.953 3803 5210739 plus $7.965 52 271 36 plus 396 $7.865 ..J2450 plus 1965 TABLE 2-BIWEEKLY Payroll Period (a) SINGLE person including head of household) (h) MARIHED person the amount of wages after If the amount of wages (after Subtracting withholding the amount of income tax Subtracting withholding the amount of income tax allowance is to withholdis allowance is to withhold is Not Over 587 50 Not over 5325 Over But not over of excess over Over But not over of excess over $87 5436 50.00 plus 10% 5325 $1,023 10.00phs 10 $325 5436 $1.506 334,00 plus 15% $1.023 -33,167 $69 80 ps 15% -$1022 51.506 57.523 $195 40 plus 25% -$1.506 52.167 --56,050 5720.80 plus -110 $3,523 57,254 5699.65 plus 28% -3523 56.050 50.000 $1,112.55 plus 20% -300 57254 $15.667 51,744 33 plus 32% -57.254 1000 59050 15006 51052 55 pls 37% 50050 $15.667 $15.731 94520 52 plus 5% 515.667 $15006 -$17.975 1 421507 35% SI5.06 515,781.. . ...... 543.2 plus 39.6% -$15.731 517,925 5492168 pls 39.6% SE -5436 Ovo TABLE 3-SEMIMONTHLY Payroll Period (a) SINGLE person including head of household (b) MARRIED person the amount of wages latter If the amount of wages after subtracting withholding The amount of income tax subtracting withholding The amount of income tax wowance is to withhold is allowance is to withheld is Not Over 504 but not over of excess over Over- 1472 $0.00 plus 10% $1,100 - 12.00 h 10% - $1,631 537.80 plus 15% -5472 -307 575.60 15% 51631 --$3,817 5211.65 plus 25% ---$1,571 -5554 2245 pks 5 53.817 57,858 ....5758. 15 plus 28% -53,817 56554 --2304 205 20 plus 28% 57858 -$16 971 $1,880 67 plus 20% -$7,85 $904 -$17,271 5 2,115 20 plus 275 516973 $17,042 4.897 58 plus 15% 516 972 517271 --$19.419 14.566.11 $17,271 517,042 54.921.13 plus 396 512.042 51949 1531 $19.419 TABLE 4MONTHLY Payroll Period 19 (a) SINGLE person including head of household the amount of wages ar subtracting with MARRED person If the act of wages The amount of income Not O SIM But not over 000 plus 10% 5 1761 5793 $15.717 -SIL - 0 .15 plus 25% 51 5155 plus 2 , PU 9792 SAMD plus 9 5010 217 55 -5555 12.410 pes 2 3121 .54 270 35 % -10508 RS 510.695 2965-22 --- $30.53 -534 033 133 1 - 5 25 A1 AaBb CcDc AaBb CcDc AaBb C AaBbcc 1 Normal 1 No Spac... Heading 1 Heading 2 Find Sc Replace A Select Editing Paragraph Styles BUSINESS DECISION: TAKE HOME PAY You are the payroll manager for the Canyon Ridge Resort. Mark Kelsch, the marketing director, earns a salary of $30,000 per year, payable monthly. He is Married and claims zero withholding allowances. His social security number is 421-84-7692. In addition to federal income tax, social security, and Medicare, Mark pays 2.3% state income tax, % for state disability insurance (both based on gross earnings), $24.99 for term life insurance, $127.84 to the credit union, and $36 to the United Way. Social security tax is 6.2% of wages up to $117,000. Medicare tax is 1.45% of all wages. Fill out the following payroll voucher for Mark for the month of May. Do not enter extra spaces in your answers. Enter the social security number as written. Write dates using word-form for the month. (E.g., "July 1") If required, round your answers to the nearest cent. Use percentage method for computing Federal income taxes. Click here for Exhibit 9-1 and Exhibit 9-2 Focus 33 16 - ed States) - A A Aav to x Avon AE 1 A1 AaBbCcDc AaBbCcDc AaBb C AaBbcc 11 Normal 1 No Spac... Heading 1 Heading 2 Find v Sc Replace A Select Dictate Sensitivity Editor Paragraph Styles Editing Voice Sensitivity Editor Canyon Ridge Resort Payroll Voucher Employee: Tax Filing Status Withholding Allowances: SSN: Full-time Pay Period From I Additional Withholdings: Term Life Credit Union $1 Primary Withholdings: Federal income tax Social security Medicare State income tax State disability United Way Gross Earnings: - Total Withholdings: NET PAY al wit holdings 4 + 100% 3 English (United States) d o lo 11:21 PM ENG 5/5/2020 e to search Payroll Period EXHIBIT 9-1 Percentage Method Amount for One Withholding Allowance Weekly ........... Biweekly. Semimonthly Monthly Quarterly .......... Semiannually .. Annually ...... Daily or miscellaneous (each day of the payroll period) ..... One Withholding Allowance $ 76.00 151.90 164.60 329.20 987.50 1,975.00 3,950.00 15.20 A D (0) ENG -M9 $0 $0 EXHIBIT 9-2 Tables for Percentage Method of Withholding Percentage Method Tables for Income Tax Withholding (For Wages Paid in 20XX) TABLE 1-WEEKLY Payroll Period (a) SINGLE person (including head of household)--- (b) MARRIED person- If the amount of wages (after subtracting withholding If the amount of wages (after The amount of income tax allowances) is: subtracting with holding to withhold is: The amount of income tax allowances) is: to withhold is: Not over $43 Not over $163 Over- But not over- of excess over- Over But not over- $43 -5218 of excess over- ......$0.00 plus 10% -$43 $163 -5512......50.00 plus 10% $218 -5163 -5753 .....$17.50 plus 15% -$218 $512 -$1,582 ...$34.90 plus 15% $753 -$512 -$1,762 ...... $97.75 plus 25% -$753 $1,582 -$3,025 .....$195 40 plus 25% $1,762 -$3,627 -S1,582 ..$350.00 plus 28% -51,762 $3,025 -54,525 ......$556.15 plus 28% -$3,025 $3,627 -$7,834 $872.20 plus 33% --$3,627 $4,525 -$7,953 ......5976.15 plus 33% -54,525 $7,834 -$7,865 $2,260.51 plus 35% $7,834 $7,953 -$8,963 ......52.107.39 plus 35% -57,953 $7,865 ...$2,271.36 plus 39.6% -$7,865 $8,963 ... .....52.460.89 plus 39.6% -58,963 TABLE 2-BIWEEKLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages (after If the amount of wages (after subtracting withholding the amount of income tax subtracting withholding The amount of income tax allowances) is: to withhold is: allowances) is: to withhold is Not over 587... Not over $325. Over- of excess over- But not over- of excess over Over But not over $87 -5436 -$87 ......50.00 plus 10% -$325 $325 ---$1,023 $0.00 plus 10% $436 -$1.506 -$1,023 ......$34.90 plus 15% $1,023 -$436 -193.163 $69.80 plus 15$ $1,506 --53,163 --$3,523 ......$195.40 plus 25% $3,163 ---$1,506 ---$6,050....390.80 plus 25% --56,050 $6,050 -$7,254 ......$699.65 plus 28% -$3,523 ---$9,050...51,112 55 plus 28% $3,523 -59,050 $9,050 $1,952.55 plus 33% -$15,667 --$15,906 -$7.254 $7,254 .....$1,744.33 plus 33% -$17.925 -515,906 54215.03 plus 35% $15,906 --$15,731 ......$4,520.62 plus 35% $15,667 ---$17.925 .54921.68 plus 39.6% $15,731 ... ......$4,543.02 plus 39.6% -$15,731 517,925. TORLE SEMIMONTHLY Payroll Period .50 ***. $0 -$15.667 J U MUUURSUICIO/exhibits/Exhibit_9_2.png ..50 TABLE 2-BIWEEKLY Payroll Period (*) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages (after If the amount of wages (after subtracting withholding The amount of income tax subtracting withholding allowances) is: to withhold is: The amount of income tax allowances) is: to withhold is: Not over $87..... Not over $325 $0 Over But not over- of excess over Over $87 But not over- -5436 .....50.00 plus 10% of excess over- -$87 $325 -$1,023 ....... $0.00 plus 10% $436 -$1,506 ......$34.90 plus 15% --$325 -5436 $1,023 -53,163 ...... 69.80 plus 15% $1,506 -$3,523 ......$195.40 plus 25% -$1,023 -$1,506 $3,163 -$6,050 ....... 5390.80 plus 25% $3,523 -$3.163 -$7,254 ......$699.65 plus 28% - $3,523 $6,050 -$9,050 .....$1,112.55 plus 28% $7,254 -56,050 -5 15,667 .....$1,744.33 plus 33% -$7,254 $9,050 -$15,906 ....... $1,952.55 plus 33% $15,667 ---$9,050 -$15,731 ......$4,520.62 plus 35% $15,667 $15,906 -$17,925 .....$4215.03 plus 35% -$15,906 $15,731 .. .......$4,543.02 plus 39.6% -515,731 $17.925 ......54,921.68 plus 39.6% -$17,925 TABLE 3-SEMIMONTHLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages (after If the amount of wages (after subtracting withholding The amount of income tax subtracting withholding The amount of income tax allowances) is: to withhold is: allowances) is: to withhold is: Not over 594............... $0 Not over $352 Over- But not over- of excess over Over But not over- of excess over- $94 -$472 ......$0.00 plus 10% -$94 5352 -$1,108 ... $0.00 plus 10% -$352 $472 -$1,631 ......537.80 plus 15% -5472 $1,108 -$3,427 ....... $75.60 plus 15% -$1,108 $1,631 -53,817 ......$211.65 plus 25% -51,631 53,427 -56,554 .......5423.45 plus 25% -53,427 53,817 -$7,858 ...... $758.15 plus 28% -53,817 56,554 -$9,804 ......$1,205,20 plus 28% - $6,554 $7,858 -516,973 ......$1,889.63 plus 33% -$7,858 59,804 517,231 ....... 52,115.20 plus 33% -$9,804 $16.973 517,042 .....$4,897.58 plus 35% - 16,973 $17,231 -519,419 .......$4,566.11 plus 35% --$17,231 $17,042 ....$4.921.73 plus 39.6% -517,042 $19.419. 55,331.91 plus 39.6% -519,419 TABLE 4MONTHLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages (after If the amount of wages (after subtracting withholding The amount of income tax subtracting withholding The amount of income tax allowances) is: to withhold is: allowances) is: to withhold is: Not over $188... Not over $692........ ... .....50 Over- But not over- of excess over Over- But not over of excess over- $188 -5944 ....50.00 plus 10% -5188 $704 -$2,217 -3704 ......$0.00 plus 10% 5944 -53,263 ....575.60 plus 15% -$944 $2,217 -$2,217 -56,854 .....5151.30 plus 15% 53.263 -57,633 ... 5423.45 plus 25% -$3,263 -56,854 56,854 -513,108 ......5846,85 plus 25% 57,633 -515,717 ...... 51,515.95 plus 28% -97,633 513,108 519,608 13.106 ... 52.410.35 plus 28% $15.717 533,946 ......53,779.47 plus 33% $15,717519,608 -19.000 -334,463.....54.230.35 plus 33% .25% 2 40250 205.04 $32 016 50.122.50 -e828 22.04624462 250 Dla J . ..SO 2462 ENG we here to search ove Over -$325 $0 -3436 ..... $0.00 plus 10% But not over- 5436 -$87 -$1,506 ......$34.90 plus 15% $325 --$1,023 ......50.00 plus 10% of excess over- $1,506 -$3,523 ......$195.40 plus 25% -5436 $1,023 -53,163 ..... 569.80 plus 15% $3,523 -$1,506 -$7,254 ......$699.65 plus 28% $3,163 -56,050 ..... 5390,80 plus 25% --$1,023 $7.254 -$3,523 -515,667 $6,050 -$3,163 $1,744.33 plus 33% --59,050 $15,667 -$7,254 .....51,112.55 plus 28% $15,731 $9,050 --$6,050 ......$4,520.62 plus 35% -$15,906 $15,731 -515,667 ...... 51,952.55 plus 33% $15,906 $4,543.02 plus 39.6% -$17,925 .......$4215.03 plus 35% -$9,050 -515,731 $17,925 -515,906 ...54,921.68 plus 39.6% -$17,925 TABLE 3-SEMIMONTHLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages (after subtracting withholding If the amount of wages (after The amount of income tax allowances) is: subtracting withholding to withhold is The amount of income tax allowances) is Not over $94 to withhold is: Not over $352 ................ Over- But not over- of excess over- Over- $94 But not over- -5472 ......$0.00 plus 10% of excess over- -$94 $472 $352 -S1,108 ......50.00 plus 10% -$1.631 ......$37.80 plus 15% -$352 -$472 51,108 $1,631 -$3,817 -$3,427 ....... 575.60 plus 15% ..$211.65 plus 25% ---$1,108 -$1,631 $3,427 53,817 -$7,858 -56,554 ...... $423.45 plus 25% $758.15 plus 28% -$3,427 -$3,817 $6,554 -59,804 ..... $1,205,20 plus 28% $7,858 -516,973 -56,554 .$1,889.63 plus 33% -$7,858 $9,804 -$17,231 ...$2,115.20 plus 33% $16,973 -$17,042 -$9,804 $4,097.58 plus 35% -516,973 $17,231 -$19,419 .......$4,566.11 plus 35% $17,042... -$17,231 $4,921.73 plus 39.6% -$17,042 $19,419. ... $5,331 91 plus 39.6% -519,419 TABLE 4MONTHLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages (after If the amount of wages (after subtracting withholding The amount of income tax subtracting withholding The amount of income tax allowances) is: to withhold is: allowances) is: to withhold is: Not over $188... $0 Not over $692... so Over But not over- of excess over Over But not over- of excess over- 5188 -5944 ......$0.00 plus 10% -5188 $704 -$2,217.....$0.00 plus 10% -3704 $944 -53,263 .....$75.60 plus 15% -$944 $2,217 -56,854 ...5151.30 plus 15% -$2,217 $3,263 -$7,633......$423.45 plus 25% -$3,263 $6,854 -$13,108 ..... $846.85 plus 25% 56,854 57,633 $15,717 ......$1,515.95 plus 28% -$7,633 $13,108 -$19,608 .....$2,410.35 plus 28% -513,108 $15,717 -$33,946 ......$3.779.47 plus 33% -$15,717 $19,608 -$34,463......$4,230.35 plus 33% -519,608 $33,946 -$34,083 ......$9,795.04 plus 35% - $33,946 $34,463 -538,838 .....39.132.50 plus 35% -334,463 $34,083 59,842.99 plus 39.6% -$34,083 538,838 .........$10,663.75 plus 39.6% -538,838 rchStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started