Answered step by step

Verified Expert Solution

Question

1 Approved Answer

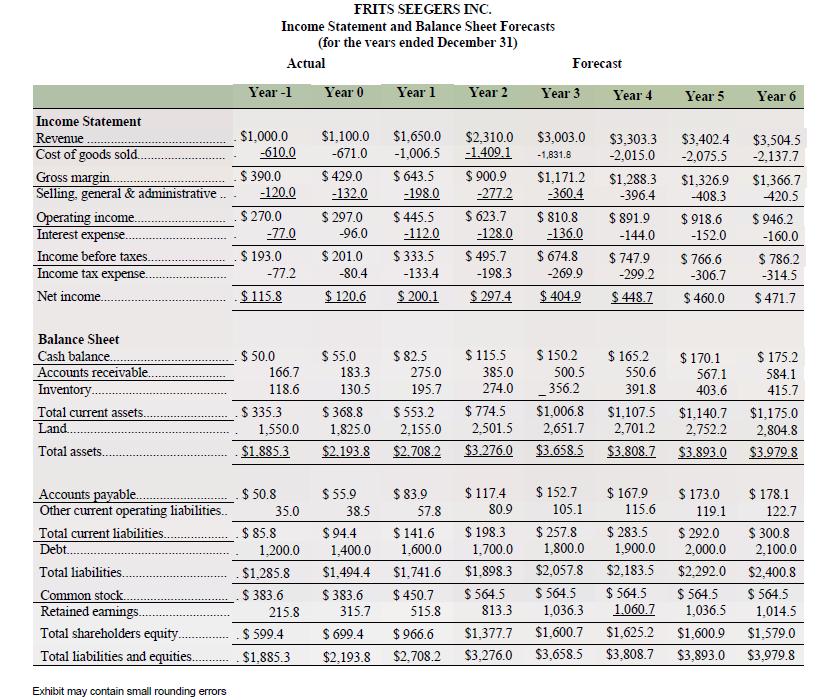

Exhibit below for Frits Seegers Inc. and measure the free cash flow for Seegers for Year 0 and six years of forecasts (Year +1 to

Exhibit below for Frits Seegers Inc. and measure the free cash flow for Seegers for Year 0 and six years of forecasts (Year +1 to Year +6) shown. The company does not hold any excess cash, so the change in the cash balance is equal to the change in required cash. The change in Retained Earnings in a year is equal to the company’s net income minus the dividends declared by the company in that year. Discuss the major factors that caused the free cash flows to change from year to year.

Income Statement Revenue Cost of goods sold.. Gross margin. Selling, general & administrative Operating income. Interest expense... Income before taxes.. Income tax expense. Net income... Balance Sheet Cash balance..... Accounts receivable.. Inventory... Total current assets. Land... Total assets.. Accounts payable... Other current operating liabilities... Total current liabilities.. Debt... Total liabilities.. Common stock. Retained earnings.. Total shareholders equity... Total liabilities and equities.... Exhibit may contain small rounding errors Year -1 $1,000.0 FRITS SEEGERS INC. Income Statement and Balance Sheet Forecasts (for the vears ended December 31) Actual -610.0 $ 390.0 -120.0 $ 270.0 -77.0 $ 193.0 -77.2 $115.8 $ 50.0 166.7 118.6 . $335.3 1,550.0 . $1.885.3 $50.8 35.0 $85.8 1,200.0 $1,285.8 $383.6 215.8 .$ 599.4 $1.885.3 Year 0 $1,100.0 $1,650.0 -671.0 -1,006.5 $ 429.0 -132.0 $ 297.0 -96.0 $201.0 -80.4 $ 120.6 $ 55.0 183.3 130.5 $55.9 38.5 $94.4 1,400.0 $1,494.4 $383.6 Year 1 315.7 $ 699.4 $2,193.8 $ 643.5 -198.0 $445.5 -112.0 $333.5 -133.4 $ 200.1 $82.5 275.0 195.7 $83.9 57.8 $368.8 $ 553.2 $774.5 1,825.0 2,155.0 $2.193.8 $2.708.2 2.501.5 $3.276.0 $ 141.6 1,600.0 $1,741.6 $450.7 Year 2 515.8 $2,310.0 -1.409.1 $ 900.9 -277.2 $ 623.7 -128.0 $495.7 -198.3 $ 297.4 $ 115.5 385.0 274.0 $117.4 80.9 $198.3 1,700.0 $1.898.3 $ 564.5 813.3 Forecast Year 3 $3,003.0 -1,831.8 $1,171.2 -360.4 $ 810.8 -136.0 $ 674.8 -269.9 $ 404.9 $ 150.2 500.5 _356.2 $ 152.7 105.1 Year 4 $257.8 1,800.0 $2,057.8 $ 564.5 $3,303.3 -2,015.0 $1,288.3 -396.4 $ 891.9 -144.0 $ 747.9 -299.2 $448.7 $ 165.2 550.6 391.8 $ 167.9 115.6 $ 283.5 Year 5 1,900.0 $2,183.5 $ 564.5 $3,402.4 -2,075.5 $1,006.8 $1,107.5 2,651.7 2,701.2 2,752.2 $3.658.5 $3.808.7 $3.893.0 1.060.7 $1,326.9 -408.3 $918.6 -152.0 $766.6 -306.7 $ 460.0 $ 170.1 567.1 403.6 $ 173.0 119.1 $ 292.0 2,000.0 $2,292.0 $564.5 Year 6 $1.140.7 $1,175.0 2,804.8 $3.979.8 1,036.5 $3,504.5 -2,137.7 1,036.3 $966.6 $1,377.7 $1,600.7 $2,708.2 $3,276.0 $3,658.5 $3,808.7 $3,893.0 $1,366.7 -420.5 $946.2 -160.0 $ 786.2 -314.5 $471.7 $ 300.8 2,100.0 $2,400.8 $ 564.5 1,014.5 $1,625.2 $1,600.9 $1,579.0 $3,979.8 $ 175.2 584.1 415.7 $ 178.1 122.7

Step by Step Solution

★★★★★

3.29 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the free cash flow for Frits Seegers Inc we need to consider the changes in cash balance retained earnings and other relevant factors Her...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started