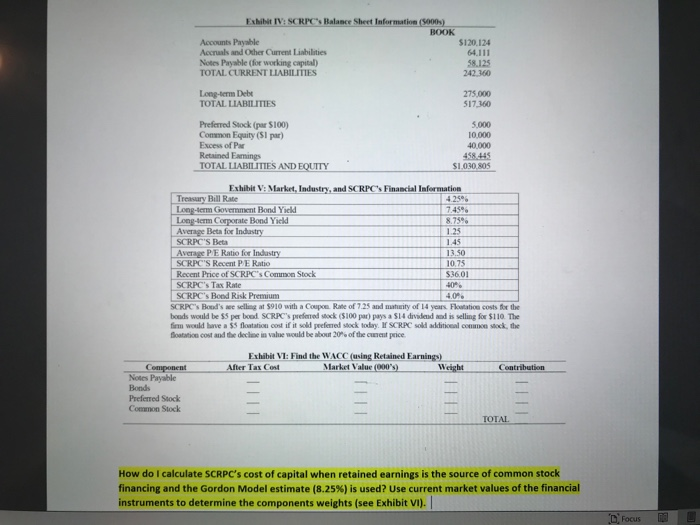

Exhibit IV: SCRPC's Balance Sheet Information (5000) BOOK Accounts Payable Accruals and Other Current Liabilities Notes Payable for working capital) TOTAL CURRENT LIABILITIES $120,124 64,111 58.125 242160 Long-term Delt TOTAL LIABILITIES 275.000 517160 Preferred Stock (par S100) Common Equity (S1 par) Excess of Pa Retained Emings TOTAL LIABILITIES AND EQUITY 5.000 10 000 40.000 458 445 SIOSOS 1.25 Exhibit V: Market, Industry, and SCRPC's Financial Information Treasury Bill Rate 4.256 Long-term Government Bond Yield 7460 Long-term Corporate Bond Yield 8.75% Average Beta for Industry SCRPC'S Beta Average PE Ratio for Industry ISO SCRPC'S Recent PE Ratio Recent Price of SCRPC's Common Stock $36.01 SCRPC's Tax Rate 20 SCRPC's Bond Risk Premium 40 SCRPC's Band's e selling at $910 with a Coupe Rate of 725 and many of 14 years. Flation costs for the boods would be $5 per bood SCRPC's preferred stock (100 par pays a S14 dividend and is selling for $110. The firm would have a $$ floatation cost if it sold preferred stock today. ISCRPC sold additional common stock the flotation cost and the decline in value would be about 20% of the content price Exhibit VI: Find the WACC (using Retained Earnings) After Tax Cost Market Value (000's) Weight Contribution Component Notes Payable Bonds Preferred Stock Common Stock TOTAL How do I calculate SCRPC's cost of capital when retained earnings is the source of common stock financing and the Gordon Model estimate (8.25%) is used? Use current market values of the financial instruments to determine the components weights (see Exhibit VI). Focus D E Exhibit IV: SCRPC's Balance Sheet Information (5000) BOOK Accounts Payable Accruals and Other Current Liabilities Notes Payable for working capital) TOTAL CURRENT LIABILITIES $120,124 64,111 58.125 242160 Long-term Delt TOTAL LIABILITIES 275.000 517160 Preferred Stock (par S100) Common Equity (S1 par) Excess of Pa Retained Emings TOTAL LIABILITIES AND EQUITY 5.000 10 000 40.000 458 445 SIOSOS 1.25 Exhibit V: Market, Industry, and SCRPC's Financial Information Treasury Bill Rate 4.256 Long-term Government Bond Yield 7460 Long-term Corporate Bond Yield 8.75% Average Beta for Industry SCRPC'S Beta Average PE Ratio for Industry ISO SCRPC'S Recent PE Ratio Recent Price of SCRPC's Common Stock $36.01 SCRPC's Tax Rate 20 SCRPC's Bond Risk Premium 40 SCRPC's Band's e selling at $910 with a Coupe Rate of 725 and many of 14 years. Flation costs for the boods would be $5 per bood SCRPC's preferred stock (100 par pays a S14 dividend and is selling for $110. The firm would have a $$ floatation cost if it sold preferred stock today. ISCRPC sold additional common stock the flotation cost and the decline in value would be about 20% of the content price Exhibit VI: Find the WACC (using Retained Earnings) After Tax Cost Market Value (000's) Weight Contribution Component Notes Payable Bonds Preferred Stock Common Stock TOTAL How do I calculate SCRPC's cost of capital when retained earnings is the source of common stock financing and the Gordon Model estimate (8.25%) is used? Use current market values of the financial instruments to determine the components weights (see Exhibit VI). Focus D E