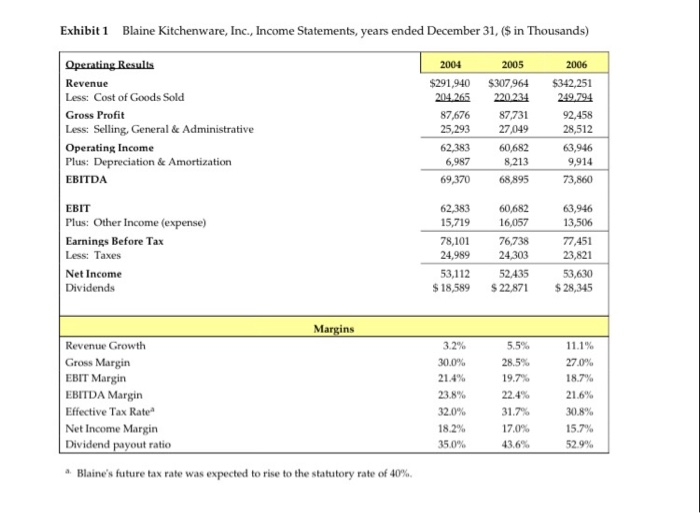

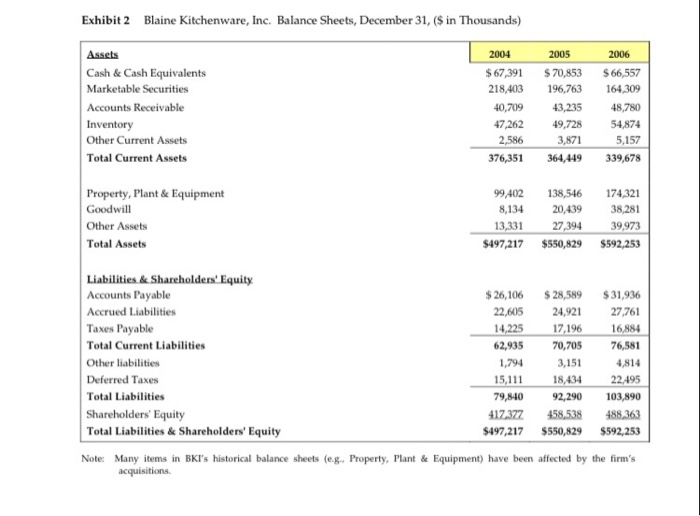

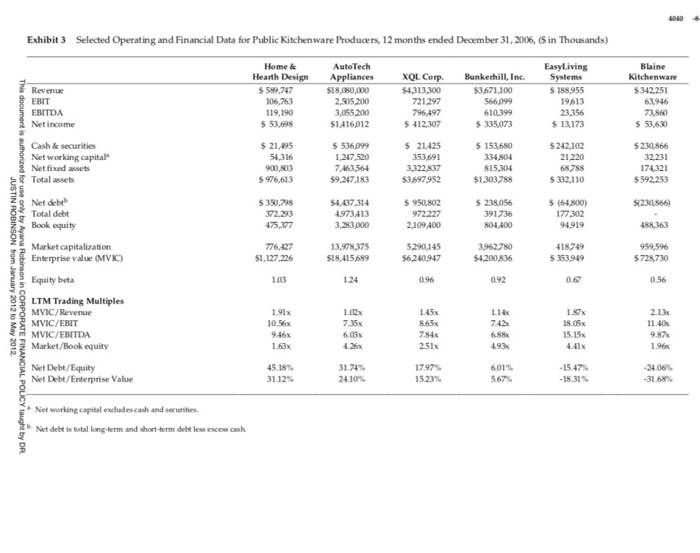

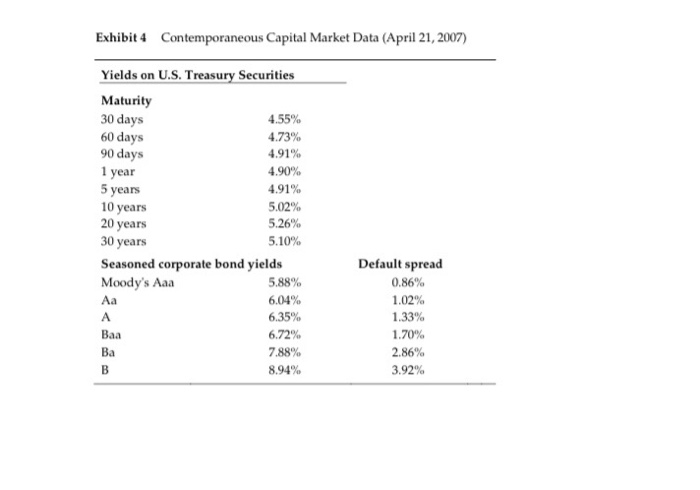

Exhibiti Blaine Kitchenware, Inc., Income Statements, years ended December 31, ($ in Thousands) Operating Results 2004 2005 2006 Revenue $291,940 $307,964 $342,251 Less: Cost of Goods Sold 204.265 220.234 249.794 Gross Profit 87,676 87,731 92,458 Less: Selling, General & Administrative 25,293 27,049 28,512 Operating Income 62,383 60,682 63,946 Plus: Depreciation & Amortization 6,987 8,213 9,914 EBITDA 69,370 68,895 73,860 62,383 60,682 63,946 Plus: Other Income (expense) 15,719 16,057 13,506 Earnings Before Tax 78,101 76,738 77,451 Less: Taxes 24,989 24,303 23,821 Net Income 53,112 52.435 53,630 Dividends $ 18,589 $ 22,871 $ 28,345 Margins Revenue Growth Gross Margin EBIT Margin EBITDA Margin Effective Tax Rate Net Income Margin Dividend payout ratio 3.2% 30.0% 21.4% 23.8% 32.0% 18.2% 35.0% 5.5% 28.5% 19.7% 22.4% 31.7% 17.0% 43.6% 11.1% 27.0% 18.7% 21.6% 30.8% 15.7% 52.9% a. Blaine's future tax rate was expected to rise to the statutory rate of 40%. Exhibit 2 Blaine Kitchenware, Inc. Balance Sheets, December 31, (S in Thousands) 2006 Assets Cash & Cash Equivalents Marketable Securities Accounts Receivable Inventory Other Current Assets Total Current Assets 2004 $ 67,391 218,403 40,709 47,262 2,586 376,351 2005 $ 70,853 196,763 43,235 49,728 3,871 364,449 $ 66,557 164,309 48,780 54,874 5,157 339,678 Property, Plant & Equipment Goodwill Other Assets Total Assets 99,402 138,546 174,321 8,134 20,439 38,281 13,331 27,394 39,973 $497,217 $550,829 $592,253 Liabilities & Shareholders' Equity Accounts Payable $ 26,106 $28,589 $ 31,936 Accrued Liabilities 22,605 24,921 27,761 Taxes Payable 14,225 17,196 16,884 Total Current Liabilities 62,935 70,705 76,581 Other liabilities 1,794 3,151 4,814 Deferred Taxes 15,111 18,434 22495 Total Liabilities 79,840 92,290 103,890 Shareholders' Equity 417.377 458,538 488,363 Total Liabilities & Shareholders' Equity $497,217 $550,829 $592,253 Note: Many items in BKI's historical balance sheets (e.g., Property, Plant & Equipment) have been affected by the firm's acquisitions. 1040 Exhibit 3 Selected Operating and Financial Data for Public Kitchenware Producers, 12 months ended December 31, 2006, (s in Thousands) Home & Hearth Design $ 599,747 106,763 119,190 $ 53,608 AutoTech. Appliances $18,000,000 2,505,200 3,055,200 $1416,012 XQL Corp $4.313,300 721297 796,497 $ 412,307 Bunkerhill, Inc. $3,671,100 566,199 610,399 $ 335,073 Easy Living Systems $ 188,955 19613 23,356 $ 13.173 Blaine Kitchenware $342.251 63.946 73,860 $ 53,630 Revenue EBIT EBITDA Net income Cash & securities Networking capital Net fixed assets Total assets Net debe Total debt Book equity Market capitalization Enterprise value (MVIC) $21.95 51,316 900,803 S 976,613 $ 536099 1,247,520 7,463564 $9,247,183 $ 21425 353,691 3,322,837 $3,697952 $ 153,680 334,804 815,304 $1,303788 $ 242,102 21.220 68788 $ 332,110 $ 230,866 32.231 174,321 $592.253 $(230866) $ 390,798 372.293 475.07 54.437,314 4,973413 3,283,000 $ 950,802 972.227 2,109400 $ 238,056 391736 804400 $ (64800) 177302 94,919 488.363 776,427 $1,127.226 13,978,375 $18.415.689 5.290.145 $6240,947 3,962.780 $4.200836 418749 $ 353,949 959,596 $728.730 JUSTIN ROBINSON from January 2012 to May 2012 This document is authorized for use only by Ayana Robinson in CORPORATE FINANCIAL POLICY taught by DR. Equity beta 103 1.24 096 092 0.67 0.56 1.91% 10:56 LTM Trading Multiples MVIC/Revenue MVIC/EBIT MVIC/EBITDA Market/Book equity Net Debt/Equity Net Debt/Enterprise Value 1.00 7.35 6.3x 4.26% 1.45x 8.65% 7.84 1.14 7.42 6.88 493 1.80X 18.05 15.15 4.41% 946x 1.63% 2.13 11.40 9.87% 1.96 251x 1797% 601% 45.18% 31.12% 31.74% 24.10% 1523% -18.31% Net working capital exdudes cash and securities Net debt is total long-term and short-term debt less excess cash Exhibit 4 Contemporaneous Capital Market Data (April 21, 2007) Yields on U.S. Treasury Securities Maturity 30 days 4.55% 60 days 4.73% 90 days 4.91% 1 year 4.90% 5 years 4.91% 10 years 5.02% 20 years 5.26% 30 years 5.10% Seasoned corporate bond yields Moody's Aaa 5.88% 6.04% 6.35% Baa Ba 7.88% B 8.94% Default spread 0.86% 1.02% 1.33% 1.70% 2.86% 3.92% 6.72% BLAINE KITCHENWARE 1. Evaluate the financial performance of Blaine Kitchen Ware over the period 2004.2005 and 2006 using financial ratios and commonsize analysis. 2. Calculate Blaine Kitchenware's Free cash flow, equity cash flow and capital cash flow for 2004,2005 and 2006. 3. Estimate Blaine Kitchenware's WACC in 2006, assuming an equity risk premium of 7.0% 4. Critically evaluate Blaine Kitchenware's current capital structure and dividend policy. 5. Analyze the impact of the proposed restructuring on Blaine's 2006 financial ratios, free cash flow, equity cash flow and wacc. (prepare the 2006 statements as if the restructuring was in place and analyze the impact. 6. Assuming a constant long term growth rate of 3%, estimate Blaine's share price in 2006 and after the proposed restructuring. Exhibiti Blaine Kitchenware, Inc., Income Statements, years ended December 31, ($ in Thousands) Operating Results 2004 2005 2006 Revenue $291,940 $307,964 $342,251 Less: Cost of Goods Sold 204.265 220.234 249.794 Gross Profit 87,676 87,731 92,458 Less: Selling, General & Administrative 25,293 27,049 28,512 Operating Income 62,383 60,682 63,946 Plus: Depreciation & Amortization 6,987 8,213 9,914 EBITDA 69,370 68,895 73,860 62,383 60,682 63,946 Plus: Other Income (expense) 15,719 16,057 13,506 Earnings Before Tax 78,101 76,738 77,451 Less: Taxes 24,989 24,303 23,821 Net Income 53,112 52.435 53,630 Dividends $ 18,589 $ 22,871 $ 28,345 Margins Revenue Growth Gross Margin EBIT Margin EBITDA Margin Effective Tax Rate Net Income Margin Dividend payout ratio 3.2% 30.0% 21.4% 23.8% 32.0% 18.2% 35.0% 5.5% 28.5% 19.7% 22.4% 31.7% 17.0% 43.6% 11.1% 27.0% 18.7% 21.6% 30.8% 15.7% 52.9% a. Blaine's future tax rate was expected to rise to the statutory rate of 40%. Exhibit 2 Blaine Kitchenware, Inc. Balance Sheets, December 31, (S in Thousands) 2006 Assets Cash & Cash Equivalents Marketable Securities Accounts Receivable Inventory Other Current Assets Total Current Assets 2004 $ 67,391 218,403 40,709 47,262 2,586 376,351 2005 $ 70,853 196,763 43,235 49,728 3,871 364,449 $ 66,557 164,309 48,780 54,874 5,157 339,678 Property, Plant & Equipment Goodwill Other Assets Total Assets 99,402 138,546 174,321 8,134 20,439 38,281 13,331 27,394 39,973 $497,217 $550,829 $592,253 Liabilities & Shareholders' Equity Accounts Payable $ 26,106 $28,589 $ 31,936 Accrued Liabilities 22,605 24,921 27,761 Taxes Payable 14,225 17,196 16,884 Total Current Liabilities 62,935 70,705 76,581 Other liabilities 1,794 3,151 4,814 Deferred Taxes 15,111 18,434 22495 Total Liabilities 79,840 92,290 103,890 Shareholders' Equity 417.377 458,538 488,363 Total Liabilities & Shareholders' Equity $497,217 $550,829 $592,253 Note: Many items in BKI's historical balance sheets (e.g., Property, Plant & Equipment) have been affected by the firm's acquisitions. 1040 Exhibit 3 Selected Operating and Financial Data for Public Kitchenware Producers, 12 months ended December 31, 2006, (s in Thousands) Home & Hearth Design $ 599,747 106,763 119,190 $ 53,608 AutoTech. Appliances $18,000,000 2,505,200 3,055,200 $1416,012 XQL Corp $4.313,300 721297 796,497 $ 412,307 Bunkerhill, Inc. $3,671,100 566,199 610,399 $ 335,073 Easy Living Systems $ 188,955 19613 23,356 $ 13.173 Blaine Kitchenware $342.251 63.946 73,860 $ 53,630 Revenue EBIT EBITDA Net income Cash & securities Networking capital Net fixed assets Total assets Net debe Total debt Book equity Market capitalization Enterprise value (MVIC) $21.95 51,316 900,803 S 976,613 $ 536099 1,247,520 7,463564 $9,247,183 $ 21425 353,691 3,322,837 $3,697952 $ 153,680 334,804 815,304 $1,303788 $ 242,102 21.220 68788 $ 332,110 $ 230,866 32.231 174,321 $592.253 $(230866) $ 390,798 372.293 475.07 54.437,314 4,973413 3,283,000 $ 950,802 972.227 2,109400 $ 238,056 391736 804400 $ (64800) 177302 94,919 488.363 776,427 $1,127.226 13,978,375 $18.415.689 5.290.145 $6240,947 3,962.780 $4.200836 418749 $ 353,949 959,596 $728.730 JUSTIN ROBINSON from January 2012 to May 2012 This document is authorized for use only by Ayana Robinson in CORPORATE FINANCIAL POLICY taught by DR. Equity beta 103 1.24 096 092 0.67 0.56 1.91% 10:56 LTM Trading Multiples MVIC/Revenue MVIC/EBIT MVIC/EBITDA Market/Book equity Net Debt/Equity Net Debt/Enterprise Value 1.00 7.35 6.3x 4.26% 1.45x 8.65% 7.84 1.14 7.42 6.88 493 1.80X 18.05 15.15 4.41% 946x 1.63% 2.13 11.40 9.87% 1.96 251x 1797% 601% 45.18% 31.12% 31.74% 24.10% 1523% -18.31% Net working capital exdudes cash and securities Net debt is total long-term and short-term debt less excess cash Exhibit 4 Contemporaneous Capital Market Data (April 21, 2007) Yields on U.S. Treasury Securities Maturity 30 days 4.55% 60 days 4.73% 90 days 4.91% 1 year 4.90% 5 years 4.91% 10 years 5.02% 20 years 5.26% 30 years 5.10% Seasoned corporate bond yields Moody's Aaa 5.88% 6.04% 6.35% Baa Ba 7.88% B 8.94% Default spread 0.86% 1.02% 1.33% 1.70% 2.86% 3.92% 6.72% BLAINE KITCHENWARE 1. Evaluate the financial performance of Blaine Kitchen Ware over the period 2004.2005 and 2006 using financial ratios and commonsize analysis. 2. Calculate Blaine Kitchenware's Free cash flow, equity cash flow and capital cash flow for 2004,2005 and 2006. 3. Estimate Blaine Kitchenware's WACC in 2006, assuming an equity risk premium of 7.0% 4. Critically evaluate Blaine Kitchenware's current capital structure and dividend policy. 5. Analyze the impact of the proposed restructuring on Blaine's 2006 financial ratios, free cash flow, equity cash flow and wacc. (prepare the 2006 statements as if the restructuring was in place and analyze the impact. 6. Assuming a constant long term growth rate of 3%, estimate Blaine's share price in 2006 and after the proposed restructuring