Answered step by step

Verified Expert Solution

Question

1 Approved Answer

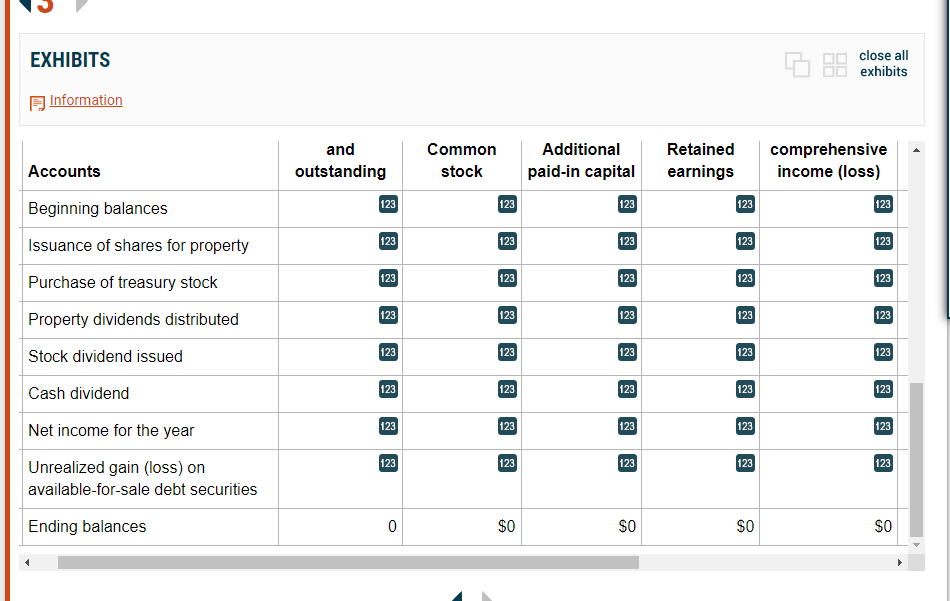

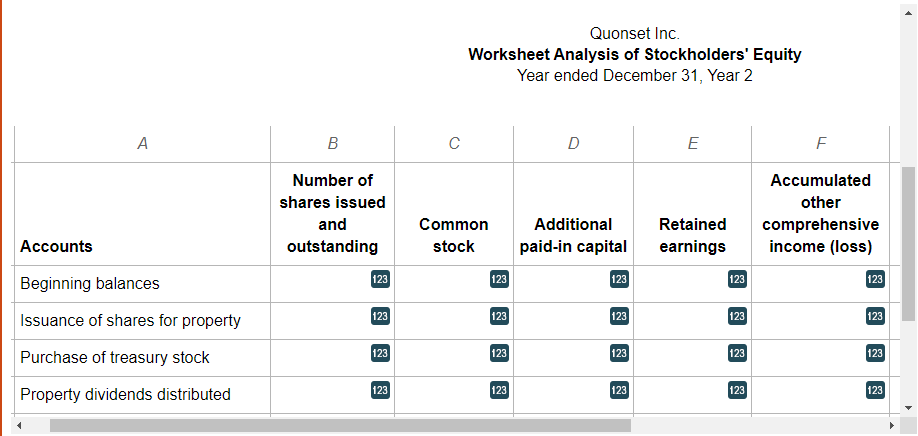

EXHIBITS close all exhibits Information Quonset Inc. Worksheet Analysis of Stockholders' Equity Year ended December 31, Year 2 Scroll down to complete all parts of

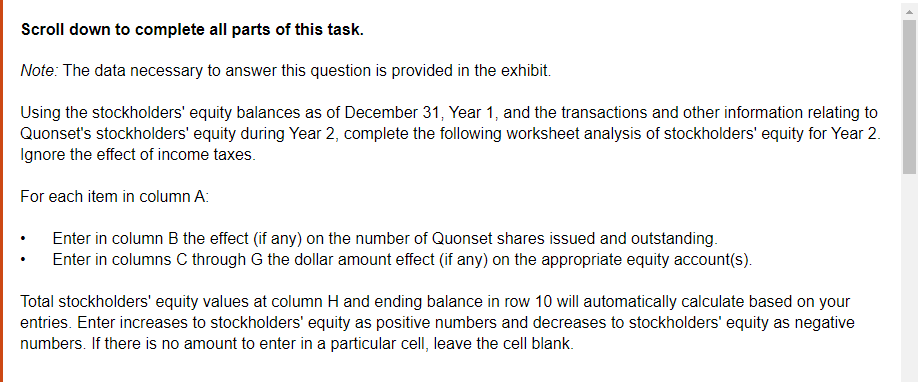

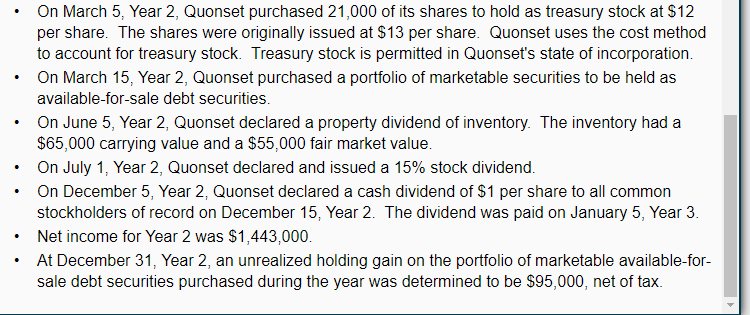

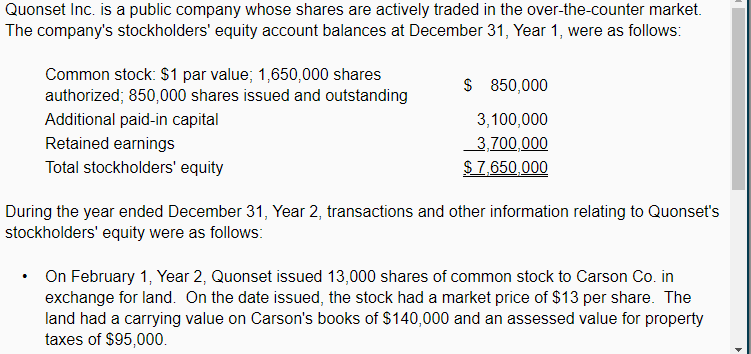

EXHIBITS close all exhibits Information Quonset Inc. Worksheet Analysis of Stockholders' Equity Year ended December 31, Year 2 Scroll down to complete all parts of this task. Note: The data necessary to answer this question is provided in the exhibit. Using the stockholders' equity balances as of December 31, Year 1, and the transactions and other information relating to Quonset's stockholders' equity during Year 2, complete the following worksheet analysis of stockholders' equity for Year 2. Ignore the effect of income taxes. For each item in column A : - Enter in column B the effect (if any) on the number of Quonset shares issued and outstanding. - Enter in columns C through G the dollar amount effect (if any) on the appropriate equity account(s). Total stockholders' equity values at column H and ending balance in row 10 will automatically calculate based on your entries. Enter increases to stockholders' equity as positive numbers and decreases to stockholders' equity as negative numbers. If there is no amount to enter in a particular cell, leave the cell blank. - On March 5, Year 2, Quonset purchased 21,000 of its shares to hold as treasury stock at $12 per share. The shares were originally issued at $13 per share. Quonset uses the cost method to account for treasury stock. Treasury stock is permitted in Quonset's state of incorporation. - On March 15, Year 2, Quonset purchased a portfolio of marketable securities to be held as available-for-sale debt securities. - On June 5, Year 2, Quonset declared a property dividend of inventory. The inventory had a $65,000 carrying value and a $55,000 fair market value. - On July 1, Year 2, Quonset declared and issued a 15\% stock dividend. - On December 5, Year 2, Quonset declared a cash dividend of $1 per share to all common stockholders of record on December 15, Year 2. The dividend was paid on January 5, Year 3. - Net income for Year 2 was $1,443,000. - At December 31, Year 2, an unrealized holding gain on the portfolio of marketable available-forsale debt securities purchased during the year was determined to be $95,000, net of tax. Quonset Inc. is a public company whose shares are actively traded in the over-the-counter market. The company's stockholders' equity account balances at December 31 , Year 1, were as follows: During the year ended December 31, Year 2, transactions and other information relating to Quonset's tockholders' equity were as follows: - On February 1, Year 2, Quonset issued 13,000 shares of common stock to Carson Co. in exchange for land. On the date issued, the stock had a market price of $13 per share. The land had a carrying value on Carson's books of $140,000 and an assessed value for property taxes of $95,000. EXHIBITS close all exhibits Information Quonset Inc. Worksheet Analysis of Stockholders' Equity Year ended December 31, Year 2 Scroll down to complete all parts of this task. Note: The data necessary to answer this question is provided in the exhibit. Using the stockholders' equity balances as of December 31, Year 1, and the transactions and other information relating to Quonset's stockholders' equity during Year 2, complete the following worksheet analysis of stockholders' equity for Year 2. Ignore the effect of income taxes. For each item in column A : - Enter in column B the effect (if any) on the number of Quonset shares issued and outstanding. - Enter in columns C through G the dollar amount effect (if any) on the appropriate equity account(s). Total stockholders' equity values at column H and ending balance in row 10 will automatically calculate based on your entries. Enter increases to stockholders' equity as positive numbers and decreases to stockholders' equity as negative numbers. If there is no amount to enter in a particular cell, leave the cell blank. - On March 5, Year 2, Quonset purchased 21,000 of its shares to hold as treasury stock at $12 per share. The shares were originally issued at $13 per share. Quonset uses the cost method to account for treasury stock. Treasury stock is permitted in Quonset's state of incorporation. - On March 15, Year 2, Quonset purchased a portfolio of marketable securities to be held as available-for-sale debt securities. - On June 5, Year 2, Quonset declared a property dividend of inventory. The inventory had a $65,000 carrying value and a $55,000 fair market value. - On July 1, Year 2, Quonset declared and issued a 15\% stock dividend. - On December 5, Year 2, Quonset declared a cash dividend of $1 per share to all common stockholders of record on December 15, Year 2. The dividend was paid on January 5, Year 3. - Net income for Year 2 was $1,443,000. - At December 31, Year 2, an unrealized holding gain on the portfolio of marketable available-forsale debt securities purchased during the year was determined to be $95,000, net of tax. Quonset Inc. is a public company whose shares are actively traded in the over-the-counter market. The company's stockholders' equity account balances at December 31 , Year 1, were as follows: During the year ended December 31, Year 2, transactions and other information relating to Quonset's tockholders' equity were as follows: - On February 1, Year 2, Quonset issued 13,000 shares of common stock to Carson Co. in exchange for land. On the date issued, the stock had a market price of $13 per share. The land had a carrying value on Carson's books of $140,000 and an assessed value for property taxes of $95,000

EXHIBITS close all exhibits Information Quonset Inc. Worksheet Analysis of Stockholders' Equity Year ended December 31, Year 2 Scroll down to complete all parts of this task. Note: The data necessary to answer this question is provided in the exhibit. Using the stockholders' equity balances as of December 31, Year 1, and the transactions and other information relating to Quonset's stockholders' equity during Year 2, complete the following worksheet analysis of stockholders' equity for Year 2. Ignore the effect of income taxes. For each item in column A : - Enter in column B the effect (if any) on the number of Quonset shares issued and outstanding. - Enter in columns C through G the dollar amount effect (if any) on the appropriate equity account(s). Total stockholders' equity values at column H and ending balance in row 10 will automatically calculate based on your entries. Enter increases to stockholders' equity as positive numbers and decreases to stockholders' equity as negative numbers. If there is no amount to enter in a particular cell, leave the cell blank. - On March 5, Year 2, Quonset purchased 21,000 of its shares to hold as treasury stock at $12 per share. The shares were originally issued at $13 per share. Quonset uses the cost method to account for treasury stock. Treasury stock is permitted in Quonset's state of incorporation. - On March 15, Year 2, Quonset purchased a portfolio of marketable securities to be held as available-for-sale debt securities. - On June 5, Year 2, Quonset declared a property dividend of inventory. The inventory had a $65,000 carrying value and a $55,000 fair market value. - On July 1, Year 2, Quonset declared and issued a 15\% stock dividend. - On December 5, Year 2, Quonset declared a cash dividend of $1 per share to all common stockholders of record on December 15, Year 2. The dividend was paid on January 5, Year 3. - Net income for Year 2 was $1,443,000. - At December 31, Year 2, an unrealized holding gain on the portfolio of marketable available-forsale debt securities purchased during the year was determined to be $95,000, net of tax. Quonset Inc. is a public company whose shares are actively traded in the over-the-counter market. The company's stockholders' equity account balances at December 31 , Year 1, were as follows: During the year ended December 31, Year 2, transactions and other information relating to Quonset's tockholders' equity were as follows: - On February 1, Year 2, Quonset issued 13,000 shares of common stock to Carson Co. in exchange for land. On the date issued, the stock had a market price of $13 per share. The land had a carrying value on Carson's books of $140,000 and an assessed value for property taxes of $95,000. EXHIBITS close all exhibits Information Quonset Inc. Worksheet Analysis of Stockholders' Equity Year ended December 31, Year 2 Scroll down to complete all parts of this task. Note: The data necessary to answer this question is provided in the exhibit. Using the stockholders' equity balances as of December 31, Year 1, and the transactions and other information relating to Quonset's stockholders' equity during Year 2, complete the following worksheet analysis of stockholders' equity for Year 2. Ignore the effect of income taxes. For each item in column A : - Enter in column B the effect (if any) on the number of Quonset shares issued and outstanding. - Enter in columns C through G the dollar amount effect (if any) on the appropriate equity account(s). Total stockholders' equity values at column H and ending balance in row 10 will automatically calculate based on your entries. Enter increases to stockholders' equity as positive numbers and decreases to stockholders' equity as negative numbers. If there is no amount to enter in a particular cell, leave the cell blank. - On March 5, Year 2, Quonset purchased 21,000 of its shares to hold as treasury stock at $12 per share. The shares were originally issued at $13 per share. Quonset uses the cost method to account for treasury stock. Treasury stock is permitted in Quonset's state of incorporation. - On March 15, Year 2, Quonset purchased a portfolio of marketable securities to be held as available-for-sale debt securities. - On June 5, Year 2, Quonset declared a property dividend of inventory. The inventory had a $65,000 carrying value and a $55,000 fair market value. - On July 1, Year 2, Quonset declared and issued a 15\% stock dividend. - On December 5, Year 2, Quonset declared a cash dividend of $1 per share to all common stockholders of record on December 15, Year 2. The dividend was paid on January 5, Year 3. - Net income for Year 2 was $1,443,000. - At December 31, Year 2, an unrealized holding gain on the portfolio of marketable available-forsale debt securities purchased during the year was determined to be $95,000, net of tax. Quonset Inc. is a public company whose shares are actively traded in the over-the-counter market. The company's stockholders' equity account balances at December 31 , Year 1, were as follows: During the year ended December 31, Year 2, transactions and other information relating to Quonset's tockholders' equity were as follows: - On February 1, Year 2, Quonset issued 13,000 shares of common stock to Carson Co. in exchange for land. On the date issued, the stock had a market price of $13 per share. The land had a carrying value on Carson's books of $140,000 and an assessed value for property taxes of $95,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started