Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exon is worried about uncertsinty regarding the price it will be able to charge to sell oil in the future. Exxon wants to lock in

Exon is worried about uncertsinty regarding the price it will be able to charge to sell oil in the future. Exxon wants to lock in the price it will charge for oll in case the price declines in the future, but does not want to be obliged to sell at that price if prices happen to increase. What derivative contract should Exoon use for this purpose?

Long futures contract

Put options

Call options

Short futures contract

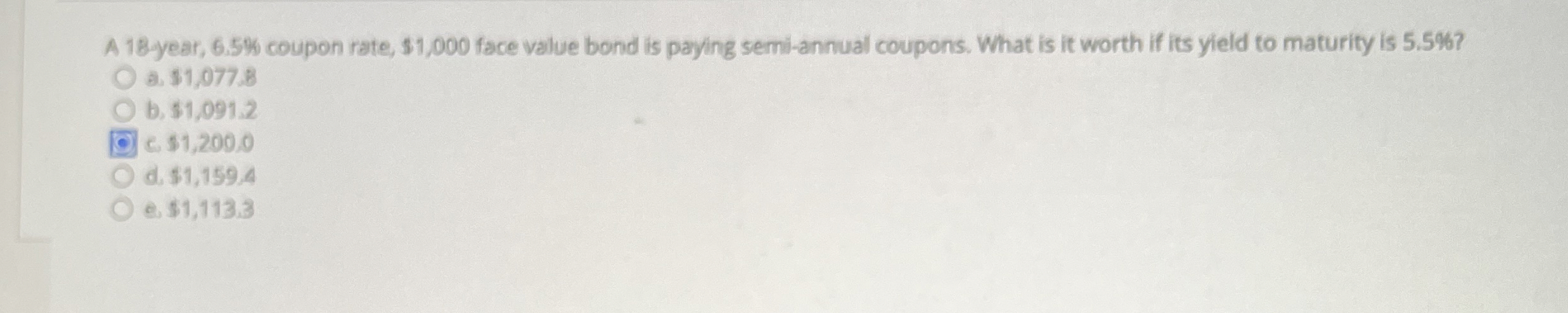

A year, coupon rate, $ face value bond is paying semiannual coupons. What is it worth if its yield to maturity is

a

b $

c $

d $

e $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started