Answered step by step

Verified Expert Solution

Question

1 Approved Answer

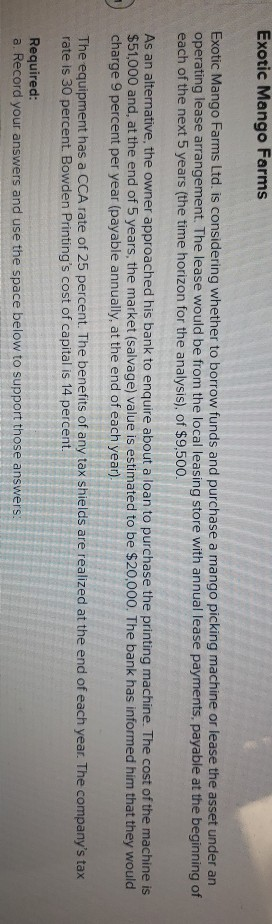

Exotic Mango Farms Exotic Mango Farms Ltd. is considering whether to borrow funds and purchase a mango picking machine or lease the asset under an

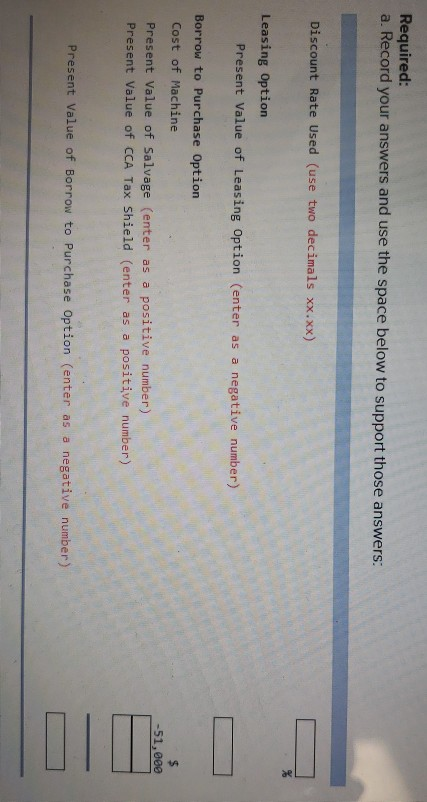

Exotic Mango Farms Exotic Mango Farms Ltd. is considering whether to borrow funds and purchase a mango picking machine or lease the asset under an operating lease arrangement. The lease would be from the local leasing store with annual lease payments, payable at the beginning of each of the next 5 years (the time horizon for the analysis), of $9,500. As an alternative, the owner approached his bank to enquire about a loan to purchase the printing machine. The cost of the machine is $51,000 and, at the end of 5 years, the market (salvage) value is estimated to be $20,000. The bank has informed him that they would charge 9 percent per year (payable annually, at the end of each year) The equipment has a CCA rate of 25 percent. The benefits of any tax shields are realized at the end of each year. The company's tax rate is 30 percent. Bowden Printing's cost of capital is 14 percent. Required: a. Record your answers and use the space below to support those answers: Required: a. Record your answers and use the space below to support those answers: Discount Rate Used (use two decimals xx.xx) Leasing Option Present Value of Leasing Option (enter as a negative number) Borrow to Purchase Option Cost of Machine Present Value of Salvage (enter as a positive number) Present Value of CCA Tax Shield (enter as a positive number) -51,000 Present Value of Borrow to Purchase Option (enter as a negative number)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started