Answered step by step

Verified Expert Solution

Question

1 Approved Answer

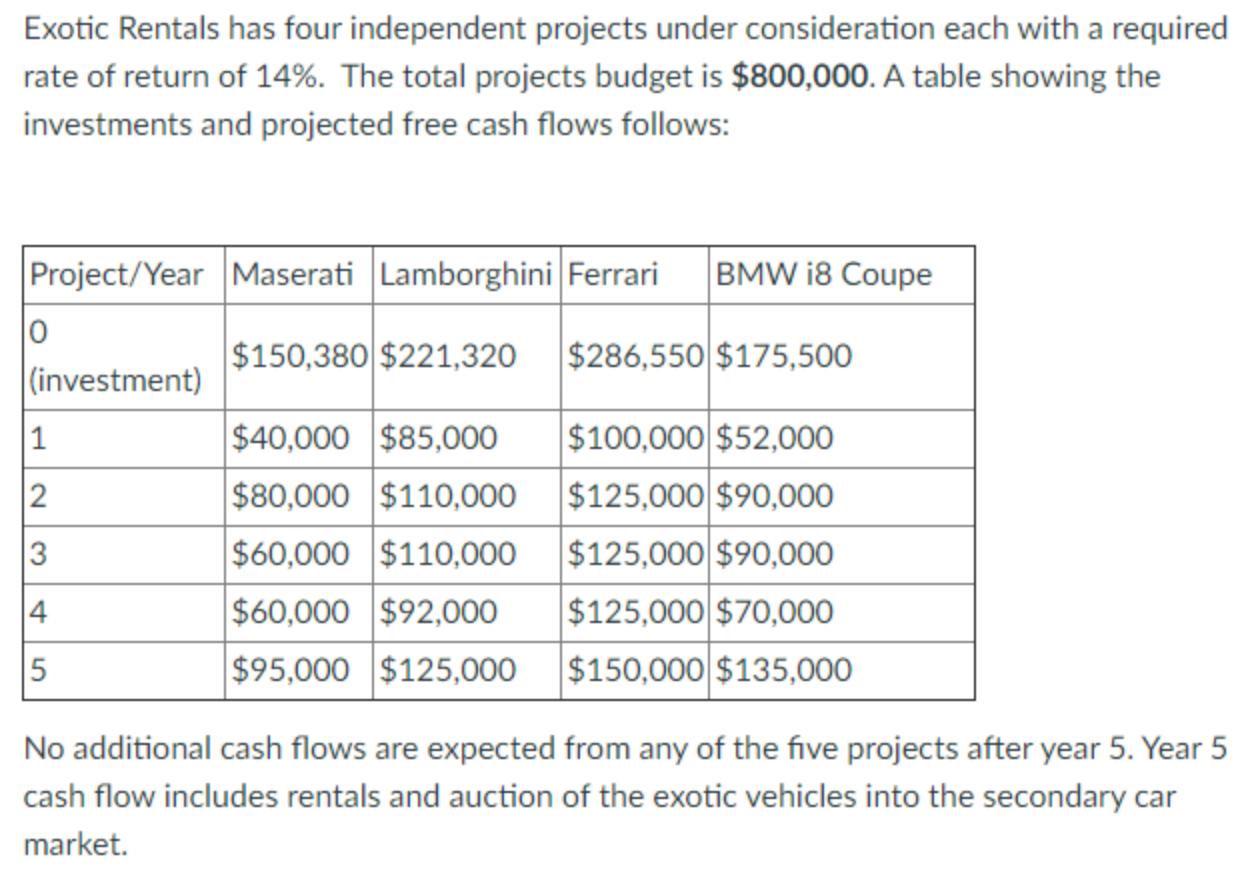

Exotic Rentals has four independent projects under consideration each with a required rate of return of 14%. The total projects budget is $800,000. A

Exotic Rentals has four independent projects under consideration each with a required rate of return of 14%. The total projects budget is $800,000. A table showing the investments and projected free cash flows follows: Project/Year Maserati Lamborghini Ferrari 0 (investment) 1 2 3 4 5 BMW i8 Coupe $150,380 $221,320 $286,550 $175,500 $40,000 $85,000 $80,000 $110,000 $60,000 $110,000 $60,000 $92,000 $95,000 $125,000 $100,000 $52,000 $125,000 $90,000 $125,000 $90,000 $125,000 $70,000 $150,000 $135,000 No additional cash flows are expected from any of the five projects after year 5. Year 5 cash flow includes rentals and auction of the exotic vehicles into the secondary car market. Continuing with Exotic Rentals, what is the combined NPV of these two projects: BMW i8 Coupe and Maserati

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Exotic Company Since we have 14 as discounting factor we calculate NPV separately then add the two ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started