Question

EXPANSION PROJECT RICH INDUSTRIES Your client, Rich Industries, is considering an expansion of its plant facilities to increase its capacity for a new product line.

EXPANSION PROJECT RICH INDUSTRIES

Your client, Rich Industries, is considering an expansion of its plant facilities to increase its capacity for a new product line. This new product is expected to have a 5-year life cycle. The company has provided the following information for your analysis.

Capital Costs:

Cost of New Building $ 15,000

Cost of Equipment $ 5,000

Equipment Installation Cost $ 3,000

Net Working Capital Requirements (Upfront) $ 2,000

Sales and Expenses:

New Product Annual Sales $ 30,000

Variable Cost Ratio 75%

Fixed Costs (Annual) $ 500

Tax Rate 40%

Depreciation (use Straight-line depreciation):

Building 20 year expected Life

Equipment 5 year expected life

Salvage Value in Year 5:

Building $ 12,000

Equipment $ 1,000

The controller has told you that Rich Industries uses a 10% hurdle rate for discounting future cash flows.

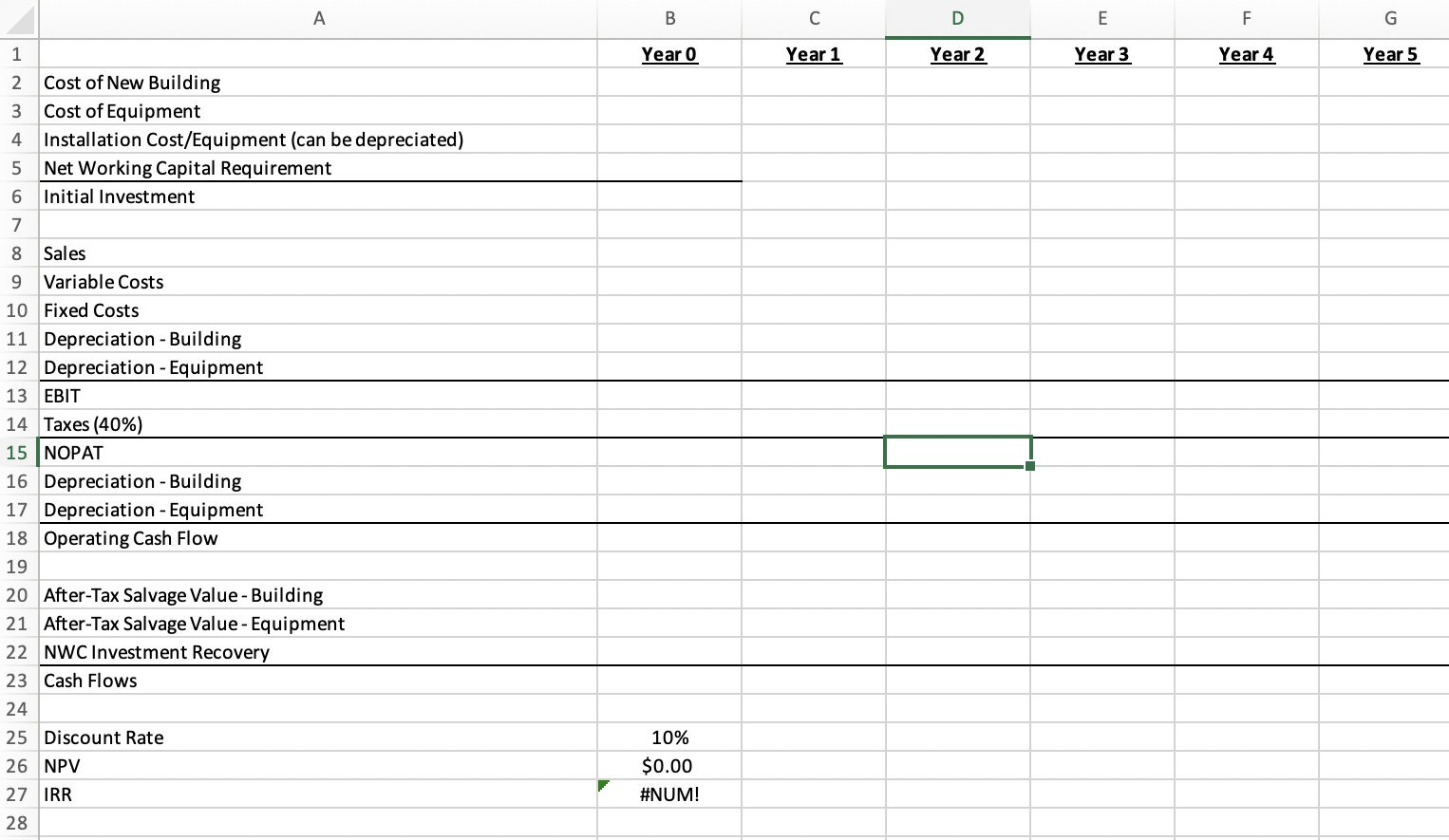

Your Job: Prepare a spreadsheet calculation (like the attached image) of the Net Present Value and Internal Rate of Return for the expansion project under consideration, including supporting information for your work. Answer this question: should the expansion project be undertaken? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started