Question

expect to generate a profit for the first four years of operation, WeightsPlus had profits of $500,000 at the end of the third year. recent

expect to generate a profit for the first four years of operation, WeightsPlus had profits of $500,000 at the end of the third year. recent pandemic membership dropped by 25%. Recently, membership rolls have increased by 20%. Mike evaluates two potential capital budgeting proposals.

He has been able to secure sufficient external financing to implement both projects if they are both acceptable. Although each of these projects may ultimately result in increased membership, Mike wants your initial analysis to assume no increase in the membership rolls, ie 95,000 hours of exercise time per quarter (base case quantity). He has asked you to focus on the savings that are generated through a reduction in total operating expenditures - labor and/or overhead. Also, as all current financial information is provided on a quarterly basis, Mike prefers the analysis to maintain the same quarter time periods.

Project Alpha has a useful life of two years or eight quarters. After that time, technology is expected to change sufficiently to require a new data capture system. The project costs $570,480> and can be applied to a maximum of 100,000 hours of equipment usage per quarter (note that if your projected usage is less than 100,000 hours of exercise time per quarter you will have to adjust your analysis accordingly.)

Project Alpha is expected to create overhead savings in reduced maintenance costs of $15,686 per quarter. Initial labor savings (in the first quarter of operation) are forecasted to be $0.71 per hour of exercise time. After the first quarter, as the club's personal trainers begin to realize the benefit of this system, the labor savings are forecasted to change by $0.04 per quarter.

Project Beta, these machines are expected to have a useful life of three years or twelve quarters. The new weight machines will not create overhead savings for the club as they require greater maintenance and utility expenditures than the free weights, however, the personal training staff will be able to reduce its direct contact time with the clients and increase its overall efficiency. Labor savings are expected to diminish over time as more clients utilize the equipment for enhanced strength training, requiring additional instructional time.

The new weight machines cost $429,784 and can be utilized a maximum of 120,000 hours per quarter (note that if your projected usage is less than 120,000 hours of exercise time per quarter you will have to adjust your analysis.) Project Beta will require new overhead expenditures, as noted, in the amount of $8,212> per quarter. Initial labor savings (in the first quarter of operation) are forecasted to be $0.70 per hour of exercise time. After the first quarter, as your clients begin to realize the benefit of the new equipment and require additional instruction, the labor savings are forecasted to decrease by $0.01 per hour of exercise time.

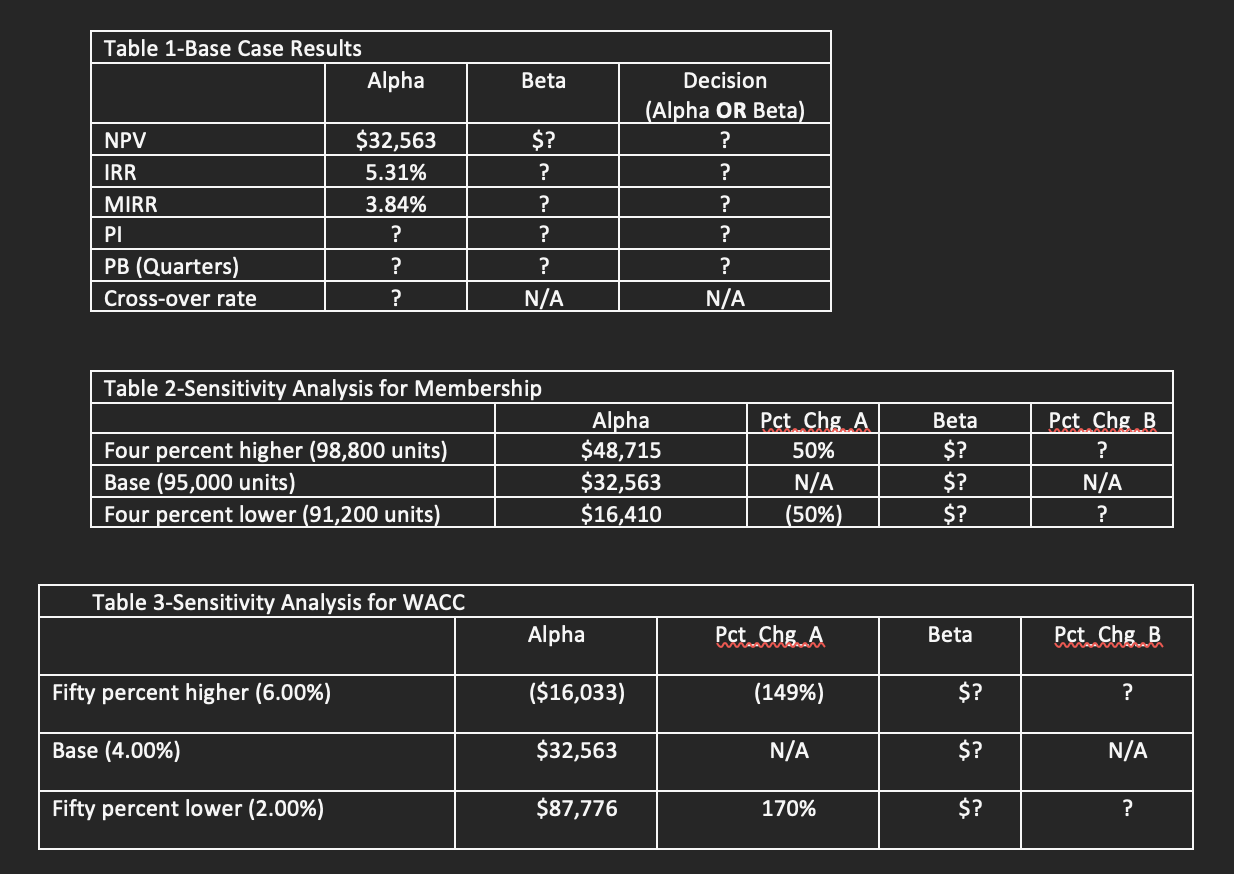

Mike has indicated that WeightPlus's historical cost of financing is 5.97% per quarter; however, due to the recent credit easing, he is able to secure new external financing at a weighted average cost of four per cent (4.00%) per quarter. The firm's reinvestment rate is 2% per quarter. The business's current marginal federal plus state tax rate is 25%. Depreciation of all new equipment should be on a straight-line basis to a salvage value of $0. Complete the following tables.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started