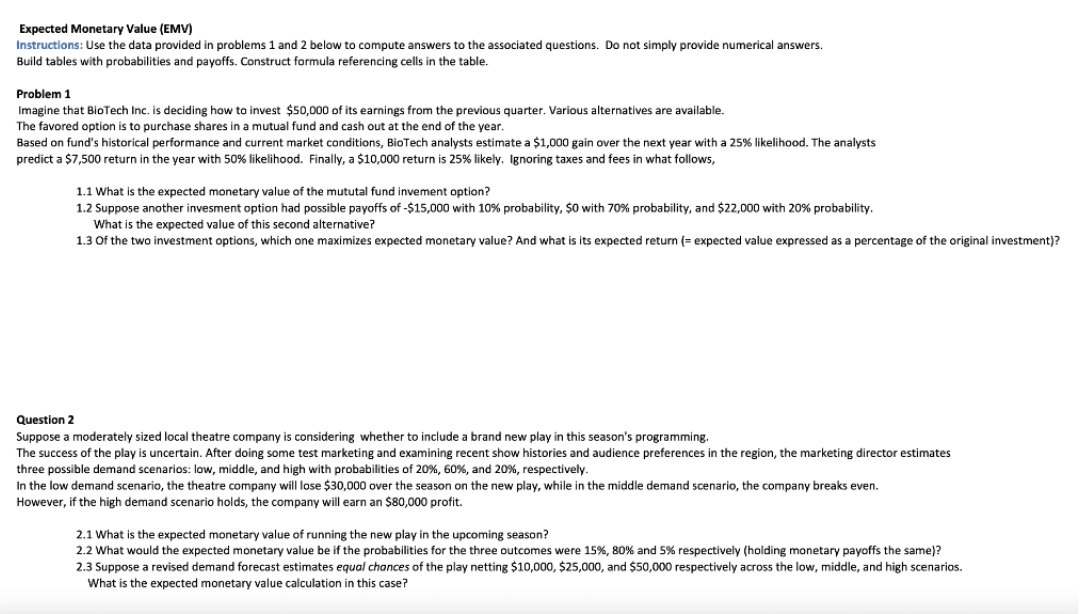

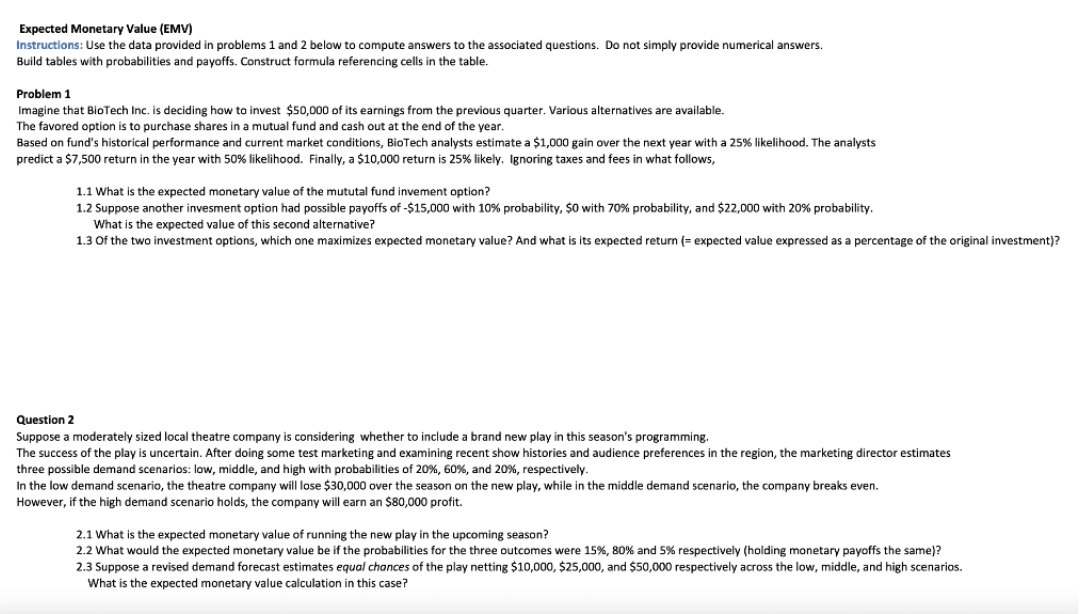

Expected Monetary Value (EMV) Instructions: Use the data provided in problems 1 and 2 below to compute answers to the associated questions. Do not simply provide numerical answers. Build tables with probabilities and payoffs. Construct formula referencing cells in the table. Problem 1 Imagine that BioTech Inc. is deciding how to invest $50,000 of its earnings from the previous quarter. Various alternatives are available. The favored option is to purchase shares in a mutual fund and cash out at the end of the year. Based on fund's historical performance and current market conditions, BioTech analysts estimate a $1,000 gain over the next year with a 25\% likelihood. The analysts predict a $7,500 return in the year with 50% likelihood. Finally, a $10,000 return is 25% likely. Ignoring taxes and fees in what follows, 1.1 What is the expected monetary value of the mututal fund invement option? 1.2 Suppose another invesment option had possible payoffs of $15,000 with 10% probability, $0 with 70% probability, and $22,000 with 20% probability. What is the expected value of this second alternative? 1.3 Of the two investment options, which one maximizes expected monetary value? And what is its expected return (= expected value expressed as a percentage of the original investmer Question 2 Suppose a moderately sized local theatre company is considering whether to include a brand new play in this season's programming. The success of the play is uncertain. After doing some test marketing and examining recent show histories and audience preferences in the region, the marketing director estimates three possible demand scenarios: low, middle, and high with probabilities of 20%,60%, and 20%, respectively. In the low demand scenario, the theatre company will lose $30,000 over the season on the new play, while in the middle demand scenario, the company breaks even. However, if the high demand scenario holds, the company will earn an $80,000 profit. 2.1 What is the expected monetary value of running the new play in the upcoming season? 2.2 What would the expected monetary value be if the probabilities for the three outcomes were 15%,80% and 5% respectively (holding monetary payoffs the same)? 2.3 Suppose a revised demand forecast estimates equal chances of the play netting $10,000,$25,000, and $50,000 respectively across the low, middle, and high scenarios. What is the expected monetary value calculation in this case? Expected Monetary Value (EMV) Instructions: Use the data provided in problems 1 and 2 below to compute answers to the associated questions. Do not simply provide numerical answers. Build tables with probabilities and payoffs. Construct formula referencing cells in the table. Problem 1 Imagine that BioTech Inc. is deciding how to invest $50,000 of its earnings from the previous quarter. Various alternatives are available. The favored option is to purchase shares in a mutual fund and cash out at the end of the year. Based on fund's historical performance and current market conditions, BioTech analysts estimate a $1,000 gain over the next year with a 25\% likelihood. The analysts predict a $7,500 return in the year with 50% likelihood. Finally, a $10,000 return is 25% likely. Ignoring taxes and fees in what follows, 1.1 What is the expected monetary value of the mututal fund invement option? 1.2 Suppose another invesment option had possible payoffs of $15,000 with 10% probability, $0 with 70% probability, and $22,000 with 20% probability. What is the expected value of this second alternative? 1.3 Of the two investment options, which one maximizes expected monetary value? And what is its expected return (= expected value expressed as a percentage of the original investmer Question 2 Suppose a moderately sized local theatre company is considering whether to include a brand new play in this season's programming. The success of the play is uncertain. After doing some test marketing and examining recent show histories and audience preferences in the region, the marketing director estimates three possible demand scenarios: low, middle, and high with probabilities of 20%,60%, and 20%, respectively. In the low demand scenario, the theatre company will lose $30,000 over the season on the new play, while in the middle demand scenario, the company breaks even. However, if the high demand scenario holds, the company will earn an $80,000 profit. 2.1 What is the expected monetary value of running the new play in the upcoming season? 2.2 What would the expected monetary value be if the probabilities for the three outcomes were 15%,80% and 5% respectively (holding monetary payoffs the same)? 2.3 Suppose a revised demand forecast estimates equal chances of the play netting $10,000,$25,000, and $50,000 respectively across the low, middle, and high scenarios. What is the expected monetary value calculation in this case