Answered step by step

Verified Expert Solution

Question

1 Approved Answer

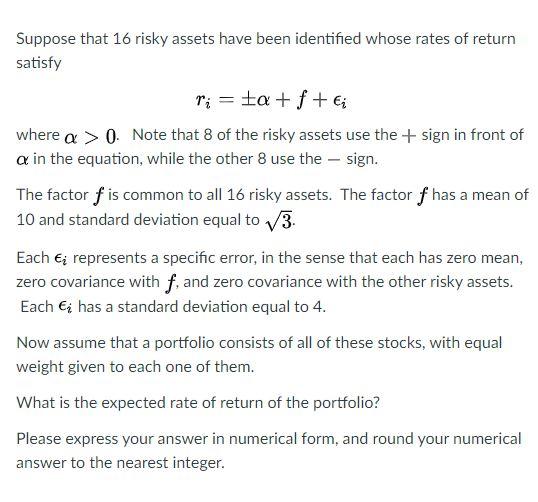

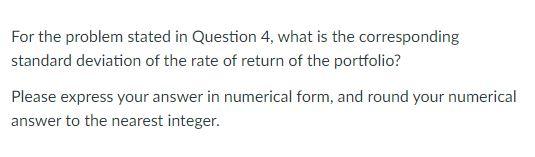

expected rate of return and standard deviation of the rate of return please! Suppose that 16 risky assets have been identified whose rates of return

expected rate of return and standard deviation of the rate of return please!

Suppose that 16 risky assets have been identified whose rates of return satisfy ri = a + f + where a > 0. Note that 8 of the risky assets use the + sign in front of a in the equation, while the other 8 use the sign. The factor f is common to all 16 risky assets. The factor f has a mean of 10 and standard deviation equal to 3. Each Ei represents a specific error, in the sense that each has zero mean, zero covariance with f, and zero covariance with the other risky assets. Each has a standard deviation equal to 4. Now assume that a portfolio consists of all of these stocks, with equal weight given to each one of them. What is the expected rate of return of the portfolio? Please express your answer in numerical form, and round your numerical answer to the nearest integer. For the problem stated in Question 4, what is the corresponding standard deviation of the rate of return of the portfolio? Please express your answer in numerical form, and round your numerical answer to the nearest integer. Suppose that 16 risky assets have been identified whose rates of return satisfy ri = a + f + where a > 0. Note that 8 of the risky assets use the + sign in front of a in the equation, while the other 8 use the sign. The factor f is common to all 16 risky assets. The factor f has a mean of 10 and standard deviation equal to 3. Each Ei represents a specific error, in the sense that each has zero mean, zero covariance with f, and zero covariance with the other risky assets. Each has a standard deviation equal to 4. Now assume that a portfolio consists of all of these stocks, with equal weight given to each one of them. What is the expected rate of return of the portfolio? Please express your answer in numerical form, and round your numerical answer to the nearest integer. For the problem stated in Question 4, what is the corresponding standard deviation of the rate of return of the portfolio? Please express your answer in numerical form, and round your numerical answer to the nearest integerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started