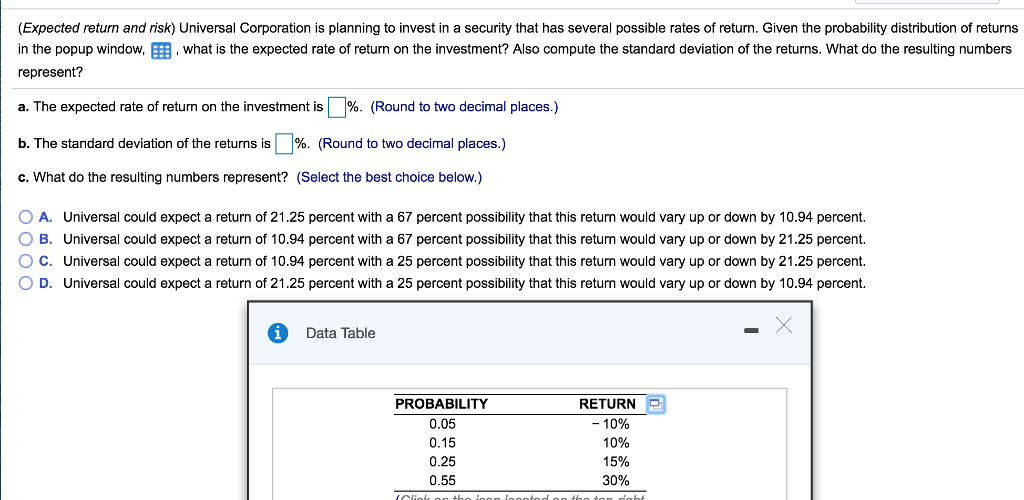

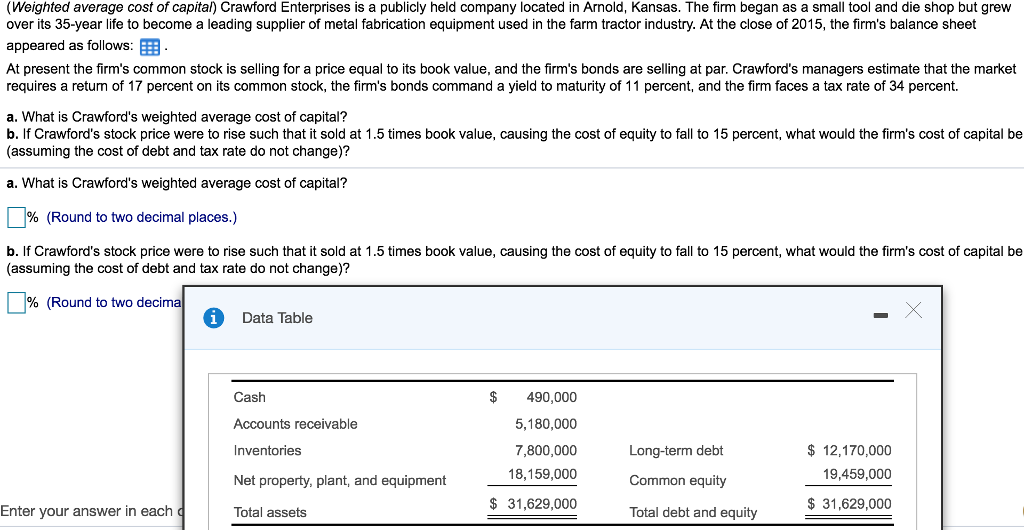

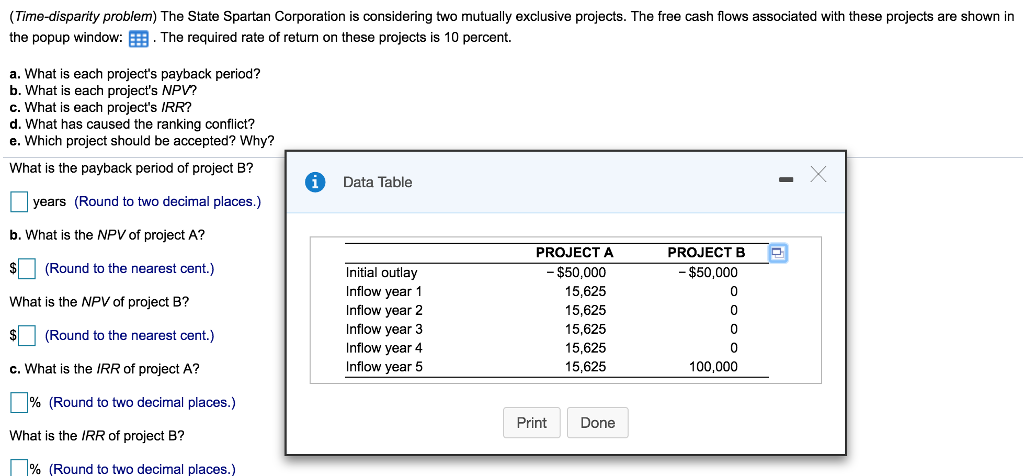

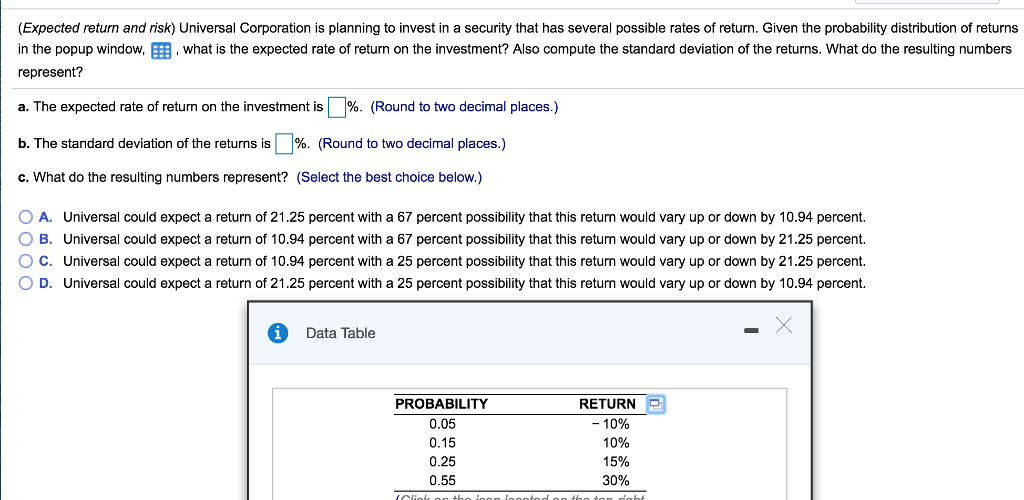

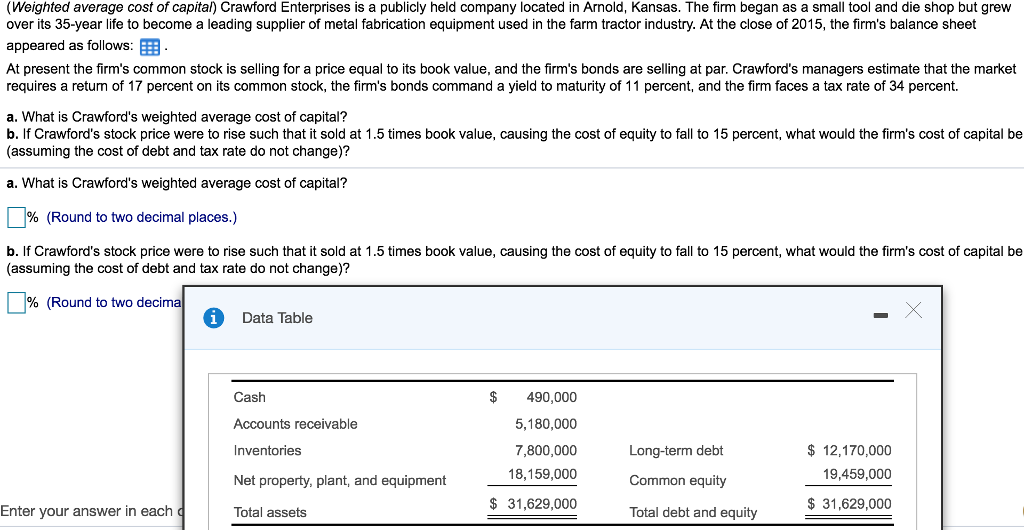

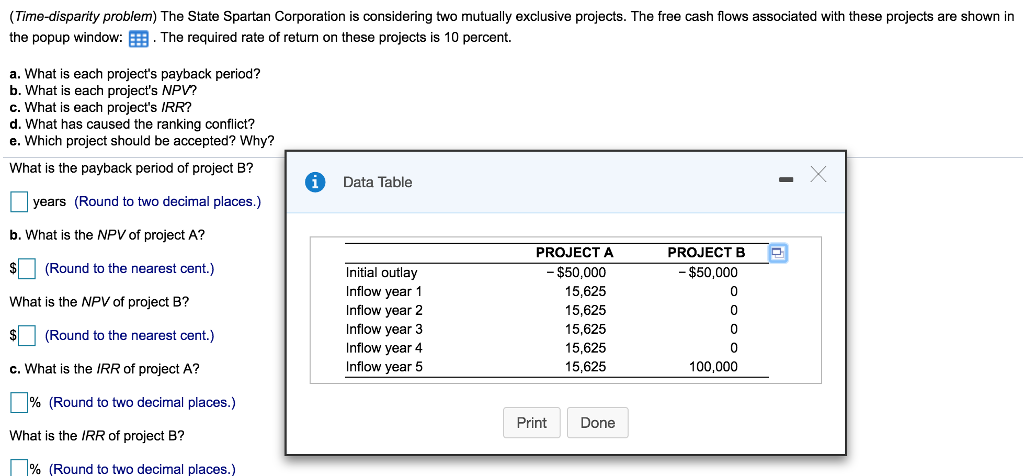

(Expected return and risk) Universal Corporation is planning to invest in a security that has several possible rates of return. Given the probability distribution of returns in the popup window,' what is the expected rate of return on the investment? Also compute the standard deviation of the returns. What do the resulting numbers represent? a. The expected rate of return on the investment is %. (Round to two decimal places.) b. The standard deviation of the returns is %. (Round to two decimal places.) c. What do the resulting numbers represent? (Select the best choice below.) 0 A, O B. C. D. Universal could expect a return of 21.25 percent with a 67 percent possibility that this retum would vary up or down by 10.94 percent. Universal could expect a return of 10.94 percent with a 67 percent possibility that this return would vary up or down by 21.25 percent. Universal could expect a return of 10.94 percent with a 25 percent possibility that this retum would vary up or down by 21.25 percent. Universal could expect a return of 21.25 percent with a 25 percent possibility that this return would vary up or down by 10.94 percent. i Data Table PROBABILITY 0.05 0.15 0.25 0.55 RETURN -10% 10% 15% 30% (Weighted average cost of capital) Crawford Enterprises is a publicly held company located in Arnold, Kansas. The firm began as a small tool and die shop but grew over its 35-year life to become a leading supplier of metal fabrication equipment used in the farm tractor industry. At the close of 2015, the firm's balance sheet appeared as follows At present the firm's common stock is selling for a price equal to its book value, and the firm's bonds are seling at par. Crawford's managers estimate that the market requires a returm of 17 percent on its common stock, the firm's bonds command a yield to maturity of 11 percent, and the firm faces a tax rate of 34 percent. a. What is Crawford's weighted average cost of capital? b. If Crawford's stock price were to rise such that it sold at 1.5 times book value, causing the cost of equity to fall to 15 percent, what would the firm's cost of capital be (assuming the cost of debt and tax rate do not change)? a. What is Crawford's weighted average cost of capital? [ % (Round to two decimal places.) b. If Crawford's stock price were to rise such that it sold at 1.5 times book value, causing the cost of equity to fall to 15 percent, what would the firm's cost of capital be (assuming the cost of debt and tax rate do not change)? % (Round to two decima Data Table Cash Accounts receivable Inventories Net property, plant, and equipment Total assets $490,000 5,180,000 7,800,000 18,159,000 $ 31,629,000 Long-term debt Common equity Total debt and equity $ 12,170,000 19,459,000 $31,629,000 Enter vour answer in each (Tme-disparity problem) The State Spartan Corporation is considering two mutually exclusive projects. The free cash flows associated with these projects are shown in the popup window: . The required rate of retum on these projects is 10 percent. a. What is each project's payback period? b. What is each project's NPV? c. What is each project's IRR? d. What has caused the ranking conflict? e. Which project should be accepted? Why? What is the payback period of project B? Data Table years (Round to two decimal places.) b. What is the NPV of project A? PROJECTA Round to the nearest cent) PROJECT B -$50,000 What is the NPV of project B? $(Round to the nearest cent.) c. What is the IRR of project A? Initial outlay Inflow year 1 Inflow year 2 Inflow year 3 Inflow year 4 Inflow year 5 -$50,000 15,625 15,625 15,625 15,625 15,625 0 100,000 % (Round to two decimal places.) Print Done What is the IRR of project B? (Round to two decimal places.)