Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Expected returns, dividends, and growth The constant growth valuation formula has dividends in the numerator. Dividends are divided by the difference between the required return

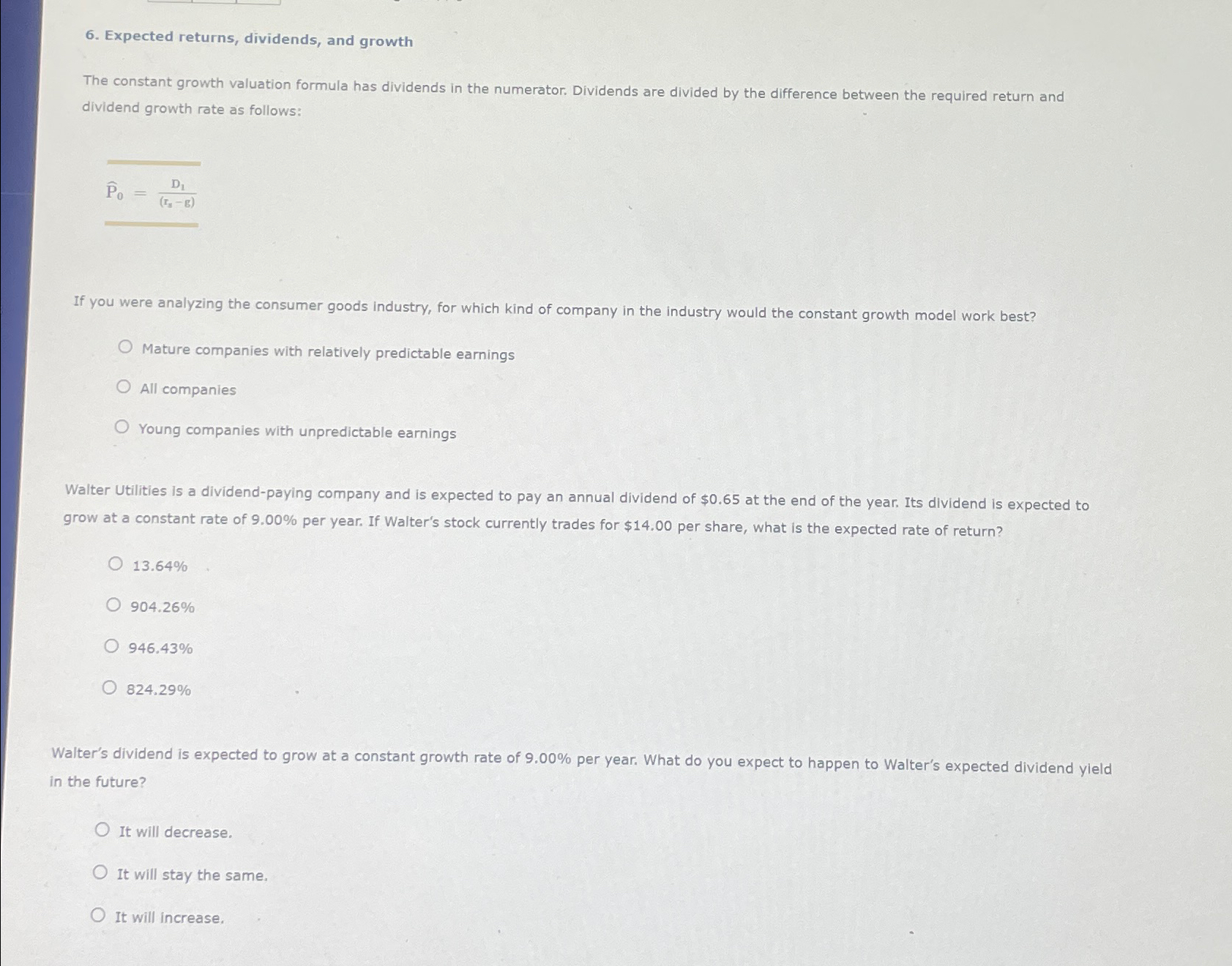

Expected returns, dividends, and growth

The constant growth valuation formula has dividends in the numerator. Dividends are divided by the difference between the required return and dividend growth rate as follows:

widehat

If you were analyzing the consumer goods industry, for which kind of company in the industry would the constant growth model work best?

Mature companies with relatlvely predictable earnings

All companies

Young companies with unpredictable earnings grow at a constant rate of per year. If Walter's stock currently trades for $ per share, what is the expected rate of return?

in the future?

It will decrease.

It will stay the same.

It will increase.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started