Question

Expected sales in units for December 2019 and the first six months of 2020 are as follows: December January February March April May June 15,200

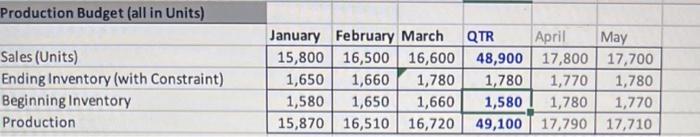

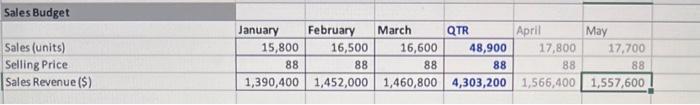

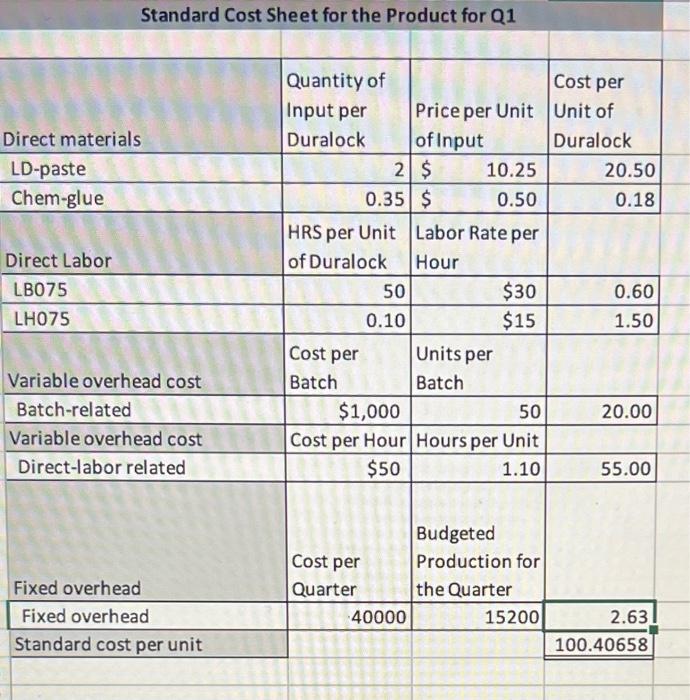

Expected sales in units for December 2019 and the first six months of 2020 are as follows: December January February March April May June 15,200 15,800 16,500 16,600 17,800 17,700 17,800 The company expects to sell each Duralock for US$88.1 Duralock requires two types of direct materialsLD-paste and Chem-glue. Two pounds of LDpaste and 350 ml of Chem-glue are required to produce one Duralock. At the end of each month, ending inventory of Duralock must be equal to 10% of the following months budgeted sales, or 1,600 (whichever is greater). Lockden is strict on this safety-stock policy; if any of his regular customers has an unexpected need for Duralock, Lockden wants to fulfill that need. The inventory policy for raw materials is to maintain the monthly ending inventory at 5% of the production needs for the next month. Chem-glue tends to dry up over time. The cost of LD-paste and Chem-glue are $10.25 per pound and $50 per liter, respectively. The production process requires two types of direct laborLB075 and LH075. LB075 represents machinists who operate the molding machines. Molding is done in batches; each batch contains 50 Duralocks. One hour of LB075 labor is required to process one batch of Duralock. LH075 represents manual finishing labor. Each Duralock requires one-tenth of an hour of LH075 labor. Hourly wage rates for LB075 and LH075 are $30 and $15 per hour, respectively. The predetermined variable overhead rate at the batch level is $1,000 per batch; at the unit level, it is $50 per direct labor hour (based on total labor hours). Fixed factory overhead is $40,000 per month. Contador had been applying fixed factory overhead based on the budgeted production volume

| Direct Materials Purchase Budget | ||||

| January | February | March | QTR | |

| Direct Materials Budget (LD-paste) | ||||

| Quantity required for production (lbs.) | ||||

| Ending inventory (lbs.) | ||||

| Beginning inventory (lbs.) | ||||

| Purchases (lbs.) | ||||

| Cost ($) | ||||

| Cross-footing check |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started